Original title: “SEC ends Uniswap investigation! Founder: After 3 years of burning millions of dollars, DeFi finally won

Original author: Dynamic Area Trend BlockTempo

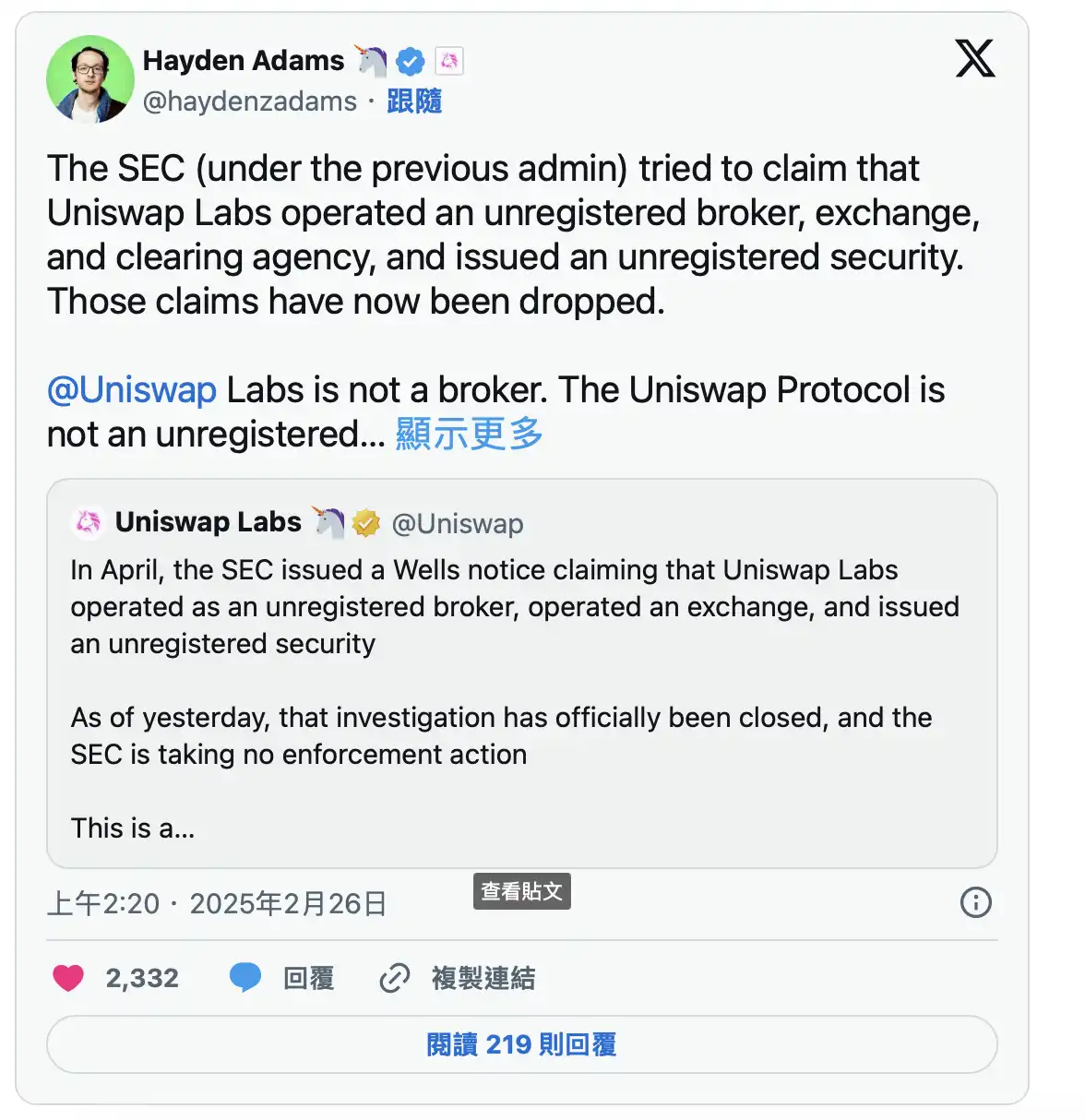

In April last year, the U.S. Securities and Exchange Commission (SEC) issued a Wells notice to Uniswap Labs, the leader of the Ethereum decentralized exchange (DEX), accusing it of operating an unregistered stock exchange, engaging in unregistered brokerage or clearing business, and even involving the issuance of unregistered securities, which may face the risk of legal action.

Now, the storm has finally come to an end. Uniswap Labs announced in the early hours of this (26th) that the SEC officially ended its investigation yesterday and did not take any enforcement action. Officials described this as a “major victory for DeFi” and emphasized:

“This once again proves what we have always believed-that the technology we are building is on the right side of the law, and our work is on the right side of history.”

Uniswap: Decentralized finance is the future, and now the United States can lead the trend

p Labs further stated in the statement thatDeFi is improving financial markets,Allows users to trade instantly, safely and transparently without having to give up control of assets.

At Uniswap Labs, we are committed to using technology to expand DeFi accessibility, improve liquidity and price transparency, reduce reliance on intermediaries, and reduce transaction costs. The products we build not only serve users, but also make the entire financial system stronger.

Uniswap also affirmed the new leadership of the SEC and believes thatLaw enforcement investigations and litigation within the industry are being reviewed, is not limited to the Uniswap case, and realizes that there are more effective ways to protect American consumers.

The end of this investigation is not just a victory for Uniswap Labs, but a victory for the DeFi community, developers and users as we strive to build a better financial system.

Finally, p once again emphasized thatThey have been happy to talk to regulators and policymakers to establish a clear and reasonable regulatory framework for DeFi, and look forward to more constructive discussions in the future.

Hayden Adams: SEC investigation cost us 3 years and millions of dollars

In response, Hayden Adams, co-founder of Uniswap, issued an article stating that the SEC (previous management) investigation continued 3 years, forcing themSpend countless hours and millions of dollars,It even brings pressure on a personal level. He pointed out:

Federal investigations are extremely intrusive and stressful. There is even a saying in the legal profession: “The investigation itself is punishment.” But this should not be the price American innovators have to pay.

He emphasized that Uniswap Labs is not a broker, nor is the Uniswap protocol itself an unregistered exchange or clearing house, nor is it operated by Uniswap Labs. In addition, UNI tokens are not securities.

However, the SEC is still taking enforcement action against Uniswap Labs, even without a clear legal basis, trying to force DeFi into a regulatory framework that is inconsistent with its nature through arbitrary enforcement, while at the same time not providing clear rules or compliance paths.

Now that the SEC’s charges have been dropped, he said this victory belongs to the entire DeFi ecosystem:

“This once again proves what we have always been holding: decentralized technologies and self-hosting are fundamentally different from the centralized intermediary systems they are replacing.”

He further pointed out that self-custodial funds operate on the public chain through smart contracts, bringing unprecedented transparency to financial markets. It would not work to directly impose on DeFi the regulatory framework that applies to centralized and opaque traditional financial markets (TradFi).

Finally, Adams expressed his gratitude to the new SEC leadership for its more constructive regulatory attitude and looked forward to subsequent cooperation to ensure that DeFi can thrive in the United States rather than being forced to relocate overseas.

original link