① Zelensky: Ukraine plans to exchange part of its territory with Russia;

② Federal Reserve Chairman Powell reiterated that there is no need to rush to adjust interest rates;

③ The United States imposes a 25% tariff on imported steel and aluminum that will take effect on March 12;

④OpenAI CEO said he hopes to cooperate with China.

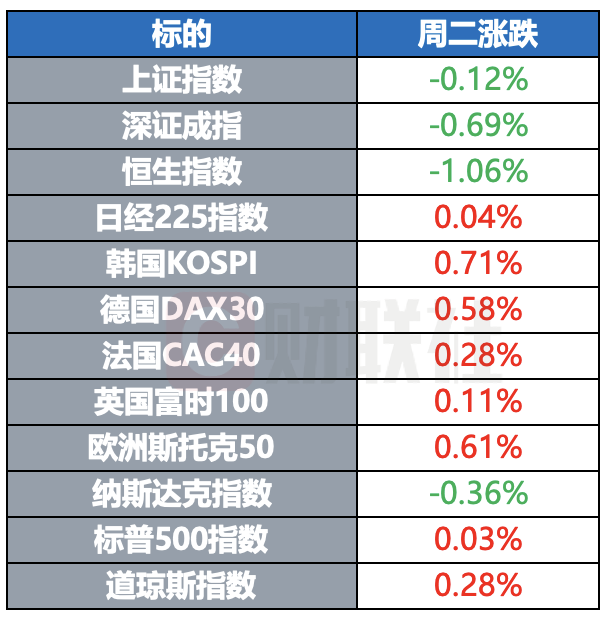

Overnight stock market

The world’s major indices were mixed on Tuesday. The three major U.S. stock indexes were mixed. The Dow rose slightly, the S & P 500 index rose slightly, and the Nasdaq fell slightly.

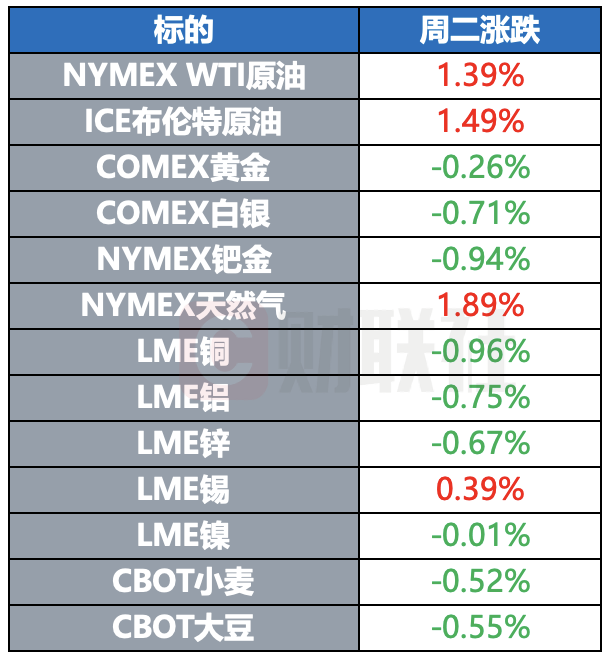

commodity market

The settlement price of international crude oil futures rose more than 1%. WTI March crude oil futures closed up US$1.01, or 1.39%, at US$73.32/barrel. Brent April crude oil futures closed up US$1.13, or 1.49%, at US$77/barrel.

COMEX gold futures fell 0.26% to US$2,926.9 per ounce, continuing to hit new highs during the session. COMEX silver futures fell 0.71% to US$32.26 per ounce.

market news

[Zelensky: Ukraine plans to exchange some territory with Russia]

[Federal Reserve Chairman Powell reiterated that there is no need to rush to adjust interest rates and the inflation target will remain at 2%]

Federal Reserve Chairman Powell appeared before the Senate Finance, Housing and Urban Affairs Committee on Tuesday. Powell reiterated that there was no need to rush to adjust interest rates.

Powell said the Fed will complete its framework review by late summer, and the framework review will not include attention to the inflation target, which will remain at 2%. Powell said that the U.S. unemployment rate and labor market conditions do not constitute a source of inflationary pressure. If the labor market unexpectedly weakens or inflation falls faster than expected, the Fed can relax policy. If the economy performs strongly and inflation fails to move towards the 2% target, the Fed can maintain policy tightening for longer.

Powell said that the Fed is in no hurry to continue to cut interest rates in the near future. Powell said that the policy is ready to deal with risks and uncertainties, and there is no need to rush to adjust the policy now.

[The United States imposes a 25% tariff on imported steel and aluminum that will take effect on March 12]

The text of the executive order signed by U.S. President Trump shows that a 25% tariff on all steel and aluminum imported into the United States will take effect on March 12. On February 10, local time, U.S. President Trump signed an executive order announcing a 25% tariff on all steel and aluminum imported into the United States. Trump also said on the same day that the relevant requirements “have no exceptions or exemptions”

[US judge stops abolishing “birthright citizenship” Trump administration: appealing]

The Trump administration in the United States said on the same day that it was appealing the ruling of a federal judge in Maryland. The judge’s ruling prevented Trump’s previous executive order abolishing “birthright citizenship” from taking effect. Trump signed an executive order abolishing “birthright citizenship” on the first day of office on January 20, which immediately triggered public outcry and encountered legal challenges in many places in the United States. Three federal judges in New Hampshire, Maryland and Washington have successively ruled to prevent the executive order from taking effect.

[Musk: If federal spending is not cut, the United States will be “bankrupt”]

Speaking at a White House event with Trump, Elon Musk said reducing federal spending was crucial. If federal spending is not cut, the United States will be “bankrupt”.

[U.S. Commerce Secretary nominee Lutnick: Considering a “trade tool” for European ESG rules]

U.S. President Donald Trump’s nominee for Commerce Secretary Howard Lutnick said the United States could use “trade tools” to retaliate against European environmental, social and governance (ESG) regulations that affect U.S. companies. Lutnik was referring to the Corporate Sustainability Due Diligence Directive (CSDDD). He told Republican senators last month that he was concerned about the impact of ESG regulations enacted in Brussels on U.S. companies.

[Summers warns that price pressure may erupt, saying this round of interest rate cuts may be over]

Four years ago, former U.S. Treasury Secretary Lawrence Summers accused U.S. fiscal and monetary policymakers of over-stimulating, potentially triggering the biggest inflation blowout in a generation. Four years later, he warned that price pressures were in danger of erupting again.

“This may be the most sensitive moment for inflation escalation since policy mistakes triggered severe inflation in 2021,” Summers said in an interview with David Westin on Bloomberg Television’s “Wall Street Week” program. “This is the moment when we have to be very cautious about inflation, even before you see the policies that the White House has in place.”

He urged the Fed to remain vigilant about price pressures and believed that further interest rates may not be cut in the current cycle.

[OpenAI CEO says he hopes to cooperate with China]

On February 10 local time, American entrepreneur Elon Musk and other investors proposed to “bid for US$97.4 billion” for the non-profit parent company of the American Open Artificial Intelligence Research Center (OpenAI), which he participated in. In response, OpenAI CEO Sam Altman, who attended the Artificial Intelligence Action Summit in Paris, France on February 11, once again emphasized that “the company is not for sale” and said that “if Musk is willing to talk,” then he will “be very happy to acquire Twitter (social media platform X).”

Altman also said,”We are willing to cooperate with China in the field of artificial intelligence and will do our best to this end because it is important.”

[Apple and Alibaba are said to cooperate to develop AI functions for China iPhone users]

Apple and Alibaba will collaborate to develop AI features for China iPhone users. According to people familiar with the matter, the move is part of Apple’s strategies to deal with declining sales in China, aiming to provide more attractive software features.

People familiar with the matter said that Apple has been testing different artificial intelligence models from well-known China artificial intelligence developers since 2023 and chose Baidu as its main partner last year.

People familiar with the matter said that Apple has begun to consider other options in recent months, evaluating models developed by Tencent, ByteDance, Alibaba and Deepseek.

[Gilead Science’s fourth-quarter revenue of US$7.57 billion was higher than market expectations]

Gilead Science’s fourth-quarter revenue was US$7.57 billion, and analysts expected US$7.13 billion. Fourth quarter revenue was $7.57 billion, with analysts expecting $7.13 billion; fourth quarter Veklury revenue was $337 million, with analysts expecting $380.1 million; fourth quarter Trodelvy revenue was $355 million, with analysts expecting $321.5 million. The company expects adjusted EPS in 2025 to be US$7.7 -8.1, and analysts expect US$7.54; the company expects product sales in 2025 to US$28.2 billion to US$28.6 billion, and analysts expect US$28.07 billion; the company expects Veklury’s revenue in 2025 to US$1.4 billion.

[JPMorgan Chase: Trading and investment banking businesses are expected to achieve double-digit growth in the first quarter]

JPMorgan Chase’s trading revenue and investment banking revenue may both grow by more than 10% in the first quarter, and volatility and capital market recovery continue to benefit Wall Street. Chief Operating Officer Jenn Piepszak told a conference hosted by Bank of America on Tuesday that in terms of percentages, transaction revenue may grow by “low double digits” year-on-year, while investment banking revenue may grow by “medium double digits.”

[Ultramicro Computer expects net sales of US$5.6 billion to US$5.7 billion in the second quarter. The company originally expected US$5.5 billion to US$6.1 billion]

Ultramicro Computer expects net sales of US$5.6 billion to US$5.7 billion in the fiscal second quarter, compared with the company’s original forecast of US$5.5 billion to US$6.1 billion. The adjusted EPS for the fiscal second quarter is expected to be US$0.58 -0.6. Analysts expected US$0.64. The company originally expected US$0.56 -0.65. Net sales for the full year are expected to be US$23.5 billion to US$25 billion, compared with the company’s original forecast of US$26 billion to US$30 billion.

Ultramicro computer delays submitting its 10Q report to the U.S. Securities and Exchange Commission (SEC). The company attracted subpoenas from the U.S. Department of Justice and the SEC over allegations by short sellers. The company is cooperating with the U.S. Department of Justice and the SEC to issue documents.