During Yin Yanji’s tenure, Hua ‘an Securities Research Institute was frequently named by regulators for compliance management issues.

Yin Yanji, director of the Hua ‘an Securities Research Institute, received a fine for personnel management problems. The company was once involved in a crisis on the quality of research reports, and the commission on division positions fell year after year.

Photo source: Visual China

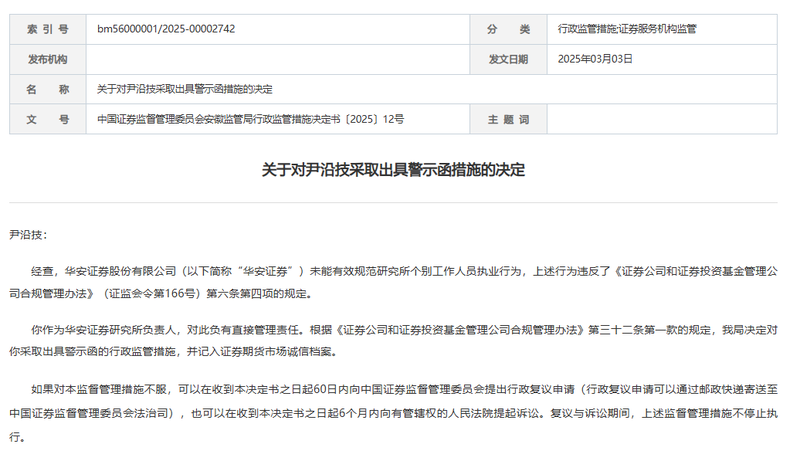

Blue Whale News, March 4 (Reporter Hu Jie)Recently, Yin Yanji, head of the research institute of Hua ‘an Securities Co., Ltd.(hereinafter referred to as Hua’ an Securities), was warned by regulatory authorities due to personnel management problems. The reporter noticed that this is also the first fine issued for brokerage research business this year, and it is directly directed to the person in charge of the research institute.

After investigation, Hua ‘an Securities failed to effectively regulate the practicing behavior of individual staff members of the institute. As the person in charge of Hua’ an Securities Research Institute, Yin Yanji has direct management responsibility for this. The Anhui Securities Regulatory Bureau decided to take administrative supervision measures to issue a warning letter against it and record it in the integrity files of the securities and futures market.

Photo source: Anhui Securities Regulatory Bureau

According to public information, Yin Yanji joined Hua ‘an Securities in February 2020. He is now the research director and director of the research institute of Hua’ an Securities, and the general manager of the Industrial Research Center. He has worked in well-known securities research institutes such as Shenwan Hongyuan and Minsheng Securities. He has nearly 20 years of research in the science and technology industry, and has ranked first in the computer industry as the best analyst in the crystal ball of New Fortune and Securities Market Weekly for many years.

The reporter sorted out and found that while Yin Yanji was in charge of the research institute, Hua ‘an Securities was frequently named by the regulatory authorities for exposing compliance management issues.

For example, in February last year, Hua ‘an Securities received double penalties from the Shenzhen Stock Exchange and the Anhui Securities Regulatory Bureau for publishing a research report involving Zuojiang Technology and others that violated regulations.

The Shenzhen Stock Exchange pointed out in the warning letter that on January 31, February 25, and March 25, 2023, Zuojiang Technology, a company listed on the Shenzhen Stock Exchange, issued three consecutive announcements that the company’s stock trading may be subject to delisting risk warnings. However, on April 25, 2023, Hua ‘an Securities released an in-depth research report entitled “The Shining Pearl in the Field of Computing Power, DPU Volume Riding on the Trend” and recommended buying. In this regard, the regulatory authorities determined that the analysis conclusions of the relevant research reports issued by Hua ‘an Securities were not sufficiently based, the conclusions were not prudent, and the investment risks were not fully disclosed. The company did not strictly control the quality review of the research reports.

Subsequently, the Anhui Securities Regulatory Bureau also ordered Hua ‘an Securities to correct its research report involving Zuojiang Technology and other countries due to its imprudent production.

Looking forward, in May 2023, the Anhui Securities Regulatory Bureau disclosed a fine. After investigation, the research report “Specialized, Special and New Intelligent Warehouse and Logistics Supplier, Self-Research and Self-Production to Create Core Competitiveness” issued by the analyst signed by Chen Xiao has insufficient basis for selecting comparable companies, insufficient demonstration of profit forecasts, inconsistent text charts, and unclear data sources. The Anhui Securities Regulatory Bureau emphasized that Chen Xiao, as the signed analyst of the above-mentioned research report, is directly responsible for the above-mentioned violations. Administrative supervision measures of issuing a warning letter were taken against Chen Xiao and recorded it in the securities and futures market integrity files. According to media reports, at that time, there was only one employee named Chen Xiao registered as a securities investment consultant (analyst) on the official website of the China Securities Association, and the practicing institution happened to be Hua ‘an Securities.

It can be seen from the above that Hua ‘an Securities’ research institute business has deficiencies in internal management and compliance.

Generally speaking, fund division commissions are one of the important sources of income for brokerage research institutes, and the proportion of commission distribution is mostly based on the buyer’s institution’s evaluation of its research and reporting services. However, Hua ‘an Securities’ successive quality problems in research reports have tortured its research capabilities to a certain extent, which will inevitably lead to a decline in institutional recognition and a reduction in commission distribution points. Especially in the context of the reduction in the scale of public offering division commissions, without strong research strength and market recognition, it will become increasingly difficult to divide the shares.

Wind data shows that in the past two years, Hua ‘an Securities’ division commission scale has shown a downward trend. In 2022, the company’s total commission on division positions will be 90.8103 million yuan, down 9% year-on-year; in 2023, the total commission on division positions will be 79.2263 million yuan, down 13% from the previous year; in the middle of 2024, the company’s total commission on division positions will be 33.7188 million yuan, down 29% year-on-year, and the decline will further expand. (Blue Whale News Hu Jiehujie@lanjinger.com)