In 2025, AI applications will usher in an explosion year.

Author: Liu Xuenan, Zhongcheng Net

The explosion of DeepSeek is enough to go down in history. Many years later, people think back on this moment. The conclusion may be that since OpenAI released ChaGPT at the end of 2022, the mainstream narrative of AI development in China has always been catch-up, and DeepSeek was born, turning catch-up into innovation and popularization, and even reshaping and transcending.

However, VCs are obviously frustrated, because none of the big model entrepreneurial projects they support, including the big model six dragons, have reached the global popularity of DeepSeek. Kimi’s new reinforced learning model k1.5, released almost at the same time as DeepSeek. Although it is the world’s first multimodal o1 model after OpenAI, its capabilities are close to or even surpass o1 in many levels, it has not made much splash and has also been drowned in DeepSeek’s fanatical public opinion.

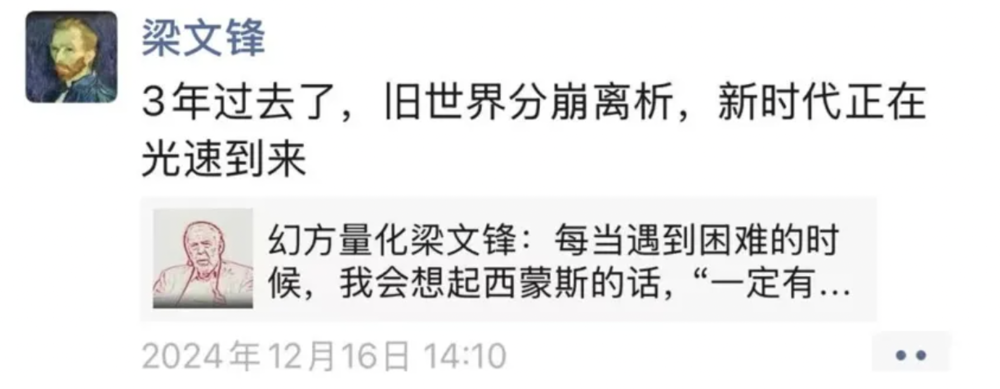

It may start with DeepSeek founder Liang Wenfeng appearing on the news broadcast and becoming a guest of the Prime Minister. What he said at this meeting may not be the most important thing. What public opinion is concerned about is why a post-80s generation with long bangs suddenly attracted the attention of high-level officials? Look at your circle of friends, huh? Doing quantitative funds. More curious.

As a first-level market observer who has been tracking the AI industry for a long time, the fermentation speed of public opinion is lower than I expected, but the extent is far beyond my imagination. On Sunday evening, January 20, Liang Wenfeng appeared on the news broadcast and lasted for a whole week. The $5.5 million training cost of DeepSeek R1, which subverted the world’s DeepSeek R1, only caused Nvidia’s share price to drop 3.12% on Friday. Turning around next Monday, it allowed the A-share GEM to gain a negative line of-2.73%. My evaluation at the time was that DeepSeek slapped Nvidia in the mouth, but turned around and kicked the A shares even harder.

The slap came quickly. On January 27, Nvidia opened low and fell by nearly 17%. The world’s computing power wailed, shouting that the wolf is coming, DeepSeek is the wolf. Of course, my personal honor and disgrace are nothing, and slapping my face in the face is also a common occurrence. However, China VCs have almost become the biggest victim in addition to AI computing power. Public opinion generously praised Liang Wenfeng and his idealism to the greatest extent, and also imposed extreme humiliation and crusade on China VCs. For example, a post in Xiaohongshu titled DeepSeek once again proves that China VCs are a joke. What’s even more unfortunate is that there are still more than a thousand likes.

But I still want to say clearly that the moral crusade is very low-level. At this stage, the discussion of why VC didn’t vote for DeepSeek is not of much significance except for emotional catharsis. If you didn’t vote, you didn’t vote. Any objective or subjective reasons are like excuses. Although further reflection is necessary, it is not immediate. Looking at the domestic primary market, from LP to GP, to all aspects of fundraising, investment, management and withdrawal, a large number of stubborn diseases are difficult to eradicate in a short time, and many of them are not VC/PE at all. It is up to them to decide.

I think what needs to be discussed urgently is the present and the future, including at least three issues: Can DeepSeek invest now and how much will it be valued? What impact does DeepSeek have on the various AI projects it has invested in before? What positive guidance does the AI industry change triggered by DeepSeek have for VC’s next step in AI capital deployment?

1. DeepSeek financing? Liang Wenfeng performs Tai Chi”

There has been a lot of news out in the past two days about how much DeepSeek is valued and whether it can be invested. Just yesterday night, it was reported that Ali would be valued at US$10 billion and invest US$1 billion to account for 10% of the shares. In response, Ali Vice President Yan Qiao quickly refuted the rumor through his circle of friends, saying that the information circulated by the outside world that Ali had invested in DeepSeek was false news. However, an investor who may be close to the deal told China Investment Network that“It is more sensitive now, and it is not convenient for them to say that they will wait any longer. Therefore, it cannot be ruled out that there may be some variables in this denied transaction.

Before that, there wereAn AI investor told China Investment Network that DeepSeek is in contact with investors and the valuation he disclosed is US$8 billion.There is a gap between the false news that Ali gave a valuation of US$10 billion. Whether it is US$8 billion or US$10 billion, DeepSeek’s valuation currently far exceeds the highest MiniMax among the six big models, by US$4 billion.

According to China Investment Network, many investors have directly or indirectly approached Liang Wenfeng in the past few days to confirm whether to formally start financing. The valuation has also roughly centered around the above range. However, Liang Wenfeng did not give a positive response of admission or denial. Instead, he mainly played Tai Chi. There are also many investors who have approached DeepSeek’s relevant person in charge of IR to inquire whether financing is being carried out, and as of yesterday, they have received denials.

Another layer of information is thatSomeone within DeepSeek has also advised Liang Wenfeng many times whether DeepSeek should raise funds. This means at least two points. First, DeepSeek’s internal opinions may not be unified on whether to carry out financing, but the decision must rest with Liang Wenfeng, who is the only one holding the key to the treasure; second, Liang Wenfeng is likely to have had contact with some investors or industrial capital in the near future, but it remains in a very small circle.

For example, President Zhu, who has scoffed at investing in big models many times, is definitely not in this circle. Even if DeepSeek asked him to change his attitude towards big models and said that I would definitely invest, Investment Network asked him if he had heard about DeepSeek’s financing. When he got no reply. But President Zhu is President Zhu after all, and he is very accurate about whether VC should participate in DeepSeek financing. This price is no longer very important. The key is to participate in it.

Anyway, in short, VC now has high expectations for DeepSeek’s financing. Many investors described the necessity of DeepSeek’s financing to China Investment Network from the perspective of C-side traffic acceptance, surge bandwidth and computing power costs, continued scaling up in the future, and most importantly, retaining talents. From the perspective of maintaining continuous innovation capabilities, he described the need for DeepSeek’s financing to China Investment Network.

Of course, it’s the same saying,The key lies only in the hands of Liang Wenfeng and the people who can decide whether DeepSeek can move towards greater narrative possibilities.What followed was a matter of time. But personally, I would like to see if DeepSeek can persist for a while longer. On the one hand, the longer the time, the more exciting the game will be; on the other hand, as an investor said in a circle of friends,“If DeepSeek can maintain the purity of private company to build public good, this beauty will be scarce.& rdquo;

2. No matter what, you must kneel in and take some shares”

DeepSeek’s exit around the Spring Festival has complicated feelings for big model investors. The surprise is that China’s big model companies can catch up with the world so quickly. The panic is that the logic of the entire AI investment may undergo huge changes.

“At least domestically, DeepSeek has won the war.Its ongoing round of financing has reached US$8 billion, the highest valuation in the industry. It has to be rushed or can only be targeted.” rdquo; An AI investor told me.

DeepSeek has not been open to financing before, and the initial funds are quantitatively supported by magic squares. According to Liang Wenfeng’s statement in the interview, he also tried to find management, but because his idea of focusing on research was inconsistent with VC’s desire to consider more commercialization, he gave up. In sharp contrast, DeepSeek began to be surrounded by investors after the explosion.

The edge has been exposed, and even if you want to hide it with a good sword, it is still difficult. In the eyes of the above-mentioned investors, financing is now forced by the situation and is a last resort.” ldquo; Now that DAU has soared to 20 million, traffic is coming so quickly that it is obviously impossible to withstand it. If DeepSeek just develops models and doesn’t make applications, it’s fine. But after making applications, it now costs hundreds or even tens of millions of dollars to go out every day. Issues such as servers and network resources must be considered. In addition, I have already cleared the single point, and now I have to scale up, which also costs money.” rdquo;

However, this news was not recognized by the parties. Faced with investors who came to inquire recently, the statement given by DeepSeek’s financing director was still that there were no plans to raise funds. Last night, Alibaba planned to invest US$1 billion to subscribe for a 10% stake in DeepSeek at a valuation of US$10 billion and was also explicitly denied by Alibaba’s vice president. This did not prevent Alibaba’s U.S. stocks from rising above 6% before the market.

State-owned assets and large factories that can invest billions at a time are considered to be the most likely candidates to join the DeepSeek Financing Bureau. Some interesting details are that Huijin International Building, where Magic Square’s Hangzhou headquarters is located, is located in the same office building as Zhejiang Province Financial Holding Co., Ltd. is currently crowded with reporters and investors. Rongke Building, where DeepSeek’s Beijing office is located, is located on the same floor as Baidu Investment.

An investor in provincial-level state-owned assets told China Investment Network that recently, their institutions have been in contact with DeepSeek from top to bottom, and they hope to kneel down a portion of their shares in it anyway., but DeepSeek was biting and insisted that there was no financing window open at present.

In fact, to people in the AI community, DeepSeek is not a mystery. The legend of hoarding 10,000 A100s during the epidemic is very widespread. What I learned from investors is that in early 2023, DeepSeek had talked about large model companies and investment institutions, including Mao Wenchao, the founder of Xiaohongshu. However, in January this year, DeepSeek and Xiaohongshu reached a cooperation. Currently, DeepSeek only has Xiaohongshu, X, and Weixin Official Accounts on official social media. Obviously, Liang Wenfeng has some preference for Xiao Hongshu.

Just like Liang Wenfeng said, after the chat, Liang Wenfeng and the VCs found that their goals were inconsistent. ldquo; VCs all manage money for LPs and have to make money, so they can’t talk about it.” rdquo; In July 2023, Liang Wenfeng established Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd., focusing on general artificial intelligence and large model development. Coincidentally, it was at that time that Byte began to invest in AI research and development.

Another detail is that around 2022, quantitative funds will continue to be suppressed by policies, and the scale of magic square management will continue to shrink. andBefore founding DeepSeek, Liang Wenfeng had not only come into contact with VCs, but because he held a large number of GPU computing power clusters and Liang Wenfeng’s own money, he wanted to use his rich computing power through investing in shares and cooperating with cloud vendors.”, and also recruited two people to specialize in fighting for this purpose, I read a large number of scientific and technological projects, including low-altitude, but the magic square concluded that what can be done outside, I can also do it myself. Most of the projects are of little significance, and in the end, I did not invest in any of them. Later, based on Liang Wenfeng’s technical idealism, DeepSeek came into being.

The big model market is changing rapidly, and DeepSeek will soon become a catfish stirring the market.& ldquo; When I go to various AI projects, I basically ask the other party which bases they are using and which models they think are better. By 2024, everyone’s general feedback will be Tongyi, Doubao and DeepSeek.” rdquo; Eric (pseudonym), a partner at an investment firm, told me.

DeepSeek’s popularity at the public level comes from two models. On January 13, DeepSeek launched an App version using the V3 model, a fully open source MoE (Hybrid Expert) model. DeepSeek reports that the training cost of its V3 model is only $6 million, which is only 1% of the cost of Llama 3. On January 20, DeepSeek released the open source model R1, which achieved performance similar to OpenAI’s latest O1 model at extremely low training costs. A day later, DeepSeek topped the list of free downloads on Apple’s Central and American App Store.

“No one could have expected DeepSeek to be so popular. When V3 was released, the industry noticed it, but because the App was not online at that time, the C-terminal had not yet been detonated. When the app was released, ordinary people felt that the product worked well, and DeepSeek began to appear in the street talk. The difference between natural traffic and purchased traffic becomes apparent at this time. rdquo; said Jared (pseudonym), a partner at an institution.

The popularity of any product is inseparable from the right time, place and people, and timing is important. In Eric’s view, the current AI rising curve has slowed down, the pre-training data has almost been used up, and the ability of large language models is no longer easy to increase. He can only switch his thinking to reasoning models represented by OpenAI’s O1 and DeepSeek’s R1.& ldquo; At this time, should we continue to spend a lot of money to fight for a cap, or should we not pursue the 5% improvement but reduce the cost to 1/10 of the original? The cost reduction route represented by DeepSeek appears at an appropriate time point.& rdquo;

3. If the six dragons do not take the path of differentiation, it will be difficult to get money again

“The comprehensive cost (data, labor, electricity and computing power) of domestic large-scale model training is lower than that of the United States, and DeepSeek controls costs to the extreme because of its excellent engineering capabilities. In the next two quarters, DeepSeek will become the industry benchmark, and cost reduction is the general trend. If you spend another 10 times as much money in order to increase the 5% cap, it is not worth it from a capital and business perspective. rdquo; Jared believes.

In the past, large models burned money fiercely and reduced R & D costs. The first thing that wavered was the valuation logic of these companies.

Eric believes thatThe reason why DeepSeek has caused such high panic overseas is precisely because the valuations of large companies are about to be re-evaluated.“In the past, everyone believed that the big model was essentially a competition for capital. Just as we said that if we did not get US$100 million before May 2023, we should not develop a big model in China. But when people find out that they don’t need that much money, the valuation of big model companies may not be able to hold on. In the long run, valuations are based on the value you create. In the short run, it depends on how high your barriers are. rdquo;

Wang Rongjin believes that it is hard to say whether the emergence of DeepSeek will affect the valuation of existing large model companies, but their extremely low costs will still have an impact on the industry. If large model companies can innovate in other ways to reduce training or reasoning costs, the impact on valuations may be limited. ldquo; It does not rule out that domestic companies can innovate through other methods to achieve similar results. This is also worth looking forward to.” rdquo;

Jared’s attitude is more pessimistic. He believes that if the six little dragons do not follow the path of differentiation, it will be difficult to find money again. Big factories have capital support and can continue to fight, but if a startup company fails to top in a single project, it will basically not make much sense. ldquo; Of course, as long as there is differentiation and no burning money, living is also a way out.” rdquo;

In fact, the six little dragons have split into different paths. Some companies are still burning money to train large models. For example, I learned that a company had revenue of about 300 million yuan last year, but its cost was as high as more than 2 billion yuan. Some companies have given up. For example, One Everything has established a joint laboratory for industrial models with Alibaba Cloud. They no longer pursue training super models, but will continue to train faster and cheaper models with moderate parameters, and build them based on the latter. A profitable application.

“When pre-training results are no longer as good as open source models, every company should not be obsessed with pre-training. rdquo; In the interview with “Late”, Kai-Fu Lee said so. There are also companies that put more energy into multimodal, such as MiniMax. Other companies have turned to take root in vertical industries. For example, Baichuan’s focus has been on building a large medical model. Jared believes that whether the valuation of these large model companies will ultimately be restructured will depend on the results of commercialization. DeepSeek will also face the same commercialization problems if it raises funds.

4. Consensus and differences on DeepSeek

DeepSeek has been regarded by some as a symbol of national destiny, but whether it can dominate is still divided in the eyes of investors.

Jared believes that it is difficult for big manufacturers to make innovations like DeepSeek. The reason is that large factories have excessive resources, but no one will think about how to optimize costs to the extreme. At the same time, internal horse racing is serious, and it is more about distracting people than things. KPIs are often simplified to how many DAUs to achieve, a goal that can be achieved by buying traffic, which also makes it difficult for everyone to do technological innovation in a down-to-earth manner. People who are trained as hedge funds attach great importance to resources and costs, and are always thinking about how to engineer and innovate to reduce costs, which is different from the genes and skills of big factories.

But Eric believes that DeepSeek will rank first among those star startups for a long time, but it is hard to say that DeepSeek is better than Ali and Byte’s big models. Judging from the technical paradigm adopted, in theory OpenAI’s O1 paradigm The upper limit is higher than DeepSeek’s R1. ldquo; Whether we should save money or pursue a high ceiling is a matter of choice. In China, everyone is very capable, but the focus is different. Doubao and Tongyi have both made multimodal models. DeepSeek is more focused and only makes language models. Its most powerful part is still saving money.& rdquo;

During the Spring Festival, Wang Rongjin, founding partner of Xuanyuan Capital, has been looking for information to study the underlying logic of DeepSeek. In his view, DeepSeek has made many innovations in many aspects such as application, engineering, and architecture. As for the reference aspect of market discussions, he felt that it was nothing. OpenAI’s Transformer originated from Google, Apple’s iOS part referenced Fuji Xerox, and Microsoft’s GUI part referenced Fuji Xerox Alto. Everyone stood on the shoulders of giants. Take one step further.& rdquo;

The descriptions of foreign media are more interesting. Some media have likened the different paths between OpenAI and DeepSeek to the conflict between the wrong but romantic Royalists and the correct but offensive Roundhead Party in the 17th century British Civil War. The AI royalists pursue AGI at all costs, while the AI Roundhead Party focuses on more practical goals and solves specific problems as efficiently as possible. The latest overseas news about large-scale model financing is that Safe Superintelligenc, founded by Ilya Sutskever, is negotiating financing at a valuation of US$20 billion, which is still an expensive price.

There is still a cloud of fog that pervades the industry.& ldquo; For several consecutive years, the big model has made shocking new developments at the beginning of the year, and it is often out of touch with what happens at the beginning of the year and what happens later, so no one can predict what will happen at the end of the year.” rdquo;Jared said.

Eric believes that the post-training model represented by R1 has just begun,DeepSeek just proposed a fork in the middle. It is not yet known how it will turn out, but there is no doubt that the demand for entrepreneurship will increase sharply.In his view, the more important significance of DeepSeek is to bring a new kind of values. ldquo; Their goal is not to say how much money they make, but whether they can make valuable innovations. This value is worthy of consideration by China companies, especially large companies.” rdquo;

As Liang Wenfeng said in an interview, there will be more and more hard-core innovations in the future. When this society makes hard-core innovators successful, group ideas will change. We just need a bunch of facts and a process.& rdquo; In the past four decades, the wealth-making movements in real estate and the Internet have not been driven by bottom-level innovation. Only when people see that there is a certain relationship between rewards and efforts will speculation not become the biggest value in China’s business society.

“In 2025, AI applications will usher in an explosion year.& rdquo;

This is the most view I heard from investors and FA at the end of last year. Some investors even made it clear that 2025 will only look at AI applications.

After the Spring Festival, with DeepSeek’s popularity, investors and companies have stronger expectations for AI applications. But in addition to excitement, they could not hide the confusion in their eyes:I know that the opportunity is here, but I don’t see where the opportunity is?

It needs to be admitted that in the face of the changes brought by DeepSeek, most companies have not had time to make adjustments at the strategic level, but from the perspective of actions, they are all holding urgent meetings around DeepSeek. Some investors also said that meetings on DeepSeek were being held for two consecutive days after the construction started, and emergency arrangements had been made.

When it comes to DeepSeek, many people’s first impression is that it is cost-effective. The industry has not reached an agreement on the impact of this alone.

Sun Linjia, CEO of Traini, believes that excessive equality in technology is not necessarily a good thing, and it will lose the driving force for innovation. It now seems that 2025 is a year to switch from closed-source shells to open-source shells. The result may be that a bunch of homogeneous products appear and no way to make profits can be found. At present, there are not as many companies that can do Fine-tuning (big model fine-tuning) as imagined, and even fewer can continue to do it and innovate, lacking data and talents.” rdquo;

Of course, he also admitted that the smaller model and the improved economy will definitely have a positive impact on applications, but on the application side, technology is not the biggest constraint, but an understanding of the industry.

In fact, Prompt can now meet the needs of many applications, and it seems that it has not made any good products. If we have Android because iOS is closed, there are not many mobile phone brands. Software apps growing on Android did not kill iOS and its apps. Llama’s capabilities are also very powerful and can meet the needs of most applications, which is far from what we expected.

More people are still willing to see the positive side that DeepSeek brings to the application. For example, some investors pointed out that after DeepSeek comes out, application manufacturers only need to focus on the front-end interactive experience of the application itself, and at the same time polish it based on the scene. It’s fine, which saves a lot of investment at the basic level.

Ma Chunquan, founder and CEO of Hesi, pointed out that the development of AI is like the development of electricity, which will give rise to many application manufacturers. This is a basic ability. The emergence of DeepSeek turned the cost of this basic capability into the price of cabbage.

He further explained: Many places that were originally reluctant to use AI can now be explored and innovated, because the current consumption cost of AI in computing power is already a drop in the bucket compared to customer value or output results. For example, in the field of small ticket identification, we used to only dare to apply it in small batches, but now it has almost zero cost, so we can apply it unscrupulously.

It should be pointed out that when it comes to whether C-side applications or B-side applications are more popular among VCs, I got a unified answer from investors, that is, to B applications are more cost-effective for investment.

Even corporate insiders in the non-investment industry believe that DeepSeek related projects will be popular in the investment market this year, because in their view, the fully open source DeepSeek will accelerate the birth of many segmented scenario models.

First of all, B-end users are the most capable of paying, and all B-side applications still follow the original enterprise software thinking, which means that each field will have its own big model. This is due to differences in databases and knowledge bases between different fields.

But the problem now is that application manufacturers do not make models themselves and cannot see the needs and effects. More importantly, application entrepreneurship is different from large models. Investors will not give companies a lot of time and money to try and make mistakes.

Similarly, it is impossible to predict which scenarios will explode. It can only be said that the emergence of these segmented applications is accelerating.

Second, the cost is lower, what was previously only carried out in the laboratory can be applied to every corner. In other words, in many current scenarios that are not covered by AI, more manufacturers will use very low-cost AI to transform them.

In the view of Lu Jiaqing, senior partner of Guoke Jiahe, if special applications can emerge, they can start quickly. Especially for listed companies with application scenarios, it used to require hundreds of servers to build an industry application, but now only ten servers are needed, and the cost has dropped sharply.

Moreover, there will definitely be more and more AI applications, and will attract more attention in the market, because applications have not yet achieved real large-scale commercialization.

As for why they would not choose C-end products, this is because investors have a consensus that C-end applications will sooner or later be the world of big manufacturers, which has been followed before.

In addition to the application layer, the hardware layer at the bottom is also undergoing tremendous changes. For example, in order to withstand the flood of traffic brought by DeepSeek, idle computing centers previously built in various places have also been revitalized. Relevant practitioners said that these computing centers have now begun to generate benefits. DeepSeek itself has also benefited from the data center previously built in Zhejiang Province. Some investors close to DeepSeek said that since the explosion before the festival, Zhejiang has given DeepSeek many spare data centers to DeepSeek at low prices.

According to the feeling of a cloud service vendor, after the launch of DeepSeek R1, the number of user registrations has increased significantly. Within a day or two, the number of registrations has increased by an order of magnitude, about 10 to 20 times. These registered users are mainly divided into two categories. One is individual developers, who will verify some of their innovative ideas, and the other is corporate developers. These users want to combine AI with business. Innovative applications.

In this field, there are also some non-consensuses in the industry.

“The emergence of DeepSeek can overturn the logic of computing power in the short term, but in the long run, the vigorous development of AI and applications will inevitably lead to an increase in overall demand, and computing power is still valuable. Of course, it is still negative for domestic GPUs, because low-process chips can be used, there is no need for so many companies in the market, and only one or two companies will be available on the market in the future. It is also negative for other domestic large model companies.& rdquo; Lu Jiaqing made this judgment.

Another chip investor said: This is absolutely good for the chip industry. The core is that chips with relatively low computing power can be used to achieve good training results, which means that many chip manufacturers can obtain relevant orders. At the same time, the lower the training cost, the more conducive to the penetration of artificial intelligence in the application field. rdquo;

As an investment institution focusing on the smart car industry chain, Wang Rongjin will also pay attention to whether DeepSeek will have an impact on the smart driving landscape and whether it will cause other companies to quickly iterate and blaze a new path, thus leading to the valuation of relevant targets. Revaluation.

Regarding the changes and opportunities brought by DeepSeek, I believe that there is far more than the above discussion. More importantly, the rise of DeepSeek is not only a technological iteration, but also drives confidence in the most scarce thing in the country. I can’t help but think of the views of “A Brief History of Humanity” on telling stories and believing stories. For thousands of years, human society has developed upwards from the collapse of old narratives and the construction of new narratives. From an optimistic perspective, maybe DeepSeek is the turning point of China’s economy. Reuniting confidence at all levels.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern