Original author: nobrainflip, crypto trader

Compiled by: zhouzhou, BlockBeats

Editor’s note:This article analyzes the current situation in the crypto market and points out that the market is in a stage of suspicion and depressed, but there are still opportunities. The market will experience a slow correction, attracting retail investors to exit, while large players (such as BlackRock) are accumulating positions. For example, the stablecoin index, FTX compensation, etc., may push the market back.

The following is the original content (the original content has been compiled for ease of reading and understanding):

We are now at one of the most divisive points in time, with bulls believing this is the last correction before altcoin season, and bears believing that the bull market is over.

Here are all possible scenarios and when the market will reverse.

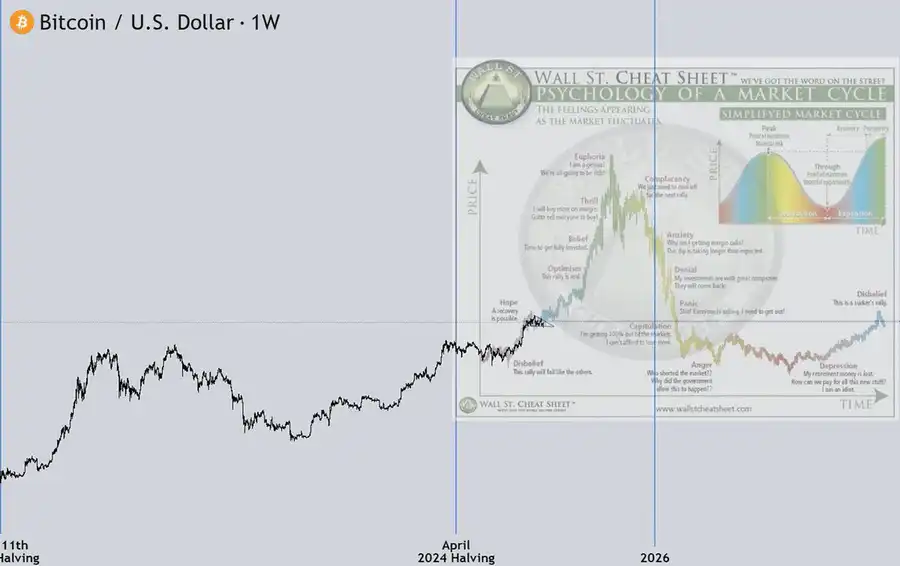

Now, it’s really difficult to determine what stage of the cycle we are at:

On the one hand, we haven’t had a true altseason yet (although we did have a memecoin season). On the other hand, Bitcoin has exceeded the previous historical high by 1.5 times (or just 1.5 times). Moreover, this bull market has lasted for 12 months since the last historical high, which is longer than any previous bull market.

Basically, the cycle has been broken, making it difficult to predict what will happen next.

I think there are three possible scenarios:

·This is the last pullback before the start of the altseason (excitement)

·This is the beginning of the end of the bull market (anxiety)

·The cycle is over (anger)

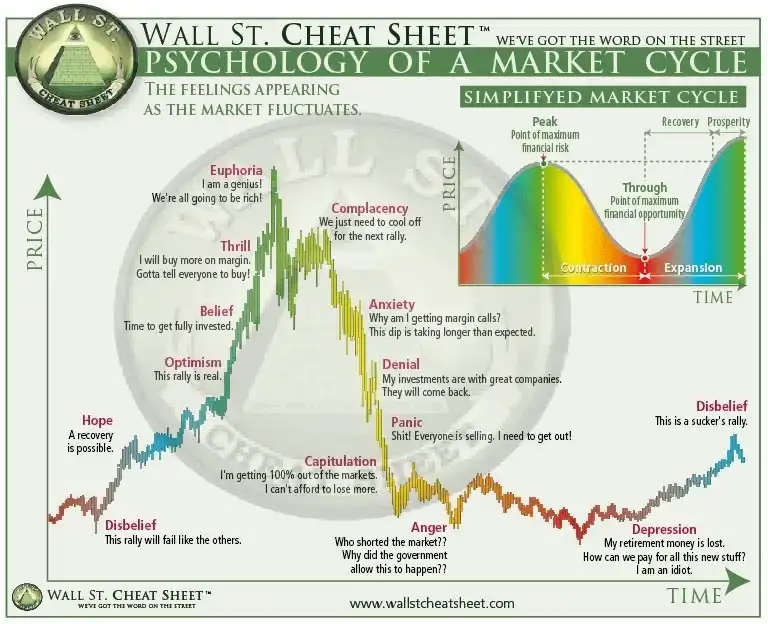

I think we are now in between the anger and depression stages, or the belief/excitement stage (which is almost the same), which may be the exit stage for many people, but for me it is a stage full of opportunity.

Here’s my view: I can’t say retail investors are completely trapped, and I think the market’s bullish sentiment is still strong, so I don’t think market-makers will see this pullback as the beginning of a bear market. The key is to understand that the goal of market makers is to squeeze as much money as possible from individual investors (us).

To achieve this goal, the most likely scenario in my opinion is for the market to slowly decline for a month or more-just to make believers lose hope, but not enough to make them give up completely, and eventually flood the altcoin market again due to FOMO. That’s why I started slowly laying out positions because I thought there was still plenty of time and prices could fall further.

Here are the key factors currently affecting the market and why I think so:

·Doubts about Altseason

·The prolonged lack of a clear and direct altseason has had a negative impact on retail investors

·Now, no one seems to believe in altseason anymore

·Most turned to memecoin casinos, while the rest simply gave up altcoin

·This leads to a loss of hope, emotion and attention

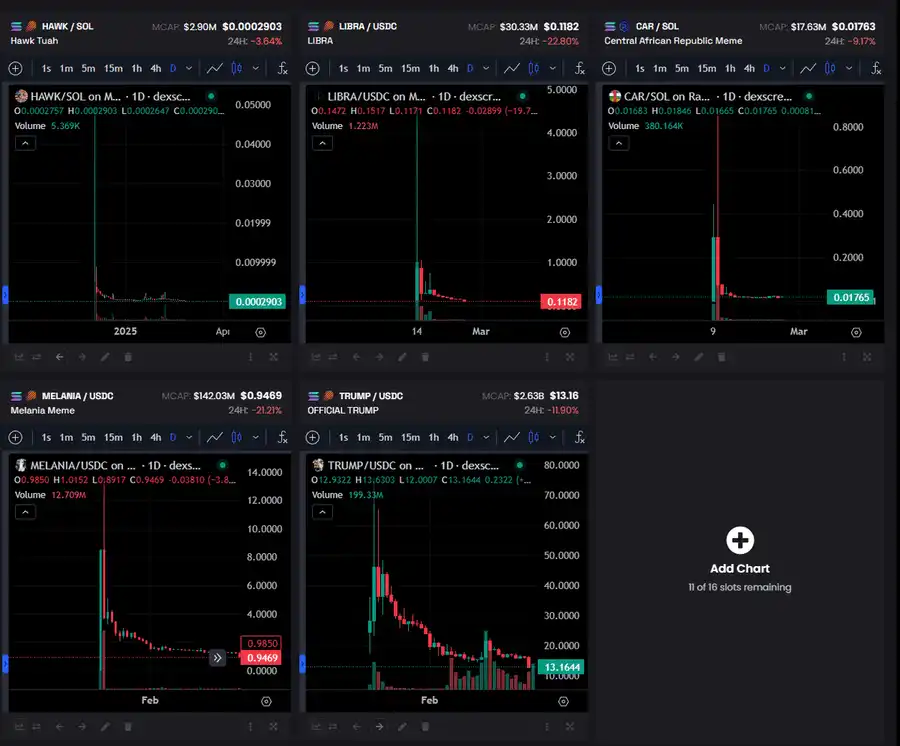

Fraud is rampant

·Never in any cycle have there been so many and so public frauds

·Every third celebrity without money talks about cryptocurrencies and issues tokens on SOL

·At the same time, they “cut” the token by-99% within a few days, and did so blatantly

·Such incidents have had a negative impact on market sentiment

Trump-Pro-Cryptocurrency President

·Trump has given us great expectations: bullish on cryptocurrencies, never selling Bitcoin, and BTC reserves

·But in fact, he has now moved away from cryptocurrency and hardly mentions it anymore

·This has also had a negative impact on the current market

·However, we still remember that the U.S. Bitcoin reserves have been confirmed

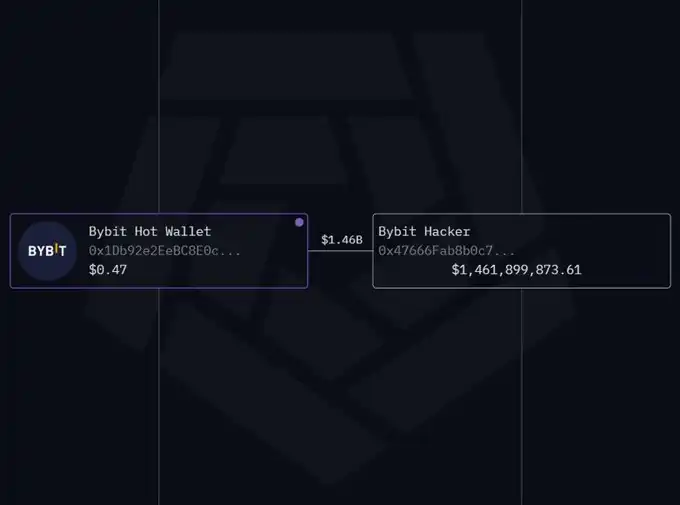

Bybit was hacked

·The largest hacking incident in cryptocurrency history caused ETH to plummet

·Bybit was hacked and $1.5 billion in ETH was stolen, a huge amount

·Hacking incidents always have a negative impact on overall market sentiment and the market itself

Bitcoin as a macro asset

·People still believe that if Bitcoin rises like this, other currencies will rise with them-but this is not the case.

·Bitcoin is now partially a macro asset and is recognized globally

·This is why Bitcoin can rise, but the cryptocurrency itself may not necessarily follow suit

·On the other hand, when Bitcoin falls, altcoin also falls

·This is because there is an oversupply of altcoin in the market, so it is crucial to understand that altcoin will rise, but by no means all, it is not 2021 anymore. Choose wisely.

stablecoin index

·On the other hand, we have the stablecoin index, which is still far from reaching levels in previous cycles

·This index represents new capital entering the crypto market

·Currently, it is just beginning to grow

Global net liquidity index

·There is also an indicator that tracks the assets of major central banks and the Federal Reserve’s reserves

·Currently, we are witnessing a reversal, which in turn portends a possible market reversal

·Now, it is also in the adjustment stage

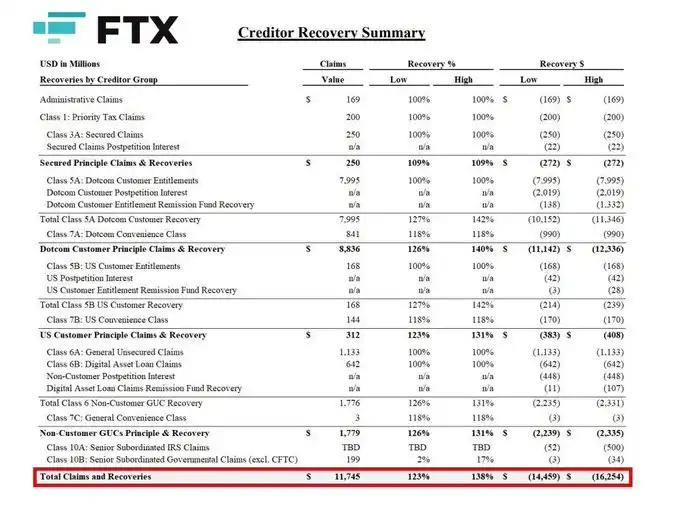

FTX compensation

·We must not forget that FTX compensation has already begun

·About $7 billion will be paid out in the next few weeks and the money will be reinvested in the market

·This will also provide a good boost to market growth

Leading market players

·The most bullish factor remains that leading market players are actively accumulating

· WorldLiberty, Michael Saylor, BlackRock-these leading companies are building massive positions

·Obviously, they did it without strategy or for no reason

conclusion

·Taking all factors and the overall situation together, the situation is not as bad as it seems, but the fact remains:

We are currently in a skeptical phase

·It is these moments that create the best opportunities

·Learn new skills, improve yourself before the market rises, and become one of the winners at the end of the cycle

“Original link”