If demand for Memecoin is unsustainable, Solana’s economy may face certain challenges.

Author:MONK

Compiled by: Shenchao TechFlow

(This article is a summary of the core points of Messari’s latest report.)

Recently, there has been a growing debate about whether Memecoin is dead and whether it will put Solana in trouble. Next, I will use the data to answer you.

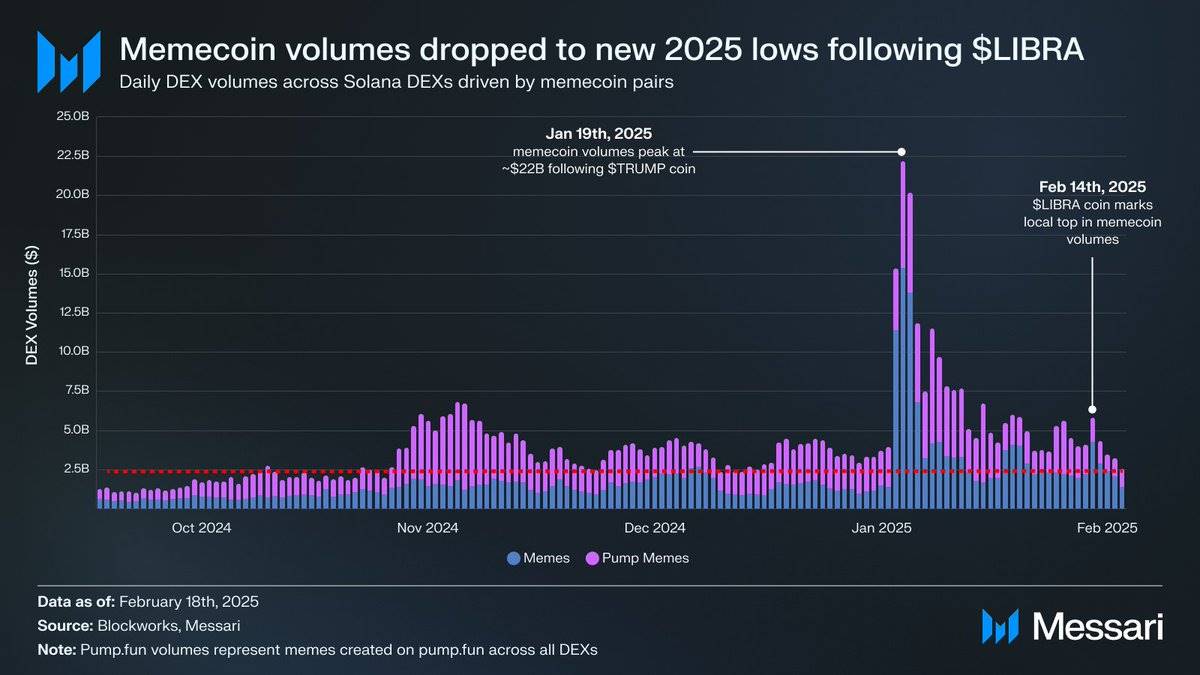

Since the $LIBRA incident, Memecoin trading volume on Solana has dropped to its lowest level this year.

However, it should be noted that the current trading volume is still higher than the level at the beginning of 2024, which does not mean that Memecoin has withdrawn from the historical stage.

What I really want to emphasize is how much the Solana economy relies on Memecoin for support.

Solana’s economic dependence on Memecoin: Risks and current situations

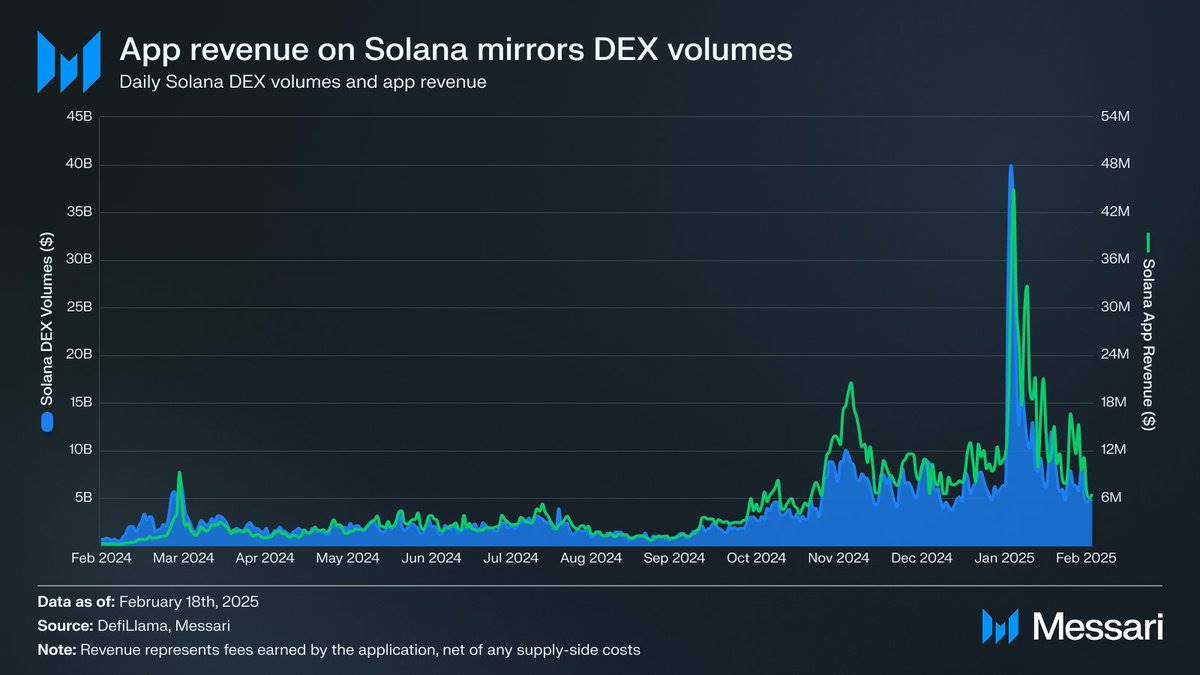

Solana’s economy is essentially driven by transaction volume.

If we look at the leading apps ranked by revenue on Solana, we see that almost all of them are agreements that promote trading activity in some way.

This can be verified by the strong correlation between daily DEX transaction volume and application revenue.

This model is not uncommon in today’s high-throughput blockchains. For example, Base’s economy also operates largely based on transaction volume.

In contrast, revenue from the Ethereum main network comes more from applications driven by total locked volume (TVL), such as lending and mining revenue, mainly because trading activity on the main network has dropped significantly.

However, it is worth noting what are the core factors driving these trading volumes.

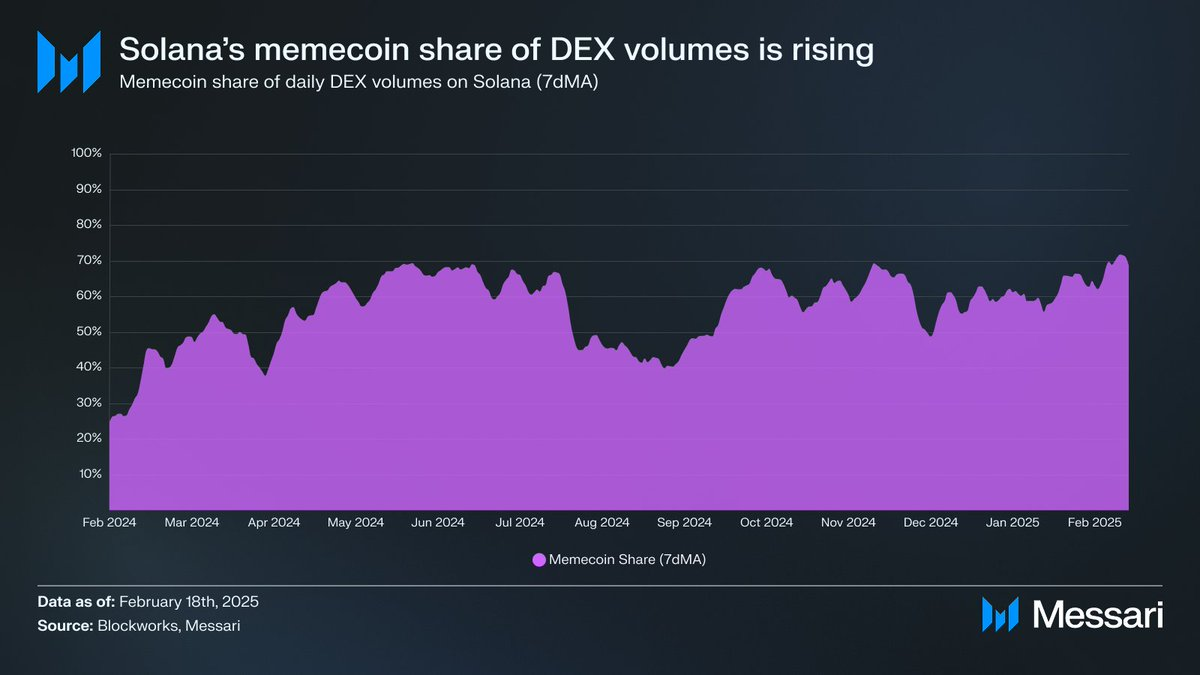

On Solana, a large amount of trading activity comes from Memecoin.

But what is worrying is that Memecoin’s trading volume has become abnormally high. Taking February 2025 as an example, Memecoin’s trading volume accounted for 70% of Solana DEX’s total trading volume.

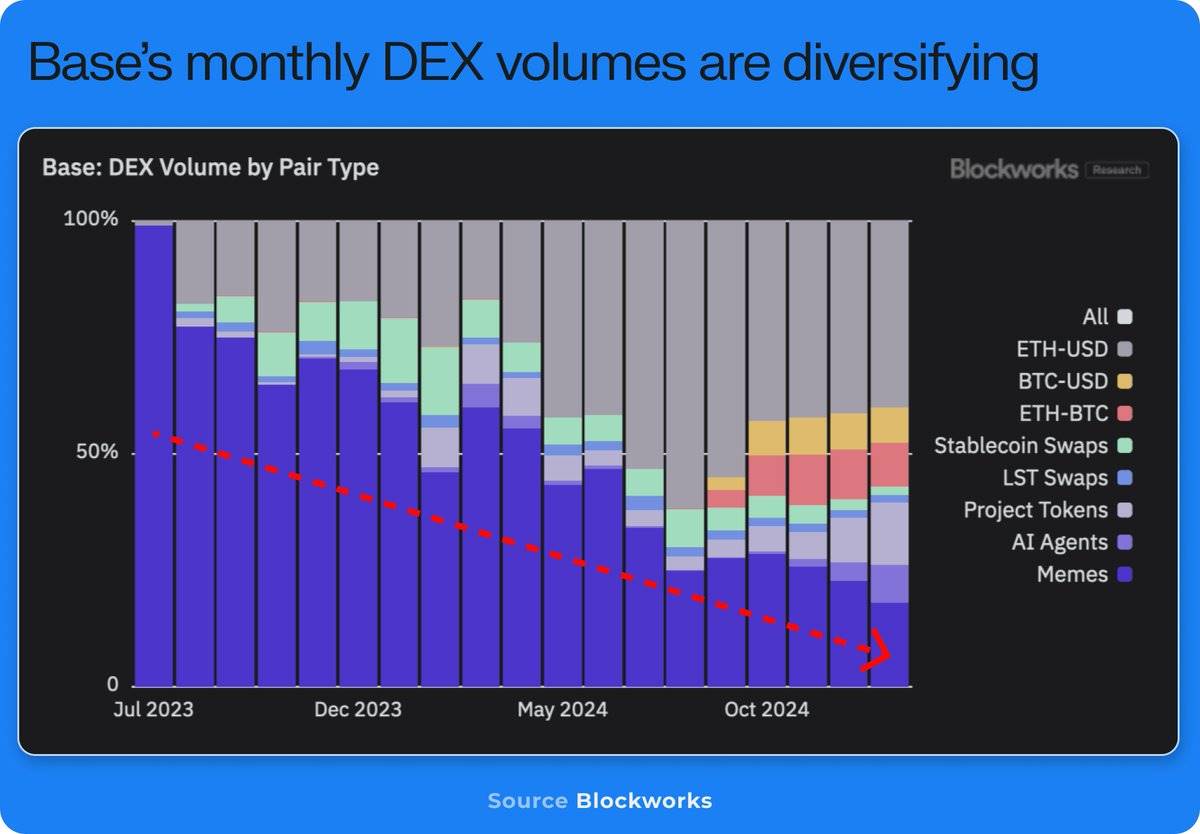

In contrast, Solana’s competitor Base is gradually moving away from its reliance on Memecoin trading volume and moving towards more project tokens and trading pairs denominated in mainstream assets:

Why is this a problem?

First, Solana’s Memecoins are extremely volatile, and the sustainability of these Memecoins remains in question.

More importantly, researchers, investors and the Solana Foundation have been emphasizing growth in app revenue and chain GDP. Solana’s app revenue is indeed growing rapidly and remains one of the best indicators of user activity.

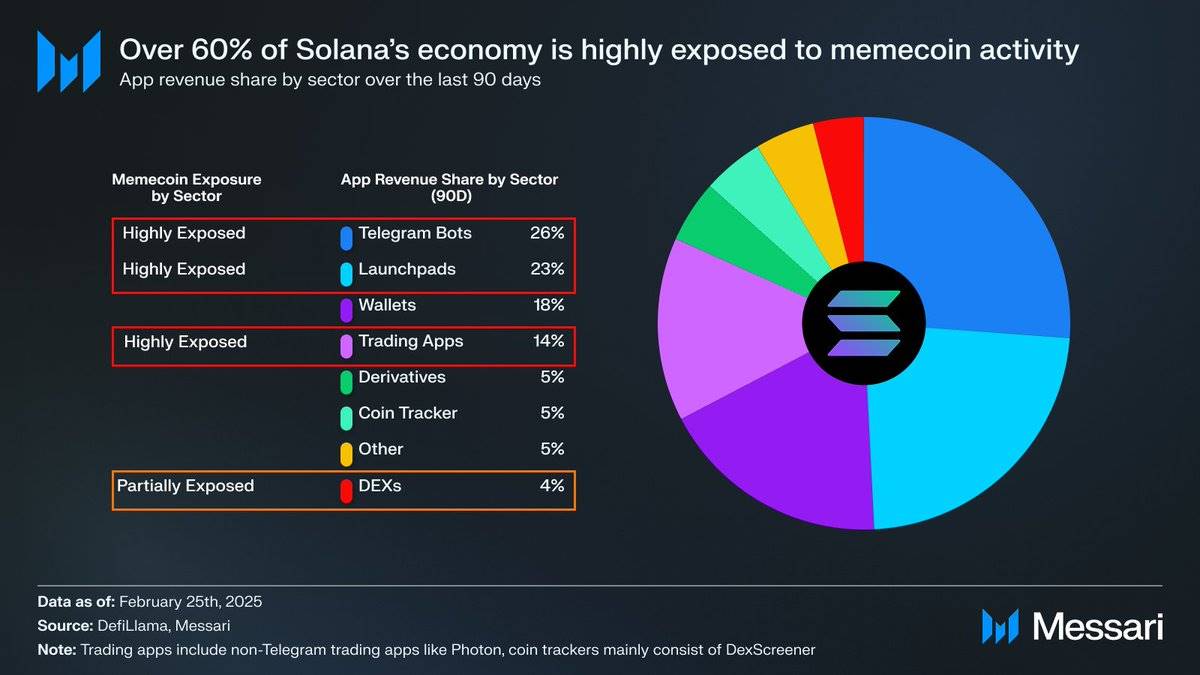

However, when we delved into these main sources of revenue, we found that the most profitable business on Solana actually relied on Memecoin for profits.

For example, the two highest-paying areas on Solana are Telegram trading robots and Launchpads (e.g. pump.fun).

These two areas together contribute more than 60% of Solana’s application revenue, with annualized revenue exceeding US$3.3 billion.

The core of these businesses is Memecoin.

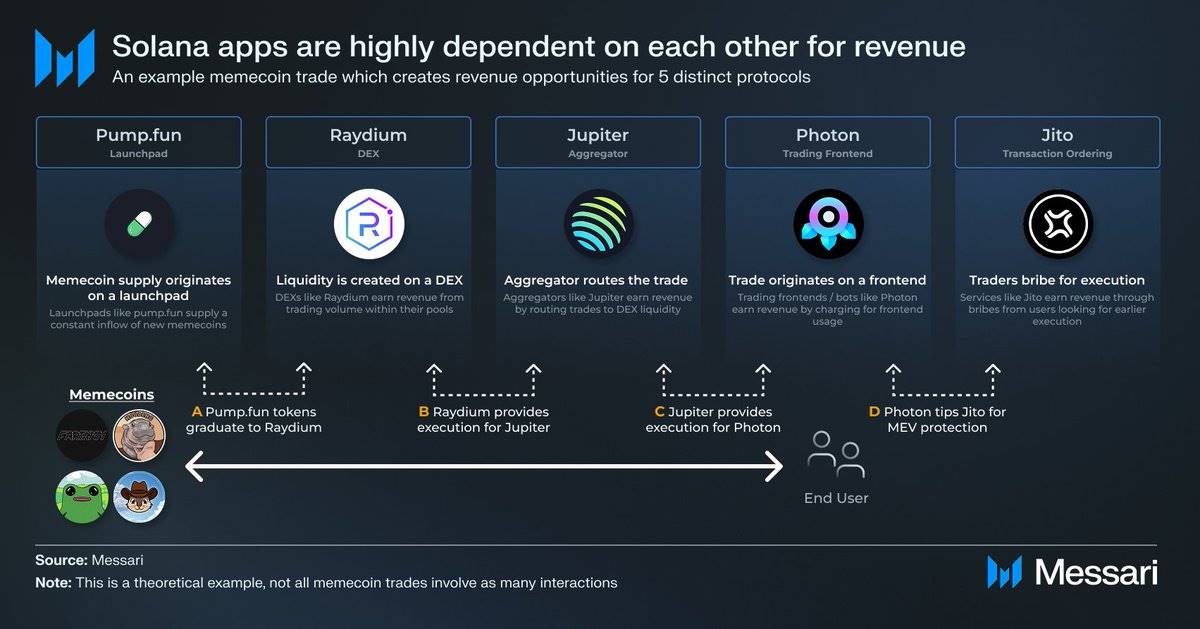

Mutual in Solana’s application economydependenceThis further exacerbates the risk of Memecoin trading volume.

For example, Pump relies on Raydium, which in turn relies on Jupiter, and then Photon and Jito.

This means that a Memecoin transaction can generate revenue for five different apps at the same time.

So these look like apps that are independent businesses, and their revenue is actually largely interdependent.

However, this cross-domain revenue is based on the fact that 50%-70% of current transaction volume comes from Memecoin activities.

From a blockchain perspective, Memecoin itself does not have a problem. For Solana, this phenomenon is a natural result of its early leadership in low-cost block space and on-chain user experience (UX).

Blockchain should essentially be neutral on the type of activity.

Building an ecosystem around Memecoin is profitable, so many agreements have seized the opportunity.

In the future, other asset classes, such as decentralized Internet of Things networks (DePIN), real-world assets (RWAs), stablecoins, and mainstream assets, may gradually replace Memecoin’s transaction volume.

But in the moment,It’s not too much to say that Solana is a Memecoin economy.

This also means that if Memecoin trading volume contracts significantly, it may trigger a chain decline in revenue.

Why is this important?

Solana’s development narrative has been centered around growth in underlying indicators that also support the performance of $SOL assets.

But in fact, these indicators are highly dependent on the Memecoin field, which is extremely reflexive (i.e. changes in trading volume amplify market volatility).

If we use these indicators to assess Solana’s progress, the collapse of Memecoin trading volumes could turn a growth story into a reconstruction story.

This will lead to a sharp shift in market sentiment, and the resumption of these economic activities may take a long time.

Of course, Murad may also be right. If so, ignore these concerns.

In the long run, I am still optimistic about Solana’s ecology. But in the short to medium term, if demand for Memecoin cannot be sustained, Solana’s economy may face certain challenges.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern