Original title: How to Backfill a Narrative on Solana, Ethereum, Memecoins, and REV

Original author: Brendan Farmer, Polygon Joint Venture

Compiled by: Ashley, BlockBeats

Editor’s note: The article criticizes Solana’s value narrative and believes that the short-term wealth effects of its reliance on Meme coins for transactions are not sustainable and present structural risks. Solana’s success may be due more to speculation than technical advantages, while Ethereum is still growing steadily in the DeFi space. The author reminds readers to always maintain critical thinking about narratives in the encryption field to avoid being misled by the market boom.

The following is the original content (the original content has been compiled for ease of reading and understanding):

The task of thought leaders in the crypto world is to tell stories that explain why the value of certain currencies has increased or decreased. Curves that fluctuate up and down on a chart are never just lines, but are part of a larger technical or economic trend. These “filled narratives” may be eye-catching (such as “Digital Gold” and “World Computer”) or less attractive (such as “Play-to-Earn is the future of work”), but it is important to critically examine how each narrative builds the world-and who benefits from this construction.

Narrated that blue-collar and venture capitalists in the factory have been working overtime, explaining why ETH is performing poorly compared to BTC and SOL. Some of these arguments are not controversial: the Ethereum community should reach a better agreement on the direction of sharing, reassess its technical assumptions, or simply do better.

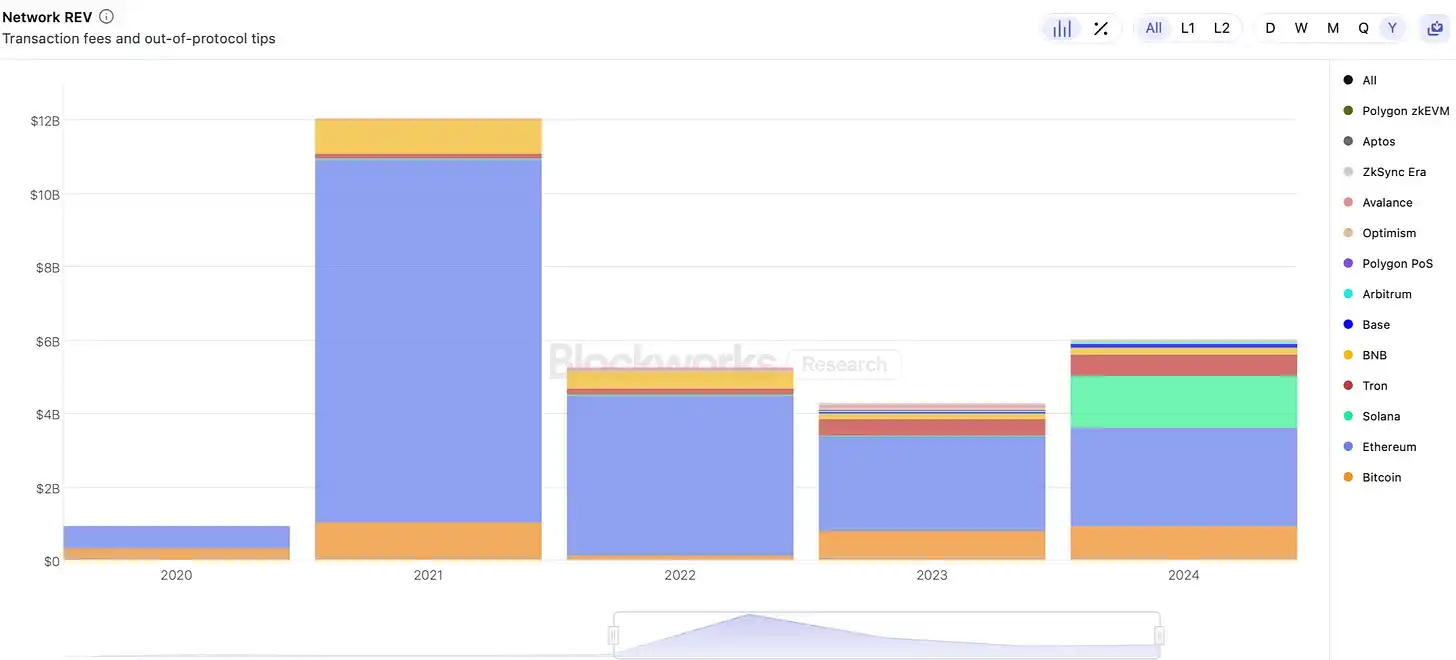

This article argued that a particular narrative about Solana and Ethereum was wrong. The story goes something like this: Solana dominates Ethereum on blockchain’s most important economic indicators, especially decentralized exchange (DEX) transaction volume and REV (real economic value = MEV + transaction fees, a measure of agreement cash flow).

According to this story, Solana’s leadership in REV stems from technological advantages and traction across multiple application categories. The value of SOL can be evaluated based on expected future REVs, which is more advantageous than ETH, which can only be valued based on “atmosphere” or “monetization.”

But this is just a narrative. Solana’s REVs are generated entirely by Meme coins transactions, making it difficult to evaluate the value of SOL based on future cash flows. Moreover, the dominance of Meme coins poses structural risks to Solana.

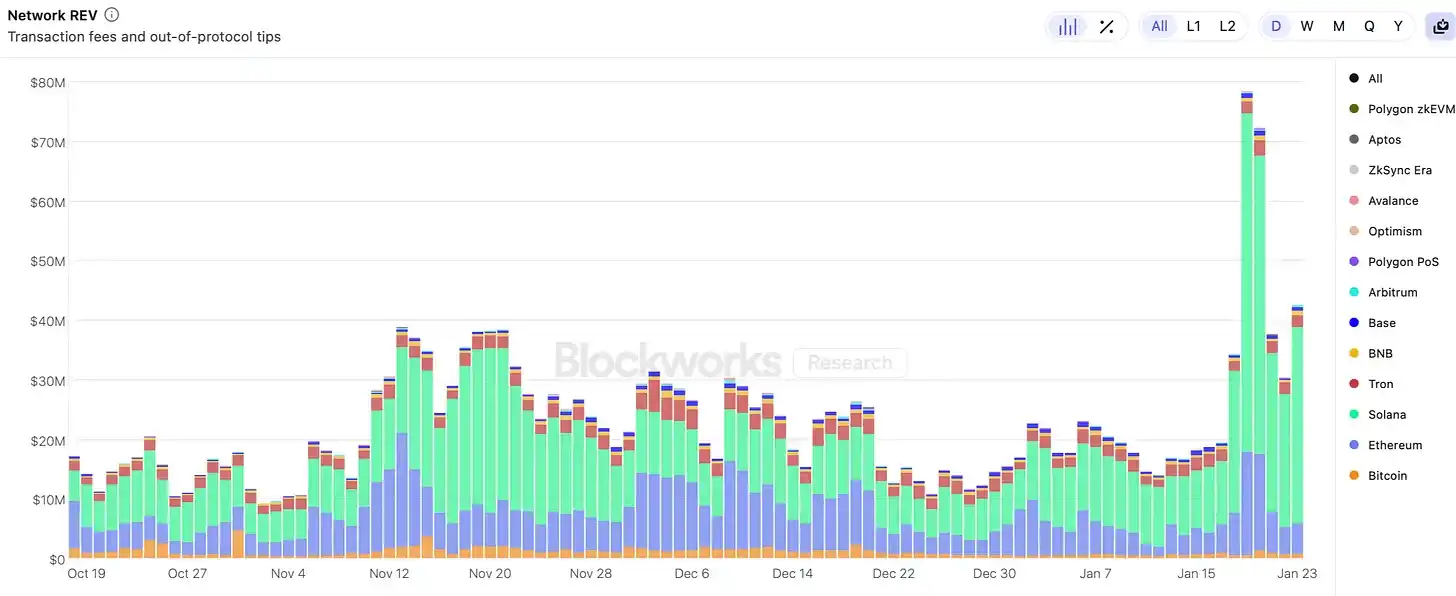

Track REV

In the past year and a half, the SOL/ETH ratio has increased about 10 times. Whenever we see similar price fluctuations, we know it’s time to fill in a new narrative.

We can tell the story: Solana has more advanced technology, users love it, and the best developers of all categories-including DePIN, DeFi, Payments, and of course MemeCoin-have turned to Solana.

Venture capitalists will argue that this huge talent migration has led to huge increases in the most important indicators of REV, transaction volume and application revenue. The story is that SOL does not need to be a currency or commodity like ETH, because its market value will ultimately be confirmed by a reasonable multiple of real income, rather than some Meme cultural nonsense.

If you want to see how Solana performs, the data will prove it.

This is a great narrative.

But for the sake of argument, let’s see where REVs come from.

Probably a wonderful combination of all the best encryption apps. Pioneering DePIN like Helium, a CLOB that is building a decentralized NASDAQ, stablecoin payment volumes, complex DeFi transactions, and of course, there may also be some from Memecoin, right?

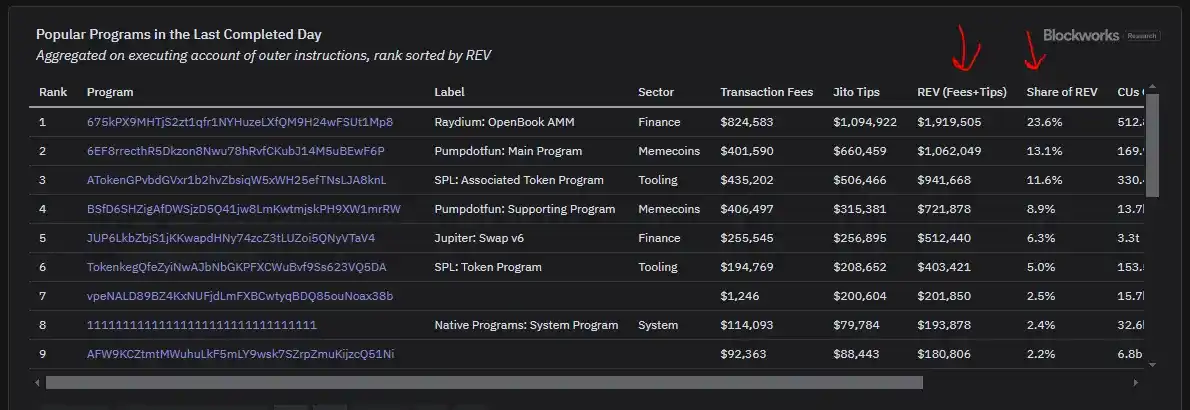

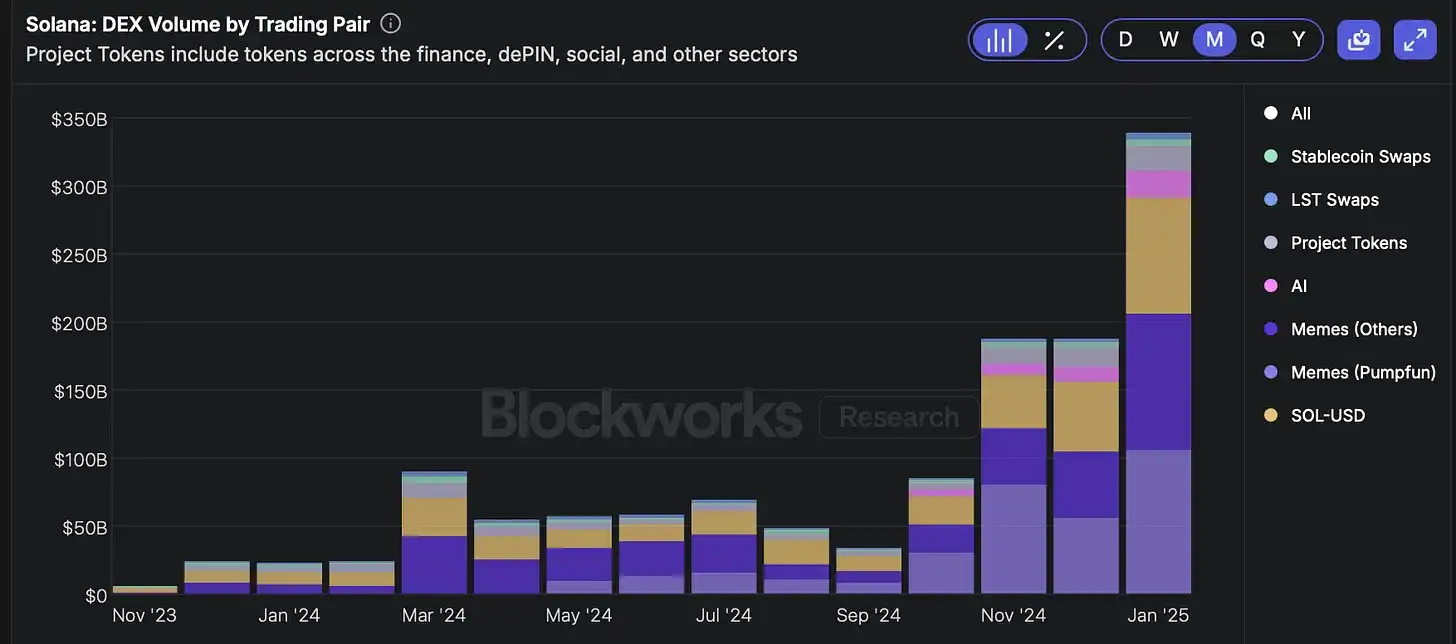

Wait-are these just pump.fun and a bunch of Telegram Bots used for Meme coin transactions?

Where are the groundbreaking applications? What about DePIN? Where are the global prices found for events in Singapore or London? Where are the top, IMO Award-winning developers?

Are we increasing bandwidth and reducing latency for Bot trading $BUTTHOLE?!

Build a decentralized “casino”

This article is not about discussing the good or bad of Meme coins. Meme coins could be a good way to direct users to crypto protocols and transfer wealth from “ignorant market participants” to skilled liquidity providers.

However, Solana’s REV comes entirely from Meme coin transactions, which raises structural issues for evaluating the value of SOL based on future REVs.

Let’s fill in our own narrative. After the FTX explosion, SOL was oversold, but Solana can still present a persuasive story to institutional capital allocators. It has a pragmatic expansion roadmap and is culturally understandable to investors familiar with Silicon Valley technology start-ups.

As the promotion of SOL was successful, prices increased. This creates a wealth effect, which is a wonderful thing in the crypto space. This is a form of financial alchemy, where token price rises (largely unrelated to technology) translate into on-chain activity (seemingly driven by more advanced technology).

You can think of the wealth effect as a pressure cooker full of money, heated up, and the only way to relieve the pressure is for capital to flow to more stupid and riskier assets, like CryptoDickButts or this:

As activities increase, thought leaders can fill in an engaging narrative, drive SOL prices up and create more activities. Apps issue tokens to inject more capital into the system (e.g. Jito effectively airdropped a new car to everyone in Solana DeFi). We can call it the flywheel effect.

According to our narrative, the reason why Memecoin activity exploded on Solana (rather than other equally scalable L1 or L2) was mainly due to the wealth effect of SOL. Solana’s cheap transaction fees are a necessary prerequisite, but a wealth effect is needed to allow the Meme coin craze to grow to its current scale.

Time is a circle

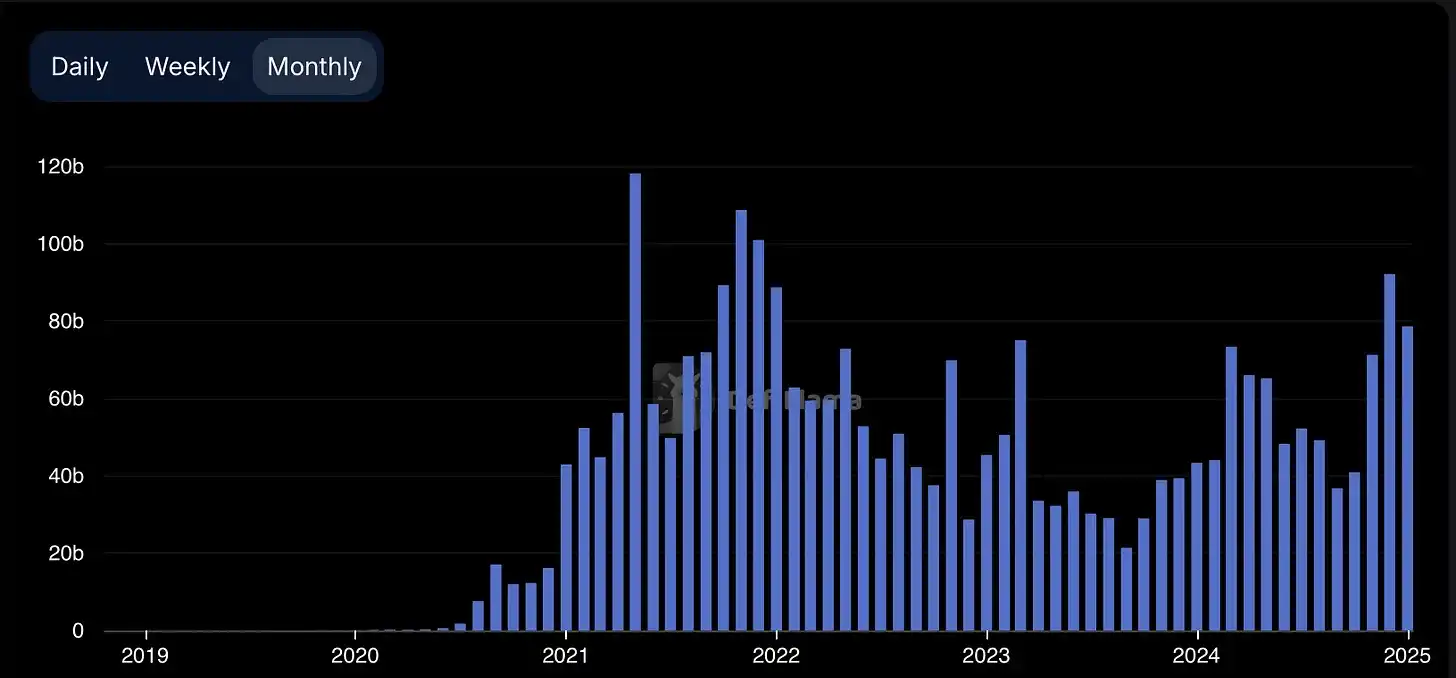

This has happened before. If we look back at 2020-2021, we will see the astonishing growth in REVs on Ethereum. In the last bull market, ETH holders ‘new wealth flowed to increasingly volatile on-chain assets, such as NFT and Meme coins.

Highly speculative assets tend to generate excessive REVs because users are willing to pay higher priority fees and MEV rates to gain exposure to fluctuations. The value of a Meme transaction is highly dependent on its position in the block, so block proposers who control the ordering can get more value. This brings higher commissions to the agreement than other forms of on-chain activity.

However, we can see that as the market cycle changes, the highly speculative activity on Ethereum (in terms of NFT and Meme coins) disappears. It is fundamentally wrong to use the 2021 Ethereum REV as the basis for estimating future REVs.

Meme coin REV will not last (and will not save you)

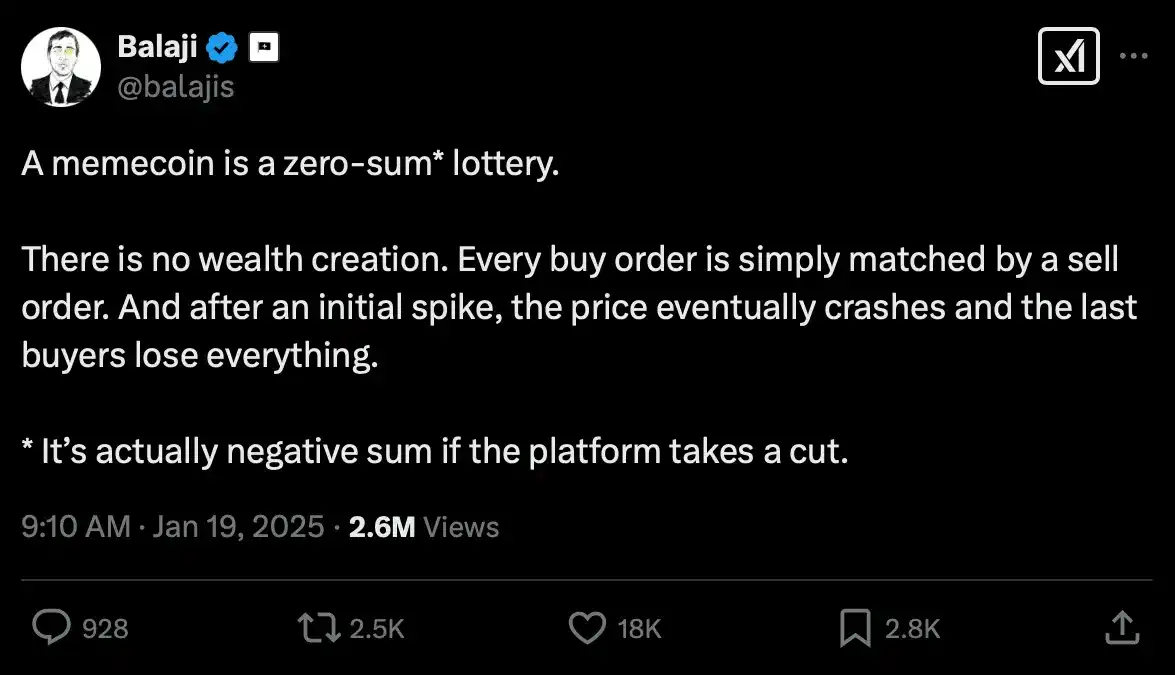

Just as the REV generated by Meme coins on Ethereum is unsustainable, it will not last on Solana. Although Meme coin may be interesting, Meme coin speculation is a zero-sum game.

The fees and MEVs paid by Meme coin gamblers are extremely high compared to other forms of gambling, and eventually gamblers run out of money. High fees and MEVs may be good for increasing REVs, but in a zero-sum game, they do not create any economic value, and the consequence is that they extract liquidity from the ecosystem. Each REV paid per dollar means less funds for future Meme-coin transactions, and future REVs will also decrease.

As a result, it is difficult to argue that the growth in REV will continue and ultimately justify SOL’s market value.

The ratio of SOL’s FDV (approximately US$150 billion) to 2024 REV (US$1.4 billion) is approximately 100:1. If we were generous, based on the Q4 REV ($825 million) annualized, we would get a ratio of 45:1. Although there has been an improvement, this still assumes that Meme coin trading volume will increase over time. Given that this is unlikely (see ETH’s REV fell from $10 billion to $2.6 billion in the previous market cycle), it is difficult to justify SOL’s valuation through expected future REVs.

The popular retort is that Solana will simply expand its block space by a factor of 10 or 100, and that REV will scale up.

The problem is that even if Solana could increase throughput 100 times, it would have trouble finding 100 times more innocent order streams willing to be “extracted”-buying Meme coins through sandwich attacks and snipers, except in Ken Griffin’s most perverted fantasy?

In order for Meme coin trading volume to continue to grow and compress SOL’s P/E ratio, we need SOL’s price to increase to enhance the wealth effect. But that defeats the purpose; we are trying to compress the P/E ratio rather than expand or maintain it.

Other applications such as DeFi, DePIN and payment applications will not generate the same number of REVs per unit of block space. For example, a complex trader lends blue-chip assets to earn 10%, or a player playing a game may consume the same amount of block space, but the REV generated is much lower than that of Meme coin trading.

“Mercenary” Memecoin

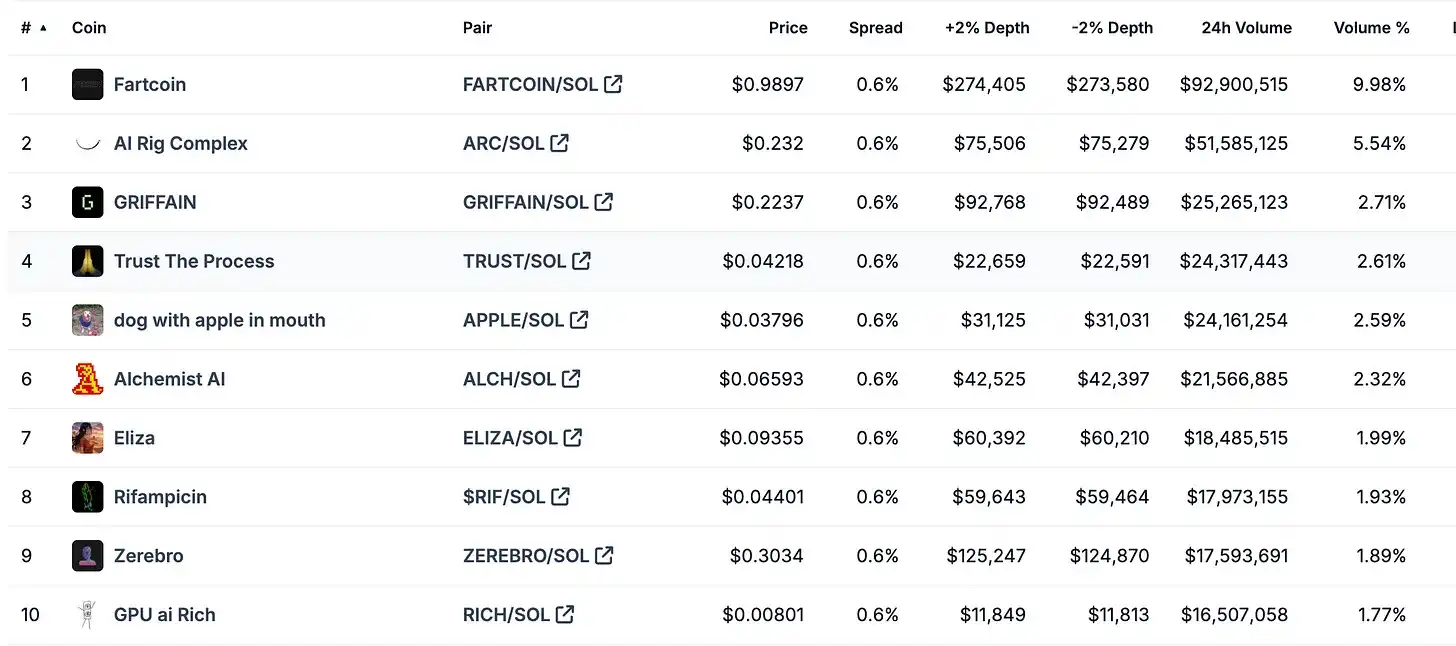

Memecoin’s trading volume also tends to shift to new chains with the wealth effects of new tokens.

You might think that the reason why Memecoin’s distribution moved from Ethereum to Solana was that Solana is more scalable and suitable for trading, and Solana’s technological advantages mean it will continue to be a hotbed of degenerate gambling. This is not the so-called “decentralized Nasdaq”, but as a center of crazy speculation, it is at least worth something.

This ignores the fact that the direct cause of the Memecoin craze is the SOL wealth effect. For example, at the end of 2023, BONK’s prices and trading volumes followed SOL’s footsteps. We can see that the same applies to trading volume on decentralized exchanges (DEX), especially Memecoin, which didn’t start to explode until March 2024, after SOL rebounded 10 times from its post-FTX crash low.

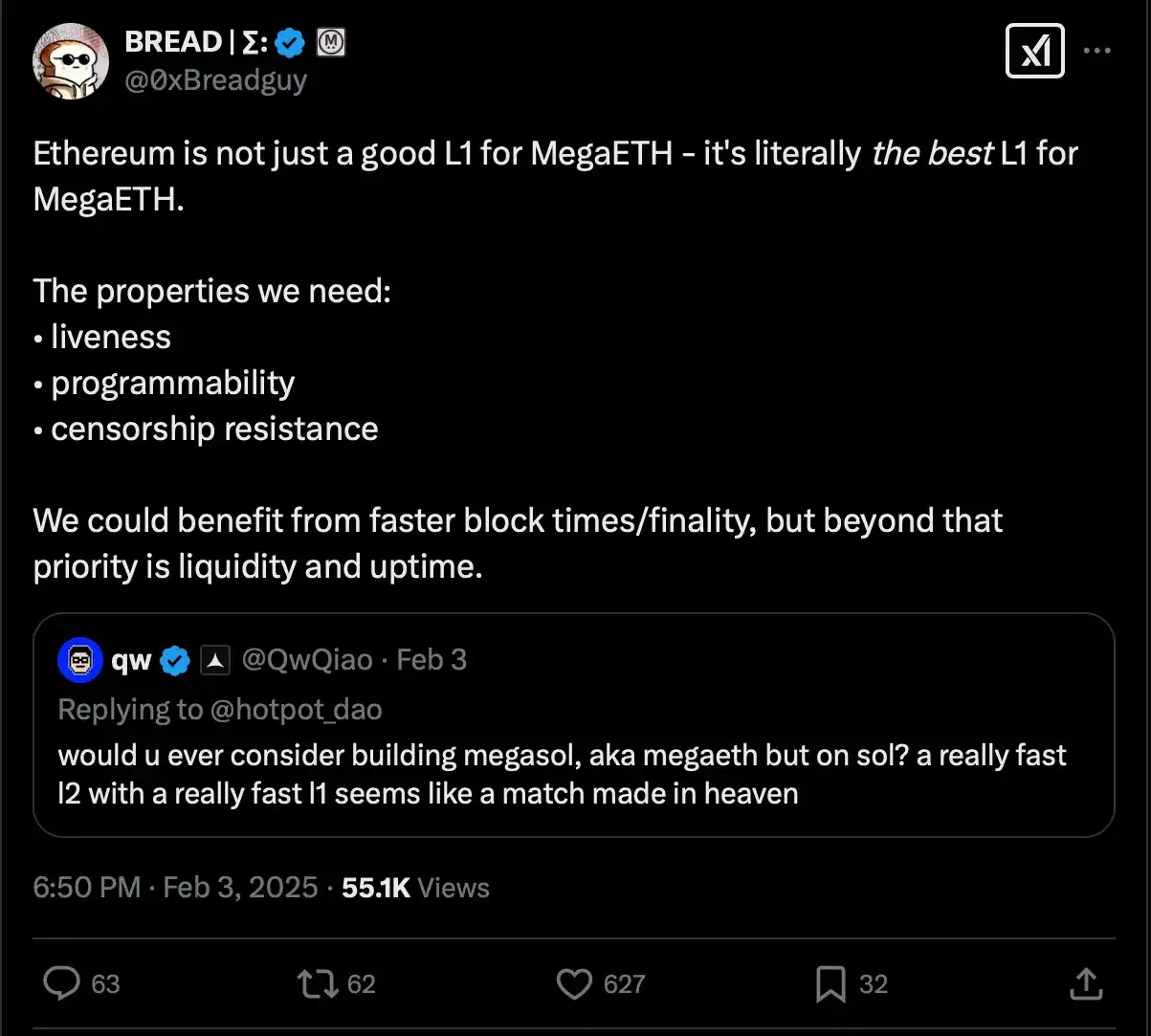

With the launch of new chains, especially high-performance L2s such as MegaETH and Rise, these chains may provide a better trading venue for Memecoin traders. These chains will be launched with new tokens and new wealth.

They may not be decentralized or synchronize global information at the speed of light, but the people trading $FARTCOIN don’t care-the risks they take on Memecoin far outweigh any risks posed by decentralization. L2 provides lower latency, better performance and higher trading success rates, which is a better trade-off.

What about Ethereum?

Narratives about REV growth on Solana have also been used to advocate change for Ethereum. The implicit argument is that Ethereum must expand to regain lost activity (and REV). This doesn’t make sense considering that Solana’s activities are driven entirely by Memecoin. Scaling L1 execution by 5x or 10x will not bring Memecoin back to Ethereum L1;Solana still has lower fees and a stronger short-term wealth effect.

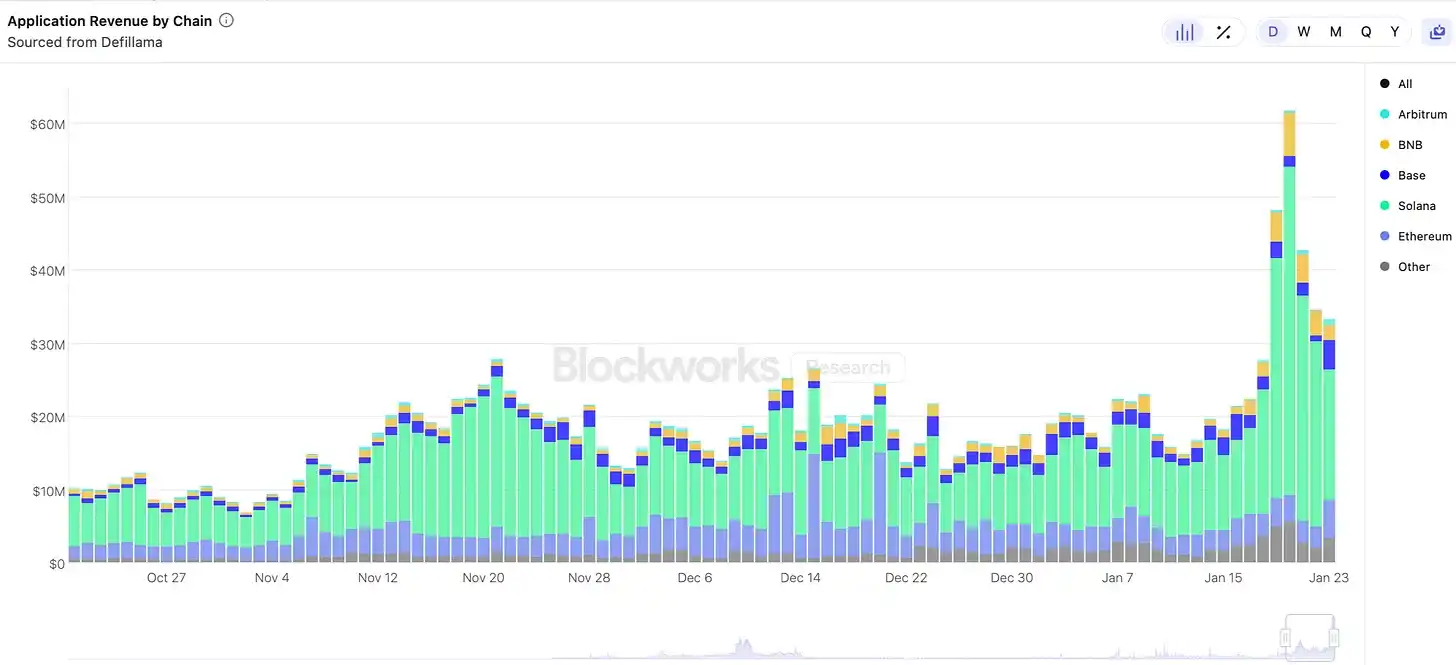

If DeFi had migrated to Solana as a whole, we would have seen a significant decline in transaction volume for Ethereum. However, Ethereum’s DEX trading volume in December 2023 remained between 10% and 20% of the highest monthly trading volume in history. Even during the bull market in 2021/22, ETH prices fluctuated more, and NFT and Memecoin trading volumes were much higher than they are now.

This supports the idea that there are different categories of DeFi users. Although Memecoin traders are increasingly flocking to Solana, a large amount of money remains on Ethereum. Citing REV or DEX transaction volumes as evidence of Solana’s dominance in DeFi is misleading.

If we use DeFi TVL as a metric for each type of network activity, we can see that Ethereum’s TVL is 6 times that of Solana (despite weak ETH prices), which suggests that activity on Ethereum is qualitatively different from activity on Solana. From DeFi’s perspective, Memecoin is almost useless; by the way, what are the mortgage requirements for a $BUTTHOLE loan?

The counterargument is that almost all on-chain activity is purely speculative, so it would be hypocritical to regard Solana’s activity as a Memecoin transaction when Ethereum’s activity is not linked to real economic activity. My first reaction was to suggest that for the benefit of the industry, stop making such remarks.

More seriously, while Solana leads the way in REVs, Ethereum clearly has a more mature and vibrant DeFi ecosystem because it still shows strong TVL and activity even without significant Memecoin releases.

Rollup Center Roadmap Counterattack

We have argued that the value of SOL cannot be proved by expected REVs in the future. Currently, SOL is still competing with BTC and ETH to become the first link in the capital flow of crypto-assets.

But Memecoin poses another structural challenge to Solana’s long-term viability, as Memecoin traders are better suited to L2 trading.

L2 is capable of high-throughput operations with extremely low latency. They respond faster to problems and outages without decentralized coordination overhead. They make it easier to filter spam transactions.

You might think that Solana’s high-performance client is a lasting advantage, but open source technology always likes to be commoditized. Ironically, while venture capitalists cite Solana’s technical advantages over Ethereum, teams like Eclipse and Atlas have already deployed SVM L2 on Ethereum.

Ethereum’s mobility and TVL make it a better platform for L2. In addition, Ethereum clearly makes a trade-off between performance and availability, which is a better choice for L2, which does not require the high throughput on L1. L2 ‘s biggest fear is that when L1 is offline, it cannot complete the transaction or bridge.

This poses a real risk for Solana, as its REV growth is driven entirely by highly cyclical activities that can be better served by other chains.

conclusion

Solana’s optimism is that it is now in the same position as Ethereum in 2021, and ultimately, the event will bring a more mature DeFi ecosystem. But this is not a guarantee.

DeFi activity on Ethereum is dominated by whales who don’t care about cost, who focus more on decentralization, usability and security. Imagine a world where retail users trade Memecoin on Unichain, and whales trade UNI on Ethereum. L2 can provide a better environment for Memecoin and long-tail crypto assets, while Ethereum provides a better environment for whales because it prioritizes activity over performance.

Solana’s pessimistic situation is that it has not really succeeded in following its own North Star and building a decentralized Nasdaq. Traders are concerned about delaying and ensuring the execution of transactions. During periods of volatility, it is difficult to include transactions on Solana, and delays cannot compete with the (more centralized) L2.

More accurately, Solana is successfully building a decentralized “casino,” a venue designed to maximize volatility and risk exposure to traders who generate rich cash through short-term wealth effects.

When the Memecoin craze ends, this may become a new form of gambling, but it is unlikely to happen because gamblers are less concerned about Solana’s advantage over L2 and more concerned about the (centralized) L2’s advantage over Solana.

But back to the point. In the crypto world, narratives that support specific opinions (and heavy positions) are very easy to fill. This is especially easy when your story includes compelling technology and activities driven by a speculative boom. But because of this, we should be skeptical of stories that clearly bias the narrator.

I think Ethereum actually harms itself by accepting the views of its critics. This includes stories about REVs and comparisons with Solana’s economic indicators, but more importantly, the debate about value accumulation and L2 ‘s parasitism as Ethereum L1. Hopefully I will discuss this issue in future posts.

Explanation: This article has been in the draft box for months, so it does not include $TRUMP,$MELANIA or recent market sell-offs. These do not have a material impact on the argument and are therefore not mentioned.

“Original link”