1. The U.S. non-agricultural data in February was slightly lower than expected, and the unemployment rate rose;2. Federal Reserve officials made an intensive appearance, and Powell delivered a speech in the early morning;3. Broadcom carried the banner of AI chips, and its share price rose 11% before the market;4. The second lunar lander lay down again, and the intuitive machine continued to plummet.

Cailian News, March 7 (Editor Shi Zhengcheng)Before Friday’s session, the U.S. stock market, which was confused by Trump’s erratic policies, rose rapidly after the non-agricultural data was released, but quickly returned to chaos.

As of press time, Dow Jones index futures (2503 contract) fell 0.16%, S & P 500 index futures rose 0.01%, and Nasdaq 100 index futures rose 0.20%.

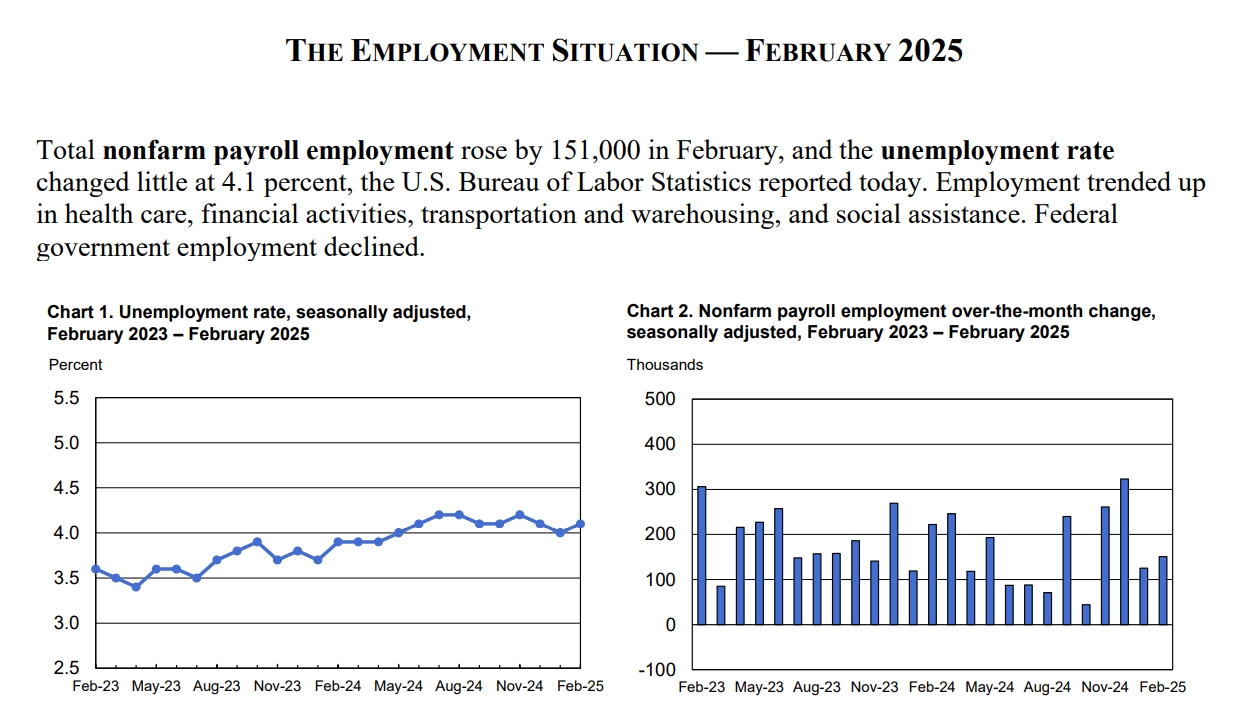

February non-agricultural survey data showed thatU.S. employers added 151,000 jobs last month, and the unemployment rate rose to 4.1 percent。Economists ‘prior expectations were 160,000 and 4%.

(Source: U.S. Department of Labor)

The non-agricultural outlook article of the Financial Union once mentioned that for tonight’s market, a not-too-bad non-agricultural data can help the U.S. stock market stop falling. After all, considering that the Ministry of Government Efficiency is cutting spending everywhere, non-agricultural data in the next few months will only become more chaotic.

Under the impact of Trump’s policies,The S & P 500 has retreated 6.6% from its historical high on February 19; the Nasdaq has retreated more than 10% from mid-February。

(Daily chart of the Nasdaq Index, source: TradingView)

Friday is also the last day before the silent period for the Federal Reserve’s March interest-rate meeting, includingA group of monetary policy officials including Federal Reserve Chairman Powell will speak out intensively, they will also be another variable that determines market sentiment tonight. Among them, Powell will deliver an economic outlook speech at the annual Monetary Policy Forum at the University of Chicago’s Booth School of Business at 1:30 a.m. Beijing time on Saturday.

There is another incident tonight that attracts the attention of melon-eating people and “currency circle people”–US President Trump will host a cryptocurrency summit at the White House。In an executive order signed Thursday, he ordered the establishment of a strategic bitcoin reserve supervised by the U.S. Treasury Department, as well as another digital asset reserve dedicated to storing bitcoin and other cryptocurrencies.

It is reported that Robinhood CEO Vlad Tenev and Strategy leader Michael Saylor will attend. Participants generally paid attention to the details of the implementation of the official U.S. strategic reserve and whether the Trump administration would enact policies that benefit the crypto industry.

other messages

[Broadcom rose 11% before the market]

After releasing earnings that satisfied the market after hours on Thursday, AI concept stock and ASIC chip leader Broadcom surged 11.31% before Friday’s session.

The financial report showed that Broadcom’s revenue in the first quarter was US$14.92 billion, exceeding market expectations of US$14.61 billion. Thanks to the strong application of its customized accelerators, artificial intelligence chip revenue surged more than 77% to US$4.1 billion. CEO Chen Fuyang said the company expects revenue from artificial intelligence chips to reach US$4.4 billion in the second quarter as some ultra-large customers invest in customized artificial intelligence chips for data centers.

[Stargate will deploy 64,000 NVIDIA GB200 pieces in its first data center]

According to reports, OpenAI and Oracle will start building a large new data center in Texas in the coming months as part of the stargate infrastructure project to start and operate. According to people familiar with the matter, the data center will be built in Abilene, Texas, and is expected to accommodate 64,000 NVIDIA GB200 chips by the end of 2026.

[Hewlett Packard Technology’s share price plunged nearly 17% after announcing its results]

Before Friday’s market, AI server maker HPE Technology fell more than 17%. The company released a differentiated financial report after Thursday’s close. Among them, revenue of US$7.85 billion (year-on-year +16%) slightly exceeded expectations, adjusted net profit per share was US$0.49, slightly lower than expectations, and non-GAAP gross profit margin plummeted 680 basis points to 29.4%. The company expects Q2 adjusted EPS to be US$0.28 -0.34 (expected US$0.50), and revenue guidance of US$7.2 – 7.6 billion is also lower than expected.

[The second lunar lander lies down again in front of the intuitive machine and continues to plummet]

Shares of U.S. space exploration company Intuition Machines continued to plummet 34.91% before trading on Friday. In intraday trading on the previous trading day, the company announced that the “Athena” lunar lander had successfully landed on the moon, but the specific landing posture was still unclear. Company CEO Steve Altemus said that some sensors sent back data that seemed to show that the lander was in a “lying side” state.

This is also the second lunar landing probe launched by the Intuition Machine. The first lander, Odysseus, landed on the moon in February last year, but accidentally capsized and failed to complete its scheduled mission. Affected by this, the company’s share price fell 20.20% on Thursday

Events worthy of attention during the U.S. stock market period (Beijing time)

March 7

21:30 US February non-farm payrolls report

23:15 Federal Reserve Governor Bowman participated in a public event

23:45 New York Fed President Williams participated in a public event

March 8

01:20 Federal Reserve Governor Kugler delivered a public speech

01:30 Federal Reserve Chairman Powell delivered a speech

02:30 US President Trump hosts the Cryptocurrency Summit at the White House