① Today, China Telecom’s volume has soared, its intraday share price has hit a record high, and its current financing balance is also the peak during the year.

② Since the holiday, the overall financing balance in the market has gradually recovered, with a total increase of 45.52 billion yuan in three trading days, and net purchases are made every day.

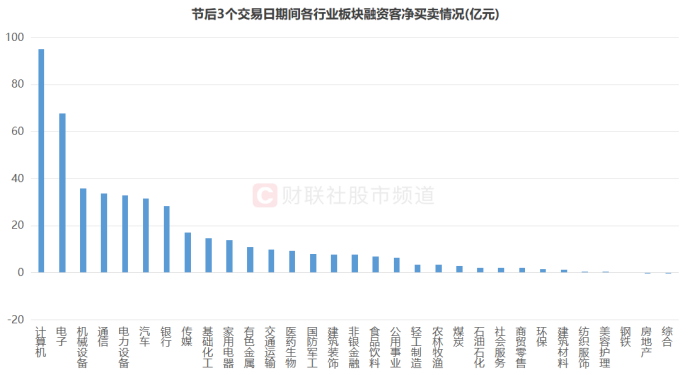

③ In terms of industries, the computer and electronics sectors have become the focus of “sweeping goods” for financiers in recent days, and the mechanical equipment, communications, power equipment and other sectors have also ranked among the top in net purchases after the holiday.

Financial Union, February 10 (Editor Zi Long),Today (February 10), the three major communications operators collectively strengthened. Among them, China Telecom once closed its trading limit, and its share price continued to hit record highs. However, it then fell back. As of the close, China Telecom closed up nearly 6.6% throughout the day, the largest single-day gain in the past year since January 25 last year.

Note: China Telecom hit a record high in intraday trading today (as of the close of February 10)

Communications giant’s volume rises sharply, and financing balance peaks during the year

Recently, when the Operation Monitoring and Coordination Bureau of the Ministry of Industry and Information Technology released relevant information on communication services during the Spring Festival in 2025, it was mentioned that all three basic telecommunications companies have fully connected to the DeepSeek open source model. Boosted by this, the three major communications operators collectively surged today. Among them, China Telecom’s volume increased today, with a full-day turnover of nearly 3.405 billion yuan, a record high since September 30 last year. At the same time, it increased by 2.473 billion yuan, an increase of nearly 265%, compared with the previous trading day (932 million yuan). At present, the total market value of China Telecom has approached 700 billion yuan.

From the perspective of funds, China Telecom has recently received key additional positions from financing customers. As of February 7, its current financing balance has risen to 531 million yuan, the highest peak during the year, and has increased by 136 million yuan compared with the low point of the year (January 27), an increase of 35%. Among them, financiers significantly increased their holdings of China Telecom on February 6, with a single-day net purchase amount of 62.13 million yuan. In addition, the net purchase amount on January 21, February 5, and February 7 was also relatively high, reaching 40.55 million yuan, 38.76 million yuan, and 35.47 million yuan respectively.

Note: Recent changes in financing balance of China Telecom (data as of February 7)

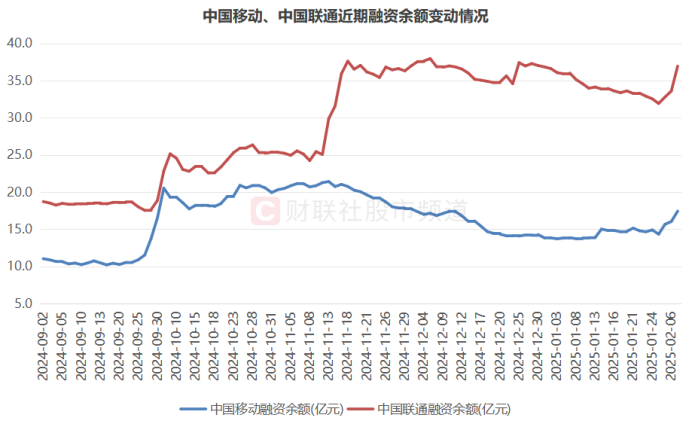

Similar to China Telecom, China Mobile and China Unicom, both of which are the three major operators, have also attracted the attention of financiers recently, and the scale of financing has increased significantly. As of February 7, the current financing balances of the two are 1.744 billion yuan and 3.696 billion yuan respectively, an increase of 27.11% and 15.75% respectively compared with the lows of the year. Among them, China Mobile’s current debt scale has hit a new high in nearly two months since December 2 last year, while China Unicom’s current debt scale has reached a new high since December 30 last year.

Note: Recent changes in financing balances of China Mobile and China Unicom (data as of February 7)

Market surplus has increased continuously for three days, and a list of key targets for increasing holdings

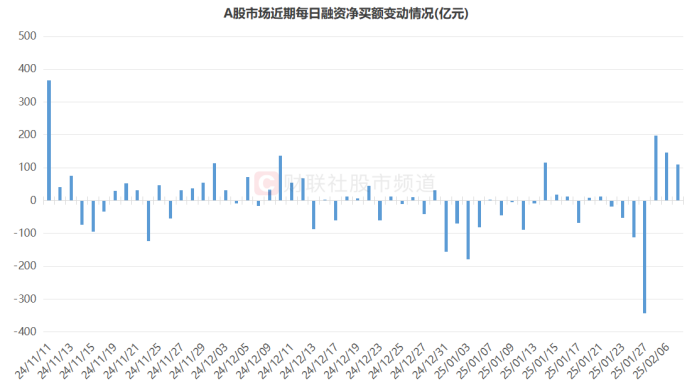

Since the holiday, the overall financing balance in the market has gradually rebounded. As of February 7, it has currently reached 1.81 trillion yuan, with a total increase of nearly 45.52 billion yuan in the three trading days during the period, and net purchases are daily. Among them, the net purchase amount on February 5 reached 19.845 billion yuan, and the net purchase scale hit a new high since November 11 last year (36.627 billion yuan). In addition, from the perspective of financing purchases, the market’s financing purchases reached 200 billion yuan again on February 7 in nearly two months, reaching a new high since December 10 last year.

Note: Recent changes in net daily financing purchases in the A-share market (data as of February 7)

In terms of industries (Shenwan level), in the three trading days since the holiday, the financing balances of 31 sectors have basically increased, especially the computer and electronics sectors, which have become the key “shopping” direction of financiers in recent days. Its net purchases reached 9.51 billion yuan and 6.79 billion yuan respectively. The mechanical equipment, communications, power equipment, automobiles, and banking sectors also ranked among the top in net purchases of post-holiday financing, while the comprehensive and real estate sectors recorded reductions, but the overall net sales were not large, only 32 million yuan respectively., 29 million yuan.

Note: Net transactions of financing customers in various industry sectors during the 3 trading days after the holiday (data as of February 7)

In terms of specific individual stocks, as of February 7, a total of 2480 individual stocks were added to positions by financiers after the holiday, and the “shareholding ratio” accounted for nearly two-thirds of the two financial targets in the entire market. Among them, Tuowei Information, SMIC, Ruixin Micro, and Lingyizhi won their key additional positions, with net post-holiday financing purchases reaching 728 million yuan, 712 million yuan, 712 million yuan, and 620 million yuan respectively. At the same time, the financing balances of ZTE, Runhe Software, Xinyisheng, Zhongke Shuguang, Guanghetong and other stocks have also increased significantly since the holiday.