China holds global leadership in manufacturing and services, and DeepSeek is more like China’s “Sputnik” moment.

Author: Wall Street News

After Deepseek exploded, the entire China assets will be reassessed.

In its latest report on February 5, Deutsche Bank boasted that 2025 is the year when China surpasses other countries. It is expected that the valuation discount on China stocks will disappear and the A-share/Hong Kong stocks bull market will continue and exceed previous highs. Deutsche Bank said:

2025 is regarded as the year when the investment community realizes that China is leading the global competition. It is increasingly difficult not to admit that China companies provide cost-effective and high-quality products in multiple manufacturing and service sectors.

We expect the valuation discount on China stocks to disappear, and profitability may exceed expectations due to policies that support consumption and financial liberalization. The bull market for Hong Kong stocks/A-shares starts in 2024 and is expected to exceed previous highs in the medium term.

Specifically, Deutsche Bank said that China’s manufacturing and service industries occupy a global leadership position, and DeepSeek is more like China’s Sputnik moment:

China also occupies a leading position in areas such as clothing, textiles, toys, basic electronics, steel, shipbuilding, and complex industries such as telecommunications equipment, nuclear energy, national defense and high-speed railways. In 2025, China launched the world’s first sixth-generation fighter jet and its low-cost artificial intelligence system DeepSeek within a week.

Mark Anderson called DeepSeek’s launch the Sputnik moment for artificial intelligence, but it was more like China’s Sputnik moment, with China’s intellectual property rights recognized. The list of areas where China performs well in high value-added areas and dominates the supply chain is expanding at an unprecedented rate.

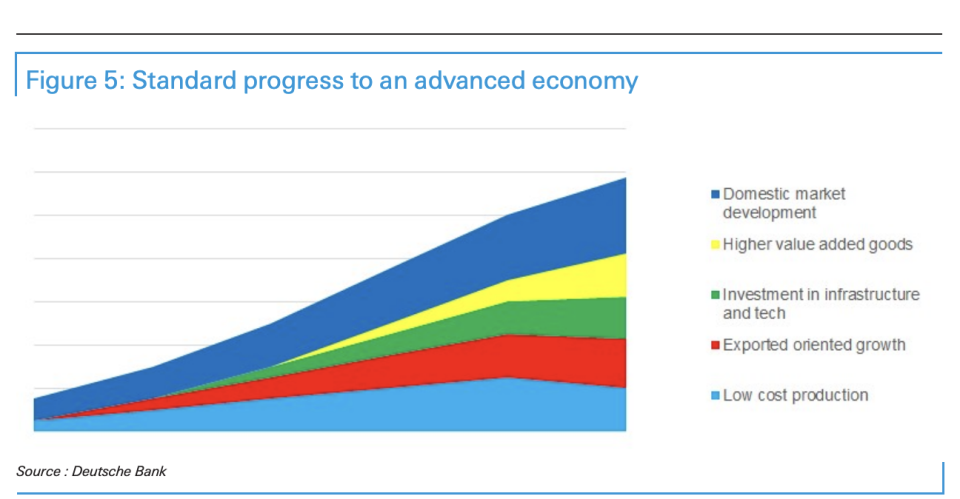

Deutsche Bank believes that China is now in Japan in the early 1980s:

People are beginning to realize that China is not where it was in 1989, but where it was in the early 1980s, when Japan’s value chain was climbing rapidly, providing higher-quality products at lower prices and constantly innovating.

In addition, Deutsche Bank optimistically pointed out that Sino-US trade issues may bring positive surprises, and trade and markets are not so closely related:

As China companies continue to consolidate their global dominance, it seems that valuation discounts should eventually turn into premiums. We believe investors will have to move quickly to China in the medium term and it will be difficult to get access to China stocks without pushing up stock prices.

The advantages of China’s manufacturing industry are increasingly prominent

In recent years, the advantages of China’s manufacturing industry on a global scale have become increasingly prominent.

Deutsche Bank said:

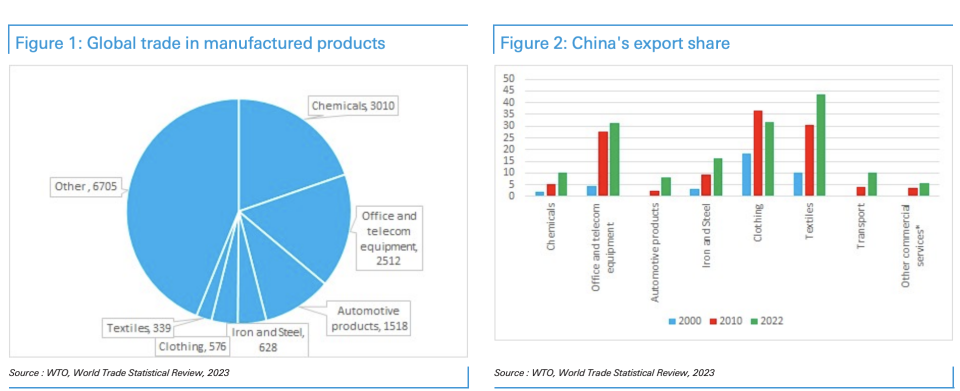

From its initial rise in the fields of clothing, textiles and toys to its current dominant position in basic electronics, steel, shipbuilding and other fields, the development trajectory of China’s manufacturing industry is eye-catching. Especially in the fields of white goods and solar energy, the performance of China companies has become even more sudden.

It is worth noting that China’s rise in complex industries such as telecommunications equipment, nuclear power, national defense and high-speed railways has demonstrated its strong technological strength. At the end of 2024, China’s rapid rise in the field of automobile exports has attracted global attention. Its high-performance, attractive appearance and competitively priced electric vehicles (EVs) have successfully entered the international market. In 2025, China launched the world’s first sixth-generation fighter jet and low-cost artificial intelligence system DeepSeek in just one week, which is regarded as an important symbol of the recognition of China’s intellectual property rights.

The strength of China’s manufacturing industry can be confirmed from the following aspects:

-

Export scale: China’s merchandise exports are twice that of the United States, contributing 30% of global manufacturing added value.

-

Patent applications: In 2023, China accounted for nearly half of global patent applications. In the field of electric vehicles, China owns about 70% of patents, and it has similar advantages in the fields of 5G and 6G telecommunications equipment.

-

Talent pool: Except for India, China has more STEM (science, technology, engineering and mathematics) graduates than other countries in the world.

-

Industrial clusters: China has created Silicon Valley-like local professional clusters for key industries and works closely with universities on research.

China is more like Japan in the early 1980s

Deutsche Bank believes that China is more like Japan in the early 1980s:

Japan’s growth is achieved through the use of abundant cheap labor, intensive use of capital, and increased productivity. Domestic investment accounts for more than 30% of GDP, thanks to financial restraint policies that keep interest rates low. Japan acquires new technologies through joint ventures. Savings accounted for 40% of GDP in the early 1970s, then fell to nearly 30% in the early 1980s. Japan began setting up factories overseas in the 1970s to avoid trade frictions, and China has only recently begun to take such actions.

Deutsche Bank also stated:

Liberalizing the financial system can help boost consumption by normalizing interest rates and thus ending the transfer of funds from depositors to businesses. This will reduce overinvestment and over-competition, as capital is rationed, which will help improve returns on state-owned enterprises. We expect that as state-owned enterprises increase returns, easing of excessive competition will be required to increase stock value. We expect this to become a key topic in 2025, and this factor will be a key factor driving the bull market.

In addition, China’s economy and exports still maintain rapid growth. In 2024, China’s exports will increase by 7%, exports to Brazil, United Arab Emirates and Saudi Arabia will increase by 23%, 19% and 18% respectively, and to ASEAN countries in the Belt and Road Initiative will increase by 13%. China’s exports to ASEAN and BRICS countries are now equivalent to its exports to the United States and the European Union combined, and its export market share to these destinations has grown by two percentage points annually over the past five years.

The driving force for China’s economic growth comes from several aspects:

-

Manufacturing advantages: In almost all industries, China has the world’s leading companies and continues to seize market share.

-

"Belt and Road Initiative: This initiative has opened up regions such as Central Asia, West Asia, the Middle East and North Africa and expanded potential markets for China.

-

Leading automation: About 70% of industrial robots are installed in China, promoting productivity advantages.

-

Domestic demand potential: Household savings growth has slowed to twice the nominal GDP growth rate, but savings have increased by $10 trillion since 2020, and these savings are expected to flow into consumer and stock markets in the medium term.

Sino-US trade issues may bring positive surprises, trade and markets are not so closely related

According to CCTV News, US President Trump signed an executive order on February 1, imposing a 10% tariff on goods imported from China. However, Deutsche Bank believes that the actual situation may be more favorable than expected. The Trump administration seems to value tactical victories more than adhering to ideological positions that are difficult to gain support.

The launch of DeepSeek shook the world’s belief that China can be contained. A better approach may be to stimulate business by reducing regulations, providing cheap energy and relatively low barriers to imported intermediate goods. It is expected that a more trade-oriented stance will eventually become part of the developing U.S. priority agenda ahead of the midterm elections.

Deutsche Bank analysts believe that a fast-concluded Sino-US trade agreement may involve limited tariffs, the removal of some current restrictions, and large contracts between U.S. and China companies. If this happens, China’s stock market is expected to rise.

Falling exports may actually push stocks higher for some time. China’s dominance in various industries is achieved through excessive investment in many areas. If supply can be restricted, it could be beneficial to stocks and free up some capital for domestic consumption.

Overall, Deutsche Bank believes that as China companies continue to consolidate their dominant position on a global scale, investors may need to quickly adjust their strategies and increase their allocation to the China market. It is expected that the Hong Kong/China stock market will continue to lead the global market in the medium term, continuing its strong performance in 2024.

We believe that global investors tend to significantly undervalue China, just as they avoided fossil fuels a few years ago, until the market punished those who made non-market decisions. We see that today’s fund’s positions in China are similar. Investors who like leading companies and have moats cannot ignore that it is now China companies that have broad and deep moats, not Western companies.

As China companies continue to consolidate their global dominance, it seems that the China story valuation discount should eventually turn into a premium. We believe investors will have to move quickly to China in the medium term and it will be difficult to get access to China stocks without pushing up stock prices. We have been bullish before, but are troubled by finding what factors will cause the world to wake up and buy, and we believe China’s Sputnik moment (or dominance in the electric vehicle space) is this factor.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern