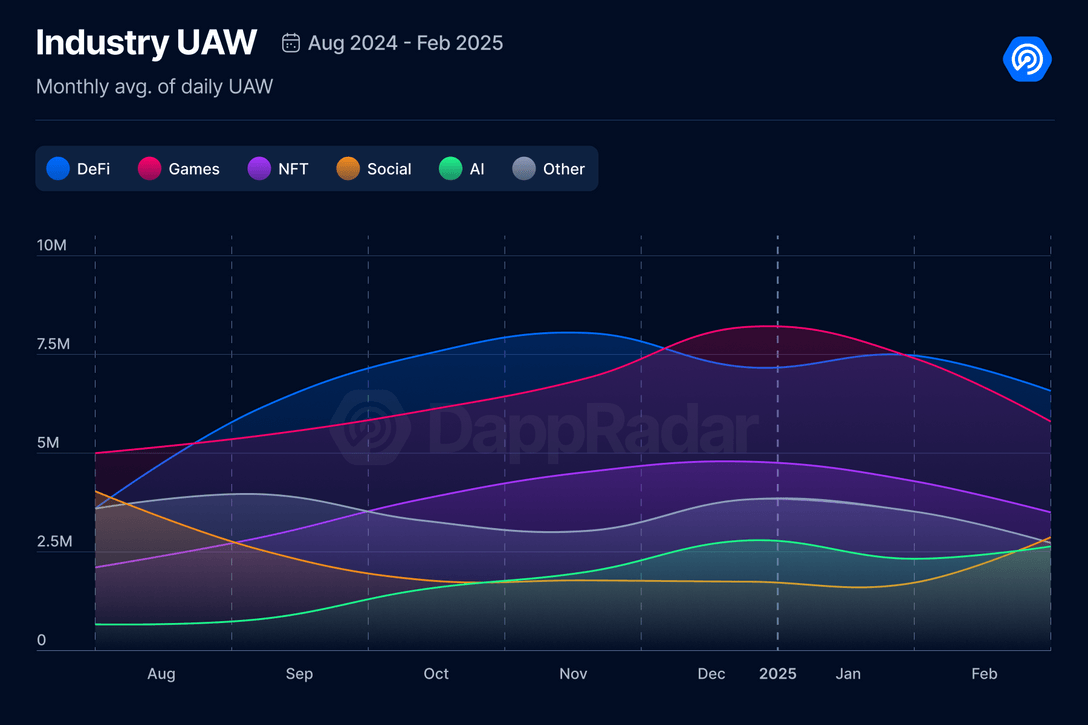

Daily independent active wallets fell 8% to 24 million, and the number of users in the AI, social and NFT categories increased.

Author: DappRadar

Compiled by: Felix, PANews

In February, the Web3 trend shifted, with AI, games and social dapps still growing despite a slight decline in overall activity. DeFi faces a sharp decline, and despite the strong momentum of AI-driven and sports-based NFT, overall NFT transaction volume has declined. A record for cryptographic hacking attacks was also set that month, highlighting the need for stronger security measures.

points

- Dapp activity cooled, with daily independent active wallets (dUAW) falling 8% to 24 million, but AI, social and NFT users increased.

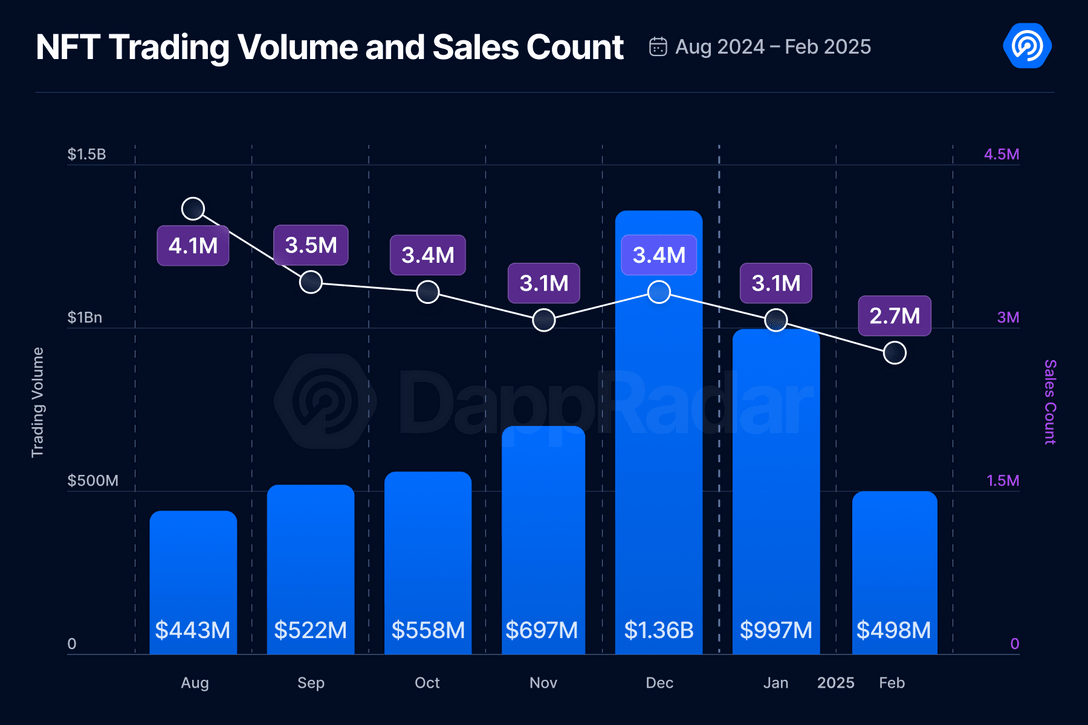

- NFT trading volumes plunged 50% to US$498 million, reflecting the broader market downturn, but AI-driven and sports-based NFTs are gaining momentum.

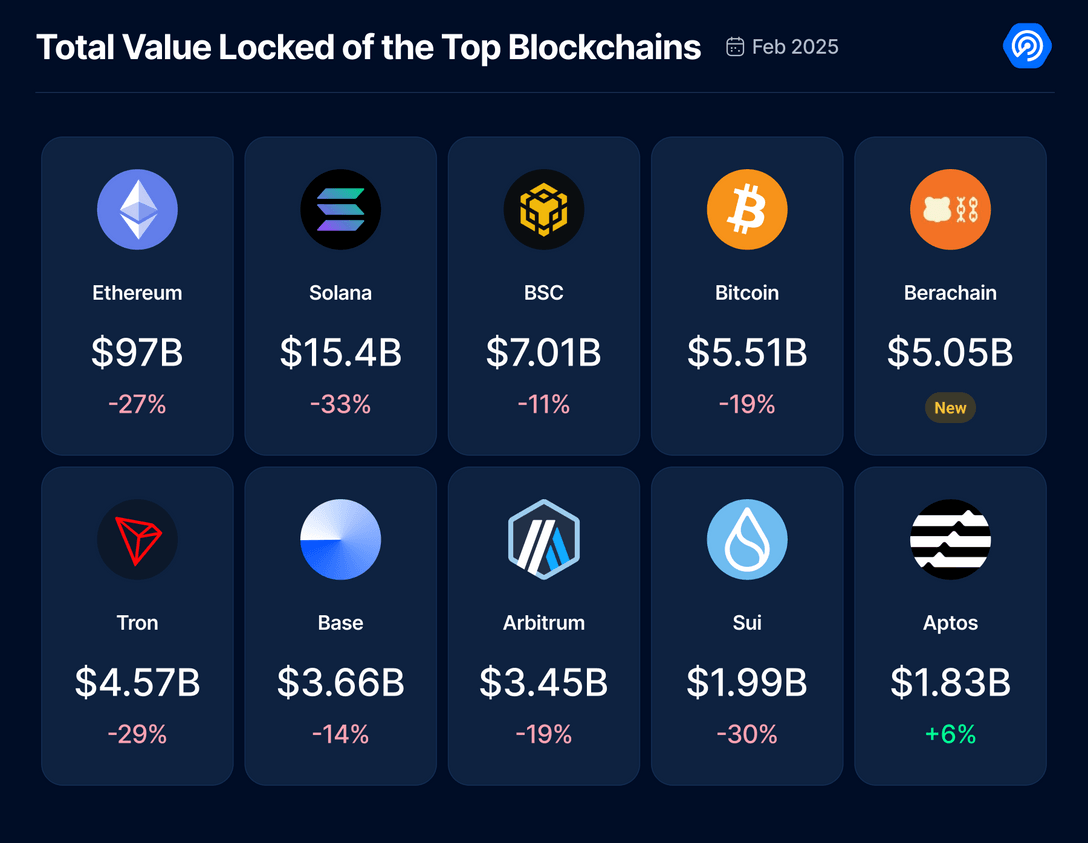

- DeFi suffered a significant decline, with TVL shrinking from $217 billion to $168 billion, with Ethereum and Solana leading the decline due to capital outflows and liquidity transfers.

- Berachain became the fastest growing DeFi chain, with TVL reaching US$5.05 billion.

- Adoption of AI-driven dapps has surged, with growth rates exceeding 700% on some platforms, consolidating AI’s dominance as the fastest-growing area of Web3.

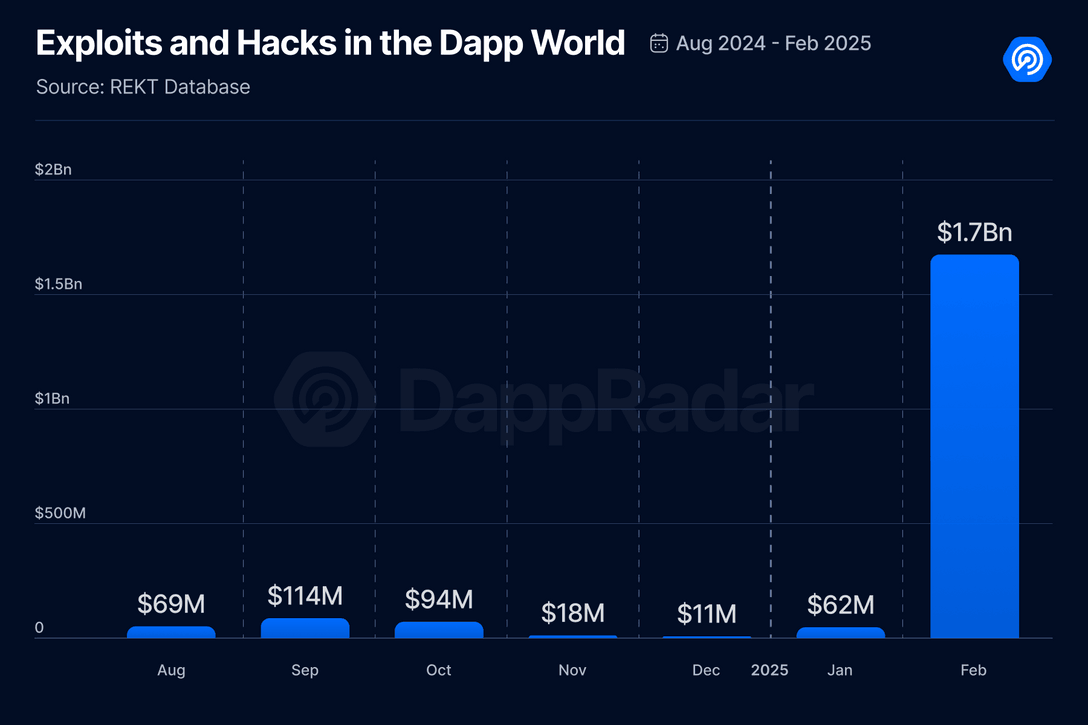

- In February, the amount stolen from encryption hacking attacks hit a record high of US$1.5 billion, mainly due to the breach of the Bybit exchange (US$1.4 billion), making it the largest attack in history.

Web3 Activity dropped, but AI、NFT and social sectors bucked the trend

Following a strong rise in January, Dapp activity cooled slightly in February. It is estimated that the total daily independent active wallets (dUAW) for all tracked dapps fell 8%, stabilizing at around 24 million.

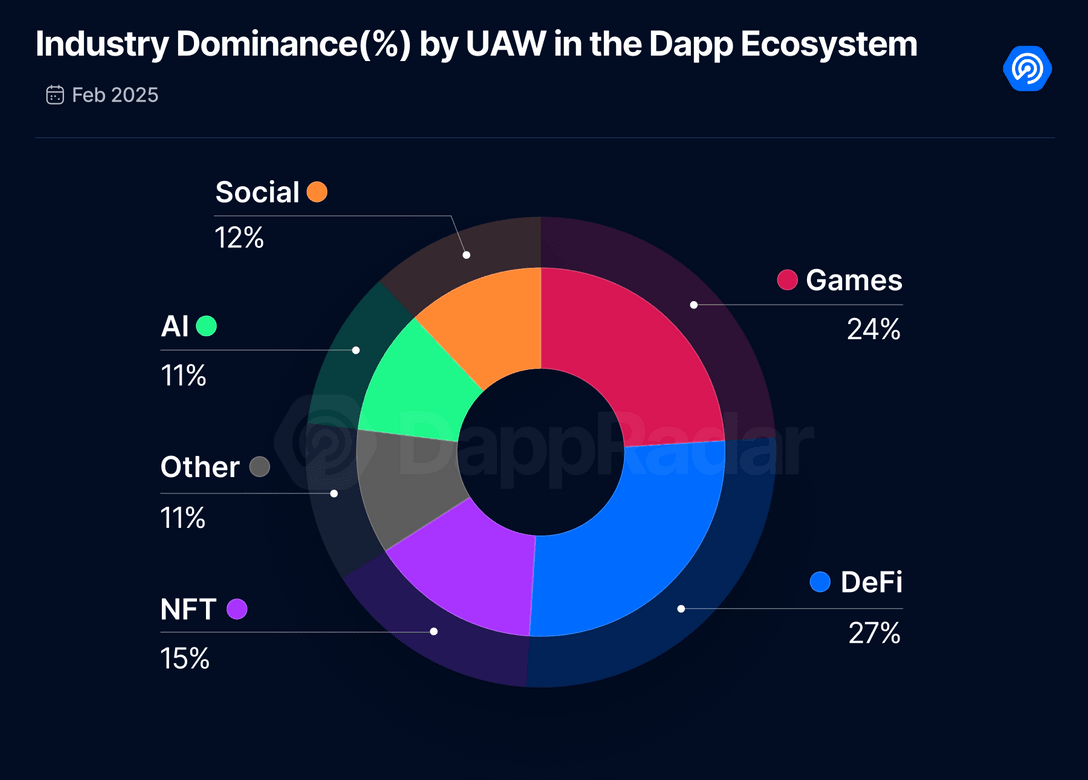

Although overall activity has declined, DeFi still dominates, with the largest user share. About 27% of active wallets in February were related to DeFi apps, consolidating its status as the most commonly used dapp category. However, not all areas have followed a downward trend, with social, NFT and AI all showing growth, indicating that user interests are constantly changing.

Social dapps grew by 9%, with daily independent active wallets (dUAW) reaching 2.8 million, while NFT activity increased by 6%, with 3.5 million users interacting with the NFT platform. AI once again became the fastest-growing area, soaring 16%, with dUAW reaching 2.6 million.

From a blockchain perspective, Solana maintains a leading position in on-chain activities, with the largest number of Independent Active Wallets (UAWs) and transaction volumes. This continued engagement reflects the growing appeal of the games dapp and memecoin being continuously launched online, making them the center of emerging trends.

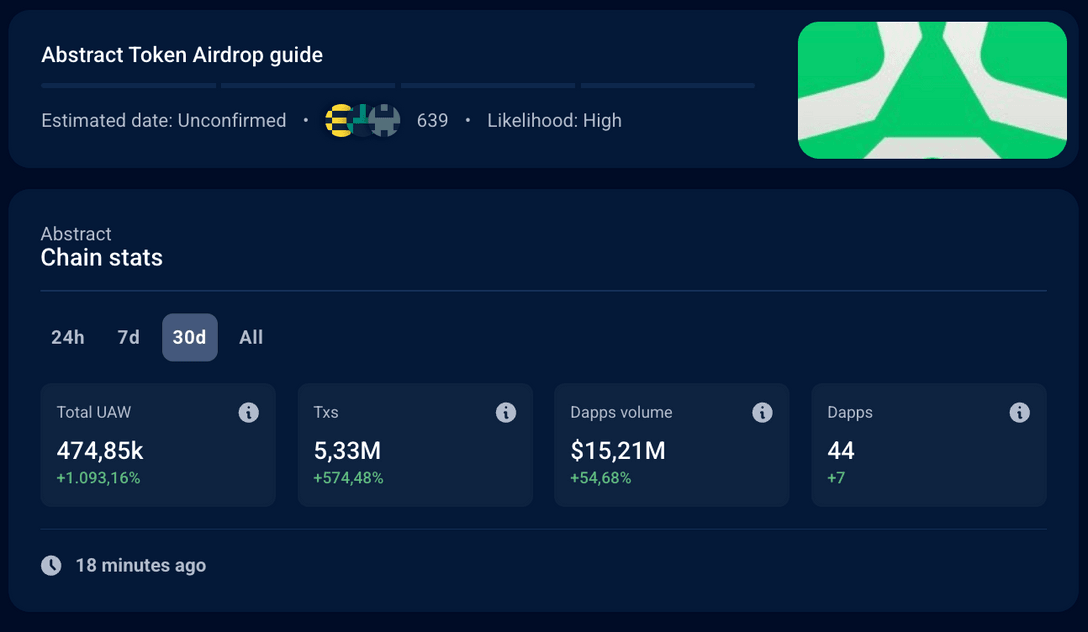

Abstract stood out, and UAW (Independent Active Wallet) grew by 1093%.

popular dapp:Web3 Changes in adoption trends

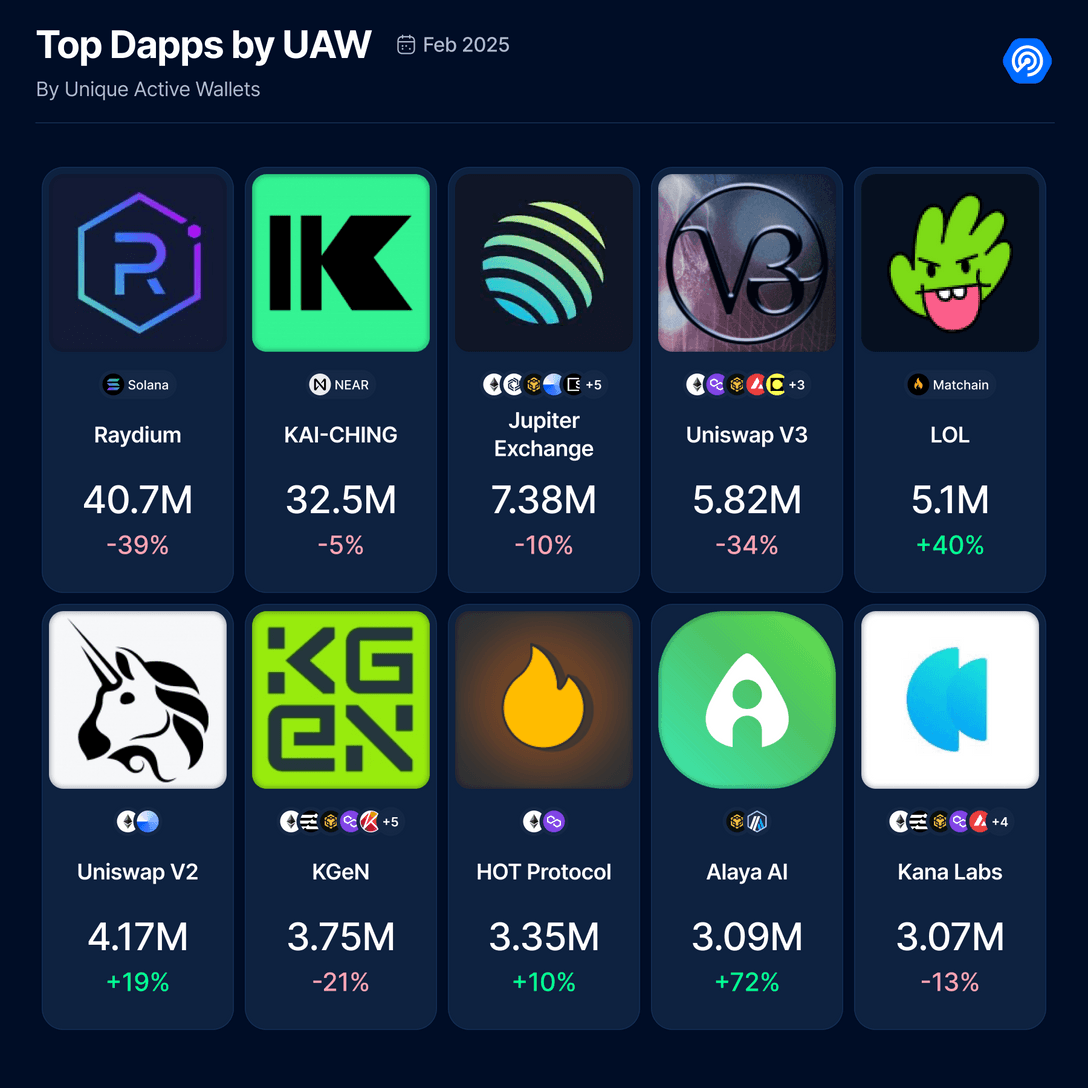

By analyzing the popular dapps with the largest number of active wallets in February, we can discover several key trends that highlight the evolving landscape of Web3.

Solana and NEAR continue to dominate user activity, maintaining their lead despite small fluctuations. Its dapp continues to attract a large number of users, consolidating its position as the preferred platform for developers and users.

Games and AI are becoming the most dynamic areas, with adoption rates increasing significantly. Game dapp LOL’s UAW (Independent Active Wallet) grew by 40%, while Alaya AI grew by 72%, highlighting the growing demand for AI-driven Web3 experiences and interactive gaming platforms.

In DeFi, user behavior indicates a shift in priority. Usage of Uniswap V3 declined while activity of Uniswap V2 increased, indicating that traders are optimizing the cost efficiency of their transactions.

At the same time, emerging chains have begun to gain attention, bringing new competition to the dapp industry. For example, Matchain has entered the market strongly, and LOL is in a leading position on the platform.

As Web3 continues to expand, these trends indicate that decentralized applications will be more integrated into daily digital life in the future.

As new chains emerge,DeFi Facing market fluctuations

In February, the DeFi sector suffered a sharp decline, with TVL plummeting from US$217 billion to US$168 billion. The decline reflects broader market volatility, capital outflows and liquidity changes that have affected the mainstream and emerging DeFi ecosystem.

The TVL of the Ethereum network, the backbone of DeFi, fell 27% to $97 billion, but still accounted for more than 57% of total liquidity. The decline was mainly due to the decrease in liquidity in liquidity pledge agreements, which had previously been the main growth driver. Despite the market downturn, Ethereum’s position remains unshakable.

Solana fell the most, with its TVL falling 33% to $15.4 billion. After a strong January, the decline may be attributed to profit-taking and a shift in liquidity to a more stable DeFi. Lower user activity for agreements such as Jupiter Exchange (UAW down 10%) and Raydium (UAW down 39%) further exacerbated the decline, indicating reduced transaction volume and liquidity supply.

At the same time, Berachain has become one of the fastest-growing DeFi ecosystems, with TVL reaching US$5.05 billion. The chain’s rise is due to its proof-of-liquidity model, which attracts users through profitable liquidity pledges and income farming incentives. As users seek high returns amid a general decline in the market, Berachain positions itself as a key player in the evolving DeFi landscape.

Other noteworthy trends include BNB Chain and Tron, both of which play key roles in stablecoin-based DeFi. As stablecoin trading and lending continued to support liquidity, BNB Chain’s TVL maintained a relatively modest 11% decline. However, Tron fell 29%, indicating a decline in demand for USDT transactions and a general decline in stablecoin settlement on the chain. In sharp contrast to the overall downturn in DeFi, Aptos stood out, with its TVL growing by 6% to $1.83 billion.

The fastest-growing areas:AI dapp surge

February was an important milestone for AI-driven dapps, as participation in multiple fields surged, strengthening the growing synergy between AI and blockchain technology. Users are increasingly exploring social, gaming and DeFi applications that integrate AI, driving a significant increase in adoption rates. The Independent Active Wallet (UAW) of AI-driven dapps has surged, with some platforms growing by more than 700% in a month, proving that AI’s influence in the decentralized space is accelerating.

Among outstanding applications, LOL became the most used AI dapp, attracting 5.1 million UAWs, a 40% increase, thanks to its AI-driven interactive social features on Matchain. At the same time, Evermoon and UneMeta achieved growth of +988% and +551% respectively, highlighting the growing demand for AI-driven games and NFT platforms. AI-generated artistic and creative tools are also becoming increasingly popular, with Fractal Visions growing at a rate of 721%, demonstrating the growing popularity of AI-generated NFTs.

AI’s role in financial and social applications is also expanding. Balance uses AI to optimize financial decisions and community interactions, and its user base grew by 116% in February. Although some platforms have experienced declines, such as Dmail Network (-22%) and MomoAI (-40%), the overall AI space remains the fastest-growing category in Web3.

Market downturn caused NFT The market was damaged, but AI and sports series shine

The downturn in the crypto market has also affected the NFT field. Although the NFT has been showing signs of recovery in recent months, its momentum has slowed since the beginning of the year. In February, total NFT trading volume fell to US$498 million, down 50% from the previous month. As expected, the correlation between cryptocurrency prices and NFT valuations remains strong, with market sentiment triggering fluctuations in trading activity.

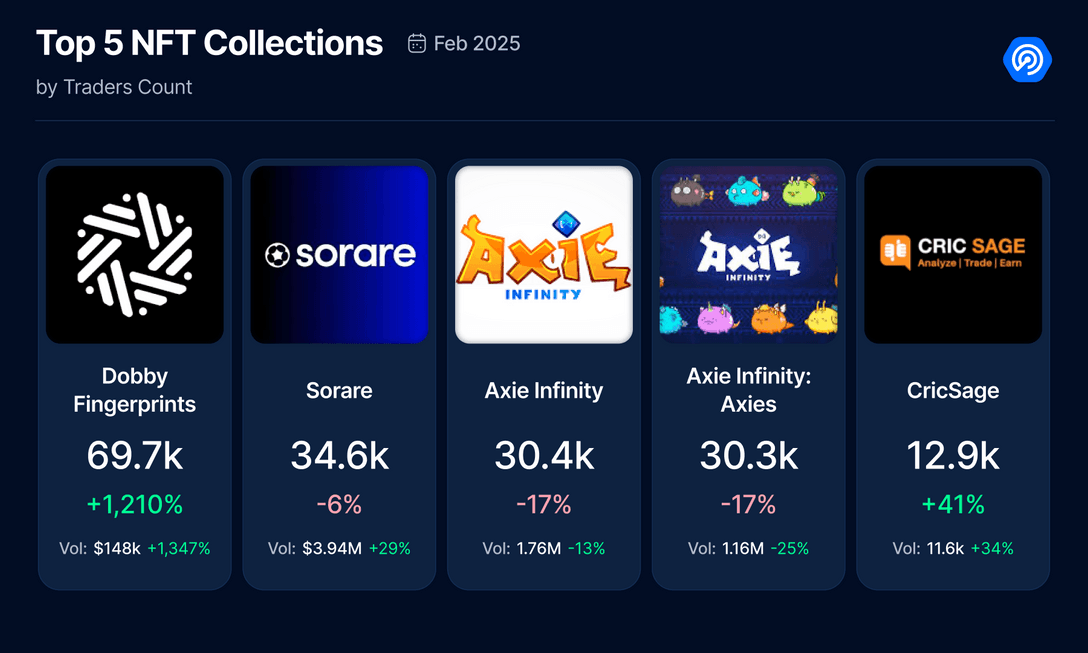

Despite the downturn in the market, Pudgy Penguins remains one of the most active NFT series. Although its trading volume fell, the number of transactions increased by 25%, indicating strong trading activity at lower prices. At the same time, Doodles ‘trading volume increased significantly, thanks to its announcement that it will launch a new token DOOD on Solana.

The new leader in the NFT space is Kaito Genesis, an AI series driven by Kaito AI, a digital asset search engine designed to democratize encrypted information. Launched in December 2024, the series consists of 1,500 unique NFTs on Ethereum and rose sharply in February, with floor prices reaching a record high of 7.65 ETH. The rise was mainly driven by strategic partnerships, including with the Azuki NFT team, aimed at integrating AI capabilities into their ecosystem.

Another outstanding project this month was Courtyard’s Tokenized Collectibles, an innovative project that connects physical collectibles and digital assets. The platform, developed by Courtyard.io, allows collectors to tokenize real-world items by storing them in a vault operated by Brink and coining them as NFT on Polygon. This fusion of tangible and digital assets represents a unique development in the NFT field, catering to the needs of both traditional collectors and Web3 enthusiasts.

In addition to the broader AI trends that dominate Web3, AI is increasingly integrated into NFT projects, marking a shift towards more dynamic, interactive, and practical digital assets.

In addition to AI, sports NFT has also consolidated its position as the dominant category. Sorare is a long-time leader in sports NFT and continues to thrive. However, new competitor CricSage offers a cricket-based opinion trading platform. This way of interacting with sports NFTs is inspiring new engagement, especially in communities that love cricket.

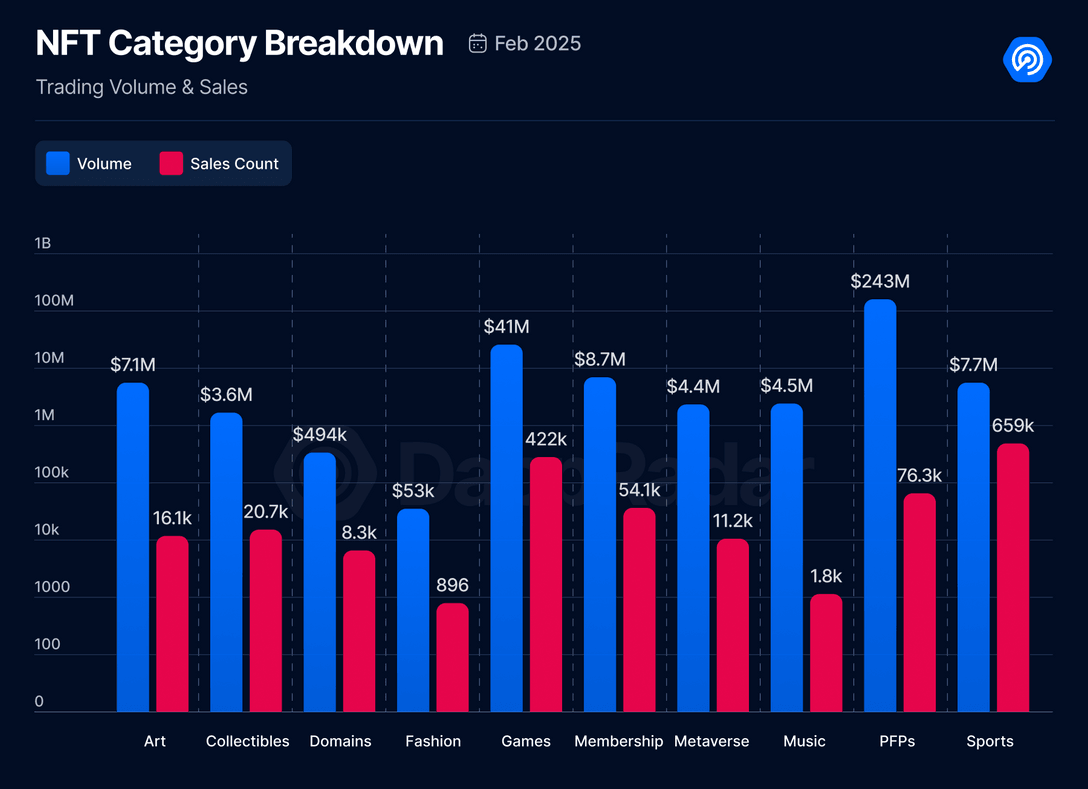

Analyze the NFT category with the largest trading volume in February to gain a deeper understanding of market trends:

- Profile Picture (PFP) NFT leads the way in trading volume, generating US$243 million in value out of 76,385 transactions, 99% of which occurred on Ethereum.

- Gaming NFT ranked second in transaction volume with US$41 million and traded 421,853 assets, mainly on ImmutableX (72%).

- Sports NFT achieved a total of 659,097 transactions and US$7.7 million in transaction volume, of which 98% of the activity occurred on Starkware.

The changing landscape suggests that while speculative trading may fluctuate, NFT, with strong practicality, engagement and real-world applications, will drive long-term adoption of Web3.

Crypto hacking hits record month

February became the most disruptive month in the history of encryption security, with $1.5 billion stolen from decentralized platforms. This number highlights persistent vulnerabilities in Web3 security.

The main reason for the record loss was the hacking attack on the Bybit exchange. North Korea’s Lazarus Group hacker group used a multi-signature vulnerability to steal approximately US$1.4 billion in cryptocurrency. The attack has now surpassed the 2022 Ronin Bridge vulnerability and become the largest DeFi-related theft to date. The breach has had an impact on the entire industry, reigniting concerns about the security and centralized operational risks of multi-signature within exchanges and DeFi platforms.

In addition to Bybit, several other dapps fell victim to vulnerabilities in February. The zkLend loan agreement lost $9.5 million due to mathematical errors, exposing a key flaw in the agreement’s design. Meanwhile, Ionic Money was stolen $8.6 million in a fake token mortgage scam, further highlighting the ongoing risks associated with the DeFi lending platform.

Interestingly, almost all of these hacking attacks stem from off-chain vulnerabilities rather than on-chain vulnerabilities. Attackers used social engineering tactics, compromised user interfaces and malicious developers to gain unauthorized access, further proving that Web3 security goes well beyond smart contract audits. The massive attack in February has renewed calls for comprehensive security measures, urging platforms to prioritize operational security, multi-signature protection and enhanced UI protection over traditional smart contract audits.

As the Web3 landscape continues to evolve, these events warn that even the most advanced blockchain ecosystems are vulnerable to complex attacks. Strengthening security protocols, improving private key governance and conducting broader risk assessments are crucial to ensuring the future of decentralized finance.

concluding remarks

February demonstrated the dynamic and unpredictable nature of the Web3 landscape. While the industry faces challenges, from the downturn in NFT transactions to security breaches, innovation continues to bring new opportunities. The rise of AI-driven dapps, the resilience of the game and DeFi ecosystem, and the emergence of new chains highlight the industry’s adaptability and continued expansion.

As we move forward, security, sustainability and user-driven innovation remain critical. The Web3 field is developing rapidly, and every challenge brings a lesson, strengthening the foundation of decentralized technology. Whether it is through enhanced security measures, more intuitive AI integration, or the continued growth of community-driven projects, the future of decentralization is still written one block after another.

Related reading: BitMart Research Institute VIP Investment Research Insights| February Crypto Market Review