① The Russian ruble rose above 90 against the US dollar for the first time since last summer;② Federal Reserve Bostic expects the Federal Reserve to cut interest rates twice this year;③ Brazilian President: If Trump imposes tariffs, it will trigger a reciprocity policy;④ Argentina’s largest state-owned bank completed the shareholding reform and the government retained 99.9% stake.

Overnight stock market

On Thursday (February 20), the three major U.S. stock indexes collectively closed down, with the Dow down 1.01%, the Nasdaq down 0.47%, and the S & P 500 down 0.43%. The Nasdaq China Golden Dragon Index closed up 1.6%, Alibaba rose more than 8%, and Wenyuan Zhixing fell nearly 19%.

Most major European stock indexes closed down, with Germany’s DAX30 index down 0.53%, and the UK’s FTSE 100 index down 0.57%.

commodity market

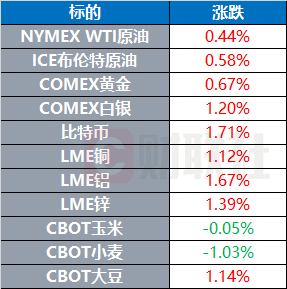

COMEX gold futures rose 0.67% to US$2,955.8 per ounce, once setting a record intraday high. COMEX silver futures rose 1.2% to US$33.44 per ounce. WTI March crude oil futures closed up 0.44% at US$72.57/barrel, while Brent April crude oil futures closed up 0.58% at US$76.48/barrel.

market news

[The Speaker of the U.S. House of Representatives says he is unwilling to introduce another appropriations bill for Ukraine]

Mike Johnson, Republican Speaker of the U.S. House of Representatives, said on February 20 local time that he had no intention of introducing another appropriations bill for Ukraine. Johnson said,”We must end this conflict. I can tell you that our European allies understand the need.”

[French President and British Prime Minister will visit the White House next week]

White House Press Secretary Karoline Leavitt said French President Macron and British Prime Minister Thomas Stamer will visit the White House next week. Leavitt said that Macron will visit the White House next Monday and Stammer will visit next Thursday.

[The Russian ruble rises against the U.S. dollar since its exchange rate against the U.S. dollar has risen above 90 for the first time since last summer]

The Central Bank of Russia announced the official exchange rate of the ruble against the US dollar on February 20 local time. The official exchange rate on February 21 was 88.51 rubles per US dollar, which rose above 90 for the first time since September last year. Starting from June 13, 2024, affected by sanctions, the Moscow Exchange issued an announcement stating that it will no longer use the US dollar and the euro for foreign exchange and precious metals transactions.

[US judge rules that Trump administration is temporarily allowed to continue mass layoffs of federal workers]

District Judge Christopher Cooper of the U.S. Federal Court in Washington, D.C., ruled on February 20 local time that the Trump administration can continue to lay off federal employees on a large scale, rejecting a union organization’s request to prevent Trump from significantly cutting about 2.3 million federal employees. It is reported that the ruling on that day was temporary and the lawsuit is still in progress.

[U.S. Commerce Secretary Lutnick: Tariff policy is not expected to lead to recession]

U.S. Commerce Secretary Lutnick said he does not expect tariff policies to lead to a recession and energy prices and interest rates will fall.

[Goldman Sachs Managing Director Rubner predicts that U.S. stocks will pull back and capital inflows will weaken]

Scott Rubner, global markets managing director and tactical expert at Goldman Sachs Group, said U.S. stocks could enter correction territory as individual and institutional buyers lose steam. “Money flow dynamics started to change sharply on Monday, and I am watching the correction,” Rubner wrote in a note to clients on Thursday. Despite uncertainty surrounding the path of tariffs and the Federal Reserve’s interest rates, U.S. stocks hit a record high on Wednesday. The strong rise was driven by resilience in corporate earnings and strong inflows from retail and institutional investors. But, Rubner wrote, those dynamics could change starting Monday. Demand from retail investors who have flocked to U.S. stocks at a record rate this year is expected to slow ahead of the March tax season. The flow of money from pension funds may also “lose steam,” which Rubner attributes to seasonal trends. January and February are usually the strongest months for annual asset allocation of the year, with inflows weakening by March.

[Federal Reserve Governor Barr: The Federal Reserve should not carry out stress test reforms by reducing banks ‘capital requirements]

Federal Reserve Governor Barr said the Fed should not carry out stress test reforms by reducing banks ‘capital requirements. It is important to have strong bank management and supervision to prevent potential shocks.

[Federal Reserve Musalem: The basic expectation is that inflation will fall back to 2% but the risk is biased upward]

Federal Reserve Musalem said the basic expectation is that inflation will fall back to 2%, but the risk is biased upward. Before further policy adjustments need to be made, inflation will need to be sure to return to the 2% target; patience is appropriate. Inflation expectations have risen and, if sustained, will make the Fed’s job more difficult.

[Federal Reserve Bostick: The Federal Reserve is expected to cut interest rates twice this year]

Fed Bostick said it expects the Fed to cut interest rates twice this year. Many things may happen in the future, which will lead to an increase or decrease in interest rate cuts. The current benchmark interest rate is in a moderately tight state, compared with the neutral interest rate of 3%-3.5%. The economic slowdown is a major concern due to upcoming policy changes, but companies expect 2025 to be a solid year, and so far, the economy has still shown resilience.

[Brazilian President: If Trump imposes tariffs, it will trigger reciprocity policy]

Brazilian President Lula said in an interview that if U.S. President Trump imposes tariffs on Brazil, it will trigger Brazil’s reciprocity policy towards the United States, which may lead to an increase in global inflation. Lula said that although the United States is an important trading partner of Brazil, Brazil does not rely on the United States. There are very balanced trade and diplomatic relations between the two countries. He hopes that Trump will stop the current protectionist policies.

[Brazil’s Supreme Court orders social media platform X to pay fines exceeding 8 million reais]

According to a ruling released on the 20th local time, Brazilian Supreme Court Justice Alexandre de Morais ordered U.S. social media platform X to pay a fine of 8.1 million reais (approximately US$1.42 million) for the platform’s failure to comply with judicial orders. Platform X’s legal representative in Brazil declined to comment.

[Argentina’s largest state-owned bank completes shareholding reform, the government retains 99.9% equity]

The Argentine government issued an official communiqué on February 20 local time, announcing that President Millay signed a decree to officially restructure the country’s largest state-owned bank, Banque Nacional de Argentina, into a joint-stock company. According to the decree, after the restructuring, the government will hold 99.9% of the shares, and the remaining 0.1% will be held by the National Bank of Argentina Foundation.