Sonic’s chain will not be a small matter in the future, but will do big things by lifting the table.

Author: Zephyr

Introduction: The ultimate deconstruction of Sonic’s ecology

Sonic is a high-performance Layer-1 blockchain that has once again emerged in the market with a throughput of 10,000 TPS and EVM compatibility. The return of @AndreCronjeTech and the announced $200 million S airdrop have directly ignited enthusiasm within the circle. I studied the articles of@0xAlexon,@Foxi_xyz,@DaPangDunCrypto,@y_cryptoanalyst,@CyberPhilos,@rich_adul and other big shots, incorporated my own experience of exploration, and compiled a long article on systematic deconstruction.

This article will start from Fantom’s technological origins, analyze the current prosperous ecosystem driven by assets such as $S and $Shadow, dismantle the Alpha opportunities of Sonic’s ecosystem, and spread out the overall picture of Sonic and the most hardcore insights in the circle to help everyone understand Sonic’s past, present and future potential!

(Looking for CA, please skip directly to II. and be sure to read V.)

I. Deconstruction of origin

Sonic didn’t come out of thin air. This started from Fantom’s time. In 2018, Fantom was born, relying on Lachesis Consensus and DAG technology to do something different.

Fantom used the ve(3,3) model to make DeFi Flywheel, and almost got a hit, which also laid the foundation for the later x(3,3). At that time, the godfather of @AndreCronjeTech DeFi created $YFI in 2020, which increased from 6 yuan to 95,000 yuan, 2900 times. In 2021,$FTM was promoted, and 800 million yuan was dropped by airdrops, which increased 180 times, and TVL reached 7 billion yuan. The old OG who tried Fantom Test Network said that the interactive silk was very slippery. Unfortunately, Solana and Avalanche crowded it out of breath, and the woes never came alone. The Multihain Cross-Chain Bridge collapsed, and the TVL dropped to 90 million dollars. The bear market came. In 2022,@AndreCronjeTech announced its retirement, and the community felt that it was going to get cold.

Until 2023,@AndreCronjeTech will return, and in 2024, the Sonic main network will be launched with Fantom’s technology upgrade. It was launched on December 18, and major firms were launched in January.$S tripled in half a month, and TVL surged 500% to 730 million yuan in one month. @ Teacher 0xAlexon said in October last year that this was not a skin replacement, but a bone marrow replacement, and it was indeed the case. In those days, X was filled with shouts of Fantom’s rebirth, which was extremely popular and really attracted a wave of attention. The cornerstone of Sonic was created by @AndreCronjeTech with its technical fanaticism.

Not only that, but also the blessing of @danielesesta, the god of cycles. In 2021, he will work hard on Fantom, with Popsicle Finance and Solid Swap, and @AndreCronjeTech will work TVL from 5 million dollars to more than 6 billion dollars. Popsicle’s cross-chain flow optimization and Solid Swap’s ve(3,3) model directly pull the ecological flywheel, which is the first step for Sonic’s x(3,3). He called Fantom on X my starting point, and now he is using the innovations of WAGMI and HeyAnon to inject new vitality into the Sonic ecosystem.

To this day,@SonicLabs ‘TVL still remains at around US$700 million, from US$27 million at the beginning of the year to this high. I think everyone has to ponder whether the rise of the hard-core Sonic ecosystem is worth participating in.

II. Ecological anatomy

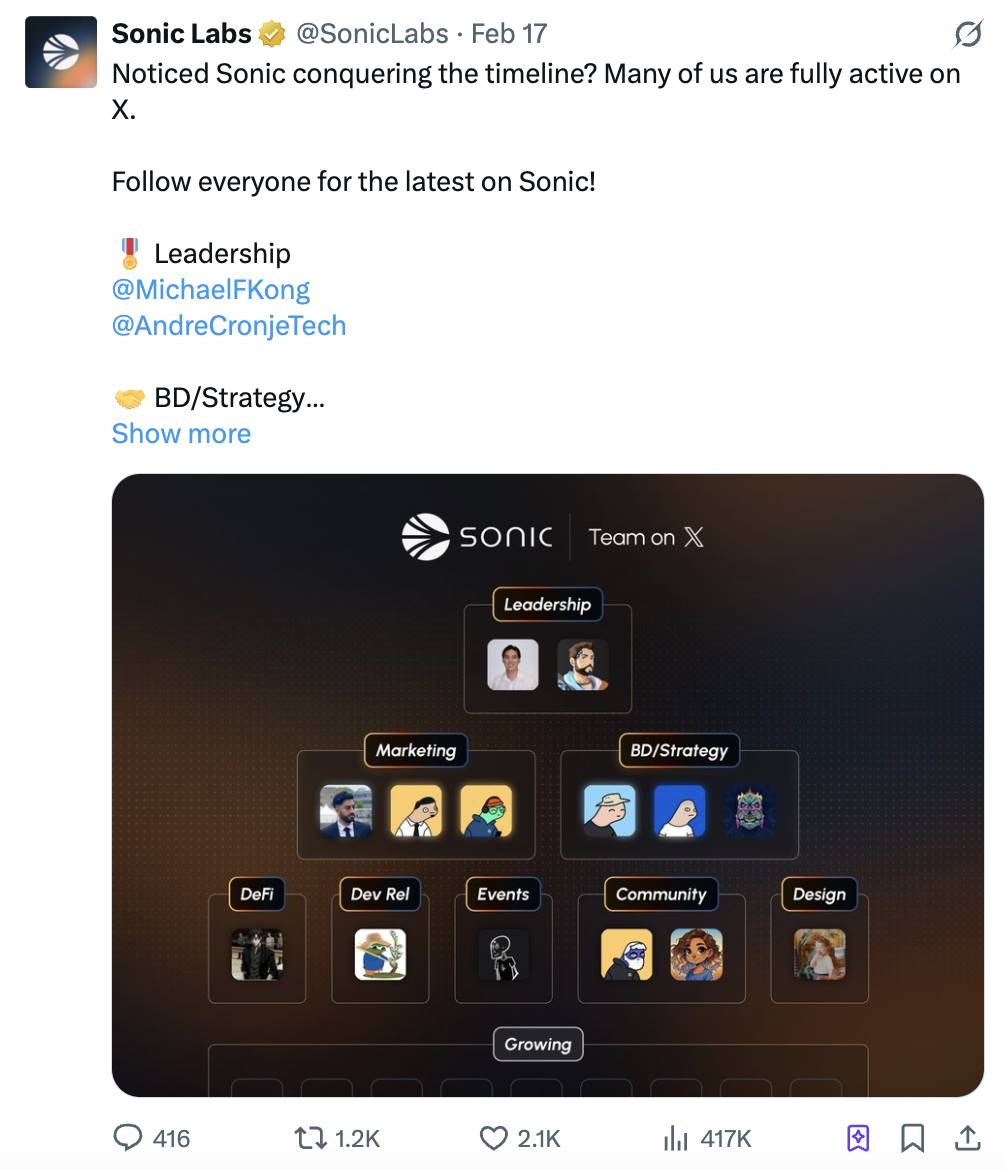

First of all, if you want to learn about new projects and find official endorsements as soon as possible, please pay attention to the official team members. The changed accounts Handle can be found in the affiliated accounts on the @SonicLabs homepage. I also personally found that @insider_Sonic and @Sonichub_These two accounts will also integrate some high-quality projects and information. You can also pay attention to BTW, the ecological anatomy section is the longest one. Please read it patiently!

Tweets link

Based on the official list of Dapps that can obtain AP and the projects currently popular in the ecosystem, this section will be divided into five parts: Spot Dex, Lending and Yield, GameFi, Meme, and NFT.

You can visit https://my.Soniclabs.com/apps This website can also check your own Points, and click on the upper right corner to filter the projects that can get AP.

Spot Dex

@ShadowOnSonic is based on CLM (Centralized Liquidity Pool Model). As of today, TVL locks in more than US$100 million, accounting for one-seventh of Sonic’s total TVL, and cumulative transaction fees exceed US$9 million. Its token,$SHADOW, increased 33 times within 20 days after its launch, with a circulating market value of approximately US$26 million. The core mechanism adopts the x(3,3) model. Users pledge $SHADOW to generate Shadow, obtain governance voting rights and transaction fee dividends, and the peak APR reaches 5500%.$ As a liquidity pledge token, the price ratio of x33 to $SHADOW is currently stable at around 80%. Through the instant exit fee structure and automatic compound interest design, the value of the position is guaranteed to be stable. The exit mechanism allows $x33 transactions to be forged, with a 50% penalty deducted for early redemption, and incentives for long-term participation. As of the end of February, the average daily trading volume stabilized at more than US$50 million.

@MetropolisDEX is based on DLMM (Dynamic Liquidity Market-Making Model). As of today, TVL has locked in US$10.42 million, and cumulative transaction fees have reached US$500,000. Its token $METRO has a circulation market value of US$10.9 million, and its FDV is as high as US$220 million. Users who pledge $METRO can receive voting rights and APR rewards. From 90 days after lockdown, the peak APR is about 30%. The core mechanism relies on segmented price ranges (Bins) to achieve near-zero slip trading, dynamically adjust fees to combat unpredictable losses, and support unilateral liquidity injection. LP can choose simple models to deposit assets, or advanced models to adjust price ranges and allocation shapes (equal, curve, Bid-Ask). As of the end of February, the average daily trading volume was approximately US$1.5 million.

@SwapXfi, based on the V4 AMM (Algebra Finance V4 Automated Market Maker) model, as of today, TVL has locked in US$55.59 million. Its token $SWPx has a circulation market value of US$9.1 million and a 24-hour trading volume of US$1.33 million. After the launch of the WBTC/scBTC pool, the increase was 58.7%, and the peak APR exceeded 80%. The core mechanism achieves low-slip trading through V4 AMM, centralized liquidity pool and automatic liquidity management optimize capital efficiency, and supports unilateral token deposit (ICHI ALM) and multiple pool types (Classic Volatile, Stable, CLAMM). Users can get voting rights and rewards by pledging $SWPx, and the VE(3,3) model is used for lock-up incentives. As of the end of February, the average daily trading volume was approximately US$2 million.

@wagmicom is based on GMI (Multi-Layer Pool Model), with TVL of US$17.5 million as of today. Its token $WAGMI has a circulation market value of US$33 million and a 24-hour trading volume of US$950,000. Since its launch, it has increased by more than 95%, and its peak APR is about 50%. The core mechanism optimizes liquidity through GMI’s multi-level pool structure, nests multi-level V3 sub-pools, and automatically rebalances market fluctuations. LP can deposit assets unilaterally, profits are distributed according to the proportion of $WAGMI holdings, and 80% of new tokens are added. Used to encourage leveraged trading and GMI pools. Users pledge $WAGMI to generate sWAGMI and receive a 20% agreement fee dividend. The lock-up cycle is flexible, and the current lock-up ratio exceeds 60%. As of the end of February, the average daily trading volume was approximately US$3 million.

Lending and Yield

@SiloFinance is based on the segregated lending model. As of today, the TVL reaches US$200 million, which is the highest TVL agreement in Sonic Networks, accounting for nearly one-third of the total TVL. The core mechanism provides high-leverage revolving loans through isolated pools. Each pool operates independently to limit the risk spread of a single asset. Users can deposit stable coins such as $S or $ScUSD to leverage the proceeds. Depositing $ScUSD will have an 18x SonicPoint score bonus., USDE deposit will have a 12% APR. The TVL moisture is very high. I estimate that the TVL brought by removing revolving loans may actually be around 20m$, which is one-tenth of the current amount. However, this agreement is very suitable for players who want to obtain high Points. The essence of revolving loans is to bear the interest rate spread in exchange for Points.

@eulerfinance Users deposit assets (such as scETH, stS, scUSD, wstkscUSD, etc.) to earn interest, or borrow other tokens by mortgaging these assets. It supports rolling strategies that are available from day one, allowing users to maximize their income by repeatedly borrowing and making deposits. Simply put, it is a one-click cycle to destroy the loan platform, but the optimization is very poor and is not recommended. For the same needs, you can manually use @SiloFinance to solve it.

@OriginProtocol and @beets_fi pledge $S , get voucher $OS, have 12% APR and pledge $S, get voucher $Sts, have 4.75% APR. Both tokens are fully liquid and can be used seamlessly in DeFi. Use and access lending markets, liquidity pools, etc., and stop pledging proceeds, but the ratio to $S is not stable 1:1. Using these two tokens to participate in other agreements requires attention to the risk of liquidation.

@Rings_Protocol, by creating meta-assets (such as $ScUSD,$ScETH,$ScBTC) linked to U.S. dollars, Ethereum, and Bitcoin, allows users to use stablecoins as collateral to participate in the revenue farming strategy managed by Veda Labs, generating high yields, while providing options for pledge passive income, fixed interest rates and income leverage. Metaassets generated on this platform have Sonic point bonuses, especially $ScUSD.

Inspired by Tomb Finance,@HandofGodSonic uses artificial intelligence@GodSonic_AI to automatically optimize emissions, bonds and supplies every 6 hours to pursue an emotion-free ecological balance. Its token system includes $HOG (anchor),$gHOG (governance/rewards) and $bHOG (bonds). TVL is currently among Sonic’s top ten, and $gHOG is scheduled to go online next week. (It looks good, but in fact, this ponzi is not perfect. For details, see V.)

@spectra_finance uses future earnings from assets to token into Principal Tokens (PTs, principal ownership) and Yield Tokens (YTs, future earnings), allowing users to sell earnings in advance or lock in principal. PTs can lock in fixed interest rates to avoid fluctuations, and YTs are used to speculate or realize future earnings; the platform’s built-in automated market makers (AMM) supports YTs trading, allowing users to speculate on yields and obtain income distribution at the end of each cycle; Its permissionless design allows anyone to create a revenue pool based on ERC-4626 tokens, and the revenue cannot be withdrawn in advance, enhancing composability with other agreements. (It is difficult to use and can easily confuse people. It is recommended to understand with a small amount of money and read the project documents carefully)

@eggsonSonic’s goal is to build $EGGS into a reserve currency. Similar to the OHM in the previous cycle, users can deposit $S to mint $EGGS, redeem $EGGS in exchange for $S, borrow $S and use a leverage cycle. 13.86 billion of $EGGS has been destroyed,$S borrowed is $662,800, and TVL is $73.95 million.

@HeyAnonai is an AI-driven DeFi protocol that simplifies DeFi interactions on Sonic through conversational AI and real-time data aggregation. Users can interact with HeyAnon through natural language to perform complex DeFi operations such as bridging, exchanging, pledging and borrowing. dev is the famous @danielesesta, and $Anon can be purchased on popular public chains.

GameFi

@sacra_fi will be launched in April 2022. After three rounds of beta testing, Q2 in 24 was officially launched. It cooperated with @SonicLabs to launch a 50w $S reward plan. For details, you can watch teacher @rich_adul’s video. The maximum $SA is 24U, and now it has dropped back to around 0.08U.

@FateAdventure’s avatar before @AndreCronjeTech was one of the characters in the game. He received a seed round investment from @SonicLabs and was considered a biological son. This is a blockchain game with clear P2E elements. Players consume and earn $FA through missions, battles or NFT.$ The FA coin price hit a high of 2U, and the current price is 0.76U.

Meme

Risk warning: @AndreCronjeTech publicly expresses its dislike of Meme coins

@GOGLZ_Sonic leader Meme, the concept of goggles, but was almost filtered many times.

@TinHat_Cat Conspiracy Cat, the currency price trend is very evil, and the NFT floor has remained high for a long time and the trading volume is stable. It is indeed Cabal.

@derpedewdz Derp is a token corresponding to NFT. Holding NFT can be claimed and airdropped for free. Uppies is a project used by the Derp community to participate in the Meme competition

The token issued by @MimonSonic on @wagmicom was airdropped to Dero holders a few days ago. It is worth more than 10U, a wizard concept.

The @PassThe_JOINT cigarette-404 concept used to sell blind boxes in the NFT market. Tokens within the randomly obtained number were opened, and they were cleared out once they were put on the shelves, but the market value has been around 200k for a long time.

@haunted_ice @Memetoona both purchased by @danielesesta personally using @HeyAnonai, and the market value is still at a very low stage.

NFT

The NFT trading market for Sonic Chain is:

https://paintswap.io/Sonic

@derpedewdz is the blue-chip NFT of Sonic Ecosystem. The official team members hold and change their avatars with famous brands.@AndreCronjeTech also changed their derp avatars two days ago. The leading NFT status is beyond doubt, with a total of 2,000. As far as I know, many group members hold dozens of them, and the holders ‘airdrops are also constant, with the highest airdrop amount even exceeding 1w US dollars. There are constantly projects directly given to the holders of derp WL. In short, It is recommended that players who are deeply involved in the Sonic ecosystem hold at least one NFT. This is an OG authentication and a community culture. (Didn’t you see that I am also Derp?)

@MetropolisDEX is one of the NFTs with high transaction volume and floor. Its issuance was originally used for Fairlaunch. Holders can get a quota to purchase tokens, which can be superimposed based on the number held. The original Metro NFT can be obtained by completing simple tasks. Currently, the floor is 1400 seconds. The official continues to empower the NFT, and there may be new airdrop opportunities and WL permissions for other projects in the future.

@LazyBearSonic is a fair NFT for Mint. Mint costs less than 1s, and you can get WL when you enter DC. Moreover, Mint lasts for four hours to complete. The highest floor is close to 500s. Currently, the floor is 300s. There are many smart group friends and early ecological participants have seen the hidden opportunities here. Multiple Mint numbers and floor sweeping, with benefits ranging from thousands to tens of thousands of S.

III. Airdrop opportunities

@SonicLabs announced an airdrop of 200 million $S. Teacher Pang Dun’s article analyzed the airdrop in a very detailed and thorough manner, so I won’t go into details. Here, I will only discuss how to maximize the benefits.

Sonic’s Airdrop Analysis

For an airdrop user, does Sonic have an opportunity?

Of course!& hellip;

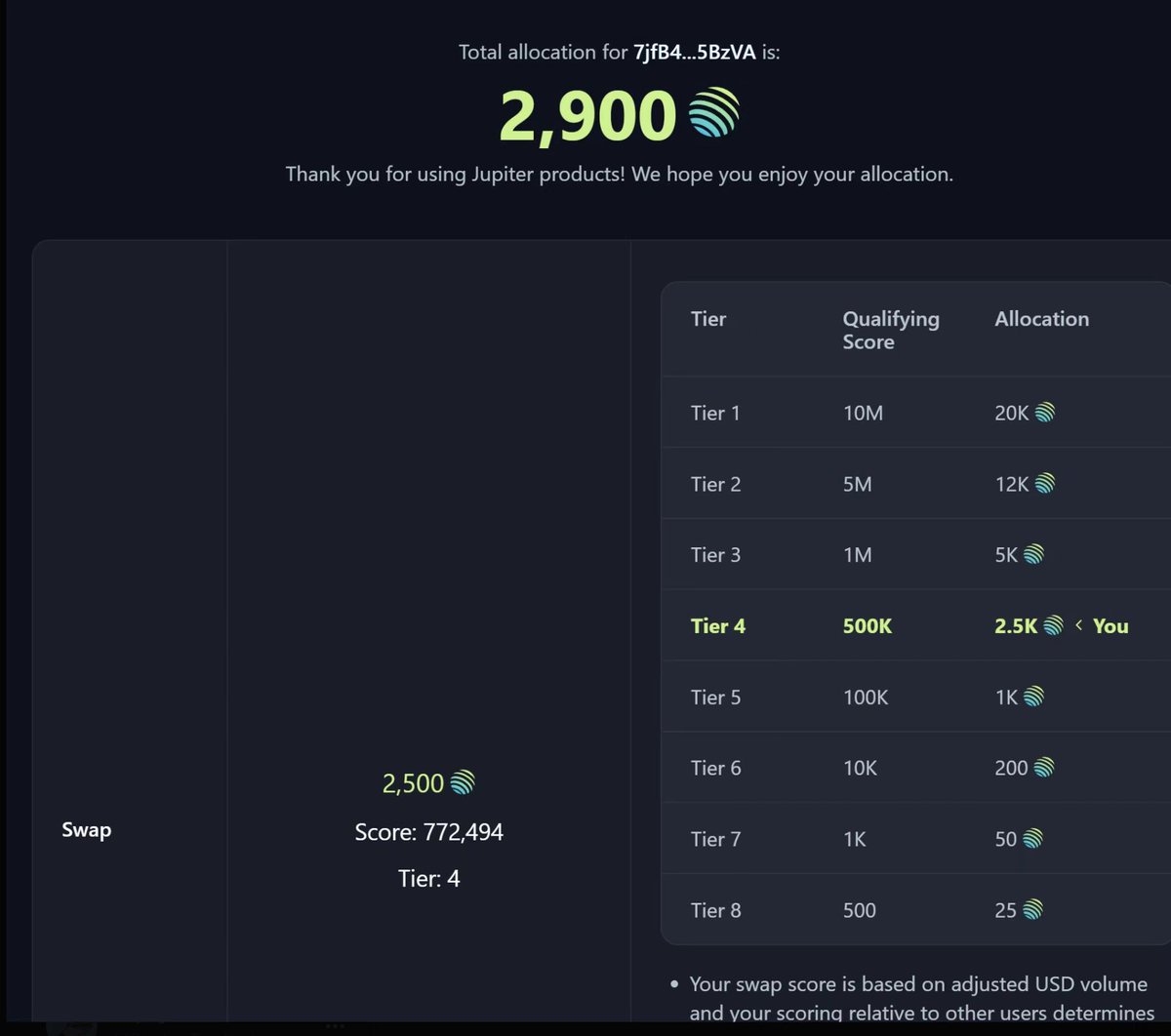

Here, I used @JupiterExchange’s airdrop data as a reference. Because the official algorithm and ranking of Points have not been announced, practical methods and strategies cannot be formed. If corresponding data is released in the future, I will post it to you for reference.

@JupiterExchange divides the transaction address into eight levels, and calculates that the number of airdrops in the last seven levels and eight levels accounts for 5% of the transaction volume, the sixth level accounts for 2%, and the fifth level accounts for 1%. The higher the level, the number of airdrops only accounts for 0.2% of the transaction volume. This reflects that it is not that the higher the transaction volume, the more the transaction volume, the more the proportion of investment is decreasing. That is to say, find a value close to the edge of the level. By spreading the transaction volume of the order number to multiple addresses, the airdrop value will be much higher. However, since there is no relevant public data, and even the underlying algorithm of Points has not been announced, the ap is not displayed on the dashboard yet. However, the official is actually a little egg. You can see the ranking of points on the @ShadowOnSonic dashboard. This data can be used as a simple reference. For example, 51w points are 1.4w points. For now, The multi-address strategy ensures that each address has about 2W names, and the main address can have 1W or 5K names. This can prevent the level assigned to be too high and the weight of the score in the airdrop becomes lower.

Of course, I am just providing a reference. It’s just my personal imagination. The opportunity for Sonic Ecosystem for our small capital lies in exploring early alpha. However, as a DeFi chain, Sonic’s scores can often be very high, which also shows us a possibility to get rich.

IV. Future blueprint

Here is Grok’s ultimate vision for Sonic:

Sonic’s chain will not be a small matter in the future, but will do big things by lifting the table.

@AndreCronjeTech’s technical soul is still burning.$YFI 2900 times and $FTM 180 times are just appetizers. He used a big move on Sonic. Sonic’s main network comes first in the TPS chain, and FVM (Fantom Virtual Machine) and DB (LiveDB+ArchiveDB) hardcore upgrades directly improve performance.

Sonic created an L1.5 to break up all nodes into Validator and Archive Nodes, and put them into operation easily. This technical foundation allows Sonic to make a difference on DeFi and GameFi, and everyone in the circle is waiting for it to complete a slow chain. Staring at Sonic Gateway, the cross-chain bridge is ridiculously fast. It competes with Ethereum for business and $S revitalizes assets such as stETH and wBTC, and TVL will explode just around the corner.

On the ecological side,$Shadow and Metropolis are just starters. Sonic’s high-performance foundation can turn DEX around, gameplay such as x(3,3) and DLMM will become more and more fierce,$Shadow’s TVL exceeds 150 million, and Metropolis’s one-sided pool filling efficiency will require more hardcore projects in the future. 1.4 With hundreds of millions of yuan incentives, 200 million US dollars were airdropped in June, and developers had to gather in. Sonic Labs still holds the 200 million US dollars Innovator Fund, and AAA projects are not a dream. I guess AC is not just holding back on that. The pile of black technologies (money markets, options, leverage) he said he mentioned will sooner or later be implemented on Sonic, and the ecology will explode.

In the community, Sonic Points and Gems fly wheels. Airdrops make sure to earn PP, LP get AP, and mining takes high risks and high returns. Just play with it, you can double your income. In the future, Sonic will tie users and developers together. Points and Gems are not just rewards, but engines that drive the ecosystem.

Sonic relies on Killer Dapp to differentiate, and the community has to play deeper. LP, pledge, and NFT are all on the table. With a turn of the flywheel, Sonic can drain the liquidity of other chains.

That’s not the end. Sonic’s ambitions are not just L1. AC has been holding on to technical design for 8 years in its self-report, including foreign exchange AMM, leveraged spot, option mining, and another upgrade of Sonic Gateway. It has brought Ethereum’s TVL across the chain, and the status of $S as hard currency has been finalized.

Sonic’s high-performance can turn the tables around. In the future, Sonic will not only do DeFi, but will have to eat all GameFi and NFT to create a new world. Everyone in the circle is watching that if Sonic turns the tables, it will turn the entire Web3 upside down

V. Deconstructing actual combat

Personally,@SonicLabs is what teacher @CyerPhilos said about growing from a very small market value or having early low-cost airdrop opportunities, with real value and applications or communities, and investing in some ecology to grow together at the early stage.

Looking back at the Derp NFT with a Mint price of 100s has been 2000s. Holding the Derp NFT has also airdropped a high price of $xshadow worth more than 10,000 knives. Until now, various project parties are still airdropped to derp holders. I believe there will only be more and more in the future. A few days ago, free Mint’s LazyBear could get paid by just going to dc to fill out the form. The high point was nearly 500 seconds. Even Metro NFT, which was given away for free after completing the task, is now more than 1000 seconds. I believe that the Sonic ecosystem is still in its early stages, and there are too many Alpha opportunities here. I am willing to follow the teachers to build it!

Recommended reading: Why do I judge that SONIC is still in its early stages?

Recommended reading: Reasons for Bullish Sonic Ecology

So how should you participate in the Sonic ecosystem as a small group?

First of all, the most important thing in the chain is security. There are various reasons for funds to be lost and stolen. The infrastructure on Sonic is not perfect. Buying unofficial endorsements of tokens cannot guarantee whether the contract authority will be lost. I was not talented and bought $Sonicxbt once. At that time, I saw it posted by my group friends. After looking at the low market value, I thought of the previous bnbxbt. Without thinking about it, I bought more than 800 s, which successfully gave the scammer a performance.

When participating in the various agreements on the chain, you should also be careful. Use small funds to run the process and principles. Many DeFi projects do not advocate fast-in and fast-out, so fast-in and fast-out require a lot of slippage or taxes. Especially for some platforms that are pledging,@ specs_finance is really cruel here. I happily took scu in and redeemed it into confusing coins such as wstkscu, sw-wstksc, etc., and the official conversion entrance is unclear. You need to be patient enough to find or slowly read those lengthy documents. This is why everyone needs to try and make mistakes with a small amount of money. This situation is very uncomfortable.

Xiao San wants to become the old OG or giant whale in the future, so playing these DeFi is not very cost-effective. Then we must look for Alpha opportunities in the ecosystem and continue to increase the capital. Then it is indispensable to develop new projects. However, we must also be open-minded and carefully read the document of each project while measuring the risks of project running away (if you are lazy, don’t read, pay attention to me, I will post high-quality new projects)

Take the recent @HandofGodSonic as an example. In the first cycle, everyone made deposits and dug out $hOG together, but the coin price was speculated to thousands of dollars at the beginning, and it plummeted when the project began to distribute tokens. However, according to the official statement,$hOG is soft anchored to $os, which means that the price of $hOG will eventually return to around 1 yuan. At that time, I warned my group of the risks that the price of $hOG has always been inflated, so it would be good to dig and sell it. Moreover, the official charged a 1% tax on deposits. Before the token distribution began, because the price of $hOG remained high, the apr of the project was as high as hundreds of thousands of daily chemical points. Until the distribution began, the number of daily chemical pairs fell to one-thousandth, which means that it would take ten days to recover the capital. There were even LP trading pairs added by Qunyou, and the LP could not be withdrawn, which was equivalent to a forced lockup. Thinking back and thinking about conspiracy theory, the project party has set up a transaction pair that deposits os\hOG without paying taxes, and has the highest daily chemical value, but cannot be withdrawn. The projects with the highest yield are all projects that cooperate with the government.$os is used as a transaction pair.$Swpx is a cooperative Dex. The maximum $hOG allocated to these projects every day is nearly 3w, and the lowest is 1w, while the other lowest currency pairs only have 2000.

Therefore, you must read the Document carefully for new projects. Often, a single piece of information can determine too many things.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern