This issue of inventory will provide an in-depth analysis of the recent magical operations of whales on the market, and decode how the encrypted giant whale plays the capital game of “licking blood at the tip of the knife” in the contract battlefield.

Author: Fairy, ChainCatcher

Since February 25, the price of Bitcoin has entered a violent shock mode. In just one week, it has experienced a large “N-shaped” fluctuation, with a rise and fall of more than 15%. The crypto greed and fear index continues to be in the “fear” zone. When retail investors are panicked amid the stock alarm, the top whales smell the “smell of blood”…

In this market game, some people accurately copied the bottom and escaped from the top, making tens of millions; some people bet in the wrong direction and were punished. Who is making trouble in the market? Who was the one who was defeated in the turmoil?

This issue of inventory will provide an in-depth analysis of the recent magical operations of whales on the market, and decode how the encrypted giant whale plays the capital game of “licking blood at the tip of the knife” in the contract battlefield.

A hundred times the coolness of the contract: double rolling with long and short + precise rhythm

On February 25, Liang Xi, once known as the “cancer of the currency circle”, made US$1 million in a short period of time with a principal of US$2000, including a profit of 600,000 U on Weex and a real profit of 500,000 U on OKX.

Referring to X user @sunyangphp’s organization, Liangxi’s operations are as follows:

Background: ETH showed a broad and volatile downward trend on February 25, with large fluctuations.

Take advantage of the volatile market to kill both long and short

The strategy of “long and short” is to operate multiple orders and short orders at the same time in volatile markets, and use high leverage (dozens of times) to amplify profits. After many short-term operations, we have received most of the fluctuating profits in the volatile market.

Eat up the last wave of plunging, and then backhand to buy the bottom

Seize all the losses in the final wave of ETH plunge and accurately backhand long at the lowest point.

Respond decisively at critical moments

During the last wave of plunging, the market rebounded slightly. Liangxi initially misjudged the trend and went long, but quickly discovered that the momentum was wrong and decisively changed her position to short.

50 times leveraged whale: luck and market timing achieve a thrilling counterattack

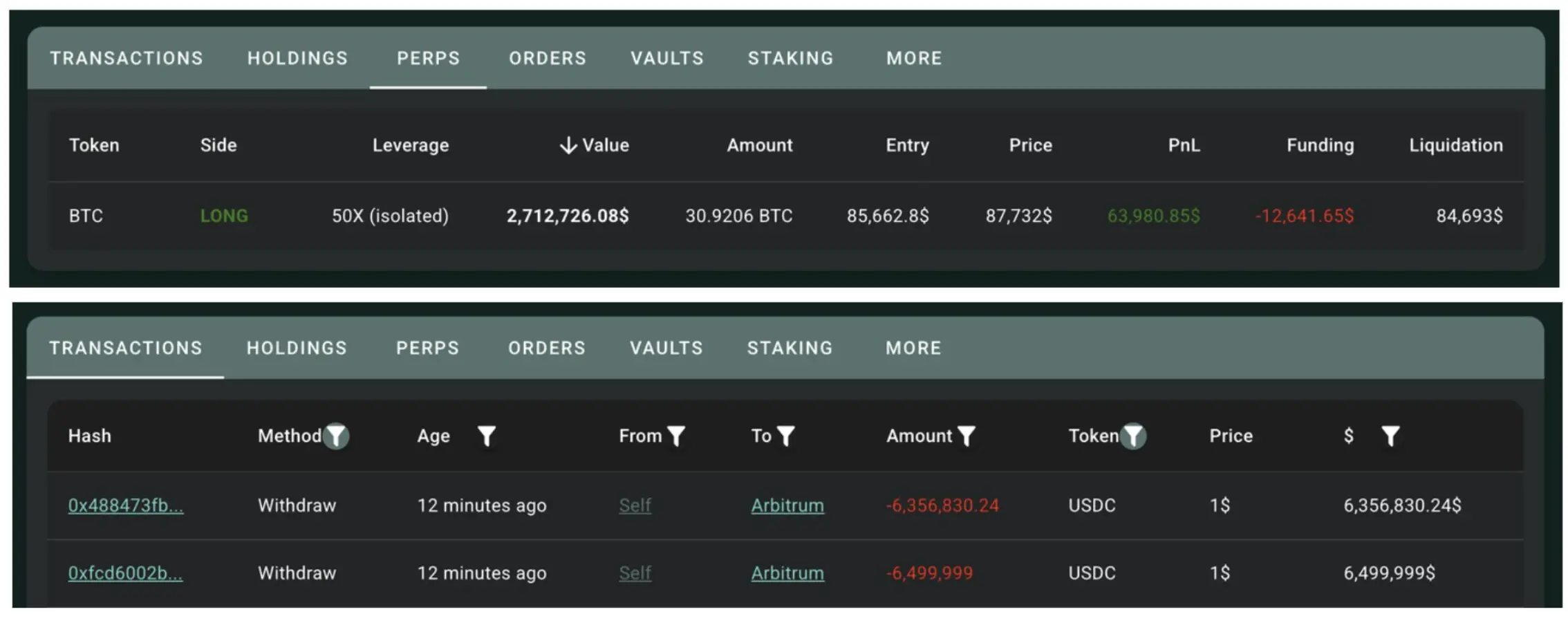

On March 2, the giant whale, which leveraged 50 times long BTC and ETH on Hyperliquid, started with 6 million USDC and achieved a profit of US$6.83 million in 24 hours.

Whale address: 0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62

Refer to@ai_9684xtpa for sorting out, and the operations are as follows:

Initial opening position: 6 million USDC principal, 50 times leverage

On March 2, the giant whale used 50 times leverage to open a long position of more than US$200 million. The initial position included multiple orders in BTC and ETH.

- ETH: 49384 pieces, opening price of $2196, clearing price of $2,133.9

- BTC: 1260 pieces, opening price of $85671, clearing price of $84,629

Add a position in ETH (floating loss of US$900,000 at this time)

At around 10:30 pm, the whale chose to add a long position of 914 ETH and 41 BTC.

Adjust positions: Liquidate some BTC and increase ETH positions

Near 11 points, the whale closed its long position of 469.48 BTC and instead significantly increased its position in ETH. ETH long positions increased to 88510.

Market turning point: Trump speech drives gains

At 11:30, Trump delivered a speech, and market sentiment quickly warmed up. BTC exceeded US$87000 and ETH exceeded US$2250. The whale’s position changed from floating loss to floating profit, and the floating profit of ETH multiple orders reached US$6.46 million.

Gradually stop profits

He first reduced his long ETH positions from 88510 to 22570, and then cleared them all. The long BTC positions were closed, and 831.57 long BTC positions were almost cleared. Profit of US$6.83 million in 24 hours.

The giant whale “sets 10 big goals first”: a moment of profit and loss, the tip of the knife dances

The giant whale with the ID of “Set 10 Big Goals First” once made a profit of up to 700 million yuan, but it eventually came to a dream. In the recent market turmoil, the giant whale also staged a series of high-leverage extreme operations.

Refer to@ai_9684xtpa for sorting out, and the operations are as follows:

Cut flesh miserably

On February 25, the price of Bitcoin fell to US$89,000. The giant whale was forced to cut off 1,783.48 BTC pieces at an average price of US$89,138, with a total value of US$159 million, while the average price of its opening positions was as high as US$100,320.

Subsequently, the giant whale completely closed all 5,185 BTC’s, resulting in an overall loss of US$24.3268 million. However, it claimed that part of its profits were not included in the software and the overall principal remained intact.

Make a comeback, earning US$15.38 million

On March 1, he sold 1,698 BTC pieces worth US$142 million at an average price of US$83,568.65. In the end, the multiple order was closed in the early morning of March 3, making a profit of US$15.38 million.

Backhand short, game market correction

After closing the position, he turned around and opened it six hours ago, holding a short position of 2285 BTC (approximately US$214 million) with a margin of US$53.45 million and an average opening price of US$93729. Giant whale closed its positions around $90,000 to take profits.

Turning to multiple orders again (a floating loss of US$15.62 million has been lost)

Go long quickly after taking profit and add to ETH at the same time:

- BTC: Average opening position price is $90,207, holding 2,069 positions

- ETH: Average opening position price is $2,285, holding 10,800 positions

Think of heaven, think of hell. Whether it’s a cool $1 million from $2000, a whale betting on the market with 50 times leverage, or a “set 10 big goals” who once made a profit of $700 million but finally dreamed of it, their trading strategies are full of drama.

Every time you open a position or close a position, it may be a watershed in destiny. Their story is not only the ultimate interpretation of trading strategy, but also the ultimate test of market psychology and fund management. The market is always full of opportunities. Only those who always respect the market can find a chance of survival between the legend of sudden wealth and the tragedy of returning to zero.

Risk Warning

The whale trading cases listed in this article include aggressive strategies such as high leverage and high-frequency trading. Although these operations can bring huge benefits in extreme markets, they are also accompanied by extremely high risks. Investors are advised to operate cautiously based on their own risk tolerance, reasonably control positions, and avoid making impulsive decisions due to fluctuations in market sentiment.