①TrendForce said that in Q1 of 2025, NAND Flash revenue may decrease by as much as 20% quarterly;

②3 consecutive board Shanghai Xiba announced that the company has not yet received batch orders for its solid-state battery-related business;

③ The three major U.S. stock indexes collectively closed down, with Nvidia falling more than 8%.

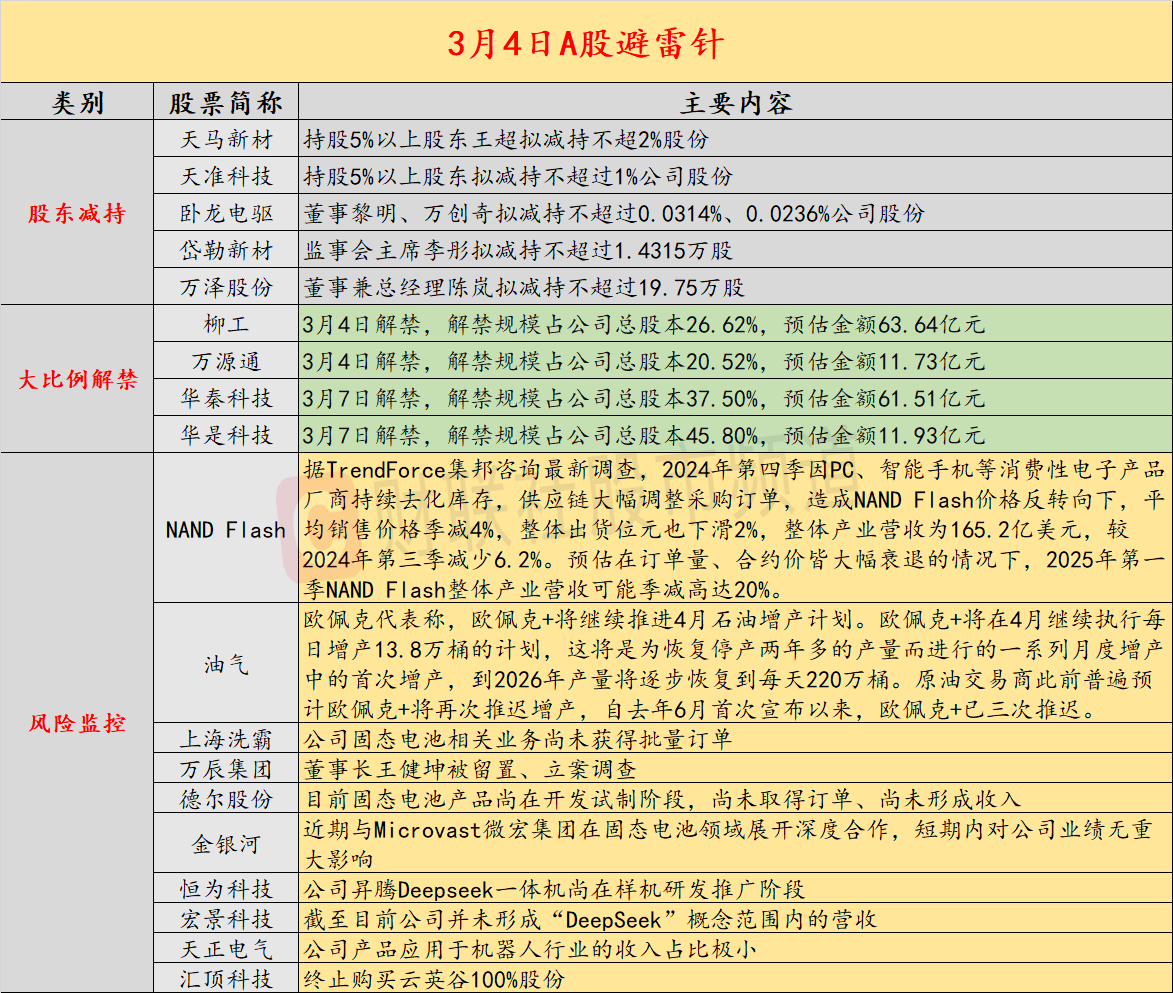

Introduction:Cailian invested in the lightning rod on March 4. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) The results of the centralized procurement of cochlear implants will be implemented this month, and 200,000 yuan will be reduced to 50,000 yuan;2) TrendForce said that Q1 NAND Flash revenue in 2025 may be reduced by as much as 20% quarterly; The company’s key concerns include: 1) The announcement of the company’s solid state battery-related business has not yet received batch orders;2) Wang Jiankun, chairman of Wanchen Group, has been detained and investigated; key concerns in overseas markets include: 1) The three major U.S. stock indexes collectively closed down, with Nvidia falling more than 8%;2) OPEC + will continue to advance its April oil production increase plan.

economic information

1. Starting this month, the results of centralized collection of cochlear implants have been implemented across the country, and the price of a single set of cochlear implant consumables has dropped from an average of more than 200,000 yuan to about 50,000 yuan. In December last year, the state organized centralized procurement of cochlear implant medical consumables, with a total purchase volume of 11,000 units. All three foreign-funded enterprises and two domestic-funded enterprises participating in the centralized procurement were selected. In addition to commonly used clinical products, they could support (3.0T) A new generation of cochlear implant for MRI examination.

2. Shenzhen Shuibei merchants said that the price of gold ornaments has dropped from 696 yuan per gram in the previous week to 678 yuan currently, and the price fluctuations in a short period of time are still very large. In some large shopping malls, the prices of many brand gold stores generally dropped from nearly 900 yuan per gram to around 875 yuan. (Securities Times)

3. According to the latest survey by TrendForce Consulting, in the fourth quarter of 2024, as manufacturers of consumer electronics products such as PCs and smartphones continued to destock, the supply chain significantly adjusted purchase orders, causing NAND Flash prices to reverse downward, and the average sales price The quarterly decrease was 4%, and the overall shipment position also fell 2%. Overall industry revenue was US$16.52 billion, a decrease of 6.2% compared with the third quarter of 2024. It is estimated that with order volume and contract prices declining significantly, NAND Flash’s overall industry revenue in the first quarter of 2025 may decrease by as much as 20% quarterly.

Company warning

1 and 3 connected boards Shanghai Xiba: The company has not yet received batch orders for its solid-state battery-related business.

2. Wanchen Group: Chairman Wang Jiankun was detained and investigated.

3. Tianma Xincai: Wang Chao, a shareholder holding more than 5% of the shares, plans to reduce his shareholding by no more than 2%.

4. Tianzhun Technology: Shareholders holding more than 5% of the shares plan to reduce their shares in the company by no more than 1%.

5. Wolong Electric Drive: Directors Liming and Wan Chuangqi plan to reduce their shares in the company by no more than 0.0314% and 0.0236%.

6. Daile Xincai: Li Tong, Chairman of the Board of Supervisors, plans to reduce the number of shares by no more than 14,315.

7. Wanze Shares: Director and General Manager Chen Lan plans to reduce the number of shares by no more than 197,500.

8. Del Co., Ltd.: Currently, solid-state battery products are still in the development and trial production stage, and orders have not yet been obtained or revenue has not yet been generated.

9. Jin Yinhe: Recently, it has carried out in-depth cooperation with Microvast Micromacro Group in the field of solid-state batteries, and has no significant impact on the company’s performance in the short term.

10 and 4 connected boards Hengwei Technology: The company’s Shengteng Deepseek all-in-one machine is still in the prototype development and promotion stage.

11. Hongjing Technology: As of now, the company has not formed revenue within the scope of the “DeepSeek” concept.

12. Tianzheng Electric: The company’s products account for a very small proportion of revenue used in the robot industry.

13. Huiding Technology: Terminate the purchase of 100% shares of Yunying Valley.

Overseas warning

1. The three major U.S. stock indexes collectively closed down. The Dow fell 1.48%, the Nasdaq fell 2.64%, and the S & P 500 fell 1.76%. Large technology stocks fell generally. NVIDIA fell more than 8%, Broadcom fell more than 6%, Amazon fell more than 3%, Tesla, Google, and Microsoft fell more than 2%. Semiconductor, blockchain, and computer hardware sectors were among the top losers, with Ultramicro Computer falling 13%, Dell Technology falling more than 7%, Bit Digital falling more than 6%, Intel and Coinbase falling more than 4%, Micron Technology falling more than 3%, Qualcomm, Kelei fell more than 2%.

Most popular Chinese stocks closed down, with the Nasdaq China Golden Dragon Index down 2.98%. Wenyuan Zhixing fell more than 11%, Ideal Cars fell more than 10%, Weilai and Jinshan Cloud fell more than 8%, Jikrypton fell more than 6%, Xiaopeng Automobile fell more than 5%, and Jingdong fell nearly 4%.

2. OPEC representatives said that OPEC + will continue to advance the April oil production increase plan. OPEC + will continue its plan to increase production by 138,000 barrels per day in April. This will be the first increase in a series of monthly increases to resume production that has been suspended for more than two years. Production will gradually return to 2.2 million barrels per day by 2026. Crude oil traders had generally expected OPEC + to delay production increases again, and OPEC + has postponed three times since it was first announced in June last year.

The settlement price of WTI crude oil futures fell 1.99% to US$68.37/barrel. Brent crude oil futures settled down 1.63% to US$71.62/barrel.

3. The United States suspended the delivery of weapons to Ukraine.