Wen| Fixed focus One (dingjiaone),author| Jin Yufan, Editor| Wei Jia

The price war on rims will start again in 2025, and the intensity will increase.

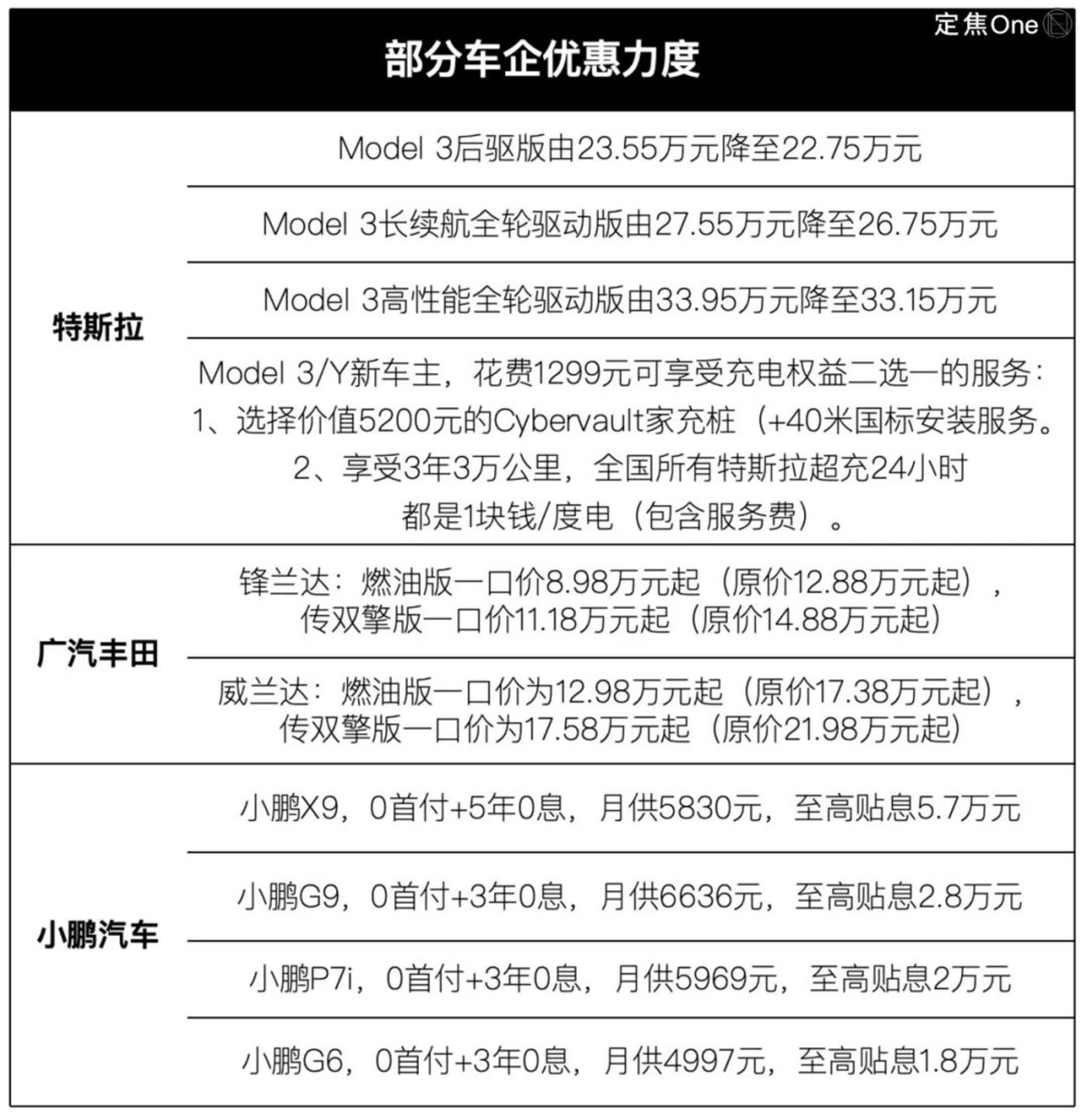

On February 5, the first working day of the Year of the Snake, Tesla took the lead in lowering prices, followed by GAC Toyota and Xiaopeng Motors.

Tesla Model 3 models have launched the largest discount combination in history, with a time-limited insurance subsidy of 8000 yuan + a five-year zero-interest policy + exclusive charging rights. The Tesla Model 3 in China is the cheapest in the global market, starting at 227,500 yuan. Under the five-year zero-interest car purchase plan, car owners can save more than 20,000 yuan in interest. The down payment for the Model 3 rear-drive version is reduced to 79,900 yuan, and the monthly supply is only 2460 yuan.

On the same day, GAC Toyota announced a price gain event. The prices of the two major SUVs, Fenglanda and Weilanda, were reduced. Fenglanda was less than 90,000 and Weilanda was less than 130,000.

Xiaopeng Automobile also launched the industry’s first 0 down payment +5-year 0 interest car purchase discount on the same day, covering Xiaopeng X9, Xiaopeng G9, Xiaopeng P7i, and Xiaopeng G6 models. Xiaopeng MONA MO3 and Xiaopeng P7+, which sell well, are not included in this event.

The price war in the new year came earlier and more fierce than expected. Since January, more than 30 car companies have adopted different forms of price cuts, from New Year gift packages and subsidies to straight price reductions, 3/5 years 0 interest or even 0 down payment, etc.

Some practitioners predict that this round of price war will last until at least nine gold and ten silver.

In fact, the price war has been raging since 2023. It was originally thought that the prices of mainstream cars have basically hit bottom, but the continued price cuts in 2025 shows that car companies are determined to maintain the quantity. Some people believe that China’s new energy vehicle market will enter a decisive battle in 2025, and sales will be the biggest match point.

However, a long-term price war will trigger a series of chain reactions. It will be more difficult for leading car companies to make money. Weak brands will be forced to follow suit in price cuts. Profits and sales will be under greater pressure. Some car companies will also go bankrupt, be hit by thunder, or be integrated.

In addition to price competition, a price war on technology has also begun. Some organizations predict that BYD will popularize smart driving to 100,000 yuan models. ldquo; Decentralization of high-end smart driving is another big competition point in 2025.& rdquo; Some investors said to “Focus One”.

The 2025 price war is an upgraded version of 2024

How to view Tesla’s pre-emptive price cuts in this round?

Clearing inventory before new cars are launched is only part of the reason. On January 10, Tesla launched a new version of Model Y in China. The starting prices of the two configurations are 263,500 yuan and 303,500 yuan respectively. After the promotion in December last year, some old Model Y models sold for 239,900 yuan.

The core reason is that competition in China’s auto industry is too fierce, and Tesla relies on price advantages to maintain its market position.

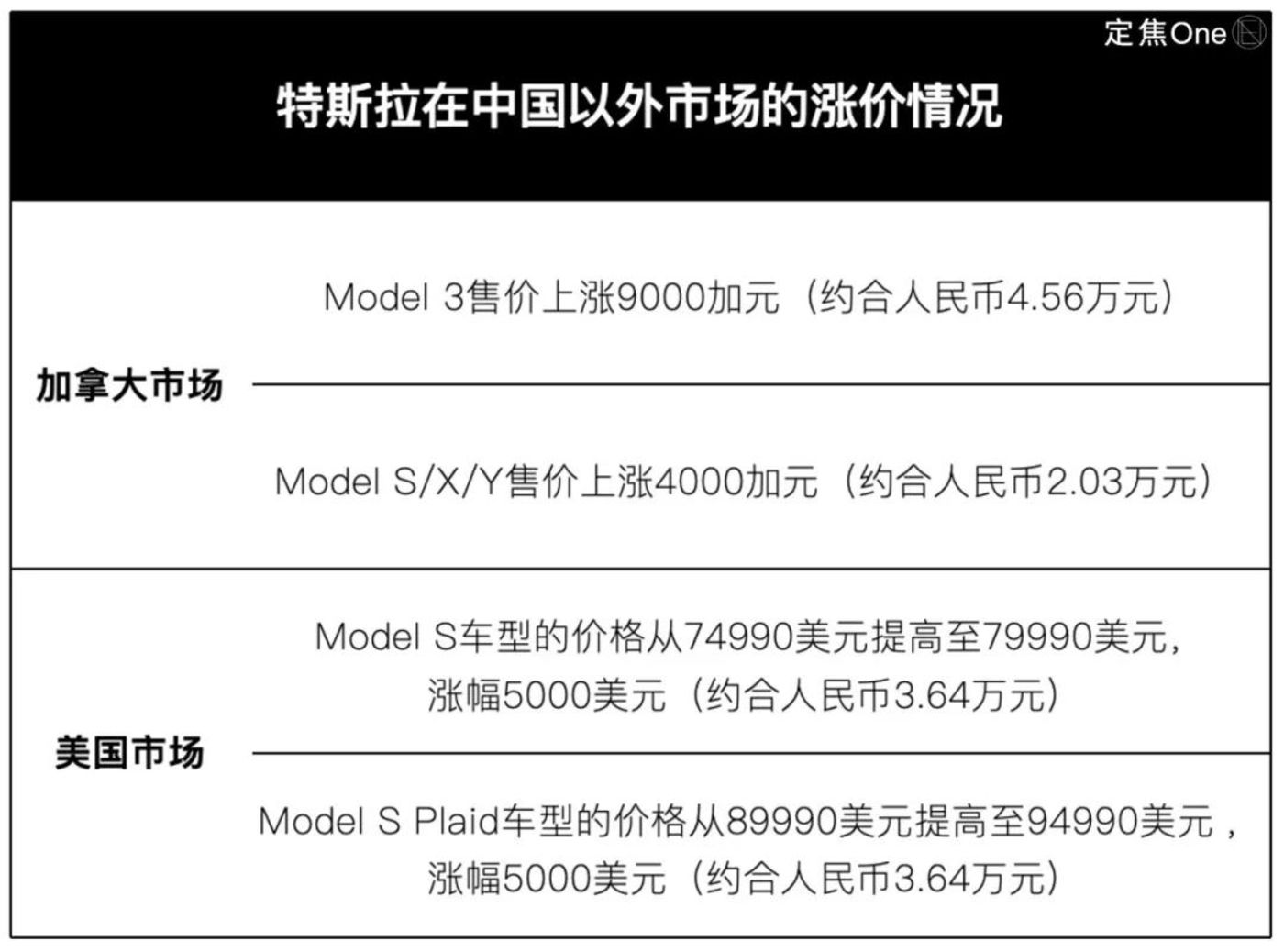

One example is that the current round of price cuts for Tesla’s Model 3 is targeted at the China market, while other markets around the world adopt a price increase strategy.

Leading companies took the initiative to launch price wars, while other car companies followed up passively.

After car companies sprinted sales targets in December last year and overdrew some demand in advance, sales of car companies declined in January this year due to the impact of the Spring Festival holiday. However, in order to maintain Q1 sales, leading companies cut prices to grab the market, and other car companies had to follow suit.

“If the leading companies do not start operations, the middle and tail companies will not sacrifice profits to follow up on price cuts.& rdquo; Feng Tao, a practitioner of the new force in car-building, said.

Since January this year, more than 30 car companies have implemented different forms of price cuts.

For example, NIO has launched a five-year zero-interest limited financial preferential policy; if you purchase a zero-run C10, you can enjoy a national subsidy of 20,000 yuan for scrapped old cars, there is also a cash discount of 15,000 yuan, as well as replacement gifts, financial gifts, etc.

Now, this round of price wars initiated by Tesla and followed by Xiaopeng and others has escalated to large insurance subsidies, one-price, zero down payment, etc. It can be seen that car companies want to further lower the threshold for consumers to purchase cars.

The price war on rims has been going on for two years, and how long it will last is a matter of concern to users, car companies and supply chains.

Wang Zheng, a practitioner in the new energy automobile industry, said that this round of price cuts is not just a response for car companies during the off-season sales season. It is expected to last until the gold 9th and silver 10th. If the peak season is ushered in, the price war will be significantly alleviated. If the peak season is not prosperous, it may last throughout the year.

The intensity of the price war mainly depends on leading companies, such as Tesla and BYD.

Some car companies believe that the decisive battle in the domestic new energy vehicle market will be in 2025. Feng Tao said that the price war will continue before leading companies achieve their goals. Not only the leading companies cut prices to grab the market, but even the leading companies have to fight hard, so the cruelty of this year’s price war is an upgraded version of the past two years.

The first round of price wars began in early 2023. At that time, the background was that the national subsidy for new energy was cancelled, and some car companies (BYD, Zero Racing, etc.) raised prices slightly. However, Tesla announced price cuts. The price cuts of the two main models, the Model 3 and Model Y, ranged from 20,000 to 48,000 yuan., and the price cuts were global.

The curtain of the price war on rims was thus opened. NIO, BYD, Wenjie, Xiaopeng, SAIC Volkswagen, etc. have followed up on price cuts. Coupled with the increase in land subsidy policies, the price war has spread to the fuel vehicle market.

Throughout 2023, more than 40 brands will directly cut prices or join the price war through cash-in subsidies. Data shows that the average terminal sales price of new energy vehicles and fuel vehicles dropped by 14.8% and 13.3% respectively during the year.

By 2024, BYD will take the lead in the price war, with Geely, Chang ‘an, SAIC and other independent brands following suit. The climax of price cuts by the new forces occurred in April, with Wenjie, Xiaopeng, Tesla and Ideal cutting prices one after another. At the end of May, fuel vehicle joint venture brands (Porsche and BMW) cut prices.

The scale of price cuts in 2024 is larger than in 2023. According to statistics from the Passenger Car Market Information Joint Branch of China Automobile Dealers Association, a total of 195 cars were reduced in price from January to November 2024, which exceeded the 150 models in 2023 and significantly exceeded the 95 models in 2022.

Entering 2025, the car trade-in policy will be confirmed on January 17, but car companies are still reducing prices and promoting sales. In Wang Zheng’s view, exchanging price for volume is no longer a short-term promotion method for car companies, but a medium-and long-term strategy. ldquo; The market is limited, and all car companies want to grow, so the price war is difficult to stop.” rdquo;

Making money is more difficult, elimination continues

The impact of the price war on car rims is a series. At this stage, it will stimulate the recovery of car purchase demand after the Spring Festival, but there are two major risks for car companies.

First, profitability is challenged.

If it is only a short-term price war, car companies can also reduce costs through scale and supply chain optimization. However, as the price reduction cycle lengthens and the magnitude becomes larger, the room for cost reduction becomes smaller, which will inevitably compress profits.

Data from China Association of Automobile Manufacturers shows that after the price war in the automobile market started in 2023, the profit margin of my country’s automobile industry was only 5%, the lowest level since 2014, and fell to 4.3% in 2024, compared with only 4.1% in December, lower than the average profit margin of the entire industrial enterprise of 5%.

Profitability of new energy vehicles is an industry problem. Currently, only three companies have achieved annual profits: Tesla, BYD and Ideal Automobile. The price war is now in force, and it has become difficult for even the big brothers to make money.

As the global leader in pure electric cars, Tesla sold 480,000 more vehicles in 2024 than in 2022, and its net profit was less than 60% of that at that time.

Gross profit margin is an important indicator to measure the ability of a new energy vehicle company to achieve sustainable self-production. Li Xiang, founder of Ideal Automobile, believes that maintaining a gross profit margin above 20% is healthy, which means that companies can invest in R & D, infrastructure and sales services for a long time.

After 2023, the gross profit margin of Tesla’s automotive sales business has remained below 20%, and from 2022 to 2024 it will be 25.6%, 16.4%, and 13.2% respectively. In Q4 of 2024, even though Tesla lowered its bicycle sales cost (less than US$35,000, or approximately RMB 256,000) to an all-time low, the gross profit margin still dropped to 10.5%.

BYD, China’s leader in electric vehicles, may also be affected. China Merchants Bank predicted in its research report that BYD’s gross profit margin in Q4 in 2024 will drop to 20.6% month-on-month.

In addition, the above-mentioned research report predicts that in 2024Q4, NIO’s overall gross profit margin will fall to 10.4% month-on-month, and the net loss will expand to 5.5 billion yuan month-on-month; Xiaopeng’s gross profit margin will fall to 14%; Wei Xiaoli, only Ideal In 2024Q4, due to the increase in the proportion of medium and high-end models, the gross profit margin will slightly improve to 21.7%, which is higher than other players.

Zero-running forecast that 2024Q4 will achieve single-quarter profit for the first time. China Merchants Bank predicts that its gross profit margin will improve to 13.8%, close to Xiaopeng.

For new forces, 2025 is a critical window period. The price war continues. Maintaining sales and share is the first priority. Improving gross profit margins and accelerating breakeven are equally important. For example, Xiaopeng calls for breakeven in 2025, and zero-running is expected to achieve profit in the second half of 2025.

Different from the price war in 2023, which is concentrated between the two camps of new energy vehicles and fuel vehicles, in late 2024, it has transitioned into the domestic new energy vehicle industry. Another risk to car companies in this round of price wars is that there will be car companies going bankrupt and thunder.

Following the bankruptcy and reorganization of Weimar and the explosion of Gaohe Automobile, in the last month of 2024, Geyue Automobile, which owns two major shareholders of Baidu and Geely, collapsed. On January 10, 2025, GAC Group confirmed the rumor that Hechuang Automobile had closed down.

There are many factors involved in these car companies ‘failure, and sluggish sales are the common reason.

The logic of the price war is that in order to grab shares or digest inventory, the leading brand lowers prices, forcing other rivals to follow suit and reduce prices, form inventory, and break its capital chain. Generally speaking, head brands have higher certainty in sales due to their higher popularity and price advantages. Weak brands were forced into price wars, putting pressure on profits because of backward technology, poor brand power, sluggish sales, and finally eliminated due to financing and operating difficulties.

From another perspective, this is also the survival of the fittest in the new energy vehicle industry.

The results of the two rounds of price wars in 2017 and 2019 were: the share of Korean, French, and American brands dropped by 5%, and independent brands gave up 5% of their share, and German and Japanese brands divided up 10% of the market.

When Wang Zheng speculated that the current round of price wars, he said that market share will be concentrated in leading independent brands and new forces in car-building. The share of second-and third-tier brands will decline for a long time. In the end, 3 to 5 companies will win, and long-term profitability will be improved. The elimination of some second-and third-tier brands will end. Those who are eliminated or integrated are players with duplicate brand positioning, backward technology, and small sales. Their elimination can reduce internal friction in the industry.

Decentralization of smart driving, another price war

Price competition continues to be stagnant, and companies with technological advantages are using another method to decentralize high-end smart driving to affordable models. This can be seen as another form of price war.

“Smart driving is not a core consideration for consumers to purchase cars at this stage, because the experience of smart driving is generally average.& rdquo; Li Xu, an investor in the field of new energy vehicles, had previously reached this conclusion through field research.

However, when returning home during the Spring Festival of the Year of the Snake, many people feel that low-tier market people have significantly enhanced their perception of new energy vehicles. Smart driving no longer stays in the science and technology exhibition halls of Beijing, Shanghai, Guangzhou and Shenzhen, and is already a consumer in third-and fourth-tier cities. choice.

In 2025, smart driving clubs will become a necessity.

One of the reasons is that the smart driving experience is better.

Due to the rapid development of AI models, high-end smart driving, also known as urban NOAs, is accelerating its popularity. Urban NOA (full urban scenario, end-to-end intelligent driving, close to L3 level) is one level higher than high-speed NOA (refers to intelligent driving in high-speed, urban elevated, fast loop and other scenarios, L2 level). At this stage, urban NOA is called high-level intelligent driving.

Li Xu said that in theory, a vehicle can travel from the starting point to the destination. Note that it is theoretically possible. The actual feeling of smart driving is getting better and better. For example, if a large vehicle approaches, it will dodge, slow down before turning, and the car in front can slow down linearly when it inserts in.

Many car owners told “Fixed Focus One” that smart driving is usually used in scenarios such as high speed driving, long distance driving, severe traffic jams in the Urban area, and automatic parking. If necessary, hands and feet can be temporarily released, but the system occasionally admits mistakes or hesitates, and the overall experience is satisfactory.

The more core reason is that high-end smart driving is not so expensive and is being relegated to affordable models.

Previously, high-end smart driving was mainly used in high-end models with more than 300,000 yuan, but it will be popularized in models with less than 200,000 yuan. Li Xu told “Fixed Focus One” that the price of models equipped with high-end smart driving will drop to 130,000 – 150,000 yuan.

He added that leading car companies are decentralizing the basic version of smart driving without lidar to a 100,000-class model and plan to spread it to the sinking market.

BYD executives revealed last year that mid-to-low-end models will be equipped with high-end smart driving within two years.

Intelligent driving is recognized as the core of the next level of competition for new energy vehicles and the key to reshaping the industry landscape.

New energy vehicle sales in the domestic market in the past six months have revealed this trend. For example, Huawei’s Hongmeng Zhixing has the ability to suppress traditional luxury brands due to its leading smart driving technology and its premium ability to suppress traditional luxury brands, ranking first among China’s new forces in 2024 with annual sales of more than 300,000 units (445,000 vehicles).

Li Xu said that compared with the power of traditional fuel vehicles, domestic car companies are leading in intelligent technology, and smart driving clubs are the key to helping domestic car companies squeeze out joint ventures. But compared with Tesla, there is still a big gap between domestic car companies.

Tesla FSD (Full Self-Driving, which is Tesla’s high-end autonomous driving based on Autopilot) is currently only implemented in North America. It plans to enter the China market in Q1 in 2025, putting a lot of pressure on domestic car companies. Previous experience is that with the major upgrade of Tesla’s FSD version, sales of Model Y models in the United States will increase step by step.

The strength of intelligent driving technology of car companies mainly depends on four aspects: computing power (including in-vehicle computing power and cloud computing power), basic software, algorithms, and data. Guangfa Securities Research Report divides automobile companies into three echelons according to the level of intelligence:

The representative of the first echelon is Tesla, which integrates self-research on chips, algorithms, etc., with better adaptability, smoother systems, easier R & D to form a positive cycle, and more advanced profitability. Ideal and Xiaopeng are also developing in the direction of integrated self-research.

The second echelon includes Wei Xiaoli, Geely, Changcheng, Chang ‘an, etc. at this stage. Generally, it is self-developed algorithm (or developed in cooperation with suppliers under the leadership of car companies) and externally acquired in-vehicle chip solutions, which mainly earns the hardware profits and software profits of the car.

Car companies in the third echelon and below have weak self-research capabilities and need to rely on external system solutions. The typical representative is Huawei’s intelligent solutions. Such car manufacturers mainly earn hardware profits and also participate in a small amount of software sharing.

The spiraling escalation of price wars and technology wars is essentially the reshaping of the automobile circle and the redistribution of benefits. It is inevitable that new energy vehicles will replace fuel vehicles, and traditional joint venture car companies will encounter challenges and the rise of domestic brand shares. As for how to divide the internal shares of domestic brands and how to rank seats, 2025 is a key window period.

Li Xu concluded that for new car-building forces, large-scale car sales, stable profits, and affordable smart driving are the three main tasks this year.

* At the request of interviewees, Feng Tao, Wang Zheng and Li Xu were used as aliases in the article.