When OG Whales handed over chips to BlackRock, it was not a prelude to a collapse, but a march in the restructuring of the global capital landscape.

Written by: Daii

One day in 2030, when BlackRock’s Bitcoin ETF surpassed the S & P 500 index funds, Wall Street traders suddenly realized that what they once ridiculed as a “dark web toy” was now controlling the throat of global capital.

But all the turning point began in 2025, when the price of Bitcoin exceeded $250,000 in the hunting of institutional whale herds, but no one could tell who it belonged to anymore. On-chain data shows that more than 63% of the circulating supply is locked into institutional custody addresses, and the exchange’s Bitcoin liquidity has dried up to only enough to support three days of trading volume.

The above is fantasy, let’s go back to the present first.

A large amount of money continues to flow out of Bitcoin ETFs, and Bitcoin once fell below 80,000. There are two main explanations for this phenomenon: first, from the policy perspective, Trump launched a tariff war in the United States; second, from the financial perspective, it is because 56% of short-term holders have closed their positions in hedge funds arbitrage strategies.

However, analysts believe that the current situation is in the “allocation phase” of the Bitcoin bull market.

The “distribution phase” of a Bitcoin bull market usually refers to the period before and after the price peak in the later period of the bull market, when large players (“whales”) begin to gradually sell their chips, transferring Bitcoin from early holders to new investors entering the market. This stage means that the market shifts from a crazy rise to the top area, which is a key link in the bull-bear conversion.

Let’s not keep the suspense in suspense, let’s give the answer first. The current market liquidity structure has changed.

OG retail investors and OG whales are playing sellers; institutional whales and new retail investors entering through ETFs are becoming the main buyers.

In the cryptocurrency field,”OG” is the abbreviation of “Original Gangster”(also often interpreted as “Old Guard”), which refers specifically to the earliest participants, pioneers or long-standing core group in the Bitcoin field.

In a word, old money is withdrawing and new money is entering. In new money, institutions are the dominant player.

Below we will provide you with a detailed analysis from the aspects of market structure, current cycle characteristics, institutional and retail roles, cycle timeline, etc.

1. Typical market structure: whale allocation to retail investors at the end of the bull market

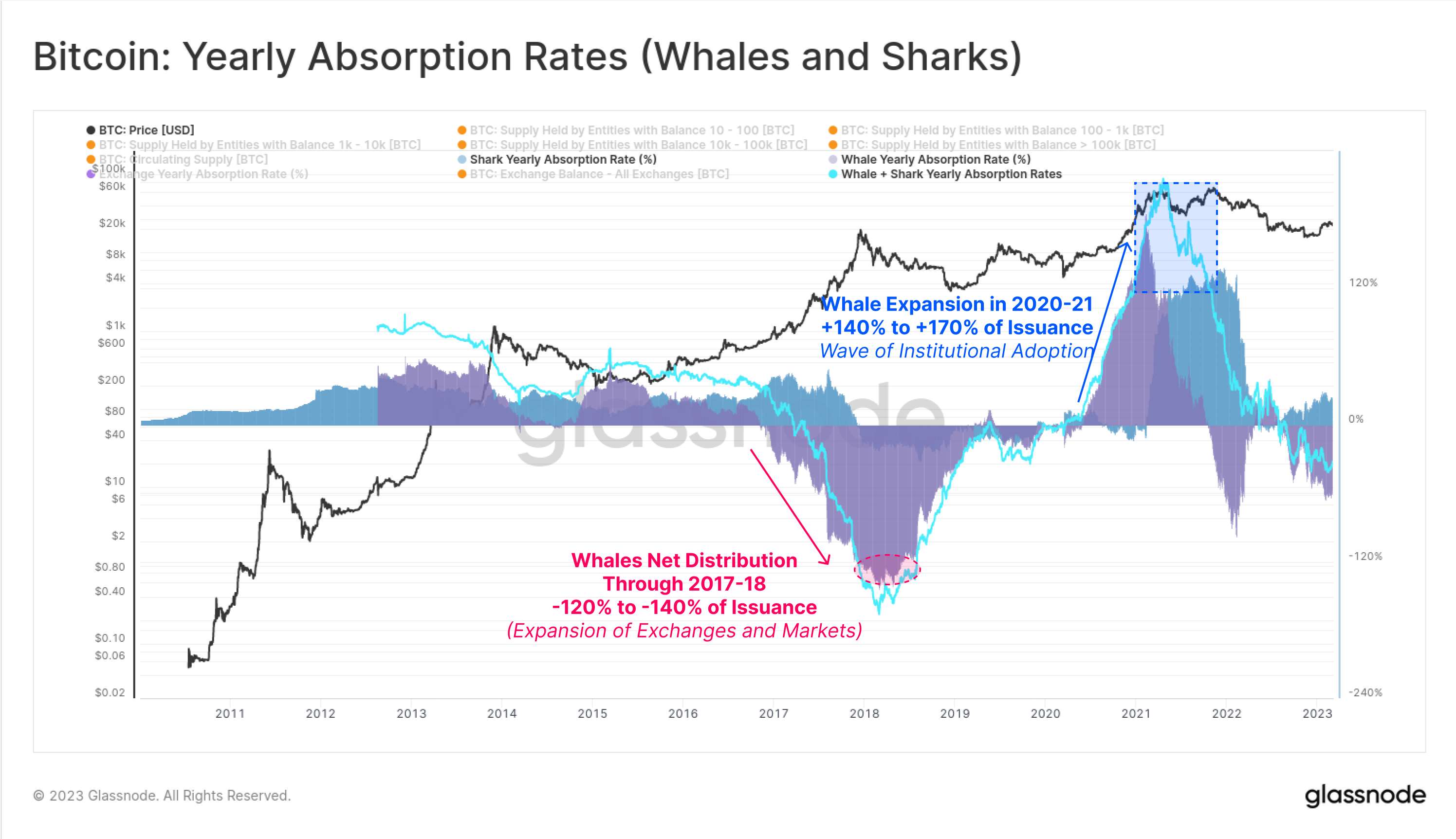

The end of a typical Bitcoin bull market shows a pattern of whales distributing chips to retail investors, that is, the retail investors who enter after early large holders sell the coin at a high price.

In other words, retail investors often take over at a high level in a fanatical atmosphere, while the “smart money” whale takes the opportunity to ship in batches on rallies to achieve profits. This process has been performed many times in the historical cycle:

For example, when the bull market was near its peak in 2017, the bitcoin balance held by whales decreased net, indicating that a large number of chips were transferred from the whales. The reason was that a large amount of new demand poured into the market at that time, providing enough liquidity for whales to distribute their positions. For more information, see: The Shrimp Supply Sink: Revising the Distribution of Bitcoin Supply.

Overall, the market structure at the end of the traditional bull market can be summarized as follows: early large currency holders gradually sold off, market supply increased, while retail investors were driven by FOMO sentiment (fear of missing out) to buy in large quantities. This allocation behavior is often accompanied by signs such as increased Bitcoin inflows on exchanges and the movement of old coins on the chain, indicating that the market is about to peak and turn.

2. Characteristics of this round of bull market: new structural changes

The distribution phase of the current bull market (2023-2025 cycle) is different from the past, especially in the behavior of individual and institutional investors.

2.1 This cycle has unprecedented institutional participation

The launch of the spot Bitcoin ETF and the massive purchase of coins by listed companies have made the structure of market participants more diverse, and it is no longer just retail investors driving the market. The addition of institutional funds has brought a deeper pool of funds and more stable demand. The direct manifestation is that the market volatility has decreased compared with the past. According to analysis, the maximum retracement in the current bull market is significantly smaller than in the past cycle, and the high correction usually does not exceed 25%-30%, which is attributed to the intervention of institutional funds to stabilize fluctuations.

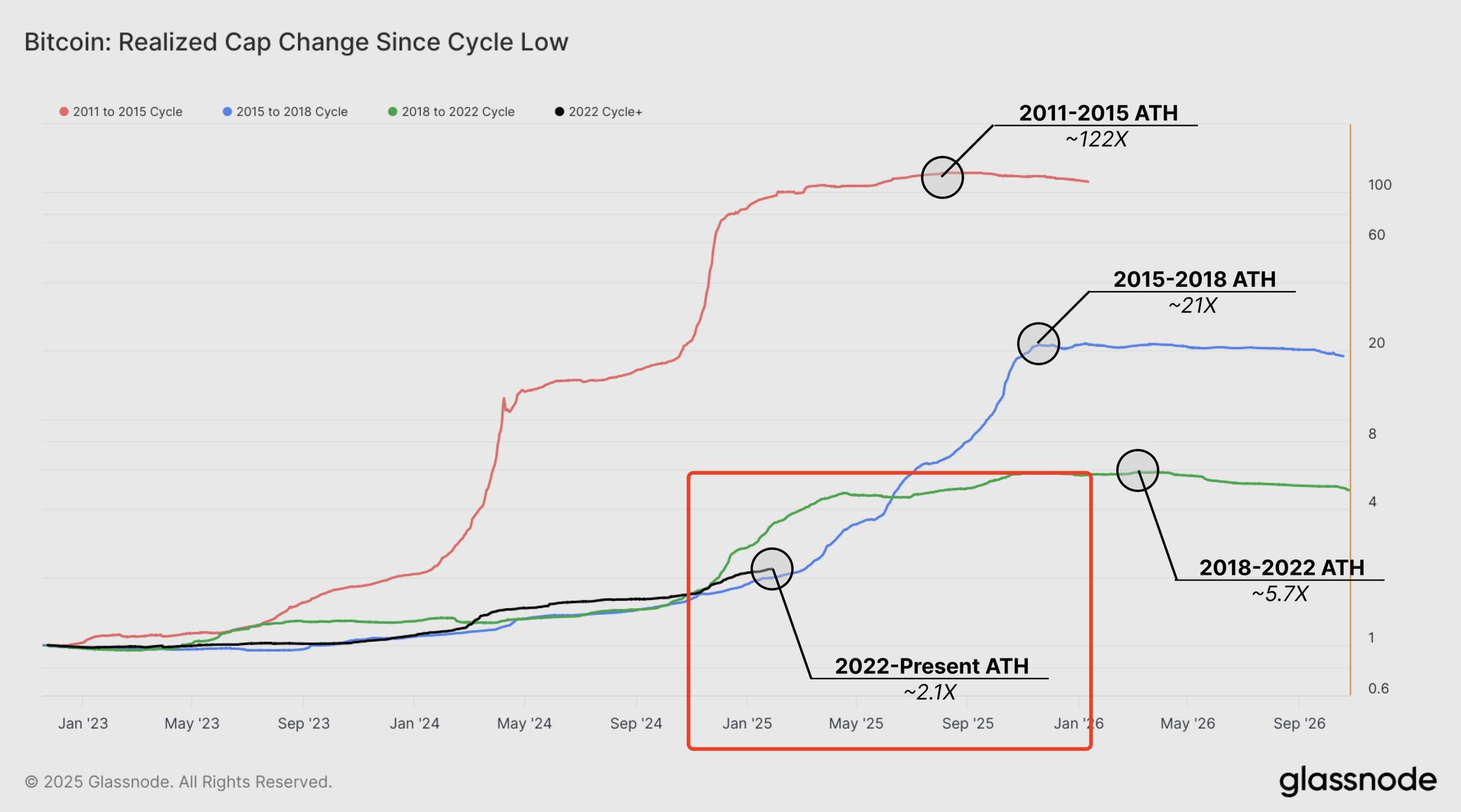

At the same time, the maturity of the market has increased, the price increase has decreased cycle by cycle, and the trend has become more stable. This can also be seen from indicators such as the growth rate of the Realized Cap: the realized cap has only expanded by a small portion of the peak of the previous round, indicating that the enthusiasm has not yet been fully released (see: Thinking Ahead for details).

Realized Cap is an important indicator to measure market capital inflows. Unlike traditional Market Cap, the realized market cap does not simply multiply the current price by the available supply, but rather takes into account the price of each Bitcoin at the last time it was traded on the chain. Therefore, it can better reflect the actual scale of funds invested in the market.

Of course, the above indicators may also indicate that the market is entering a more mature and stable stage of development.

2.2 The behavior of retail investors in this round has also become more rational and diverse

On the one hand, senior retail investors (individual investors who have gone through multiple cycles) are relatively cautious and lock in profits earlier after a certain amount of increase, which is different from the previous situation where retail investors chased the top all the way.

For example, data from the beginning of 2025 shows that small currency holders (retail investors) net transferred about 6000 BTC (about US$625 million) to the exchange in January and started to cash out early. During the same period, whales only had a small net inflow of about 1000 BTC, basically staying put. This divergence means that many retail investors believe that the period has peaked and choose to take profits, while whales (regarded as “smart money”) sit tight, apparently expecting higher profit margins.

On the other hand, the investment enthusiasm of newly entered retail investors is still accumulating. Indicators such as Google Trends show that public attention once fell and “reset” after prices hit new highs, and has not yet seen the peak of national fanaticism at the end of previous cycles. This suggests that the current bull market may not yet enter the final fanatical stage, and the market still has potential for growth.

2.3 The behavior of institutional investors has become one of the important features of this round of bull market

The last bull market in 2020-2021 was the first cycle in which a large number of institutions and listed companies entered the market. At that time, there was an increase in whale currency holdings, and new “big players” such as institutions bought in large quantities, and Bitcoin flowed from retail investors to these whale accounts.

This trend continues in the current cycle: large institutions purchase bitcoin in large quantities through channels such as OTC over-the-counter markets, trust funds or ETFs, making traditional whales no longer net sellers, delaying the arrival of the allocation phase to a certain extent. This has made the allocation of this bull market more relaxed and decentralized, rather than the past model of purely retail investors taking over: the depth and breadth of the market have increased, and new funds are enough to absorb the chips thrown by long-term holders.

The Glassnode report pointed out that a large amount of wealth has been or is being transferred from long-term holders to new investors, which is a sign that the Bitcoin market is maturing. Long-term holders have achieved record profits (up to $2.1 billion in a single day), and new investors have Enough demand to take on these sell-offs. For more information, see Bitcoin sees wealth shift from long-term holders to new investors Glassnode

。

It can be seen that the interaction between retail investors and institutions in this round of bull market has created a more resilient market environment.

3. Changing Role of Institutions and Individual Investors: The Impact of OG Individual Investors and Institutions on Liquidity

As the structure of market participants evolves, the roles of institutions and individual investors in the distribution stage have also changed significantly.

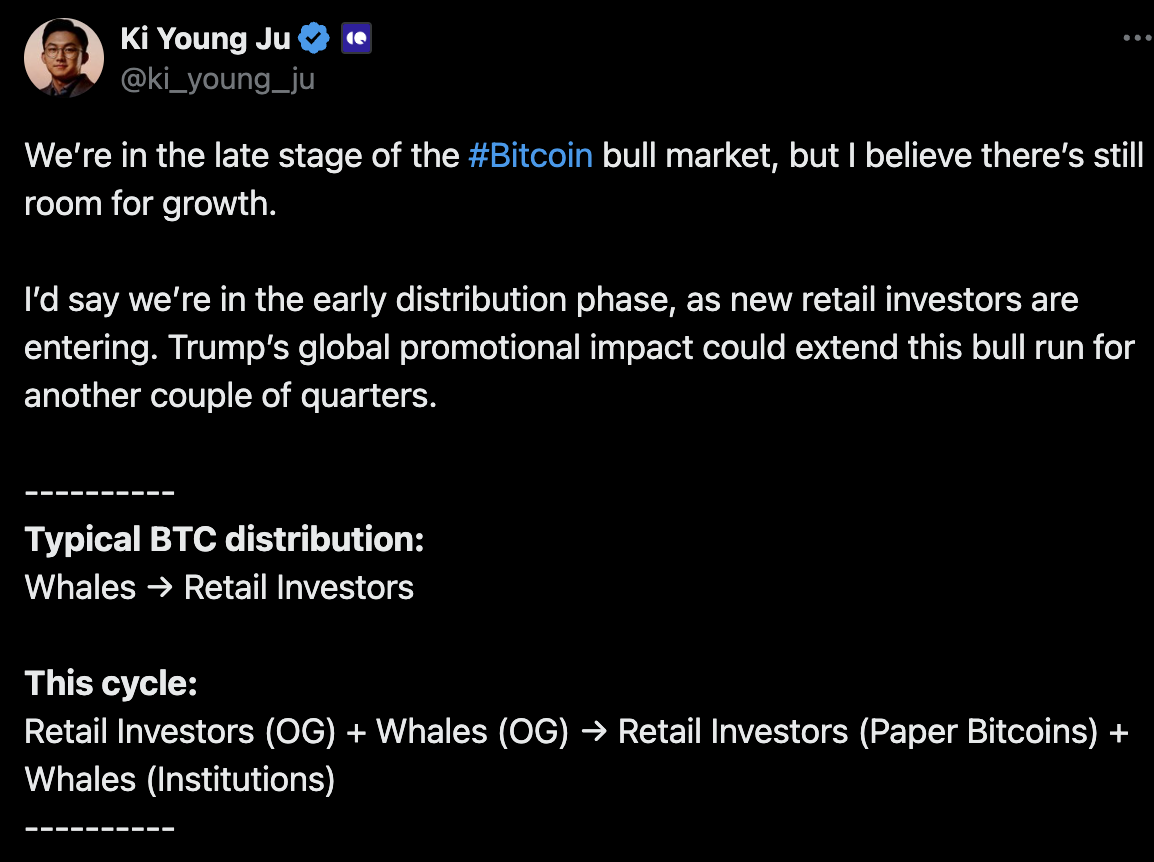

CryptoQuant CEO Ki Young Ju summarized the allocation model of this round as: “veteran” retail investors (OG retail investors)+ original whale new retail investors (through ETFs, MSTR and other channels)+ new whale (institutions).

In other words, retail investors and whales that have gone through early cycles are gradually selling, and the recipients include not only retail investors in the traditional sense, but also ordinary investors who enter through investment vehicles such as ETFs, and new institutions that play the role of whales. funds.

This diversified participation pattern is completely different from the traditional “whale retail” single-line distribution model.

In this cycle, OG retail investors (early entry individual currency holders) may hold a considerable amount of Bitcoin. They choose to cash out during the bull market peak, providing some selling pressure and liquidity to the market.

Similarly, OG Whales (early large-scale households) would ship in batches to realize several times or even dozens of times the profits. Correspondingly, institutional whales act as a new buyer force to absorb these selling pressure. They buy through channels such as escrow accounts and ETFs, and Bitcoin flows from the old wallets to the escrow wallets of these institutions.

In addition, some traditional retail investors now also hold Bitcoin indirectly through ETFs and listed company stocks (such as MicroStrategy stocks), which can be regarded as a new form of “retail takeover.”

This role shift has had a profound impact on market liquidity and price movements.

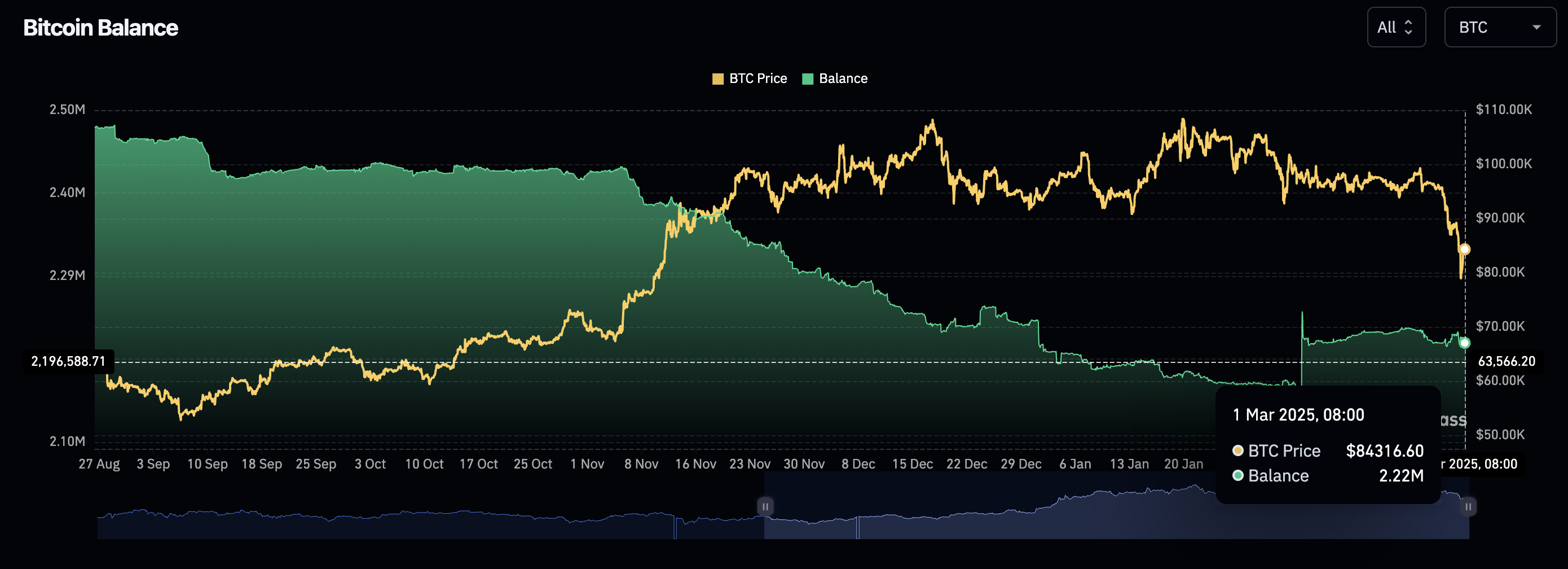

3.1 More Bitcoin is leaving the exchange

On the one hand, the selling behavior of OG holders usually leaves obvious on-chain footprints: increased changes in old wallets, large transfers flock to exchanges, etc.

For example, in this bull market, it was observed that some wallets that had not been moved for a long time began to become active, and the transfer of coins to exchanges for sale is a sign that old holders have begun to allocate chips. Ki Young Ju pointed out that the activities of OG players are reflected through on-chain and exchange data, while the flow of “paper bitcoins”(such as ETF shares, bitcoin-related stocks) is only reflected as on-chain records of the escrow wallet at settlement. In other words, most purchases of institutional funds occur over-the-counter or through custody, and the direct chain reflects the increase in the balance of the custodian’s address rather than the direct flow of traditional exchanges.

The current exchange bitcoin balance is 2.22 million, which is also a reflection of this feature.

3.2 New whales and new retail investors are more resilient

On the other hand, institutional investors, as new whales, not only provide huge buying support, but also enhance the market’s ability to withstand and liquidity depth under selling pressure.

Unlike in the past when retail investors dominated, they were prone to panic and stampede, institutional funds are more inclined to absorb on dips and allocate them in the long term. When there is a correction in the market, the intervention of these professional funds can often stabilize prices. For example, some analysts pointed out that the reduction in volatility in this round of bull market is attributed to institutional participation: when retail investors sell, institutions are willing to take over the offer to ensure market liquidity, resulting in price retractions much smaller than in the past.

Although the launch of Bitcoin ETFs has brought a large amount of incremental funds to the market, some ETF holders (such as hedge funds) may have carry trading as their main purpose, so their funds are highly liquid. The recent large outflow of ETF funds shows that some institutional funds are only engaged in short-term arbitrage rather than fully long-term holding. Bitcoin’s recent financial pressure below 80,000 came from the liquidation of hedge funds ‘arbitrage strategies.

However, newly entered retail investors have shown strong resilience. They have not panicked in selling during each adjustment, but are willing to continue to hold. Bitcoin’s short-term holder indicator shows greater resilience.

In general, the interaction between OG retail investors +OG whales and new institutional whales + new retail investors has formed a unique supply and demand pattern in the current market: early holders provide liquidity, and institutions and new buyers absorb chips, making the distribution process in the later stages of the bull market more smooth and traceable.

4. Timeline of the market cycle: Historical trends and outlook for this round of bull market

From historical data, the Bitcoin market shows a cycle of about four years, with each round including a complete cycle of bear-bull market-transition. This is highly related to the halving event of Bitcoin block rewards: after the halving occurs, new coin output drops sharply, and there is often a sharp price increase (bull market) in the next 12-18 months, followed by a bear market adjustment near the high point.

4.1 history

Looking back at the timelines of several major bull markets:

-

The first halving occurred in late 2012, and the Bitcoin price peaked in December 2013, about 13 months later;

-

The second halving was halved in 2016, and about 18 months later, the bull market peak in December 2017 was close to US$20,000;

-

The third halving was halved in May 2020. About 17-18 months later, at the end of 2021, Bitcoin experienced two highs (April and November) close to $70,000.

It is speculated that the fourth halving in April 2024 may trigger a new round of bull market, and its peak probability will occur within one to one and a half years after the halving, that is, around the second half of 2025, when it will usher in the final distribution stage (the end of the bull market).

Of course, cycles are not mechanically repetitive, and changes in the market environment and participant structure may affect the duration and peak of this bull market.

4.2 optimistic

Some analysts believe that the macro environment, regulatory policies and market maturity will have an important impact on this cycle.

For example, Grayscale’s research team pointed out in a report at the end of 2024 that the current market is only the middle stage of a new cycle. If fundamentals (user adoption, macro environment, etc.) remain good, the bull market may continue into 2025 or even longer. They emphasized that the newly launched spot Bitcoin ETF has broadened channels for capital entry, and that clarity in the future of the U.S. regulatory environment (such as the potential impact of the new Trump administration) may further boost crypto market valuations.

This means that this bull market is expected to be longer than previous cycles, and the rally may cross the traditional time window.

On the other hand, there are also on-chain data that supports the view of a longer bull market. For example, the growth of real capital inflows (Realized Cap) in this cycle mentioned above has not yet reached half of the previous high, indicating that market enthusiasm has not yet been fully released. As a result, some analysts predict that the final high of this bull market may be much higher than the previous round, and expectations for high highs are often raised to $150,000 or higher.

4.3 conservative

However, there are also views that the peak will appear in 2025.

CryptoQuant’s Ki Young Ju predicts that the final allocation phase of the Bitcoin bull market (concentrated shipments by various OG holders and institutions to the last receiving funds) will occur in 2025. His judgment is based on the early distribution phase that has now entered and the observed influx of new retail funds, and believes that there is no need to turn to a short view prematurely before final shipments are completed.

Based on historical models and current indicators, it can be speculated that the high probability of this round of bull market will come to an end in the second half of 2025. By then, as prices reach a phased peak, various holders will accelerate the distribution of chips and complete the final distribution process.

Of course, the precise time and height are difficult to predict, but judging from the cycle length (about 1.5 years after the halving) and market signs (the degree of madness of individual investors, institutional capital movements, etc.), 2025 may become a critical year.

conclusion

As Bitcoin transforms from a geek toy to a trillion-dollar strategic asset, this bull market may reveal a cruel truth: the essence of the financial revolution is not to eliminate old money, but to use new rules to reconstruct the genetic chain of global capital.

The “distribution stage” at this moment is actually the coronation ceremony for Wall Street to officially take over the crypto world. When OG whales handed over chips to BlackRock, it was not a prelude to a collapse, but a march in the restructuring of the global capital landscape. Bitcoin has evolved from a myth of quick wealth for individual investors to a “digital strategic reserve” on institutional balance sheets.

The most ironic thing is that while retail investors were still calculating the “escape code”, Blackstones had already written Bitcoin into the 2030 balance sheet template.

The ultimate torture in 2025: Is this the culmination of the cycle, or is it the pain of the birth of a new financial order? The answer is hidden in the cold on-chain data. The transfer-out record of every OG wallet adds to the escrow addresses of BlackRock; the net inflow of every ETF rewrites the definition of “value store”.

A word of advice to investors crossing the cycle: The biggest risk is not to go short, but to interpret the rules of the game in 2025 using the perceptions of 2017. When “holding addresses” become “institutional custody accounts” and “halving narratives” become “derivatives of the Federal Reserve’s interest rate decisions,” this transition of the century has long exceeded the scope of a bull and bear.

History is always repeating itself, but this time it is not the tears of individual investors, but the endless sound of online transfers from institutional coffers.

This trend of institutionalization may be comparable to the evolution of the Internet in the Web 1.0 era, which originally belonged to geeks and eventually fell into FAANG

(Facebook, Apple, Amazon, Netflix and Google).

The cycle of history is always full of black humor.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern