They neither walked out nor defended the base area.

Congtai Laojiao attack, Lao Baigan’s “Hebei Dilemma”| Observation of 5 billion wine companies

Blue Whale News, February 21 (Reporter Zhu Xinyue)The revenue of 5 billion yuan is a key turning point in the development process of liquor companies. It marks that the company has established a solid scale foundation in the market and indicates that it may enter a rapid growth track and move towards the ranks of tens of billions of liquor companies. Accelerate forward. However, this figure is also regarded by the industry as an invisible challenge or growth curse for wine producers. When many provincial wine brands approach or reach the milestone of 5 billion yuan in revenue, they often encounter unprecedented challenges and bottlenecks, making it difficult to maintain their previous strong growth trend.

In this context, Blue Whale Finance has launched a series of reports on 5 billion wine companies to analyze the challenges and opportunities faced by wine companies after reaching this scale and explore how they can seek breakthroughs in the fierce market competition. The wine company we focus on in this issue is Laobaigan Liquor (600559.SH)known as Hebei King.

Recently, Laobaigan Liquor announced the plan for directors and senior managers to reduce their shares. Zhang Yuxing, vice chairman of the company, and three senior executives, deputy general managers Li Yulei and Zheng Baohong, plan to reduce their shares in the company from March 3 to June 2 due to personal capital needs. The planned number of shares to be reduced is no more than 67,500 shares. The total reduction of the three will not exceed 202,500 shares. It is uncommon for executives and shareholders in the liquor industry to reduce their holdings. This is the first time in recent years that a senior executive of Laobaigan Liquor has announced a reduction in holdings. This move has inevitably attracted market attention and raised concerns about the prospects of Laobaigan Liquor.

In fact, Laobaigan Liquor successfully crossed the important threshold of revenue of 5 billion yuan in 2023, ushering in a more severe market competition pattern. On the one hand, first-line wine companies such as Luzhou Laojiao (000568.SZ) and Shanxi Fenjiu (600809.SH) continue to sink into the market, forming a considerable squeeze on Laobaigan Liquor; on the other hand, local wine companies such as Congtai and Shanzhuang Lao Liquor are not willing to be outdone, posing a direct competitive impact on Laobaigan Liquor. This situation of being attacked from top to bottom is not only a unique challenge faced by Laobaigan Liquor, but also a common dilemma encountered by many provincial wine brands.

Go nationwide through mergers and acquisitions

The predecessor of Laobaigan Liquor was the local state-owned Hengshui Winery of the Southern Hebei Administrative Office. It entered the capital market in 2002, with revenue of 260 million yuan that year. The main product is the Hengshui Laobaigan Liquor series.

In 2008, Laobaigan Liquor used a slogan on CCTV Hengshui Laobaigan, and its masculine flavor resounded across the country. The following year, Hebei Hengshui Laobaigan Brewing (Group) Co., Ltd., the controlling shareholder of Laobaigan Liquor, announced a restructuring.

However, it was not until 2014 that the mixed reform plan of Laobaigan Liquor was late.

An industry insider who declined to disclose told Blue Whale News that due to the long-term failure to implement the restructuring process, Laobaigan Liquor’s operating performance may have been artificially restricted.

This view is not without foundation. According to media reports at the time, the research report of securities firms repeatedly mentioned that performance suppression was still continuing and looked forward to an early breakthrough in the restructuring and other similar statements, which also confirmed the views of industry insiders.

Finally, in 2015, Laobaigan Liquor successfully completed the mixed ownership reform, and strategic investors, management and core dealers were deeply bound to the company’s market value through targeted additional issuance. This year, the net profit of Laobaigan Liquor reached 75.0419 million yuan; and in 2016, the net profit jumped to 111 million yuan, a year-on-year increase of nearly 50%.

At that time, Hengshui Laobaigan Liquor’s market share in North China was about 65%, making it the well-deserved King of Hebei.

However, from the perspective of operating income, Laobaigan Liquor’s performance from 2016 to 2017 was slightly flat, with revenue remaining at around 2.4 billion yuan, with a growth rate of less than 5%.

In order to break this situation, Laobaigan Liquor decided in 2017 to further expand the national market through extended acquisitions. In the end, it acquired four wine companies owned by Fenglian Liquor, Chengde Qianlong Zui, Anhui Wenwang, Hunan Wuling and Qufu Kongfujia for 1.399 billion yuan.

Talking about this transaction in its financial report, Laobaigan Liquor said that it would take the acquisition of Fenglian Liquor as an opportunity to accelerate integration, optimize resource allocation, complement each other’s advantages to achieve synergy with Qianlong Zui, and defend Hebei Liquor’s leadership position. At the same time, relying on the resource advantages of liquor companies outside the province, we will expand the market outside the province in an orderly manner and spare no effort to build a first-class liquor company in China.

In April 2018, the acquisition of Fenglian Liquor was officially completed, and Laobaigan Liquor conducted a consolidated statement on Fenglian Liquor. That year, Hengshui Laobaigan series achieved liquor revenue of 2.3 billion yuan, a year-on-year increase of about 3%, and the overall revenue of Laobaigan Liquor was 3.58 billion yuan, an increase of about 41%.

Market pressure has doubled

The actual situation after the merger obviously fell short of Laobaigan Liquor’s expectations. Not only was the promotion of the nationalization strategy blocked, but even its market position in Hebei Province was in jeopardy.

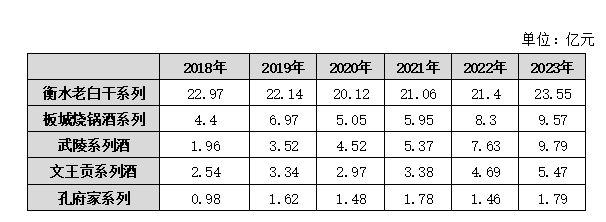

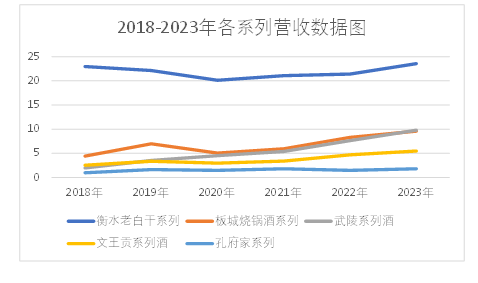

According to financial report data, Hengshui Laobaigan Series, the core brand of Laobaigan Liquor, had operating income of 2.297 billion yuan, 2.214 billion yuan, 2.012 billion yuan, 2.106 billion yuan, 2.14 billion yuan and 2.355 billion yuan respectively from 2018 to 2023. From 2018 to 2020, sales of this series experienced a decline, and only gradually recovered after that.

As for other product lines, although they have all increased, the growth rate is relatively limited. For example, the growth of the Confucius Fujia series in the past six years is less than 100 million yuan; the Bancheng Shaoguo series has increased from 440 million yuan to 957 million yuan; and the Wuling series, which Hengshui Laobaigan once had high hopes, has benefited from the sauce wine market. The boom has climbed from 186 million yuan to 979 million yuan, becoming the fastest growing among the four brands acquired, but its growth rate is still slightly insufficient compared with the overall market potential.

During this period, Laobaigan Liquor’s competitors have made great progress. According to research data from wine industry experts, the current scale of low-grade national cellar in the Hebei market has reached about 4 billion yuan, accounting for about 30% of the national market; and the overall scale of Luzhou Laojiao in the Hebei market is as high as 7 billion yuan. Among them, Shijiazhuang, Tangshan, Baoding, Langfang and other places are Luzhou Laojiao’s core markets in Hebei, especially Shijiazhuang, whose market size has exceeded 3 billion yuan, Baoding is more than 1 billion yuan, and Tangshan also has a market size of 400 million to 500 million yuan.

“Luzhou Laojiao dispatched more than 1000 people from all over the country to the sinking counties and even township markets in Hebei Province, creating a terminal direct supply store model of Luzhou Laojiao. Through the marketing of the Hebei Conference, three years ago, low-grade national cellar had more than 40 million yuan in Hebei. District and county-level markets. rdquo; Liquor industry analyst Xiao Zhuqing told Blue Whale News.

Liquor evaluation blogger Hui Yue revealed to Blue Whale Financial News that Laobaigan liquor belongs to Laobaigan flavor and is classified as Daqing-flavor liquor. However, in recent years, Laobaigan wine has not only failed to gain the momentum of a strong fragrance, nor has it fully highlighted its unique charm. On the contrary, it has intentionally or unintentionally downplayed its distinctive characteristics. On the contrary, Fen-flavor liquor, relying on its similar taste to Laobaigan liquor, continues to encroach on the price band of Laobaigan liquor below 400 yuan, especially the market share within 100 yuan. This may have a huge impact on the future status of Laobaigan Liquor in the Hebei market.

Impact on the provincial market from Taiwan

The competitive situation faced by Laobaigan Liquor is not limited to the fierce competition from domestic first-line wine companies, but the competition in the provincial market is also fierce.

At the 2023 Hebei Congtai Liquor Beijing-Tianjin-Hebei Thousand Merchants Fortune Conference, Guo Wei, then chairman of Congtai Liquor Industry, publicly announced that Congtai has firmly ranked first in the provincial wine industry and is moving towards the top spot in Hebei. Impact. rdquo;

According to the forecast announced by Congtai Liquor to continue to maintain a growth rate of 30% in 2023, based on the sales of Congtai Liquor of 2 billion yuan in 2022, its sales in 2023 will reach 2.6 billion yuan. This figure has surpassed the Hengshui Laobaigan series of 2.355 billion yuan in the same period.

At the same time, Shanzhuang Lao Liquor, featuring China’s royal liquor culture, is also on the rise. At the first seminar of China Royal Liquor Culture Research Institute in March 2024, Shanzhuang Group officially announced that in 2023, the sales growth rate will reach 47%, liquor sales will reach 3 billion yuan, and taxes will be paid 480 million yuan.

Xiao Zhuqing pointed out that Hengshui Laobaigan intends to accelerate the national layout through mergers and acquisitions, but its lag in management and talent training has led to the unreasonable dispersion of core talent resources, the weakening of channel power, and the limited market development to local areas, making it difficult to form a national synergy., which in turn affects the improvement of the influence of its core brand.

In addition, Hengshui Laobaigan has also encountered setbacks in brand promotion. In 2018, Lao Baigan changed the classic advertising slogan that had been used for ten years to drink a man’s flavor to drink Lao Baigan, not to the top. This change has aroused widespread controversy in the industry, and some industry insiders even bluntly said that this was a foolish move.

In 2022, the brand strategy of Laobaigan Liquor will be upgraded again, with the core demands of A Gold Medal, healthy quality, Hengshui Laobaigan, and healthier high-end liquor, striving to play the health card and stand out in the fierce market competition.

The adjustment of brand strategy brings high sales expenses. According to statistics, from 2018 to 2023, the cumulative investment in sales expenses of Laobaigan Liquor exceeded 7.1 billion yuan.

Cai Xuefei, an analyst in the liquor industry, pointed out that Laobaigan Liquor has been undergoing high-end transformation, but it is limited by factors such as brand image, category value and limited organizational execution, and has had little effect. Promoting high-end products requires a large amount of front-end investment, which may affect the profits of Laoguan.

He Yanzhao, general manager of Hengshui Laobaigan Marketing Co., Ltd., said in an exclusive interview with Fenghuang. com that Hengshui Laobaigan is still in the category of wine conservation, and any company in the national market wants to do it, but there is a prerequisite for this to do a good job in the local market. We plan to rely on Shijiazhuang and Tangshan, which have the strongest economies, to increase the overall proportion of the Hebei market to more than 670%. Of course, at the same time, we are gradually developing outside the province. There are also arrangements outside the province. Now we have made Henan and Shandong our focus outside the province. Generally speaking, Hebei is a comprehensive network, and the country is expanding in points.& rdquo;

A salesman at the Zhengzhou General Distribution Bureau of Laobaigan Liquor told Blue Whale News that the current volume of Laobaigan Liquor in Henan is about 100 – 200 million.

The 2024 interim financial report shows that Laobaigan Liquor achieved revenue of 2.47 billion yuan in the first half of the year, of which more than 1.6 billion yuan came from the base camp of Hebei Province, accounting for about 65%. The nationalization of Laobaigan Liquor still has a long way to go.