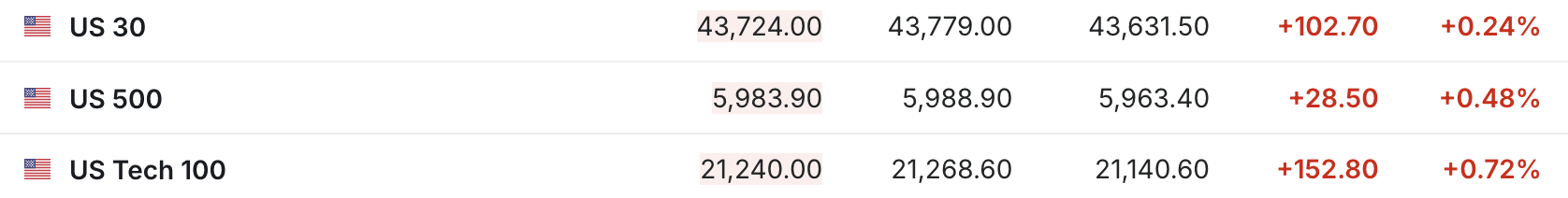

① The three major U.S. stock index futures collectively rose;

② Nvidia rose more than 2% before the market;

③ Hot Chinese stocks and U.S. stocks surged sharply before the market.

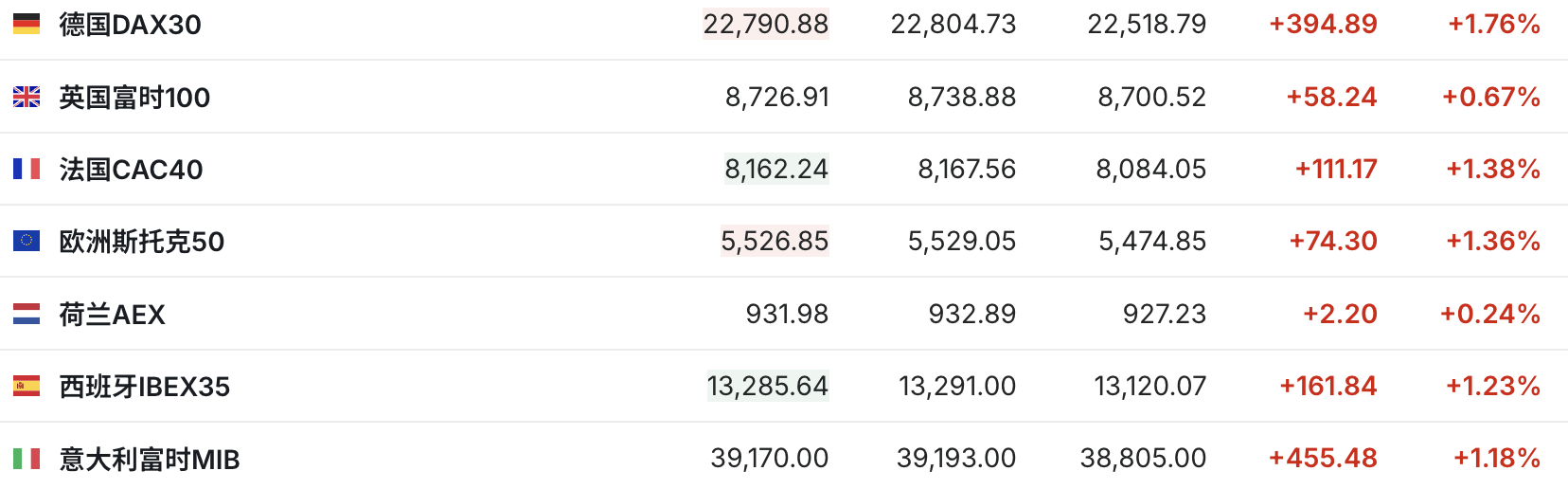

Cailian News, February 26 (Editor Xia Junxiong)Before Wednesday’s session, market sentiment recovered after a difficult period, and futures of the three major U.S. stock index stocks collectively rose. Major European indices rose across the board.

(Source: YingweiCaijing)

The Conference Board’s February confidence index released on Tuesday fell 7 points to 98.3, lower than expected, putting pressure on stocks. A series of recent economic data, including disappointing retail sales data and weak consumer confidence, have sparked concerns about the economic outlook and put pressure on major stock indexes.

Investors are closely watching Nvidia’s fourth-quarter earnings report, which will be released after the close of U.S. stocks on Wednesday and could become the next key factor in determining the market’s direction. Nvidia shares rose more than 2% in pre-market trading on Wednesday.

The earnings release comes at a critical period for Nvidia. The rise of DeepSeek has caused the market to question the sustainability of previously popular artificial intelligence transactions. Since 2025, Nvidia’s share price has fallen by more than 5%.

“I think the market reaction after the earnings release may be similar to last September,” Aswath Damodara, a professor of finance at New York University’s Stern School of Business, said on Tuesday.

“Nvidia may exceed analysts ‘expectations, but the market may still be disappointed because expectations seem to be higher than analysts’ forecasts,” Damodara said.

Ultramicro computers surged more than 22%. On the news, the company had previously submitted delayed financial results.

Popular Chinese stocks surged sharply before the session. As of press time, Alibaba was up nearly 5%, Jingdong was up more than 7%, Ideal Car was up more than 9%, Xiaopeng Automobile was up 8%, and Pinduo was up more than 3%.

company news

[DeepSeek cuts the price of API calls by up to 75%]

On February 26, DeepSeek announced that DeepSeek API now implements off-peak preferential pricing. The daily preferential period is 00:30-08:30 Beijing time, and the rest of the time is charged at the standard price. During this period, the price of API calls has been significantly reduced: DeepSeek-V3 has dropped to 50% of the original price, and DeepSeek-R1 has dropped to 25%.

[Lilly lowers the price of diet drugs in the US market]

On February 25, local time, Lilly’s U.S. official website announced that it would reduce the price of the weight loss drug Zepbound vials, which would reduce the monthly cost of the 2.5 mg and 5 mg dose vials to US$349 and US$499 respectively. These are only provided through LillyDirect’s out-of-pocket pharmacy solution. In addition, Lilly is introducing small vials of Zepbound for 7.5-mg and 10-mg doses, each costing $499 per month, provided that patients need to replenish the drug within 45 days.

[Cisco plans to expand cooperation with Nvidia to provide AI technology solutions to enterprises]

On February 25, local time, Cisco announced plans to expand its cooperation with Nvidia to provide AI technology solutions to enterprises. The two sides plan to jointly create a unified architecture across product portfolios to simplify building AI-ready data center networks. Nvidia will support the combination of Cisco Silicon One chips with Nvidia SuperNICs to become part of Nvidia’s Spectrum-X Ethernet network platform. Cisco will become the only partner chip supplier to be included in the NVIDIA Spectrum-X platform.

[The Indonesian government signed an investment agreement with Apple, paving the way for lifting the iPhone 16 ban]

Indonesian Industry Minister Agus announced on February 26 that the process of issuing domestic component-level certification (TKDN) to Apple can be initiated, but the latter still needs to submit some administrative documents. Previously, the Indonesian Ministry of Industry and Apple completed the negotiation process and signed a memorandum of understanding on the latter’s various investment plans in Indonesia. The Indonesian government’s move means that the iPhone 16 ban is about to be lifted.

In October last year, Indonesia refused to issue a sales license for the iPhone 16 to Apple on the grounds that the latter did not meet Indonesia’s domestic manufacturing requirements for smartphones and tablets. Apple subsequently promised to invest US$1 billion in Indonesia, but the Indonesian Ministry of Industry last month upheld the ban in seeking better conditions.

[Samsung launches quantum-resistant chips and is preparing for sample shipment]

On February 25, Samsung’s semiconductor business unit announced that it had completed the development of the S3 SSE2A chip and is currently preparing for sample shipment. The S3 SSE2A chip is designed to protect critical data on mobile devices from serious threats posed by quantum computing. Samsung said that because quantum computers may render current encryption algorithms obsolete, it is necessary to develop PQC (post-quantum algorithms) to withstand potential quantum attacks.

[bp releases strategic update: increase oil and gas investment and increase production, and reduce investment in energy transformation business]

On February 26, energy giant BP released a strategic update, which involves developing upstream oil and gas business, focusing on downstream business, and “being more restrained” in transformation investment.

According to the statement, bp will increase investment in oil and natural gas to nearly US$10 billion per year, increase production to 2.3 million to 2.5 million barrels of oil equivalent/day by 2030, and add an additional approximately US$2 billion in operating cash flow by 2027; Reshaping the downstream investment portfolio to drive growth, adding an additional US$3.5 billion to US$4 billion in operating cash flow by 2027, and launching a strategic review of its subsidiary Castrol.

In terms of transformation investment, bp will selectively invest in biogas, biofuels and electric vehicle charging; establish a light capital partnership in the field of renewable energy; focus on investing in hydrogen energy and carbon capture and storage; and invest annually in transformation business The amount is US$1.5 billion to US$2 billion, more than US$5 billion lower than the previous guidance target.

[General Motors Board approves $6 billion stock repurchase plan]

On February 26, General Motors announced that its board of directors had approved an increase in the quarterly common stock dividend yield by $0.03 per share, which will take effect from the next planned dividend payment. In addition, the board approved a new $6 billion share repurchase authorization. The company has signed into an accelerated share repurchase (ASR) program, through which it will execute $2 billion of the $6 billion share repurchase authorization. The ASR plan is expected to be completed in the second quarter of 2025.

[Stellantis net profit last year was 5.5 billion euros, a year-on-year decrease of 70%]

On February 26, Stellantis released its 2024 full-year results: net revenue of 156.9 billion euros, a year-on-year decrease of 17%; net profit of 5.5 billion euros, a year-on-year decrease of 70%; adjusted operating profit of 8.6 billion euros, a decrease of 64%; It is proposed to pay a dividend of 0.68 euros per share (yield of 5%) to ordinary shareholders, subject to shareholders approval. In addition, the selection of the new permanent CEO is progressing smoothly and will be completed in the first half of 2025.

Events worthy of attention during the U.S. stock market period (Beijing time)

on February 26

23:00 Annualized total new home sales in the United States in January

23:30 EIA crude oil inventories from the United States to February 21

on February 27

01:00 2027 FOMC Election Committee and Atlanta Fed Chairman Bostick delivered a speech on the economic outlook and the property market