① Ideal Auto U.S. stocks rose more than 13% before the market;

②DeepSeek is reported to strive to release its R2 model in advance;

③ Baidu plans to spend US$2.1 billion to acquire YY live broadcast business.

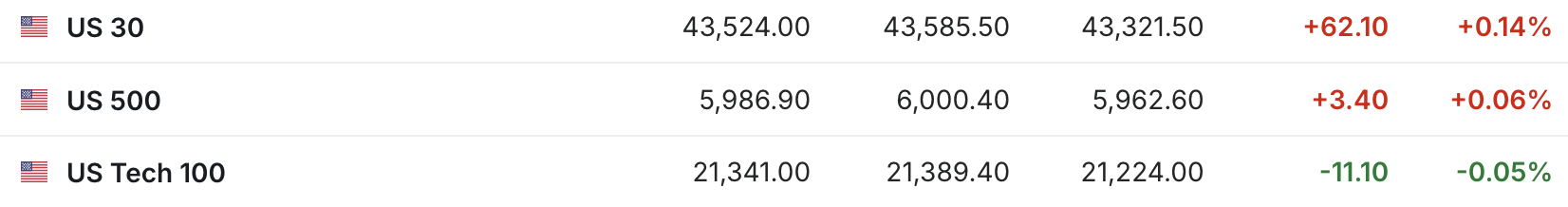

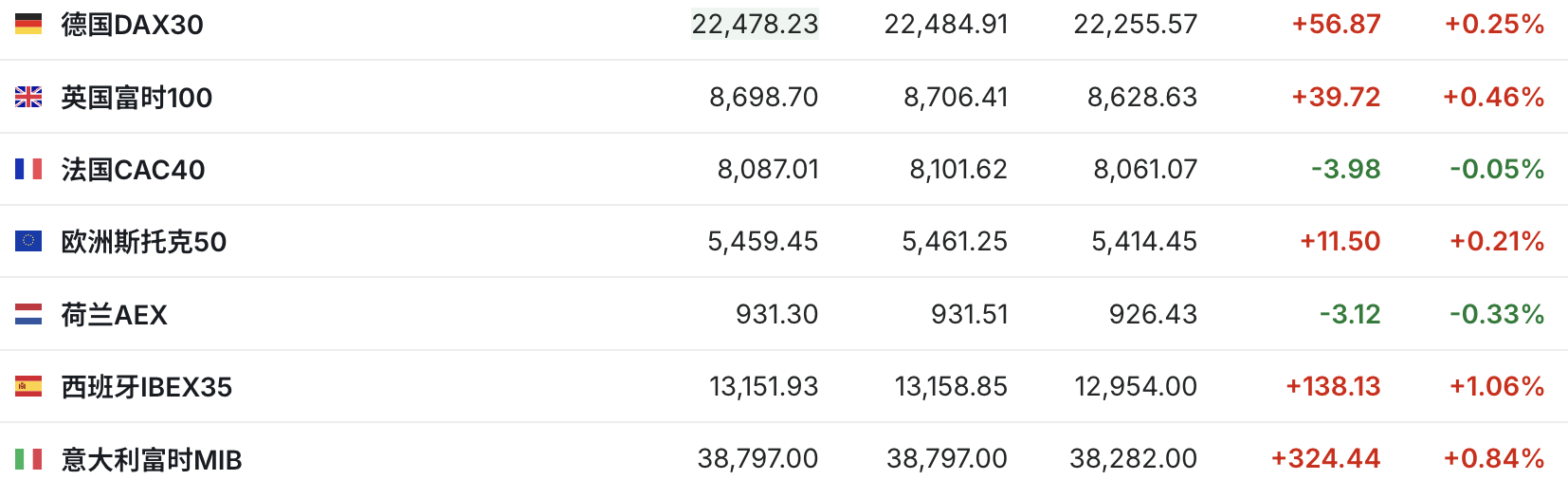

Cailian News, February 25 (Editor Xia Junxiong)Before the market on Tuesday, U.S. stock index futures were mixed, with market sentiment still tense, and investors gathered for geopolitics and global trade. Most major European indices rose.

(Source: YingweiCaijing)

On the last trading day, the U.S. stock market continued its decline. The three major indices collectively closed down. The Nasdaq index fell more than 1%, and its trend turned downward during the year.

“More broadly, investors in the market almost want to believe that the AI boom is over. They are looking for evidence and reasons to suspect,”Doug Clinton, managing partner of Deepwater Asset Management, said on CNBC’s Closing Bell program.” From our perspective, the AI craze is still there. I don’t think this boom is over, and I still think we have two to four years left.”

Bitcoin prices fell below $90,000 overnight, setting a three-month low and down 20% from their all-time high on President Trump’s Inauguration Day.

As of press time, Novo Nordisk continued to rise nearly 3% before the market. The stock had been rising for five consecutive days, with a cumulative increase of about 15%.

U.S. stocks rose more than 13% before the market after announcing the appearance of the first all-electric SUV, the Ideal i8.

company news

[DeepSeek is reported to be striving to release its R2 model in advance]

People familiar with the matter said DeepSeek is accelerating the launch of its R2 artificial intelligence model, which the company originally planned to launch in May, but is currently working to launch as soon as possible.

[Baidu plans to spend US$2.1 billion to acquire YY live broadcast business]

Baidu announced on February 25 that it had reached an agreement with Huanju Times to acquire the latter’s previous video entertainment live broadcast business (i.e. YY Live Broadcast) in the mainland of China with a total purchase price of approximately US$2.1 billion. As part of the transaction, all of approximately US$1.6 billion that Baidu had previously deposited in escrow accounts under the equity purchase agreement has been released to Baidu. The funds released will be invested in cloud computing and artificial intelligence infrastructure.

As of press time, Huanju U.S. stocks rose nearly 11% before the market.

[Guo Mingxi: Apple’s new Houston factory will produce AI servers equipped with M5 high-end processors]

On February 25, well-known analyst Guo Minghao, who has been following Apple’s industrial chain for many years, posted on social platform X that Apple’s new factory to open in 2026 in Houston, USA, will produce AI servers equipped with M5 high-end processors. Apple announced on February 24, 2025 that it expects to spend more than US$500 billion in the United States over the next four years. It mentioned that a new factory will be opened in Houston in 2026 to produce AI servers for Apple Intelligence Private Cloud Compute (PCC). Its previous forecast mentioned that “the infrastructure construction of Apple PCC will accelerate with the mass production of high-end M5 chips.” The mass production time of M5 high-end chips is 2H25 -2026, which is consistent with Apple’s announcement to accelerate the expansion of AI server production capacity.

[STMicroelectronics CEO is reported or will be dismissed due to poor performance]

People familiar with the matter said the Italian government wants to replace St. Microelectronics CEO Jean-Marc Chéry because of his poor performance. Italy and France each hold a 27.5% stake in STMicroelectronics. In January this year, ST forecast that first-quarter net revenue would fall short of analysts ‘expectations. Reported that while demand continues to be sluggish, STMicroelectronics is seeking to lay off as many as 3000 people. ST’s share price has fallen 37% in the past 12 months.

[Japan Steel Corporation said it will negotiate with the U.S. government to seek to restart its acquisition of U.S. Steel]

Nippon Steel President Masaasa Imai said on February 25 that the company would start negotiations with the U.S. Department of Commerce to restart its plan to acquire U.S. steel companies.

Earlier, Japanese Prime Minister Shigeru Ishiba said on the 17th of this month that after Trump came to power, Japan Steel Corporation has greatly changed its thinking about American steel.”Now the consideration of transaction intentions is investment rather than acquisition… We need to take necessary countermeasures. Measures to ensure that it is beneficial to both parties.”

[JPMorgan Chase will allocate an additional $50 billion for direct lending business]

JPMorgan Chase said on February 24 local time that it would allocate an additional US$50 billion for direct lending business.

JPMorgan Chase said the new commitment builds on the bank’s investment of more than $10 billion from its balance sheet in more than 100 private credit transactions since 2021.

Events worthy of attention during the U.S. stock market period (Beijing time)

on February 25

23:00 US February Consultative Conference Consumer Confidence Index, US February Richmond Fed Manufacturing Index

on February 26

00:45 Federal Reserve Governor Barr speaks on financial stability