① Slashing budgets, Kimi suspended “burning money” under the impact of DeepSeek;

②16 Days 10 Board Jidong Equipment stated that the company and its shareholding subsidiaries have not yet made arrangements in the field of humanoid robots or carried out specific cooperation with the outside world;

③ Trump said he would impose a tariff of about 25% on imported cars.

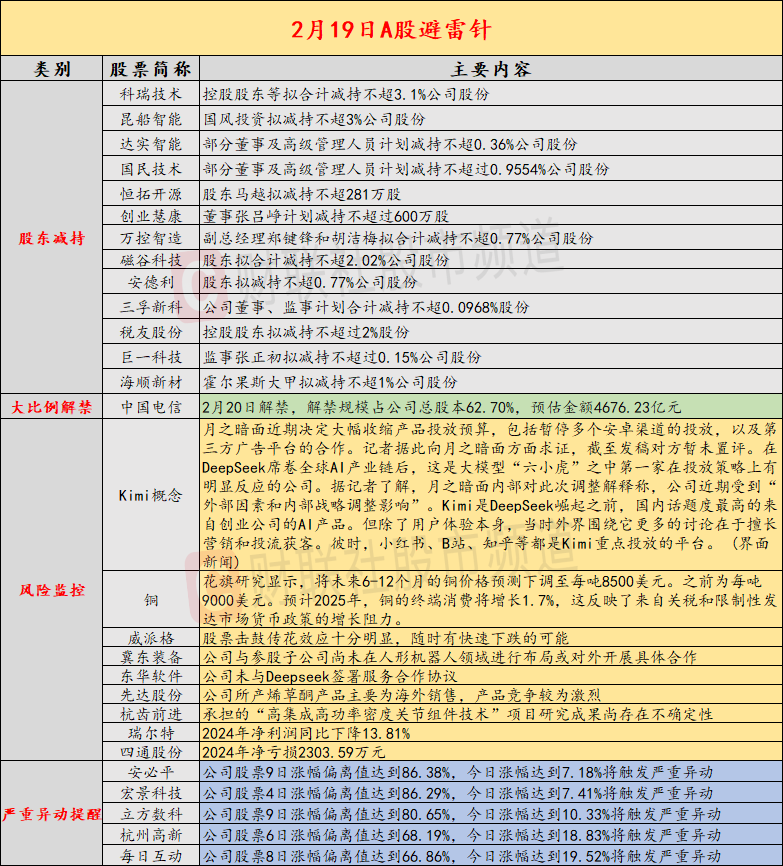

Introduction:Cailian invested in the lightning rod on February 19. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) The budget has been cut sharply, and Kimi has suspended “burning money” under the impact of DeepSeek;2) Insurance companies have disclosed the latest solvency, and seven companies have “turned on red lights”; the company’s key concerns include: 1) 6 consecutive board Weipeg announced that the drum-beating effect of stocks is very obvious, and there is a possibility of rapid decline at any time; 2) 16 Days 10 Board Jidong Equipment said that the company and its shareholding subsidiaries have not yet made arrangements in the field of humanoid robots or carried out specific cooperation with other countries; key concerns in overseas markets include: 1) The Nasdaq China Golden Dragon Index closed down 1.28%;2) Trump said he would impose a tariff of about 25% on imported cars.

economic information

1. Dark Side of the Moon recently decided to significantly reduce its product launch budget, including suspending the launch of multiple Android channels and cooperation with third-party advertising platforms. Based on this, the reporter asked the Dark Side of the Moon for verification, but as of press time, the other party had not commented. After DeepSeek swept the global AI industry chain, it was the first company among the big model “Six Tigers” to have a significant response to its launch strategy. According to the reporter’s understanding, the Dark Side of the Moon explained this adjustment internally that the company has recently been affected by “external factors and internal strategic adjustments.” Kimi was the most talked about AI product from a startup company in China before the rise of DeepSeek. But in addition to the user experience itself, more discussions around it at the time were that it was good at marketing and attracting customers. At that time, Xiaohongshu, Station B, Zhihu, etc. were all key platforms for Kimi to launch. (Interface News)

2. According to reporters ‘statistics, as of February 16, more than 140 insurance companies have disclosed their solvency reports for the fourth quarter of 2024. Among them, 7 insurance companies are not up to standard solvency, including 3 life insurance companies and 4 property insurance companies. The main reason is that the comprehensive risk rating is not up to standard, and there are problems in indicators such as corporate governance, reputation risk, operational risk and capitalizable risk. (China Securities Journal)

Company warning

1 and 6 consecutive board Weipegg: The drum-spreading effect of stocks is very obvious, and there is a possibility of rapid decline at any time.

2. 16 days and 10 boards of Jidong Equipment: The company and its shareholding subsidiaries have not yet made arrangements in the field of humanoid robots or carried out specific cooperation with the outside world.

3. Kerui Technology: Controlling shareholders and others plan to reduce their shares in the company by no more than 3.1% in total.

4. Kunming Shipbuilding Intelligence: Guofeng Investment plans to reduce its shares in the company by no more than 3%.

5. Dashi Intelligent: Some directors and senior managers plan to reduce their shares in the company by no more than 0.36%.

6. National Technology: Some directors and senior managers plan to reduce their shares in the company by no more than 0.9554%.

7. Hengtuo Open Source: Shareholder Ma Yue plans to reduce his holdings by no more than 2.81 million shares.

8. Entrepreneurship Huikang: Director Zhang Luzheng plans to reduce his holdings by no more than 6 million shares.

9. Wankong Intelligent Manufacturing: Deputy General Managers Zheng Jianfeng and Hu Jiemei plan to jointly reduce their shares in the company by no more than 0.77%.

10. Magnetic Valley Technology: Shareholders plan to reduce their shares in the company by no more than 2.02%.

11. Andri: Shareholders plan to reduce their shares in the company by no more than 0.77%.

12. Sanfu Xinke: The company’s directors and supervisors plan to reduce their shares by no more than 0.0968%.

13. Shuiyou shares: The controlling shareholder plans to reduce its shares by no more than 2%.

14. Juyi Technology: Supervisor Zhang Zhengchu plans to reduce his shareholding by no more than 0.15%.

15. Haishun Xincai: Horgos Dajia plans to reduce its shares in the company by no more than 1%.

16.2 Lianban Donghua Software: The company has not signed a service cooperation agreement with Deepseek.

17 and 4 Lianban Xianda Co., Ltd.: The clethodim products produced by the company are mainly sold overseas, and product competition is fierce.

18 and 5 Connecting Plate Hangzhou Tooth Advance: There are still uncertainties in the research results of the “Highly Integrated High Power Density Joint Component Technology” project undertaken.

19. Rierte: Net profit in 2024 will decrease by 13.81% year-on-year.

20. Stone Shares: The net loss in 2024 will be 23.0359 million yuan.

Overseas warning

1. Hot Chinese stocks were mixed, with the Nasdaq China Golden Dragon Index closing down 1.28%. iQiyi fell more than 9%, Baidu fell more than 7%, Jingdong fell nearly 6%, Beili fell more than 5%, and Shangrong fell more than 3%. Wenyuan Zhixing rose more than 28%, Xiaopeng Automobile rose nearly 5%, Dianduo rose more than 3%, and Alibaba rose nearly 2%.

2. The offshore RMB (CNH) against the US dollar was reported at 7.2759 yuan at 05:59 Beijing time, down 96 points from late New York on Monday. The overall trading during the day was in the range of 7.2633-7.2863 yuan.

3. U.S. President Trump said he would impose a tariff of around 25% on imported cars, and he will make more statements on this topic on April 2.

4. Citi research shows that the copper price forecast for the next 6-12 months will be lowered to US$8500 per ton. Previously it was US$9000 per ton. Terminal consumption of copper is expected to grow by 1.7% in 2025, reflecting growth resistance from tariffs and restrictive developed market monetary policies.