Built-in mobility is an important link connecting the entire network ecosystem and one of the core mechanisms of Initia.

Author:Initia

Compiled by: Shenchao TechFlow

The crypto industry doesn’t need another one-size-fits-all L1, what it really needs is oneDedicated infrastructure that delivers on the promise of multi-chain networks。And this is Initia’s mission to bring the multi-chain ecological Garden of Eden to reality.

Building a multi-chain network is a unique challenge that fundamentally changes the architectural design of L1. Taking Ethereum as an example, in order to support Rollup’s expansion roadmap, they had to conduct a comprehensive rethink of the architecture. Fortunately, Initia has learned from the beginning from established projects such as Cosmos, Polkadot and Ethereum. The successful experiences and challenges faced by these projects provide important inspiration for Initia’s design decisions.

As the choreography layer for interweaving Rollup, Inititia’s L1 assumes the following three core responsibilities:

-

economic security

Rollup deployed by interleaving stacks not only inherits the infrastructure, but also obtains verified security from L1. This means that economic security not only serves Initia itself, but also provides guarantees for all intertwined Rollups deployed on Initia. In addition, with MilkyWay’s Modular Retaking, Rollup can further enhance its security by integrating more economic pledges.

-

Reliable and accessible mobility

History has proven that multi-chain networks without a centralized mobility hub often fail and encounter serious mobility fragmentation problems, resulting in extremely poor user experience.

Even the most liquid Ethereum has failed to solve this problem for its L2. Although Rollup on Ethereum runs on the top-level liquidity blockchain, it still needs to build its own liquidity from scratch.

To address this pain point, Initia’s L1 was designed to serve as a centralized liquidity hub that intertwines the economy. It provides deep liquidity to blue-chip assets through dedicated mechanisms and simplifies Rollup’s process to obtain liquidity.

For example, Echelon’s interweaving Rollup will rely on the liquidity of Initia DEX for clearing, which is achieved through non-perfect atomic cross-chain lightning loans.

-

Economic synergy: Let overall benefits exceed the sum of parts

In an ideal multi-chain network, the overall benefit should be better than a simple superposition of the various parts. But reality often backfires. For example, the ongoing debate in Ethereum over L2 value capture is highlighting this mismatch of economic interests.

Initia’s Vested Interest Program (VIP) is designed to address this pain point. By building a positive economic synergy mechanism, it allows Igntia users to care about Rollup, and also allows Rollup users to pay more attention to Igntia.

Built-in liquidity: Capital efficiency with three birds with one stone

Now let’s talk about the key secrets of Initia”——Built-in liquidity (Enshrined Liquidity)。This is an important link connecting the entire network ecosystem and one of the core mechanisms of Initia.

At the L1 level, Initia has its own native DEX, Initia DEX. This is not only the liquidity cornerstone of the entire Interwoven Economy, but also the main routing engine for cross-Rollup exchanges. For example, if you want to swap ETH on Echelon for USDC on Zaar, Initia DEX and unified interoperability standards can make the process simple and efficient.

Why can’t we have both?

When you provide liquidity to whitelisted trading pairs on Initia DEX, you can pledge the LP tokens you obtain to the verifier. In this way, users can not only contribute to the economic security of the network, but also earn pledge income and gain governance voting rights at the same time! This capital efficiency is rare among L1 native tokens.

(Original picture comes from Initia , compiled by Shenzhen TechFlow)

Take Jennie, for example, who has just acquired some INIT tokens and hopes to pair it with a USDC that is natively bridged to provide liquidity. By pledging her INIT/USDC LP tokens, Jennie achieved triple benefits:

-

She earned transaction fees through LP;

-

She partially obtained pledge income through INIT;

-

She also gained governance voting rights and could participate in VIP decision-making.

-

If Jennie wanted to go further, she could even get extra revenue by selling her voting rights to the highest bidder through a bribery agreement similar to Cabal-style.

However, beyond these immediate benefits, what are the real drivers of built-in liquidity?

Improve capital efficiency

With built-in liquidity, the same amount of INIT can be used for dual purposes. That is, Y units of INIT can now create the same value as 2Y units of INIT without built-in liquidity.

This triggers a virtuous cycle:Higher capital efficiency, more attractive, more benefitsliquidity provider (LP) Greater network security and a deeper liquidity pool.

Unlike traditional L1, the latter’s pledge reward mechanism usually only incurs native tokens for a single security budget. In Initia, the pledge reward mechanism further encourages liquidity providers to contribute to security.

Strengthening cybersecurity: unlocking the potential of liquid assets

As mentioned earlier, built-in liquidity not only encourages users to pledge native tokens, but also encourages the participation of LP assets. This design to improve capital efficiency significantly expands network security, as assets that were once idle in the liquidity pool can now contribute to network security.

More importantly, Initia’s economic security not only protects Initia’s L1, but also covers the entire network, including all intertwined Rollups. This design is undoubtedly a huge breakthrough.

Deep and lasting liquidity: Say goodbye to short-term capital flows

Traditional liquidity mining is often expensive and liquidity is extremely unstable.

Once the incentive mechanism stops, liquidity will be quickly lost.

In contrast, built-in liquidity is a permanent liquidity mining model built into the chain mechanism. Its incentive mechanism is more sustainable, allowing liquidity providers to participate in the long term, creating a more stable liquidity foundation.

The most gratifying thing is that this mechanism saves a lot of money for interweaving Rollup. Instead of investing huge amounts of money in liquidity mining plans, they can directly leverage the deep liquidity pool provided by Initia DEX.

Built-in liquidity mechanisms may not apply to all trading pairs. To enjoy this mechanism, trading pairs need to meet the following two conditions:

-

Approval through Initia Governance.

-

One token in a transaction pair must be INIT.

This is not an arbitrary restriction, but a careful design based on game theory.

Imagine what this means for intertwined Rollup who wants to whitelist their local tokens? They need to accumulate enough voting rights on their own, or influence existing voters, to ensure that economic goals across the network remain consistent.

In addition, there is one significant benefit. By requiring each whitelisted transaction pair to contain INIT, the L1 layer builds a rich network of transaction paths that operate around INIT. This not only helps optimize the token economy model, but also significantly improves the efficiency of cross-Rollup transactions.

Although the role of stake yields obtained through Enshrined Liquidity has become very obvious, the importance of voting rights in an intertwined economy still deserves in-depth discussion.

Why is voting rights important?

At Initia,Economic consistencyIt is the core and focus of the entire system. This consistency can bring broad benefits to the entire intertwined economy.

This is not just a theory; it has been proven in practice. In the Cosmos ecosystem, each chain develops its own economy independently, but its connection to the hub is very limited. Although IBC (Cross-Chain Communication Protocol) enables inter-chain communication, economic ties are missing. ATOM holders are not truly involved in the success of a single chain, and users of a single chain have no reason to care about the hub. This lack of connection causes both sides to appear indifferent.

Economic consistency is the main reason why VIP (Voting Incentive Protocol) was designed, and it is also the key why voting rights are so important!

The VIP Gauge Vote is held every two weeks, and voting rights holders will decide which Rollups can receive incentive enhancements. This is a large-scale capital coordination game. The most gratifying thing is that decisions are made by those most relevant to the interests of the system.

The VIP mechanism creates a powerful feedback loop that tightly connects the intertwined Rollup network. Holders with voting rights need to carefully evaluate which Rollup is worth supporting, and each Rollup needs to prove its worth to these voters. What’s even more interesting is that through agreements like Cabal, Rollup can even provide rewards directly to voters, further strengthening economic consistency.

How to get voting rights? The method is simple:

-

Pledge INIT

-

Pledge INIT/X LP tokens with Enshrined Liquidity

The principle is clear: the more closely you are associated with INIT’s success, the greater your say in the direction of the network. But will this lead to an oligarchy where whales control everything and small holders are ignored?

Don’t worry, Initia is also concerned about the interests of small fish. It provides a way to increase voting rights, making competition fairer.

The power given to the pledgers by the voting lock-in mechanism

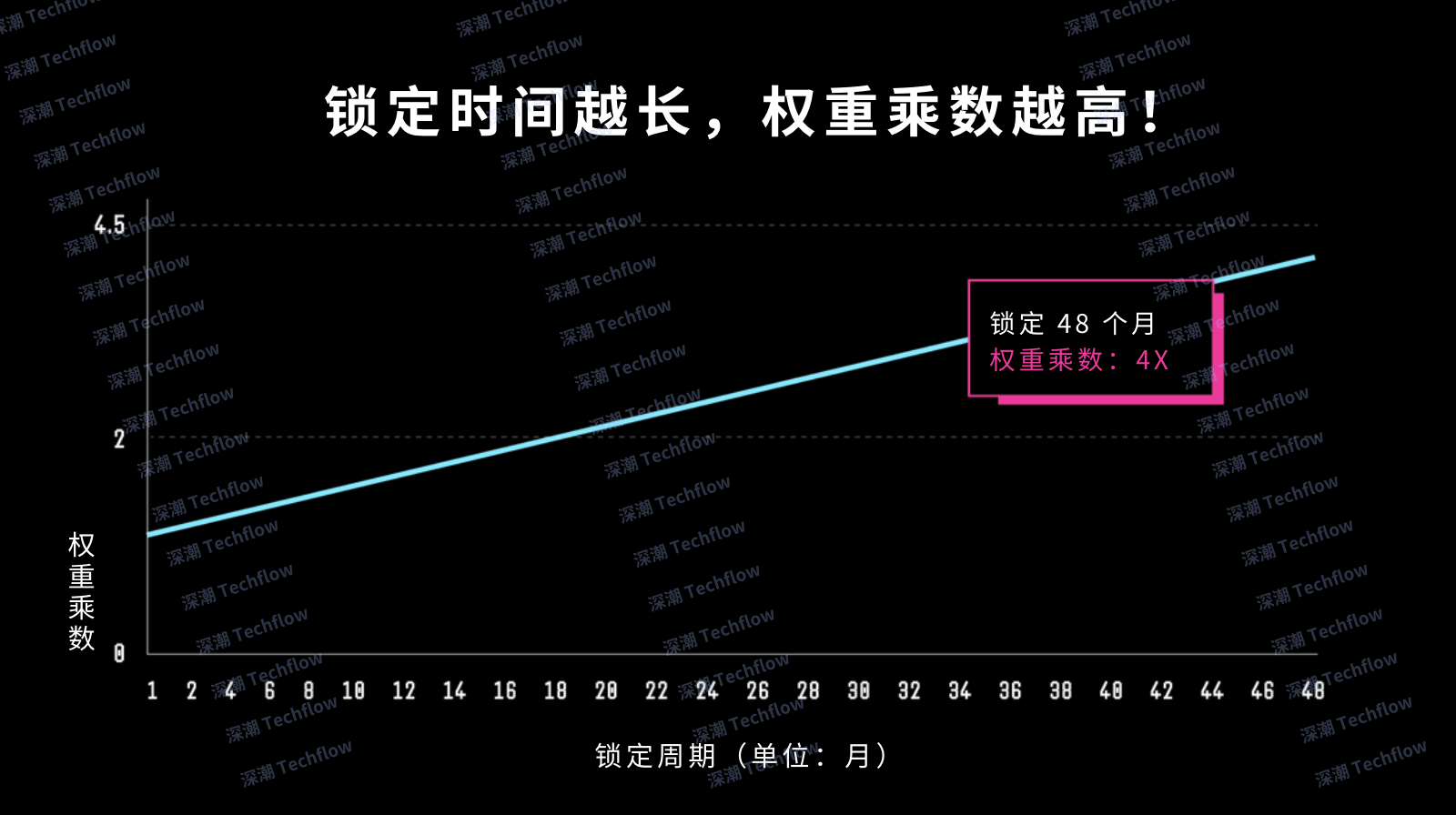

(Original picture comes from Initia , compiled by Shenzhen TechFlow)

The fact is that commitments should have practical meaning. It is not just a verbal expression, but also a measurable influence. After all, one of the goals of blockchain is to build Money Legos (a composable financial modular system).

It can be understood this way: commitment is hierarchical. Some users may just want to take a taste of it, while others are willing to participate deeply in the network. So shouldn’t their influence be commensurate with this depth of commitment? This is the value of the voting lock-in mechanism, which gives users corresponding quantifiable influence based on their commitment ratio.

When you pledge tokens, whether directly or through Enshrined Liquidity, you can choose to lock your position between 1 month and 4 years to gain a doubling effect of voting rights.The longer you lock in, the greater your influence on the network.

The voting buff directly depends on the lock-in time you choose and is calculated as: (3&www.gushiio.coms; number of months/48)+1

Give a few examples:

-

If locked for 1 month, voting rights will increase by 1.063 times: ((3 1)/48)+1((3 1)/48)+1

-

If you promise for 1 year, voting rights will increase by 1.75 times: ((3 12)/48)+1 ((3 12)/48)+1

-

If you lock in for 4 years, you will enjoy a maximum 4-fold increase: ((3 48)/48)+1((3 48)/48)+1

For example, if 25 INIT tokens are locked for 4 years, their voting rights are equivalent to the effect of simply pledging 100 INIT tokens. This design allows users to truly express their long-term commitment to Initia through on-chain behavior, while also injecting greater trust and stability into network governance.

(Original picture comes from Initia , compiled by Shenzhen TechFlow)

Let’s take our furry friend Jennie as an example. She has 100 INITs on hand and hopes to optimize her position.

Jennie decided to directly pledge 50 INITs and vote to lock the other 50 for four years. In this way, her voting rights were increased from 100 yuan that could be obtained through mere pledge to 250 yuan. At the same time, she can flexibly adjust her strategy based on her risk appetite, rather than betting all her chips on one method.

The voting lock-in mechanism gives true believers more influence while retaining enough flexibility to allow each user to participate in his own way.

conclusion

The right way to build a multi-chain world depends not only on technology, but also on implementation.Value alignment。This is the reason why previous attempts failed. There was a lack of consensus and even a sense of alienation between different levels. At Initia, we focus particularly on designing value flows and incentives to ensure that every participant in the network has a clear path to contribute and receive corresponding rewards from it.

Initia’s core mechanisms, Initia DEX, Enshrined Liquidity, Vote Lock and VIP, complement each other to build an ecosystem where users naturally tend to beneficial behaviors. Improved capital efficiency makes liquidity providers (LPs) more satisfied and creates a deeper pool of liquidity, which in turn attracts more users who want governance power. These positive effects further extend to Initia’s Rollup network, where users can experience seamless cross-chain transactions and be rewarded for their continued use of Rollup through the VIP mechanism.

Want to know more? Please check our documentation:

-

Built-in Liquidity Docs

-

Binding Vested Interest Program (VIP) documents

These mechanisms are currently online on the test network. I encourage you to experience for yourself:

-

Providing liquidity on Initia DEX

-

Pledge your LP token to the verifier and choose the longest locking time!

-

Participate in VIP voting mechanism

Visit the Initia testnet Apps to get started, and join the Discord community to explore Initia with other developers and users. The multi-chain Eden is growing. Come and build it together.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern