After the SEC successively confirmed in February this year that several traditional American giants applied for ETFs for LTC, DOGE, SOL and XRP, favorable policies and loosening of SEC supervision have caused frequent news of progress from counterfeit ETFs this week.

Author: Ashley

After Trump made a high-profile announcement of the cryptocurrency strategic reserve, although the market price performance was unsatisfactory, it did not prevent traditional financial institutions from listening to the news. After the SEC successively confirmed in February this year that several traditional American giants applied for ETFs for LTC, DOGE, SOL and XRP, favorable policies and loosening of SEC supervision have caused frequent news of progress from counterfeit ETFs this week.

The latest application for ETF altcoins

The order of filing documents for applying for an ETF in the United States is: first, the issuer submits Form S-1/S-3, then the exchange submits Form 19b-4, and then enters the public comment period. After that, the SEC reviews and provides feedback, and finally approves. The entire process takes approximately 6 – 8 months, depending on the progress of the SEC’s review. The following are the altcoins that have recently applied for ETFs and the market data in the past 30 days, sorted by application time.

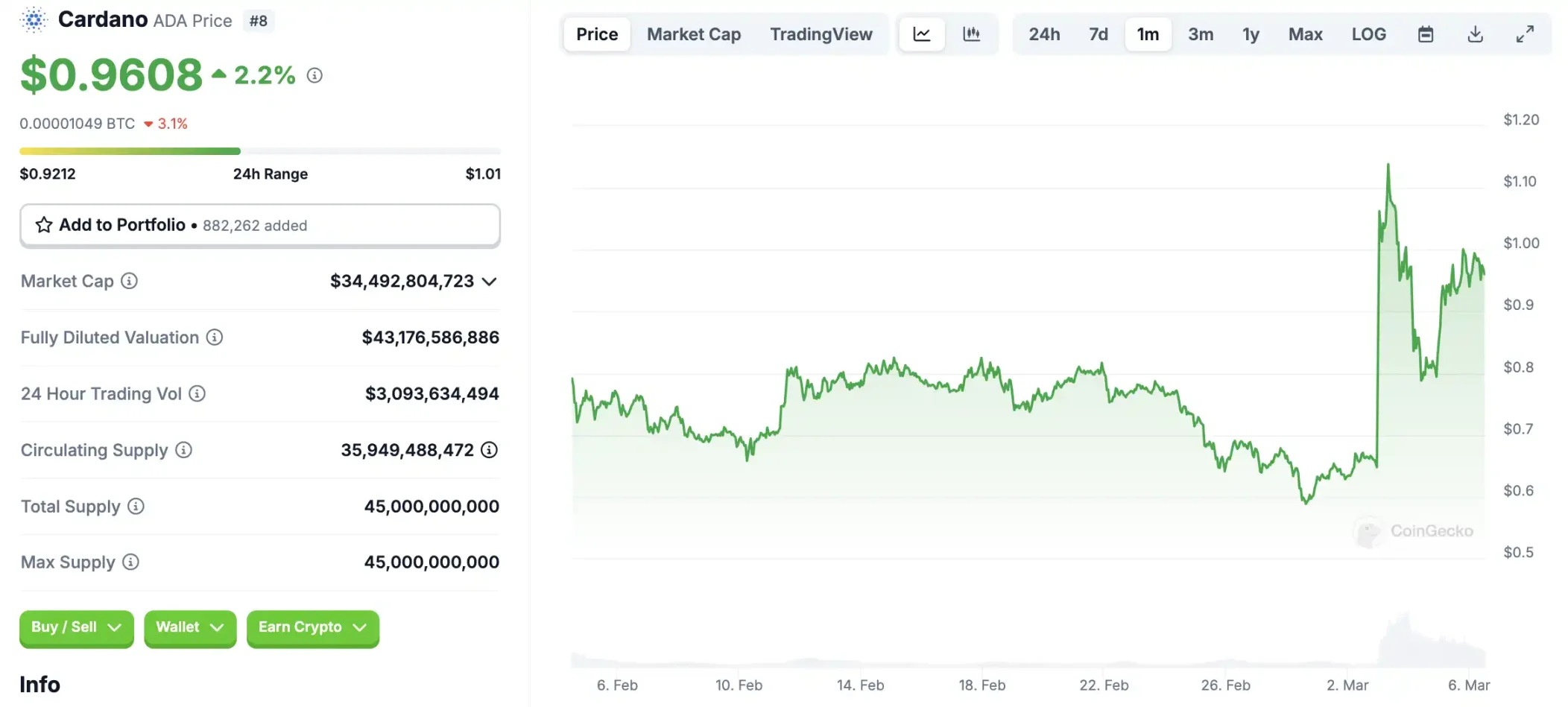

ADA (Cardano)

On February 25, the U.S. Securities and Exchange Commission (SEC) confirmed that it would accept the spot Cardano (ADA) ETF listing application submitted by NYSE Arca on behalf of Grayscale. The application was filed on February 10 and will be hosted by Coinbase Custody Trust Company, with BNY Mellon responsible for asset services and administration.

On March 2, Trump posted a post on social media to “call for” cryptocurrency strategic reserves, including ADA. ADA rose more than 70% that day.

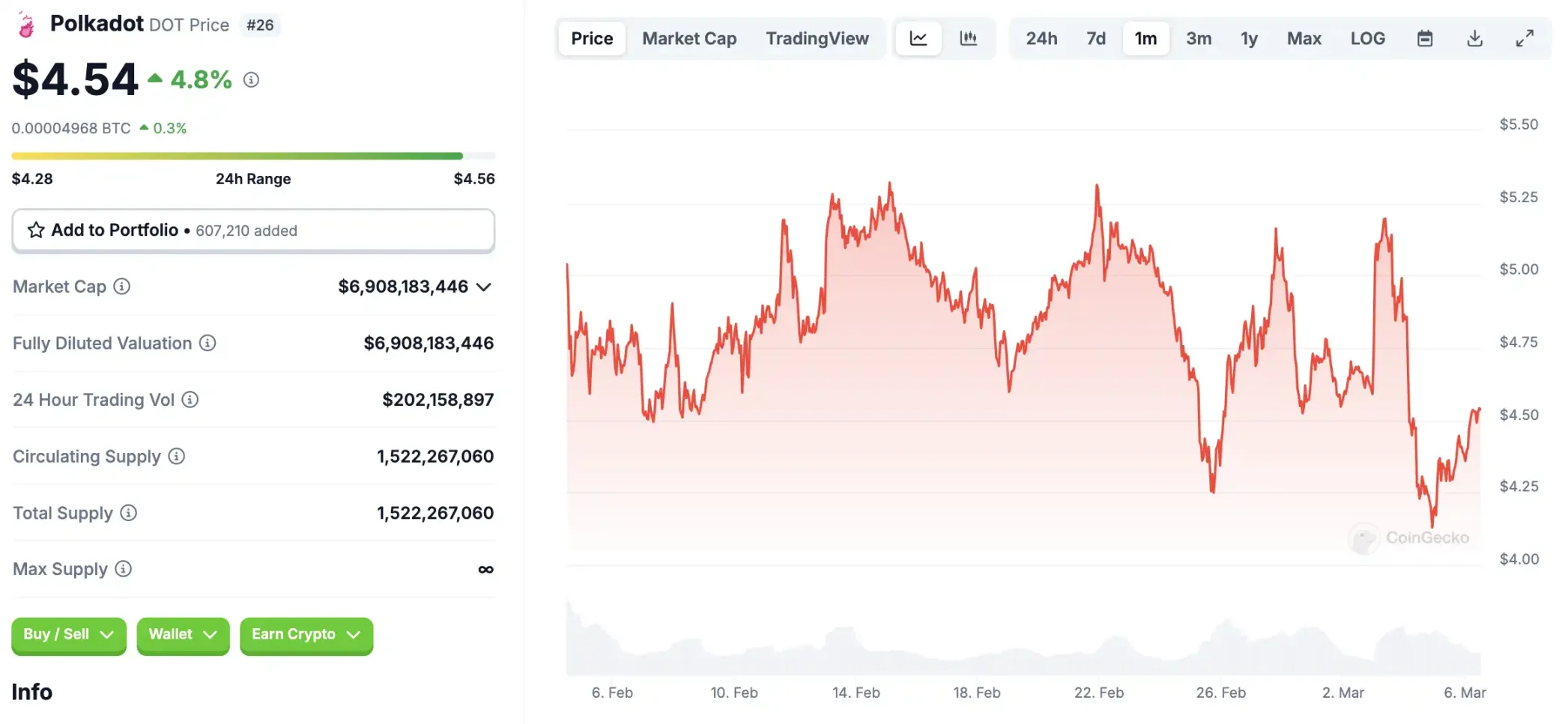

DOT(Polkadot)

On February 25, Nasdaq submitted a 19b-4 application document for the Grayscale Polkadot Trust.

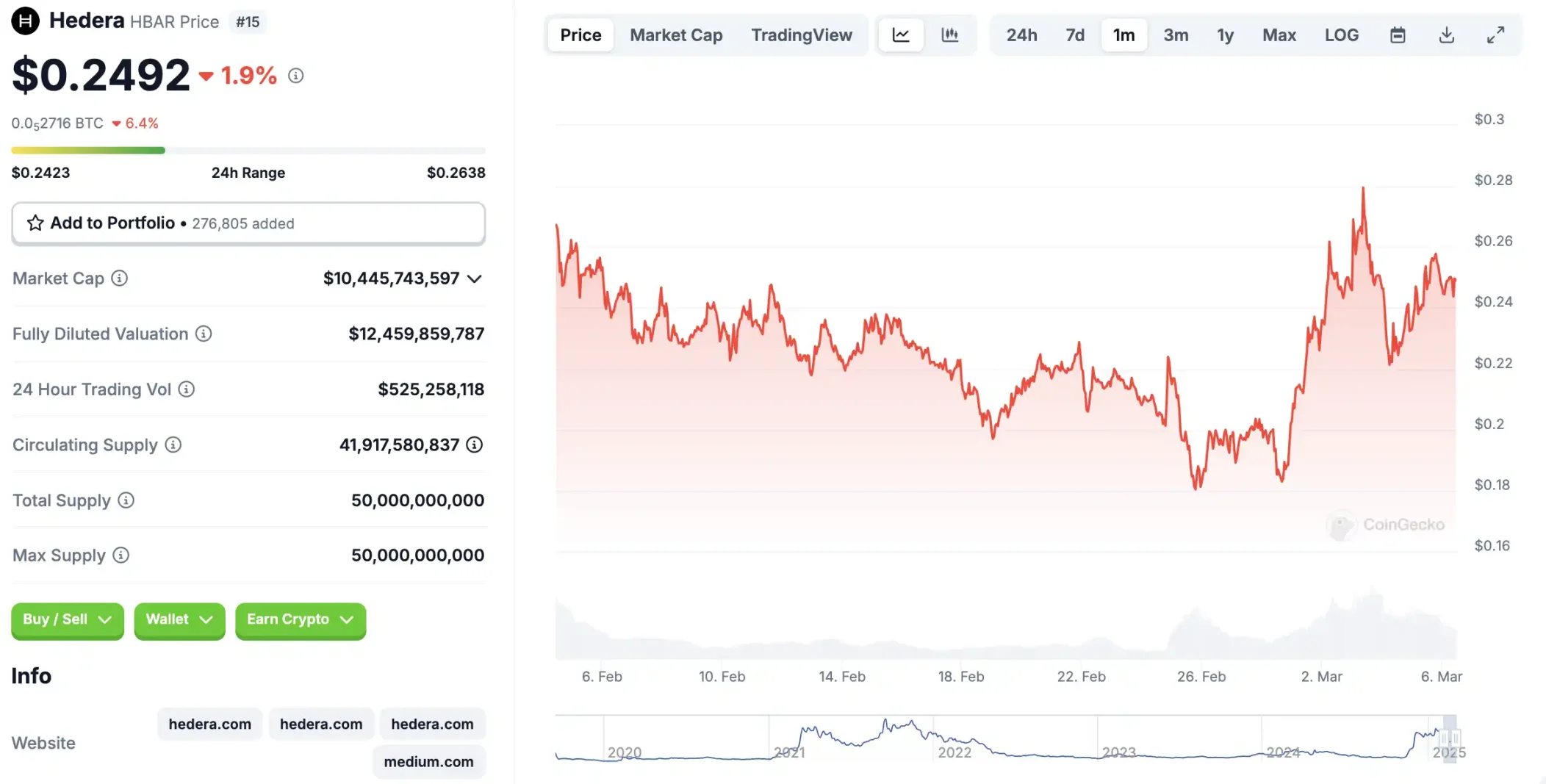

HBAR(Hedera)

On February 24, Nasdaq submitted 19b-4 application documents for Canadian investment firm Canary Capital’s HBAR ETF; on March 4, Nasdaq submitted 19b-4 application documents for Gray Hedera ETF.

Hedera is often regarded as a dark horse for cryptocurrencies. Hedera’s most exciting thing is the possible launch of a spot HBAR ETF. Valour Funds has submitted an application for physical pledge products to the Euronext exchange in Europe. At the same time, Canary Capital submitted an application for a U.S. spot HBAR ETF, further raising market expectations, with investors closely monitoring regulatory developments in the post-election environment.

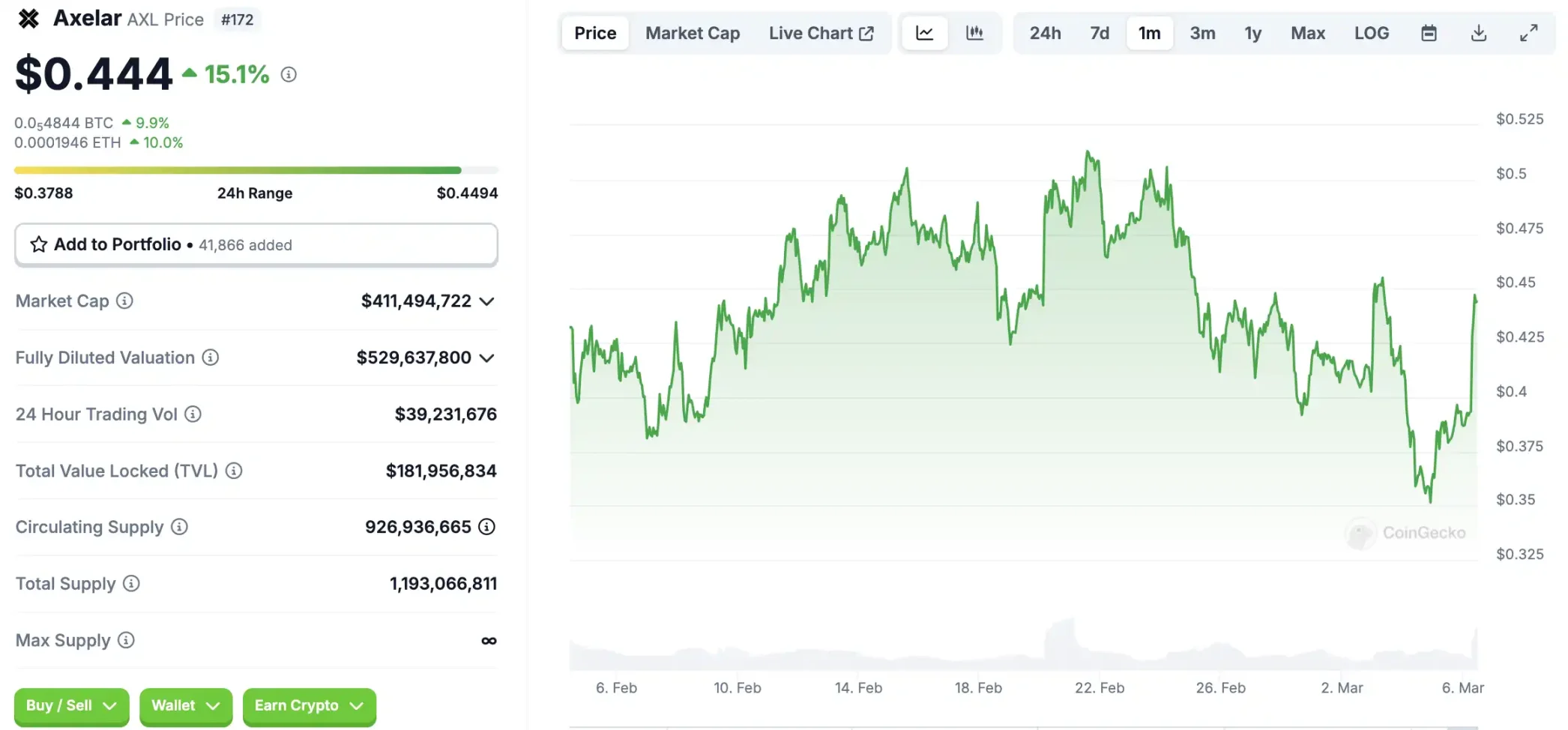

AXL(Axelar)

On March 6, Canary filed an S-1 application for its AXL ETF.

In addition, former Coinbase legal director Brian Brooks has joined Axelar’s New Institutional Advisory Board, a project that focuses on regulatory coordination and institutional adoption.

BlockBeats previously reported that Canary Capital has launched the AXL (Axelar) trust fund Canary AXL Trust, which will contain native tokens from the Axelar network and is the first investment trust to provide universal blockchain interoperability protocol investments.

The trust fund will provide institutional investors with investment opportunities in blockchain interconnected technologies, connecting Web3 ecosystems such as XRP Ledger, Hedera, Stellar, TON, Sui, Solana and Bitcoin.

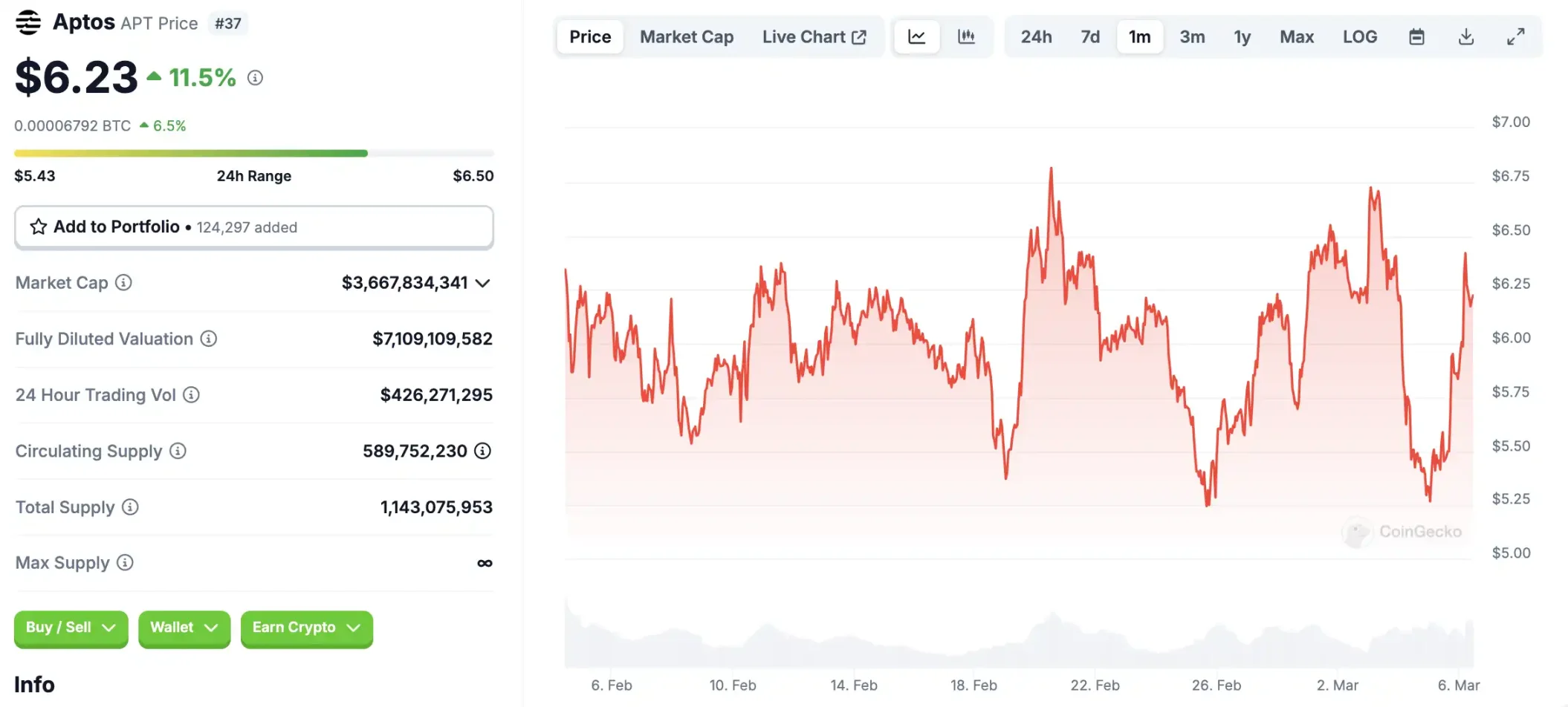

APT(Aptos)

On March 6, Bitwise formally submitted an S-1 application with the U.S. Securities and Exchange Commission to register for a possible Aptos ETF, taking the first step in launching the Aptos ETF in the U.S. market.

Aptos and major asset managers are seeking to launch U.S. -listed ETFs, making Aptos one of the few crypto agreements in the world to achieve this milestone.

Prior to this, Bitwise had launched Aptos Staking ETP on the Swiss Stock Exchange in November 2024 to pledge Aptos tokens.

How is the Ethereum ETF performing now after its adoption?

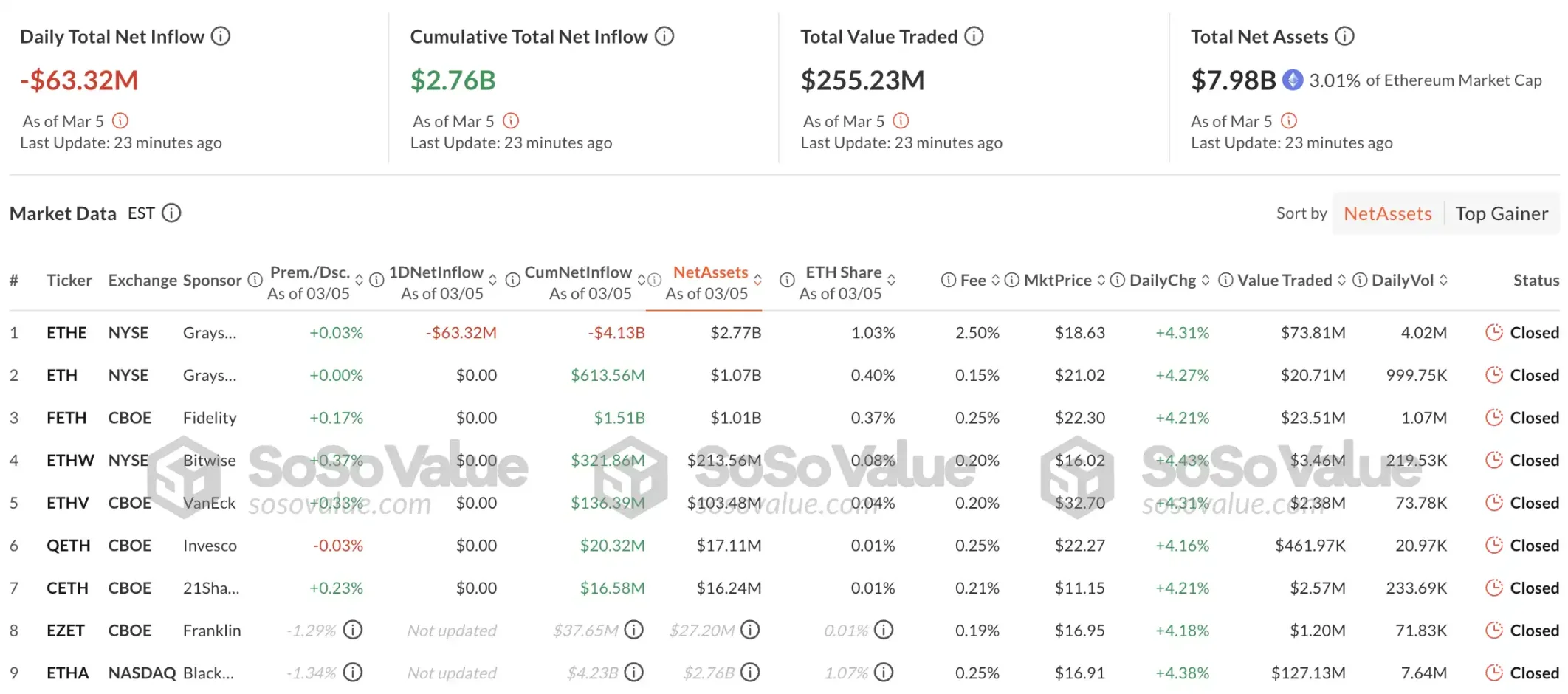

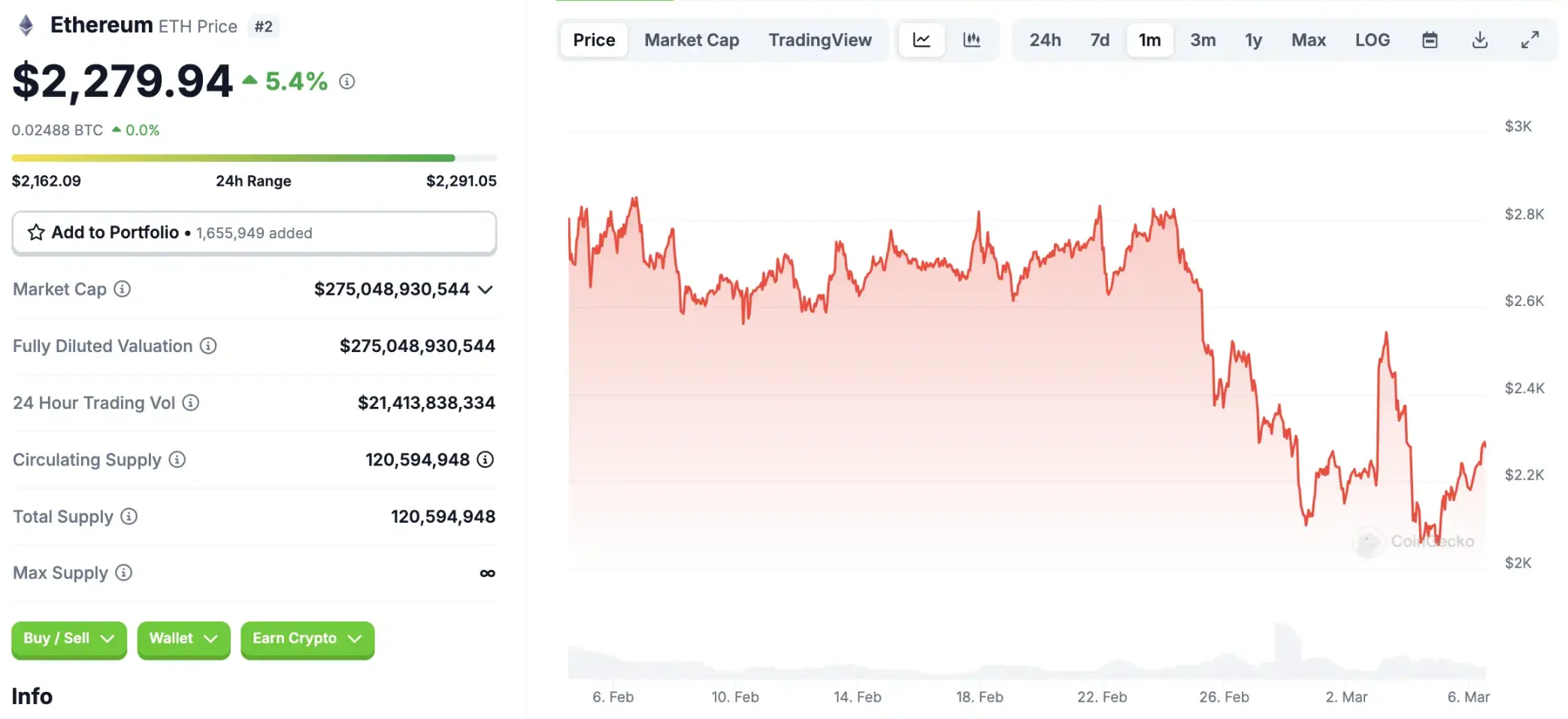

The Ethereum ETF officially landed on the U.S. capital market on July 23 last year, and the price of Ethereum was around US$3200 that day. Market data shows that the net inflow of Ethereum ETF since its launch for about half a year has been US$2.76 billion, equivalent to Wall Street purchasing nearly 1% of Ethereum. However, Ethereum has currently fallen to around US$2300.

On the one hand, this is because Grayscale has continued to sell Ethereum ETFs and become the largest seller in the market, which has hindered Ethereum’s rise; on the other hand, Ethereum will be more seriously affected by the sale of giant whales than Bitcoin. Currently, Ethereum is still digesting the potential selling pressure of giant whales.

But the good news is that Trump-related entity World Finance Liberty continues to increase its holdings in Ethereum. The net inflow of ETFs and the continuous buying by Trump-related institutions demonstrate the attitude of long-term investors towards Ethereum in a market environment where policies are increasingly open.

By analogy, if the above-mentioned altcoin ETF is approved in 2025, although this category of ETF will become an inflow window for traditional funds, it does not mean that these tokens will show a significant upward trend.

Crypto ETF 2.0 under Trump

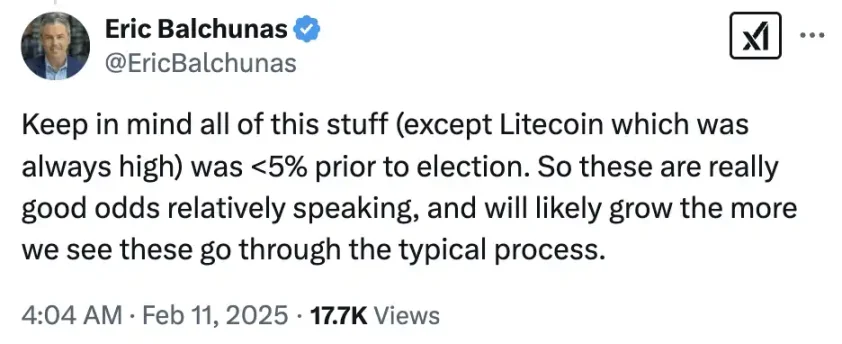

Looking at the development history of crypto ETFs, it is not difficult to see the major benefits for the entire market after Trump returns to the White House this year. Bloomberg analyst Eric Balchunas pointed out that before Trump won the election, the probability of approval for all assets except litecoin remained below 5%. It is expected that as applications enter the approval process and the SEC’s decision-making deadline approaches, the probability of approval of cryptocurrency ETFs will continue to rise.

What is the impact on the crypto market?

Bloomberg analysts expect the SEC to make a decision on the proposed altcoin ETF in October. It is foreseeable that if altcoin ETFs are approved one after another, there is a high probability that various future benefits will continue to attract more conservative and institutional investors to participate, thereby changing the investor structure of the market. In this policy environment, the crypto market may experience increased liquidity, price increases and changes in investor structure. Therefore, the passage of more ETF products will also bring more funds to the crypto market, enhance market liquidity, and thereby reduce price fluctuations.

In addition, due to regulatory arbitrage, ETFs launched in the United States may directly lead to the imitation of other countries and regions around the world. This kind of imitation may promote the popularity of cryptocurrencies around the world to varying degrees, especially in areas with looser regulations, where adoption of cryptocurrencies will see more rapid growth. Global policy convergence can not only effectively reduce the compliance costs of cross-border transactions, but also further eliminate investors ‘concerns about legal risks, thereby promoting the participation of more institutions and individuals. This trend may accelerate the transformation of cryptocurrencies from marginal assets to mainstream financial instruments, driving their rising status in the global economy.

As the Trump administration further supports the crypto industry, U.S. states gradually introduce “strategic bitcoin reserve” legislation, and the Republican Party controls the House and Senate, Congress may have a chance to pass cryptocurrency-related bills. Once legislation is passed, cryptocurrencies may be expected to become a new asset class that is neither securities nor commodities, which will have epoch-making significance for the crypto market.

What other altcoins may apply for an ETF?

As the Trump administration continues to relax crypto regulations, 2025 is likely to usher in a peak in altcoin ETF applications. Some institutions have predicted that the surge in demand for cryptocurrency ETFs will cause their total assets in North America to surpass precious metals ETFs, making them the third largest asset class in the fast-growing $15 trillion ETF industry after stocks and bonds.

Especially for altcoins that are highly related to the United States, they are more likely to be favored. For example, ONDO (Ondo Finance), as an RWA track representative that anchors real assets such as U.S. bonds, may be the first to obtain the approval qualification of an ETF linked to tokenized treasury bond, and even become the core target for traditional institutions to allocate crypto assets. If the FIT21 bill is passed within the year and establishes the principle of “decentralized agreement exemption from securities laws”, mainstream U.S. DeFi tokens such as UNI (Uniswap), MKR (MakerDAO), and AAVE (Aave) may accelerate their integration into the traditional financial system.