Under the spotlight of Consensus 2025, Hong Kong has proved that it is not only a policy innovator, but also an ecological builder.

Author: OKG Research

Global Web3 ‘s eyes are focusing on Hong Kong. Consensus, the top event in the Web3 industry, landed in Hong Kong for the first time this week. More than 10,000 practitioners flocked to the Convention and Exhibition Center, and the encryption boom has once again set off on both sides of Hong Kong. The Hong Kong Consensus Conference is not only a showcase for global Web3 innovation, but also a phased answer to Hong Kong’s Web3 strategy. Since the “Policy Declaration on the Development of Virtual Assets in Hong Kong” in October 2022, Hong Kong has adopted a strategy of regulatory first and ecological advancement. Accelerate the construction of a bridge connecting the traditional financial and encrypted worlds, and become an indispensable and important part of the global Web3 landscape.

As an industry observer, OKG Research has continued to track the development of Hong Kong’s Web3 policy since 2022, focusing on ecological and technological innovation practices, and has produced more than 30 in-depth articles on hot topics such as VASP, stablecoins, and RWA tokenization, and has established column content cooperation with Hong Kong’s mainstream media Sing Tao Group and Dagong Wenhui Media Group to continue to export industry insights. Taking the Consensus Conference as an opportunity, we once again systematically sorted out the core context of Hong Kong’s Web3 ecosystem and launched the “HK Web3 Frontline” topic, hoping to let more people fully understand the evolution of Hong Kong’s Web3 ecosystem.

1. Supervision comes first: Exploring the boundaries of Web3 compliance in an orderly manner

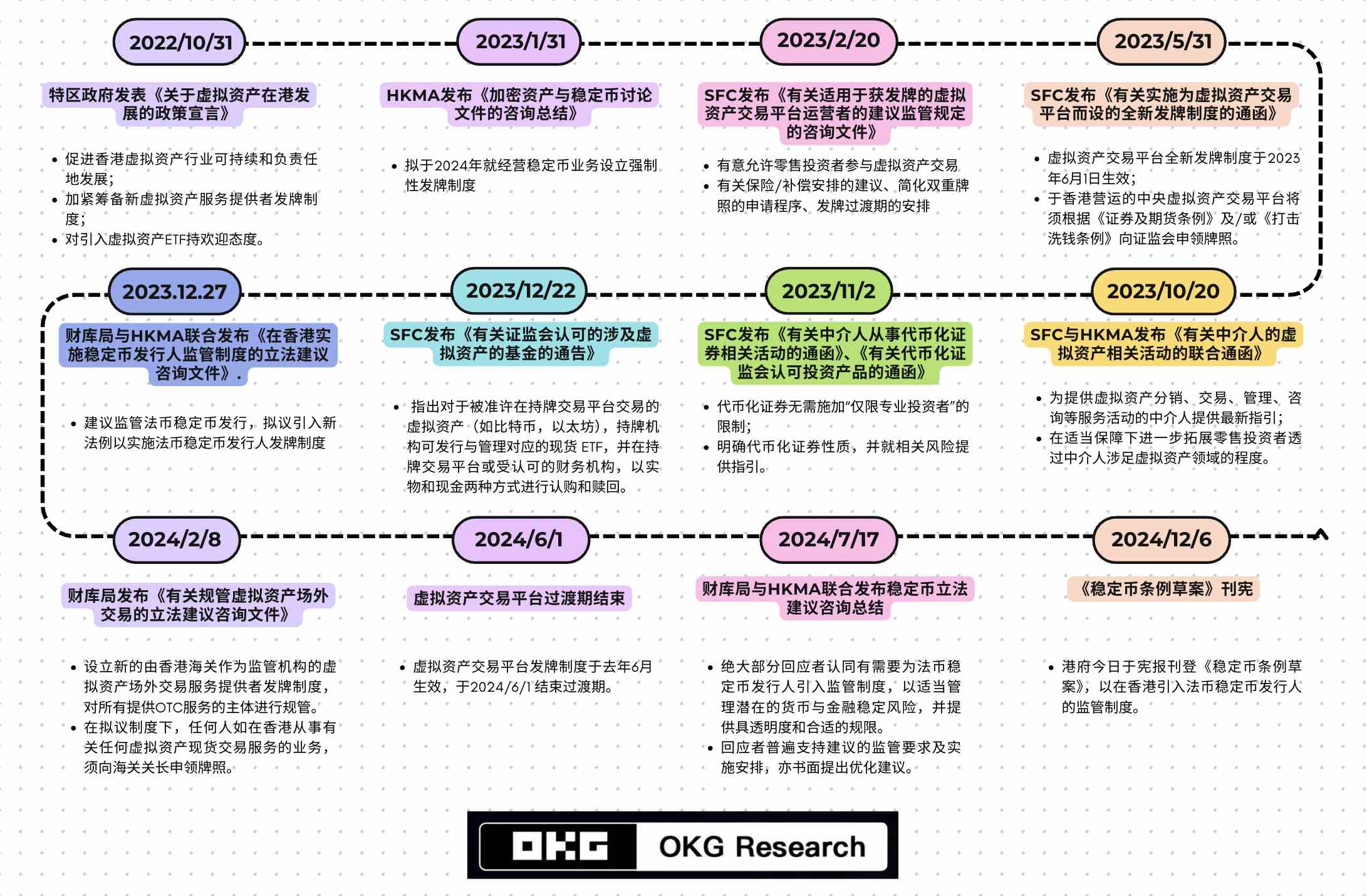

Compliance has always been the core keyword in the development of Web3 in Hong Kong. Since the release of the policy declaration, Hong Kong has continuously explored the compliance boundaries of Web3 and successively introduced a series of regulatory systems, laying the foundation for the development of Hong Kong’s virtual asset and Web3 industries, and also providing clear compliance guidance for industry participants.

Starting from the virtual asset service provider (VASP) license, Hong Kong’s virtual asset market is gradually establishing a compliance development system, and on this basis, it promotes regulatory rules in stablecoin issuers, custodian service providers, OTC and other fields to ensure market security and transparency. These measures not only enhance the credibility of Hong Kong’s virtual asset market, but also continue to attract capital and companies to flow into Hong Kong. As of the end of 2024, Hong Kong Cyberport alone has gathered nearly 300 Web3 companies, with a cumulative financing scale exceeding HK$400 million.

However, Julia Leung, CEO of the Hong Kong Securities and Futures Commission (SFC), repeatedly mentioned the balance between supervision and innovation in her opening speech at the Consensus Conference. How can relevant practitioners maintain their motivation for innovation in Hong Kong’s existing regulatory environment? Compared with the United States, can Hong Kong’s crypto regulatory initiatives promote market development?

2. Hong Kong dollar stablecoins: Hong Kong’s financial ambitions

Stable coins are a hot topic at this Consensus conference and a key area that Hong Kong has continued to pay attention to and invest in the past two years. Standard Chartered Hong Kong, ASG Group and Hong Kong Telecom were recently reported to form a joint venture company, hoping to apply to the Hong Kong Monetary Authority for a license under the new regulatory system to issue stable currencies pegged to the Hong Kong dollar. Circle, the issuer of USDC, has previously announced cooperation with Hong Kong’s three major banknote banks to launch HKDCoin anchored 1:1 to the Hong Kong dollar.

Although it is impossible to determine how much pie the Hong Kong dollar stablecoins will eventually get in the current environment where the US dollar occupies an absolute market share, for Hong Kong, developing the Hong Kong dollar stablecoins is an inevitable choice to seize the initiative in Web3 development and seize future financial opportunities. The connection channel with fiat currency is the most worthwhile and most valuable scenario in the current encryption ecosystem, and stablecoins are the indispensable infrastructure for building channels; at the same time, the next stage of development of Web 3.0 in Hong Kong and even around the world is to break the gap between the virtual world and the real world. stablecoins are the core link connecting traditional finance and the crypto world, and may become a widely accepted payment tool.

If Hong Kong dollar stablecoins can be widely used in the Web3 ecosystem, it will greatly enhance the competitiveness of Hong Kong and Hong Kong dollar in the international financial market. But how should Hong Kong dollar stablecoins develop? What does it have to do with Cyberport? Are the proposed regulatory measures in line with market conditions?

3. RWA tokenization: The fission from concept to the 100 billion market

RWA is undoubtedly the hottest concept in this year’s Consensus.& ldquo; Real-World Asset (RWA) tokenization is not a trend, but a necessity.” rdquo; The assertion made by John Cahill, head of digital assets at Morgan Stanley, at the Institutional Investment Summit reveals the current strategic shift of traditional financial giants.

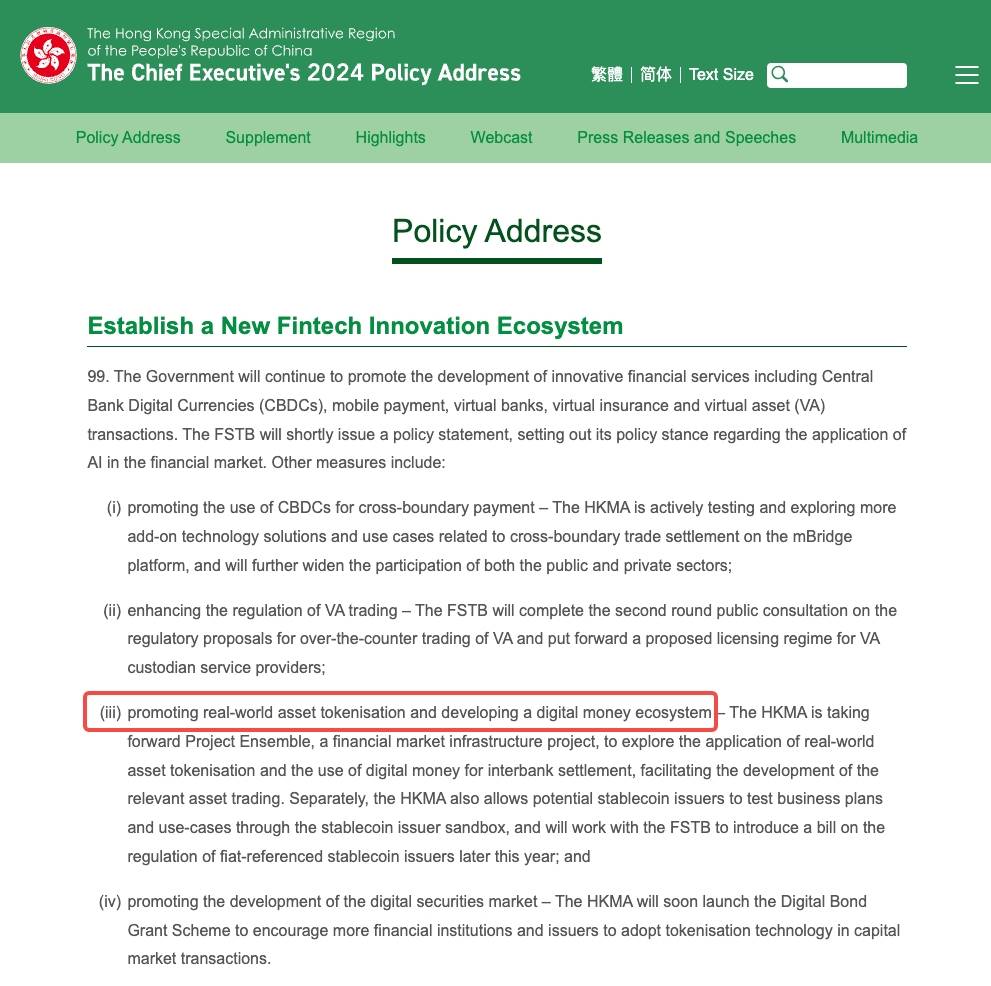

As a global financial center, Hong Kong is also actively embracing the wave of RWA tokenization. The 2024 policy address proposed to promote RWA tokenization and the construction of a digital currency ecosystem. The Hong Kong Monetary Authority also launched a digital bond funding program to encourage the capital market to adopt tokenization technology. The Ensemble project led by the Hong Kong Monetary Authority has attracted more than 30 institutions including HSBC and BOC to participate, covering multi-dimensional assets such as bonds, funds, and carbon credits.

When attending the Consensus conference, the Secretary for Financial Services and the Treasury of the Hong Kong SAR Government, Hui Ching-yu, also said that Hong Kong is considering promoting gold tokenization and combining physical gold with blockchain technology to provide investors with greater flexibility and enhanced security. Hope to innovate financial markets through tokenization. But why is Hong Kong suitable for developing RWA? What areas of tokenization should we focus on at this stage? Compared with the United States, does Hong Kong have a competitive advantage in the field of tokenization?

4. ETF and OTC: The confrontation between the dark and dark in the capital channel”

One of the key measures for the development of Web3 in Hong Kong in 2024 is the launch of virtual asset spot ETFs. From the explicit acceptance of relevant applications at the end of 2023 to the official listing of six virtual asset spot ETFs officially approved by the Hong Kong Securities and Futures Commission on the Hong Kong Stock Exchange at the end of April, it took only more than 100 days, which is enough to reflect the speed and efficiency of Hong Kong regulatory authorities. The launch of virtual asset spot ETFs has opened up another funding channel for investors to deploy encrypted assets. As of the end of 2024, the total asset management scale of Hong Kong’s Bitcoin Spot ETF has exceeded HK$3 billion, accounting for 0.66% of the total volume of the Hong Kong ETF market.

In addition to ETF channels, Hong Kong has gradually formed a three-layer capital network of licensed exchange-compliant OTC-banks. Among them, the volume of OTC over-the-counter trading in Hong Kong has surged since 2023. According to incomplete statistics from OKG Research, the annual transaction volume of Hong Kong’s OTC market is as high as nearly 10 billion US dollars. At the same time, thanks to the encryption exchange shop, a physical product with regional characteristics, it not only attracts young investors from around the world, but also attracts middle-aged participants. In recent years, Hong Kong’s OTC market has also attracted the attention of many users and institutions in the fields of international trade and cross-border payments, becoming another important channel for Hong Kong to pool global funds.

Under the spotlight of Consensus 2025, Hong Kong has proved that it is not only a policy innovator, but also an ecological builder. Regulation can be designed and technology can be iterated, but only deep awe of market laws is the ultimate weapon to cross the cycle. OKG Research will continue to track the development of Hong Kong’s Web3 industry, provide our observations and insights to a wider range of users and market participants, and jointly help build a more prosperous Hong Kong’s Web3 ecosystem.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern