In the perpetual contract DEX market, Hyperliquid is the undisputed winner.

Author:Cheeezzyyyy

Compiled by: Shenchao TechFlow

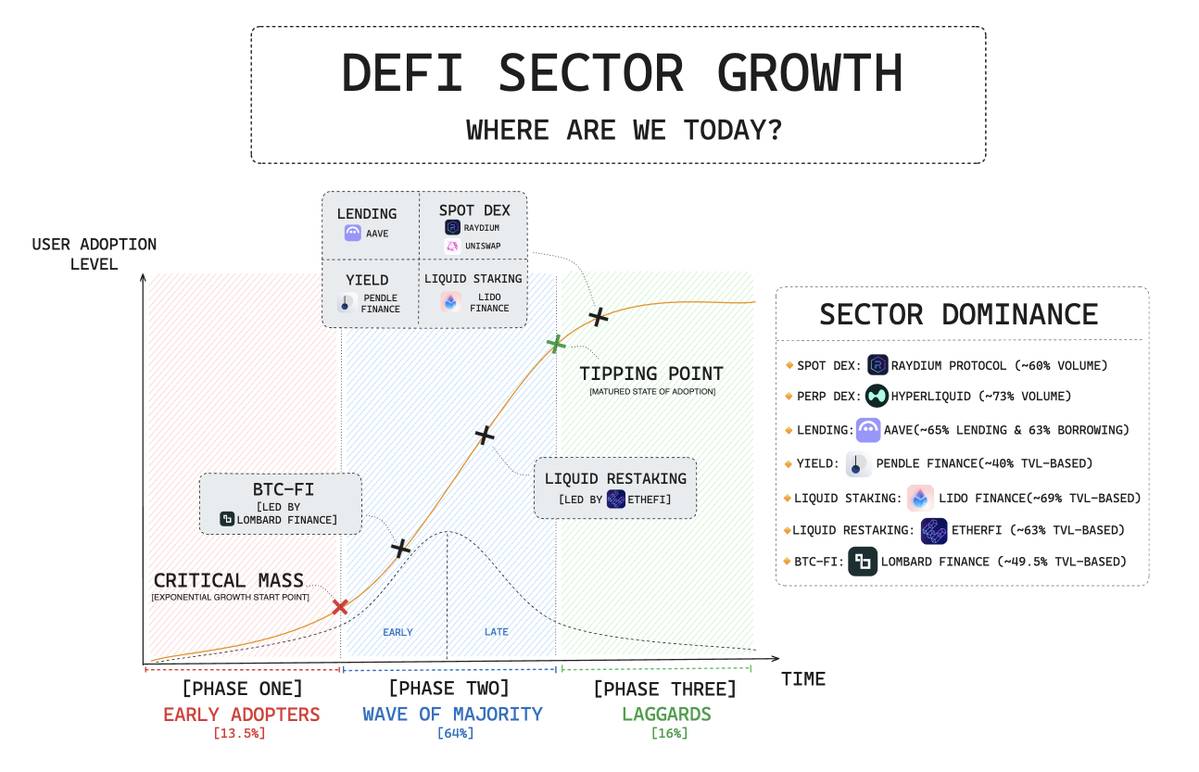

DeFi has made significant progress since the 2021 DeFi Summer.

Today, DeFi has formed multiple mature areas that are achieving self-sustaining growth and activity. However, compared to traditional finance (TradFi), the entire crypto space is still in its early stages. Currently, the total market value of cryptocurrencies is approximately US$3.3 trillion, while TradFi’s market value is as high as US$133 trillion.

DeFi’s core goal is to solve the inefficiencies of traditional finance through innovative and efficient systems. These solutions have demonstrated significant product-to-market fit (PMF) in multiple areas.

Key areas of DeFi often show an oligopoly market structure, and here are the latest developments in each area.

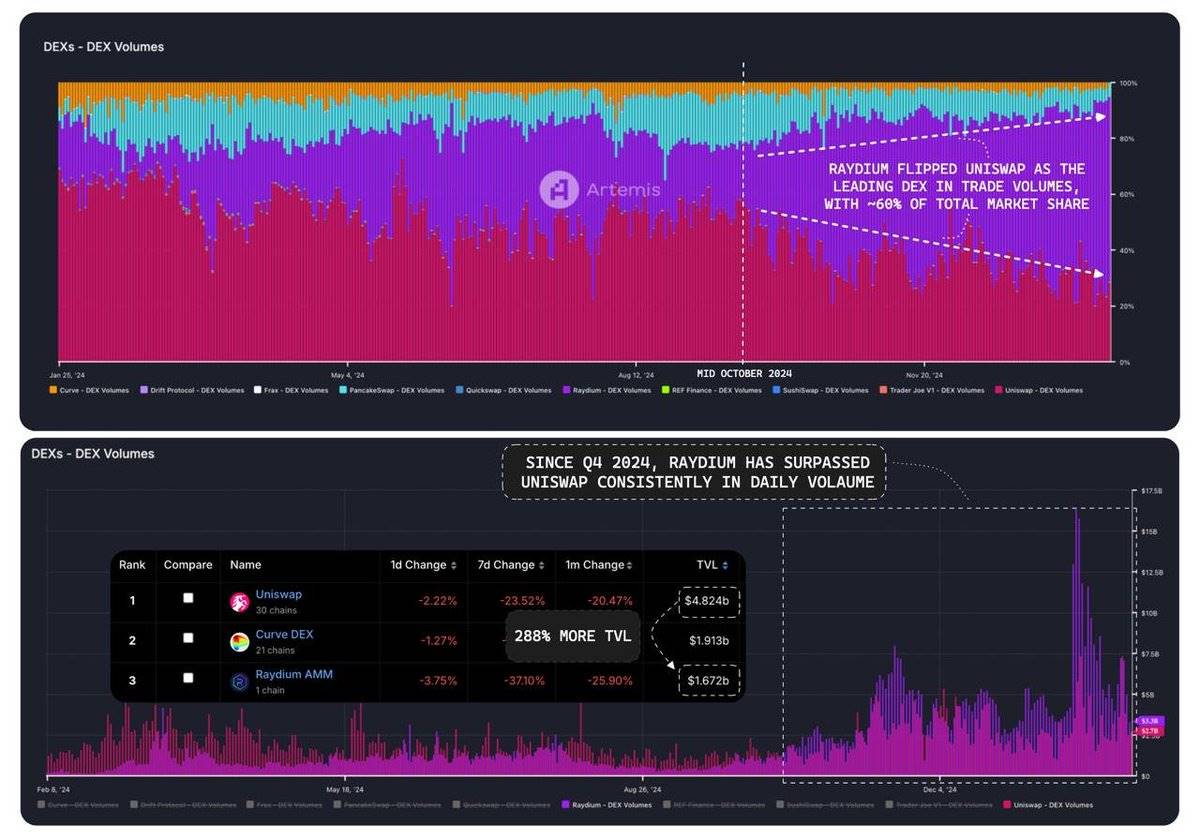

The competitive landscape of decentralized exchanges (DEX)

In the fourth quarter of 2024,@RaydiumProtocol became the new leader in the DEX market, accounting for approximately 61% of the transaction volume market share, successfully surpassing @Uniswap.

However, Raydium’s total locked volume (TVL) is only 39% of Uniswap’s. This contrast may be related to the Memecoin craze on @solana, but its long-term market performance remains to be seen.

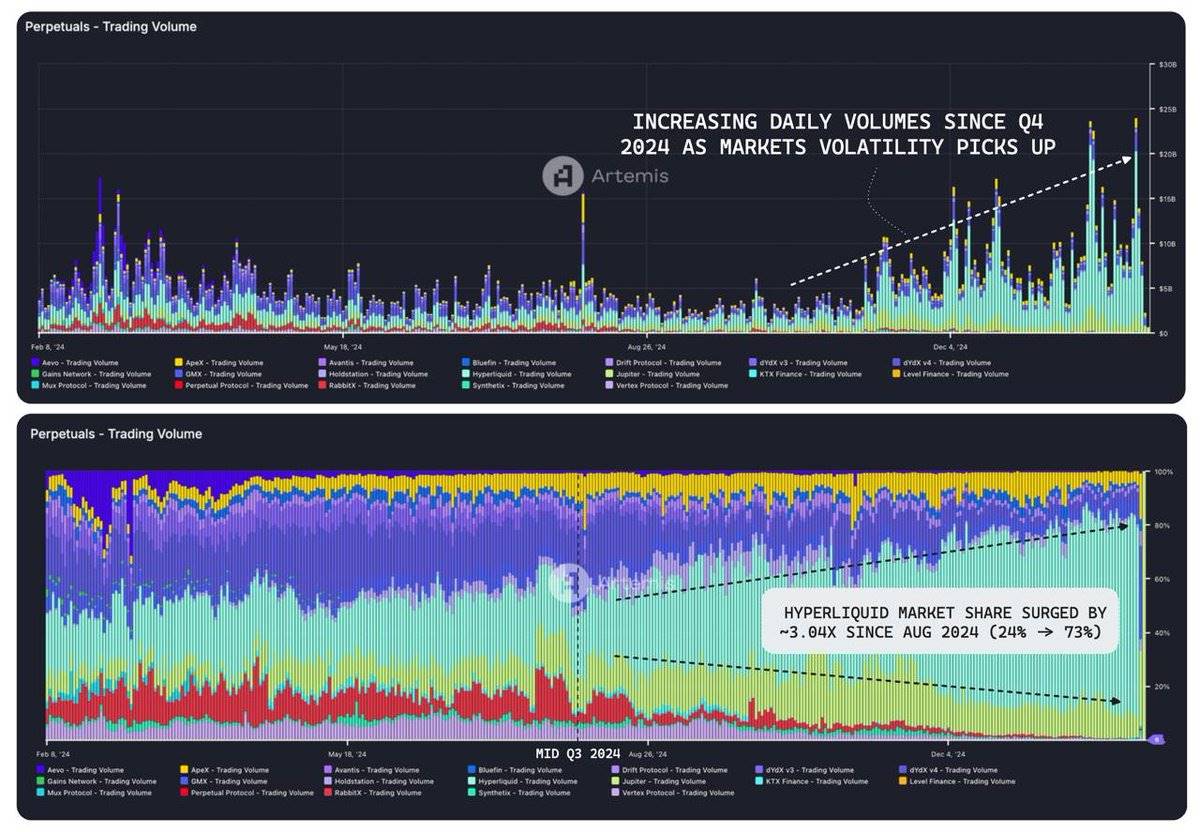

Winners of Perp Dex Decentralized Exchange (Perp DEX)

In the perpetual contract DEX market,@HyperliquidX is the undisputed winner. Since the third quarter of 2024, Hyperliquid’s market share has soared from 24% to 73%, achieving a three-fold growth.

At the same time, the overall transaction volume of Perp DEX is also growing rapidly. Growing from US$4 billion per day in the fourth quarter of 2024 to US$8 billion currently, Hyperliquid is challenging the Centralized Exchange (CEX) and gradually becoming an important price discovery platform.

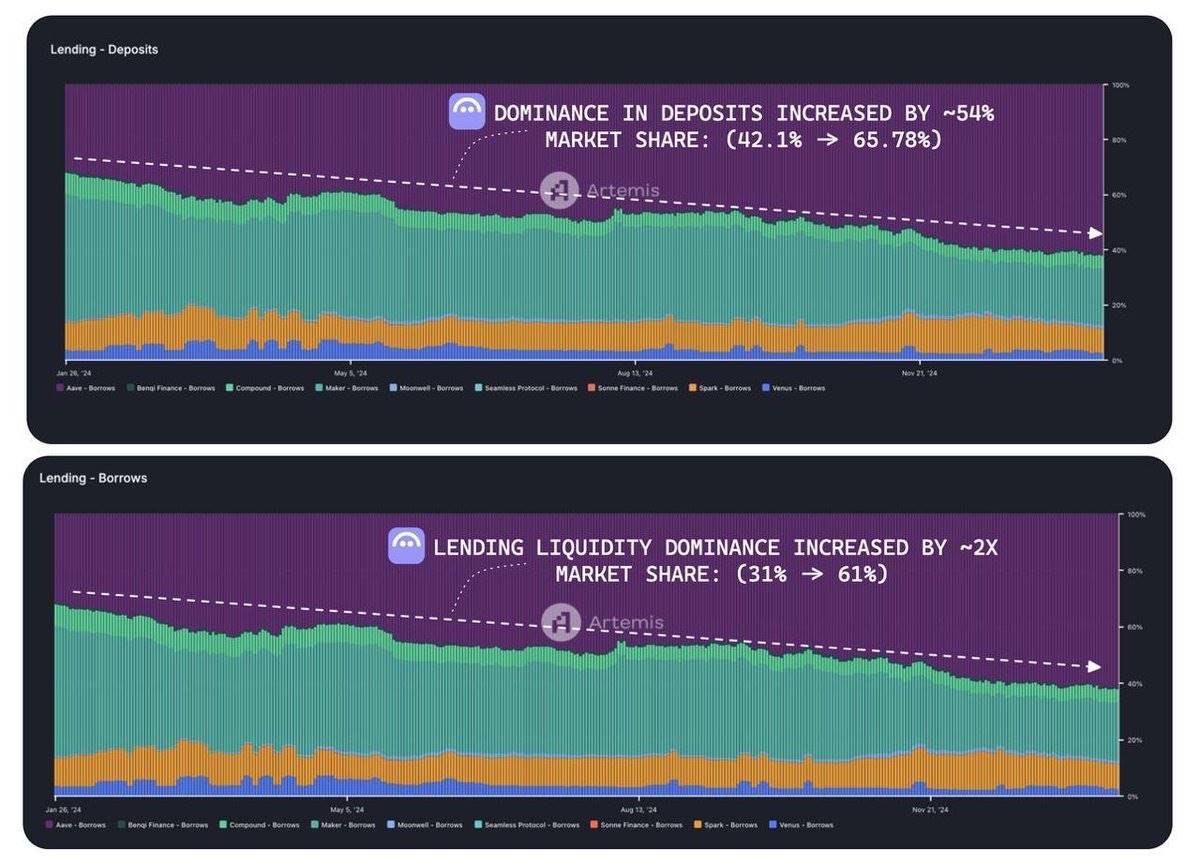

Continued growth in the lending sector

In the lending space,@aave’s dominant position continues to grow. Since 2024, its market share has increased significantly in both deposits and borrowings:

-

Deposit market share increased from 42.1% to 65.78%

-

Borrowing market share increased from 31% to 61%

Although the yields offered by Aave are not the most attractive in the market, its long-standing reputation and user trust make it the platform of choice in the lending space.

@ pendant_fi is leading the development of revenue tracks, with its total locked value (TVL) on Ethereum ($ETH) reaching a record high of approximately $1.59 million.

Its core competitiveness lies in becoming the preferred promoter of value discovery in this field, maintaining TVL at a record high even as the overall slowdown in the DeFi industry and sluggish market sentiment. This fully proves the high degree of fit between its products and market demand (PMF).

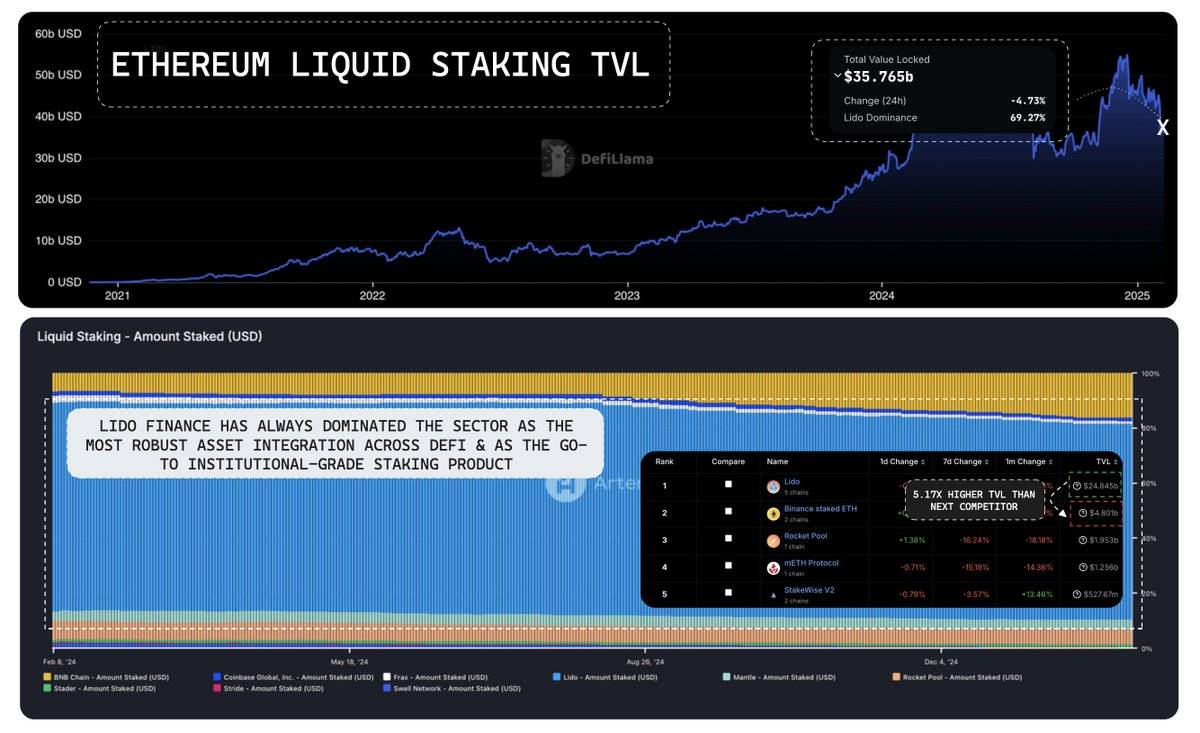

Liquid Staking is currently the largest track in DeFi, with a total value of approximately US$35 billion based on TVL.

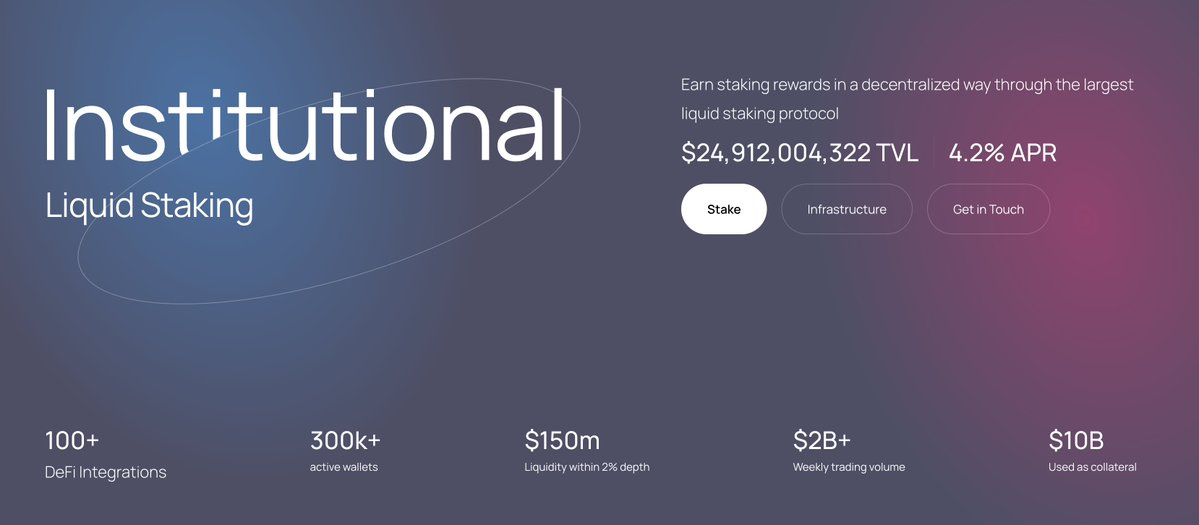

On this track,@LidoFinance is a well-deserved leader, accounting for approximately 70% of the market and almost monopolizing the liquidity pledged token (LST) market. Lido’s TVL reached $24.8 billion, which is 5.17 times higher than its next competitor @binance’s $bETH ($4.8 billion).

Lido’s dominant position does not rely on pledge proceeds, but benefits from the asset value of $stETH:

-

bestasset utilization:$stETH is the most widely used asset in the DeFi ecosystem.

-

The most trusted service: As an institutional pledge solution, Lido is the first choice for funds and companies.

In this area, credibility and trust are key to driving user adoption.

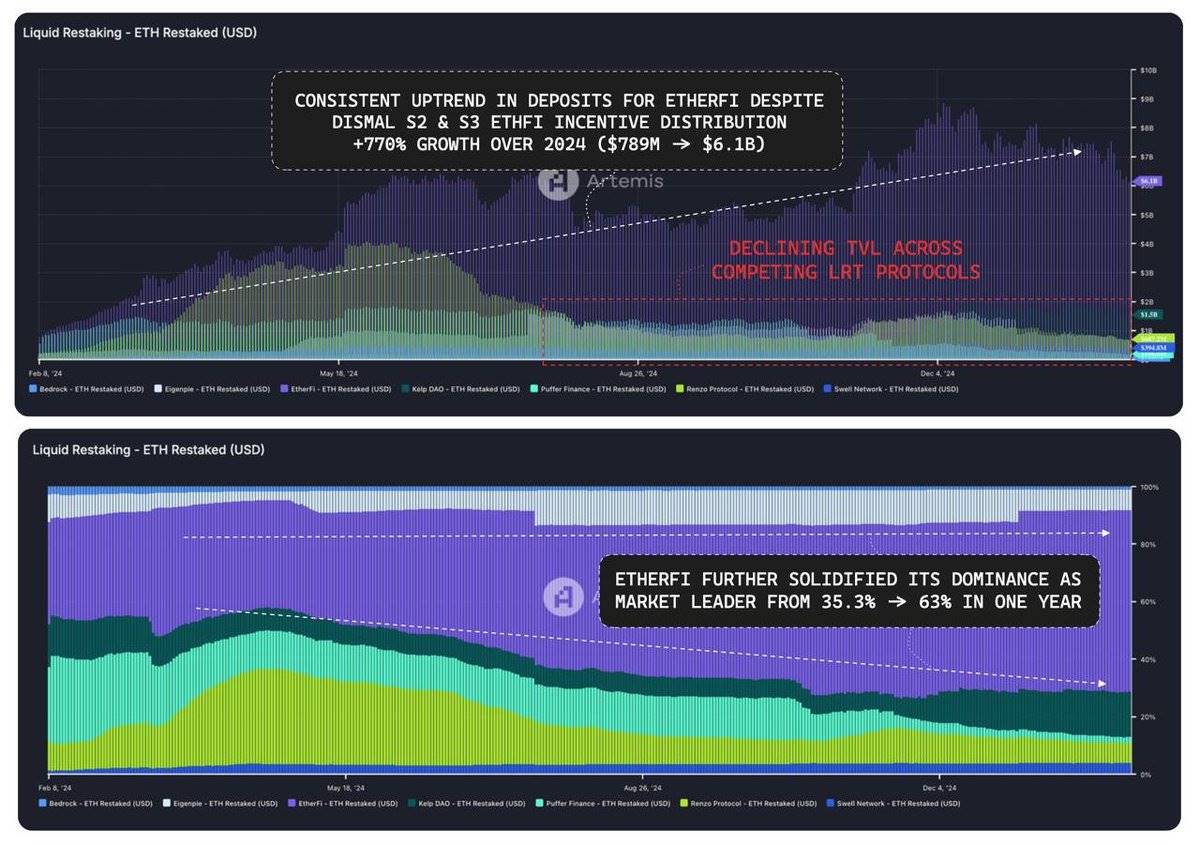

We have observed a similar trend in the field of Liquid Restaking.

It is particularly noteworthy that @ether_fi’s market share continues to grow, increasing from 35.3% to 63%. Even after the stakedrop campaign for S1 and S2 ended, its TVL will still grow by approximately 770% in 2024.

The main factors driving this growth include:

-

First-mover advantage in ecosystems such as @eigenlayer,@symbioticfi and @Karak_Network.

-

Deep integration with the DeFi protocol.

-

High trust in the product suite.

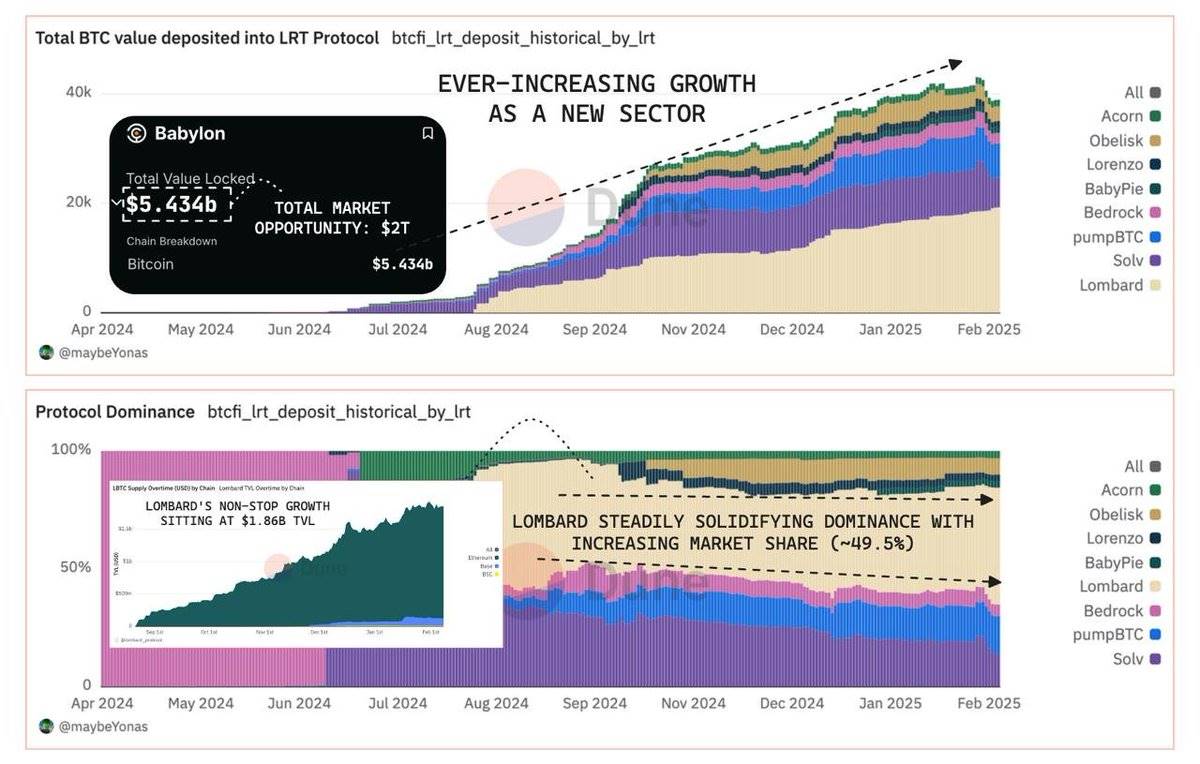

@Lombard_Finance’s performance in the BTC-Fi sector is gradually approaching the trend of LST (Liquidity Pledged Tokens) and LRT (Liquid Rempledged Tokens) tracks, with its market share steadily rising to 49.5%.

As @babylonlabs_io continues to grow (currently has a market value of US$5.5 billion), demand for Bitcoin ($BTC) as a top cryptographic security asset is expected to grow exponentially. In the future, market opportunities in this area may reach US$2 trillion.

@Lombard_Finance has successfully mastered the strategy to dominate the track.

Its token,$LBTC, is the most widely integrated, frequently used LRT with security at its core in the DeFi ecosystem. This advantage makes Lombard a landmark asset similar to $stETH, capable of winning the trust of institutions and achieving widespread adoption.

In general, DeFi’s various tracks have gradually found their own positioning and complement each other and develop together as a complete ecosystem.

This marks the rise of a new financial model that is disrupting traditional centralized finance (CeFi), and we are fortunate to be witnesses of this change.

As DeFi enters the next phase of expansion, we will see more attempts to explore new areas, including developing markets that have not yet been touched, and even deeply integrating with CeFi:

-

@ethena_labs plans to integrate traditional financial payment functions into its products.

-

@Mantle_Official launched the Mantle Index Fund and Mantle Bank, which aim to combine cryptocurrency with traditional financial services.

In addition, more and more institutions are beginning to pay attention to DeFi, such as @BlackRock’s participation in the DeFi layout through $BUIDL,@worldlibertyfi’s DeFi portfolio and spot ETFs. These trends all show that the future development potential of DeFi is very worth looking forward to.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern