The 112th National Sugar and Liquor Fair will be held in Chengdu, Sichuan from March 25 to 27.

Financial Union, February 27 (Editor Zi Long),From March 25 to 27, the 112th National Sugar and Liquor Fair will be held in Chengdu, Sichuan. According to reports, this sugar and wine fair includes four parts: exhibitions, conferences, events and activities. The total exhibition area is 325,000 square meters. There will be 9 major exhibition areas and 23 special category areas. In addition, this sugar and wine fair set up an “AI Equipment Zone” for the first time to systematically demonstrate the innovative integration and technical application of AI in the field of food machinery.

As an important food industry conference, the Sugar and Liquor Fair has always attracted much attention from the market. It is also often called the “barometer” of the food and alcohol industry. Dongxing Securities pointed out in a recent research report that it is optimistic about the future reform and promotion of national policies in terms of consumption environment, transaction environment, and policy environment, and is optimistic about the overall improvement of the performance of the food and beverage industry. Especially for catering consumption, with the implementation of the plan, consumption such as tourism, shopping in business districts, and offline experience will be boosted, which will have a significant boost to catering consumption. At the same time, it is expected that consumption subsidies in various places will also increase catering subsidies, which will positively help the catering industry.

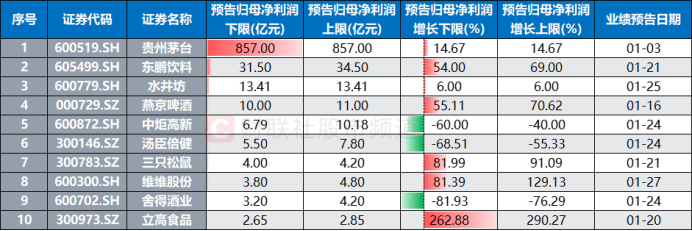

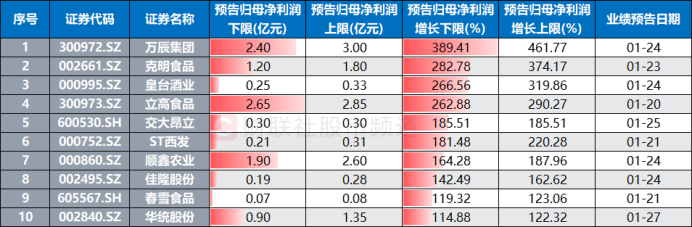

At present, more than 50 listed food and beverage companies have disclosed their 2024 annual report forecasts, and the sector’s “disclosure rate” is close to 40%. In terms of specific individual stocks, Kweichow Moutai, Dongpeng Beverages, Shuijingfang, Yanjing Beer, Zhongju High-tech and other stocks ranked first last year in terms of profit scale (forecast lower limit of net profit attributable to parent companies), while Wanchen Group, Keming Food, Huangtai Wine Industry, Ligao Food, Jiao Da Angli and other stocks ‘performance growth rates (forecast lower limit of net profit growth attributable to parent companies) are relatively high.

Note: Food and beverage stocks with the highest growth rate of parent net profit/parent net profit and whose annual report forecast has been disclosed (data as of February 26)

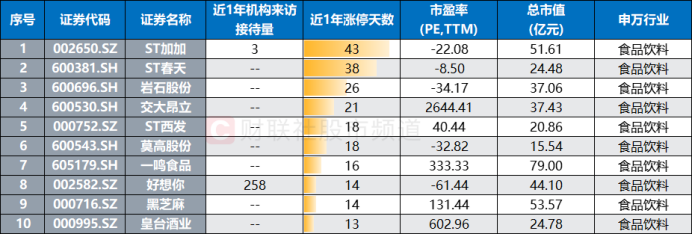

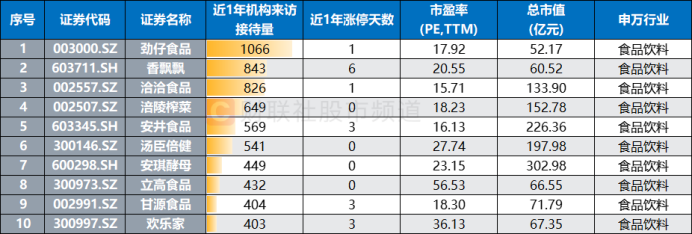

Regarding the target areas that can be focused on, screening food and beverage stocks. As of February 26, a total of nearly 30 stocks have received more than 100 institutional surveys in the past year. Among them, Jinzi Food, Xiangpiao, Qiaqia Food, Fuling Pickled Vegetable, Anjing Food and Tomson Beijian ranked among the top in surveys, with more than 400 surveys. In addition, excluding ST shares, Rock Shares, Jiao Da Onli, Mogao Shares Yiming Food, Haoxiangyou and other stocks have had more daily limits in the past year.

Note: Food and beverage stocks ranked among the top in institutional surveys in the past year (as of the close of February 26)