① Tesla customer service responded to a software update in China that it was only L2 intelligent assisted driving and could not yet achieve full autonomous driving;

② Weltai announced in 7 days and 5 days that the company’s shares may be subject to delisting risk warnings;

③ Trump signs an executive order to launch a 232 investigation into copper.

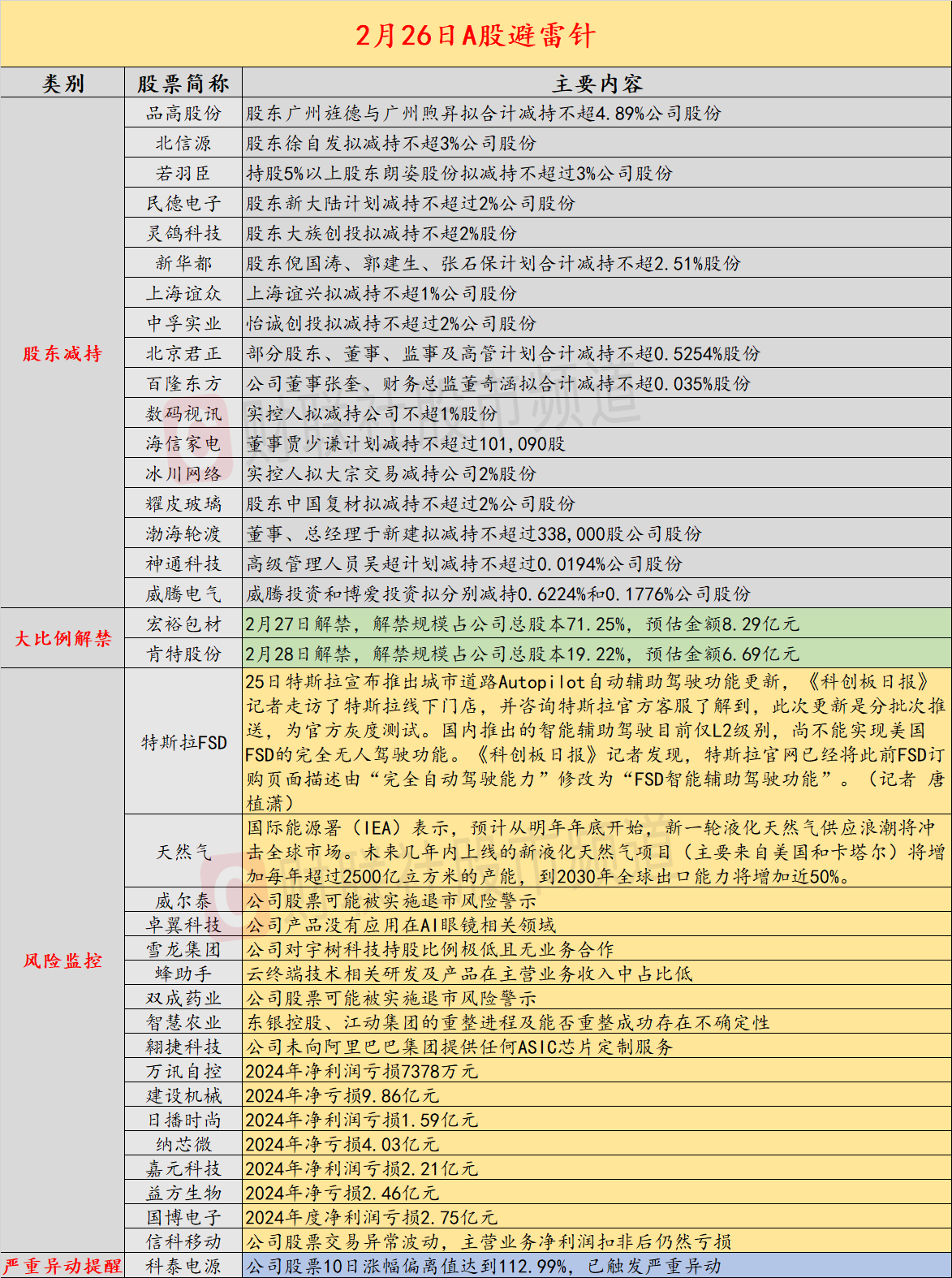

Introduction:Cailian invested in the lightning rod on February 26. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) Most of the main domestic futures contracts fell, and caustic soda fell nearly 3%;2) Tesla customer service responded to a software update in China, only L2 intelligent assisted driving, and fully autonomous driving cannot yet be achieved; The company’s key concerns include: 1) The 7-day 5-board Weltai announcement that the company’s shares may be subject to delisting risk warnings;2) 5 Lianban Zhuoyi Technology warned about risks that the company’s products have not been used in AI eyes-related fields; Key concerns in overseas markets include: 1) The closing trends of the three major U.S. stock indexes diverged, with Tesla falling more than 8%;2) Trump signed an executive order to launch a 232 investigation into copper.

economic information

1. Most of the main domestic futures contracts fell. Caustic soda fell nearly 3%, glass fell more than 2%, and low-sulfur fuel oil (LU), soybean II, fuel oil, soybean meal, vegetable oil, and rubber fell more than 1%. In terms of increase, white sugar rose slightly.

On the 25th, Tesla announced the launch of an update to Autopilot’s automatic assisted driving function on urban roads. A reporter from the “Science and Technology Innovation Board Daily” visited Tesla’s offline stores and consulted Tesla’s official customer service to understand that the update is in batches. Push, is an official grayscale test. The intelligent assisted driving launched in China is currently only at the L2 level and cannot yet achieve the completely driverless driving function of the US FSD. A reporter from the Science and Technology Innovation Board Daily found that Tesla’s official website has revised the description on the previous FSD ordering page from “fully autonomous driving capability” to “FSD intelligent assisted driving function.” (Reporter Tang Zhixiao)

Company warning

1. 7 days and 5 days Weertai: The company’s shares may be subject to delisting risk warnings.

2 and 5 Connecting Board Zhuoyi Technology: The company’s products have not been used in AI glasses related fields.

3. Pingao Shares: Shareholders Guangzhou Jingde and Guangzhou Xusheng plan to jointly reduce their shares in the company by no more than 4.89%.

4. Beixinyuan: Shareholder Xu Zifa plans to reduce his shareholding in the company by no more than 3%.

5. Ruo Yuchen: Langzi, a shareholder holding more than 5% of the shares, plans to reduce its shareholding by no more than 3% of the company’s shares.

6. Minde Electronics: Shareholder New World plans to reduce its shares in the company by no more than 2%.

7. Lingge Technology: Shareholder Dazu Venture Capital plans to reduce its shares by no more than 2%.

8. Xinhuadu: Shareholders Ni Guotao, Guo Jiansheng and Zhang Shibao plan to reduce their shares by no more than 2.51% in total.

9. Shanghai Yizhong: Shanghai Yixing plans to reduce its shares in the company by no more than 1%.

10. Zhongfu Industrial: Yicheng Venture Capital plans to reduce its shares by no more than 2% of the company’s shares.

11. Beijing Junzheng: Some shareholders, directors, supervisors and senior executives plan to reduce their shares by no more than 0.5254%.

12. Blum Oriental: Zhang Kui, director of the company, and Dong Qihan, chief financial officer, plan to reduce their shares by no more than 0.035%.

13. Digital video: The actual controller plans to reduce its shareholding in the company by no more than 1%.

15. Glacier Network: The actual controller plans to reduce its shareholding by 2% in a block transaction.

16. Yaopi Glass: Shareholder China Composite Materials plans to reduce its shares in the company by no more than 2%.

17. Bohai Ferry: Director and General Manager Yu Xinjian plans to reduce the number of shares in the company by no more than 338,000 shares.

18. Shentong Technology: Senior manager Wu Chao plans to reduce his shareholding by no more than 0.0194%.

19. Witten Electric: Witten Investment and Bo ‘ai Investment plan to reduce their shares of the company by 0.6224% and 0.1776% respectively.

20. Xuelong Group: The company has a very low shareholding ratio in Yushu Technology and has no business cooperation.

21. Bee Assistant: Cloud terminal technology-related R & D and products account for a low proportion of main business income.

22. Shuangcheng Pharmaceutical: The company’s shares may be subject to delisting risk warnings.

23.2 Connected smart agriculture: There is uncertainty about the reorganization process of Dongyin Holdings and Jiangdong Group and whether the reorganization can be successful.

24. Aojie Technology: The company does not provide any ASIC chip customization services to Alibaba Group.

25. Wanxun Controls: The net profit loss in 2024 will be 73.78 million yuan.

26. Construction machinery: The net loss in 2024 is 986 million yuan.

27. Daily Fashion: Net profit loss in 2024 is 159 million yuan.

28. Naxinwei: The net loss in 2024 will be 403 million yuan.

29. Jiayuan Technology: Net profit loss in 2024 will be 221 million yuan.

30. Yifang Biotech: The net loss in 2024 will be 246 million yuan.

31. Xinke Mobile: Net profit loss for 2024 is 275 million yuan.

Overseas warning

1. The three major U.S. stock indexes closed in divergence. The Dow rose 0.37%, the Nasdaq fell 1.35%, and the S & P 500 fell 0.47%. Large technology stocks fell generally. Tesla fell more than 8%. NVIDIA and Google fell more than 2%. Microsoft and Meta fell more than 1%. Cryptocurrency, semiconductors, and automobile manufacturing were among the top losers, with Jiannan Technology falling more than 16%, Strategy falling more than 11%, Coinbase falling more than 6%, and Rivian falling more than 4%.

2. The Bloomberg Big Seven Index fell 10% from its record high.

3. The settlement price of WTI crude oil futures fell 2.5% to US$68.93/barrel. Brent crude oil futures closed down 2.35% at US$73.02/barrel.

4. COMEX gold futures closed down 1.17% at US$2,928.6 per ounce;COMEX silver futures closed down 1.68% at US$32.055 per ounce.

5. Trump signed an executive order to launch a 232 investigation into copper, and Trump launched an investigation by the Department of Commerce, which may lead to the imposition of copper import tariffs.

6. The International Energy Agency (IEA) stated that it is expected that starting from the end of next year, a new wave of liquefied natural gas supply will hit the global market. New liquefied natural gas projects launched in the next few years (mainly from the United States and Qatar) will increase production capacity by more than 250 billion cubic meters per year, and global export capacity will increase by nearly 50% by 2030.