Ethena successfully seized discount opportunities by shorting perpetual futures contracts, and last week’s agreement revenue exceeded $500,000.

Author: Ethena Labs Research

Compiled by: Shenchao TechFlow

abstract

-

The perpetual futures market experienced its largest liquidation event in history last week, while open interest fell to a new high.

-

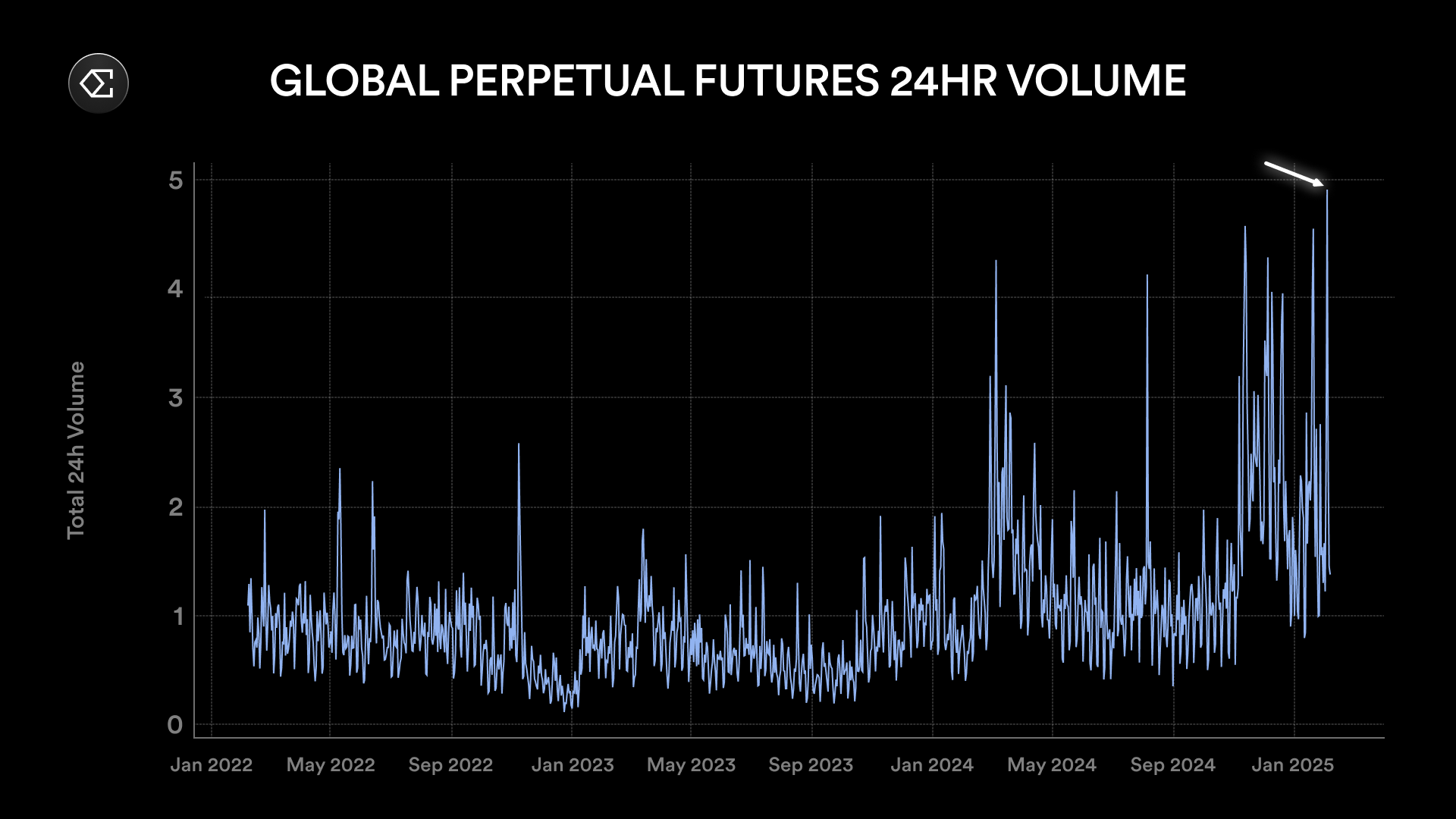

Within 24 hours, trading volume in the perpetual futures market reached an all-time high.

-

Open interest fell by approximately US$14 billion, basically in line with the estimated liquidation size of approximately US$10 billion.

-

Despite sharp market fluctuations, the USDe stablecoins performed steadily and were in line with other legal stablecoins.

-

During the sell-off period, perpetual futures contracts showed a discount of as much as 5.8% to the spot market.

-

Ethena successfully seized discount opportunities by shorting perpetual futures contracts, and last week’s agreement revenue exceeded $500,000.

-

Ethena automatically terminated underperforming contracts, helping return funding rates to positive values, and shifted more than US$1 billion in perpetual futures contracts to stablecoins with stable yields.

Historic liquidation event

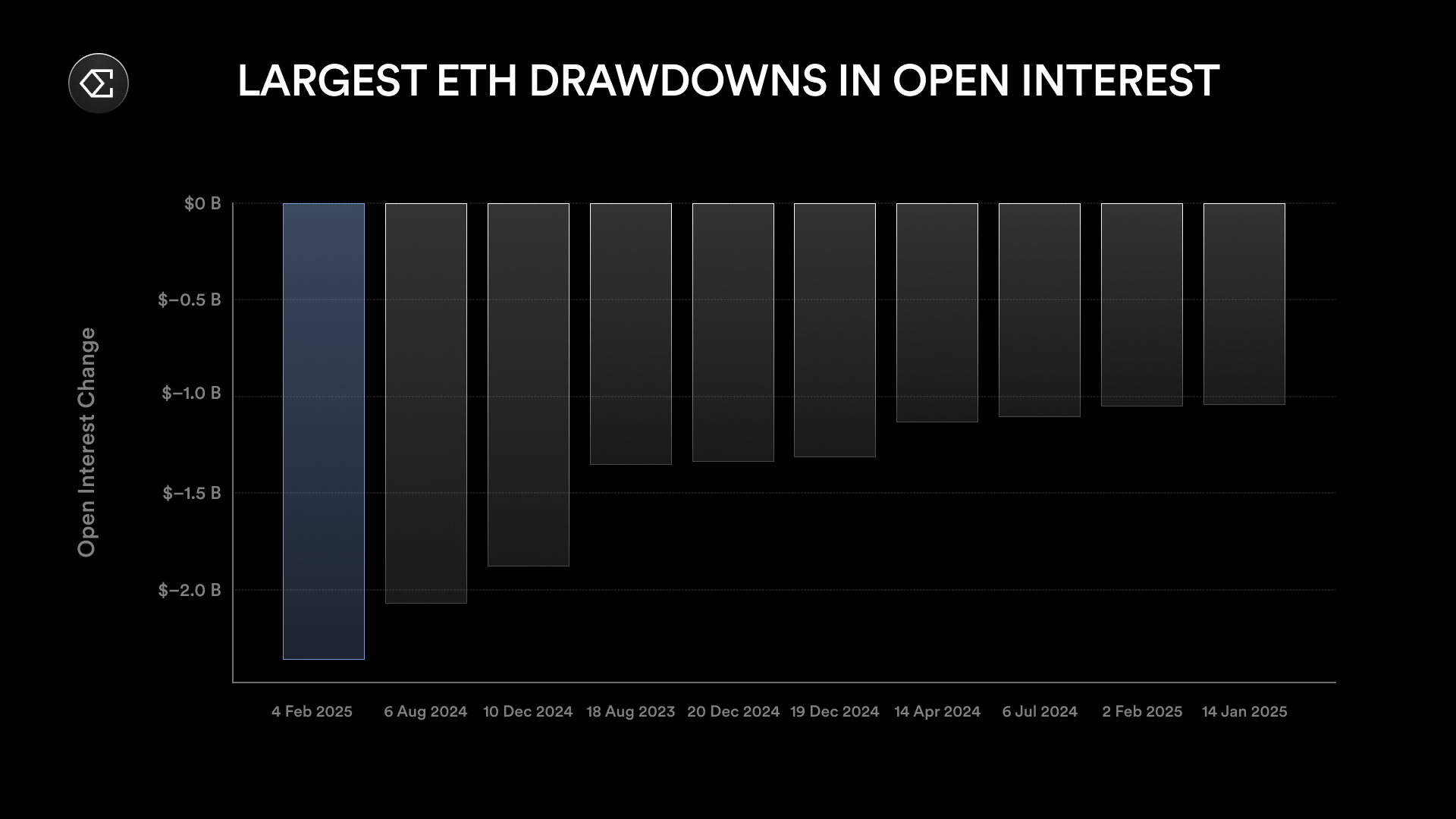

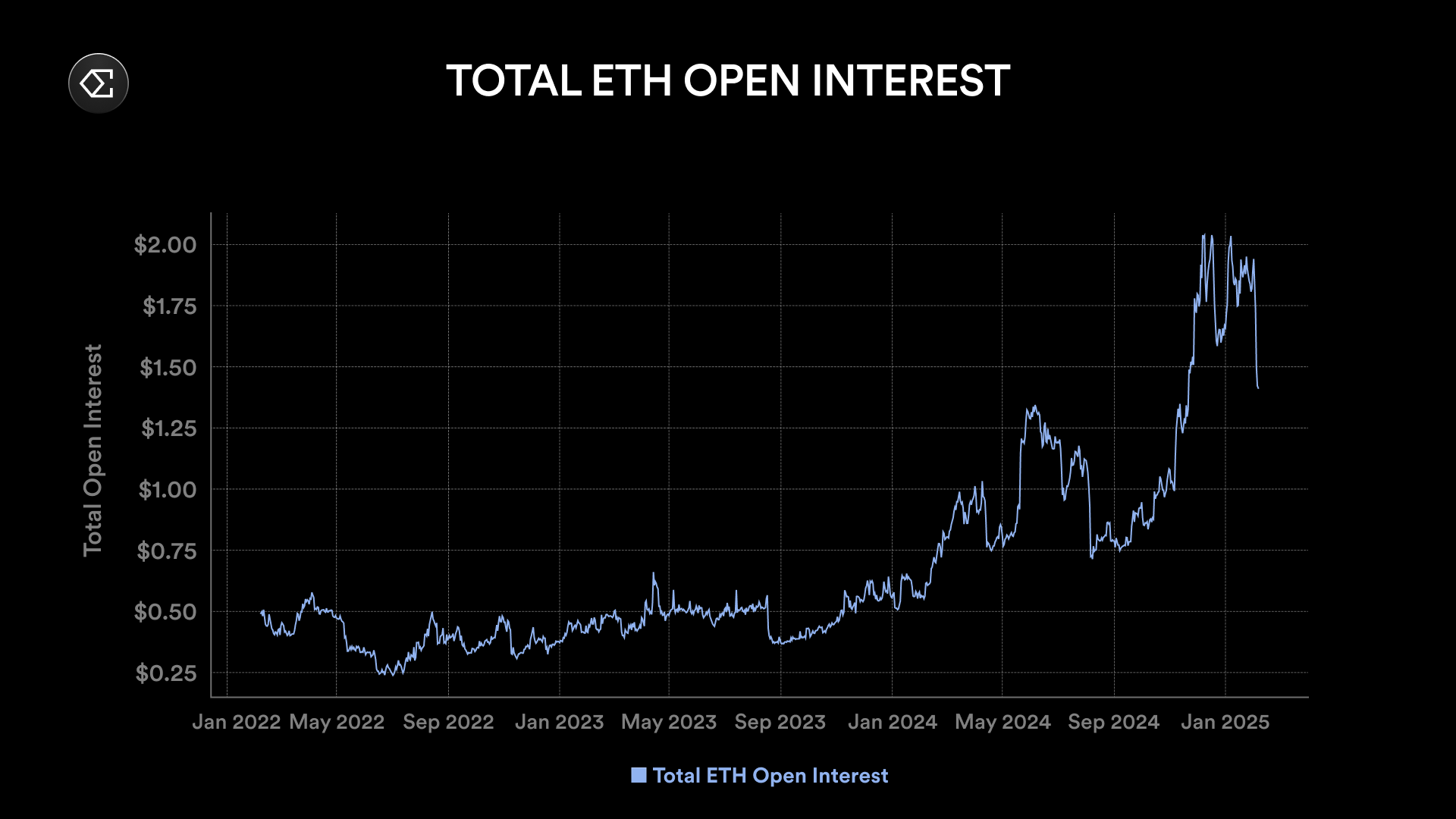

The perpetual futures market has experienced the largest liquidation event in history, with the ETH market having the most significant fluctuations. This is the ninth time since the launch of Ethena that ETH open interest has dropped by more than $1 billion, and the second time that ETH open interest has dropped by more than $2 billion. In just 24 hours, ETH open interest fell by US$2.3 billion, setting a record high in a single-day decline.

Chart: 24-hour decline in ETH open interest

In the past week, ETH open interest has dropped by more than US$5 billion in total, a drop of more than 25%.

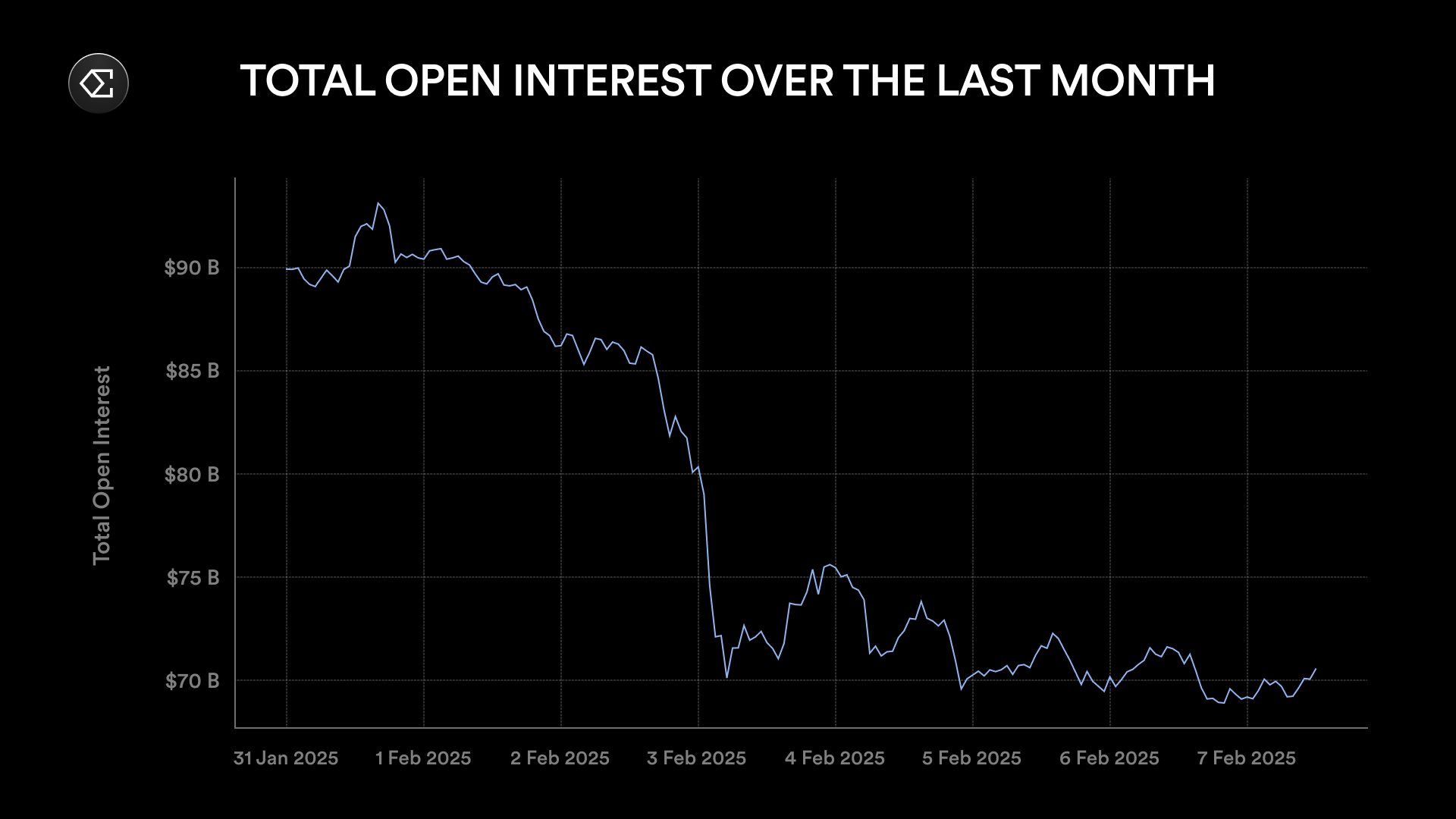

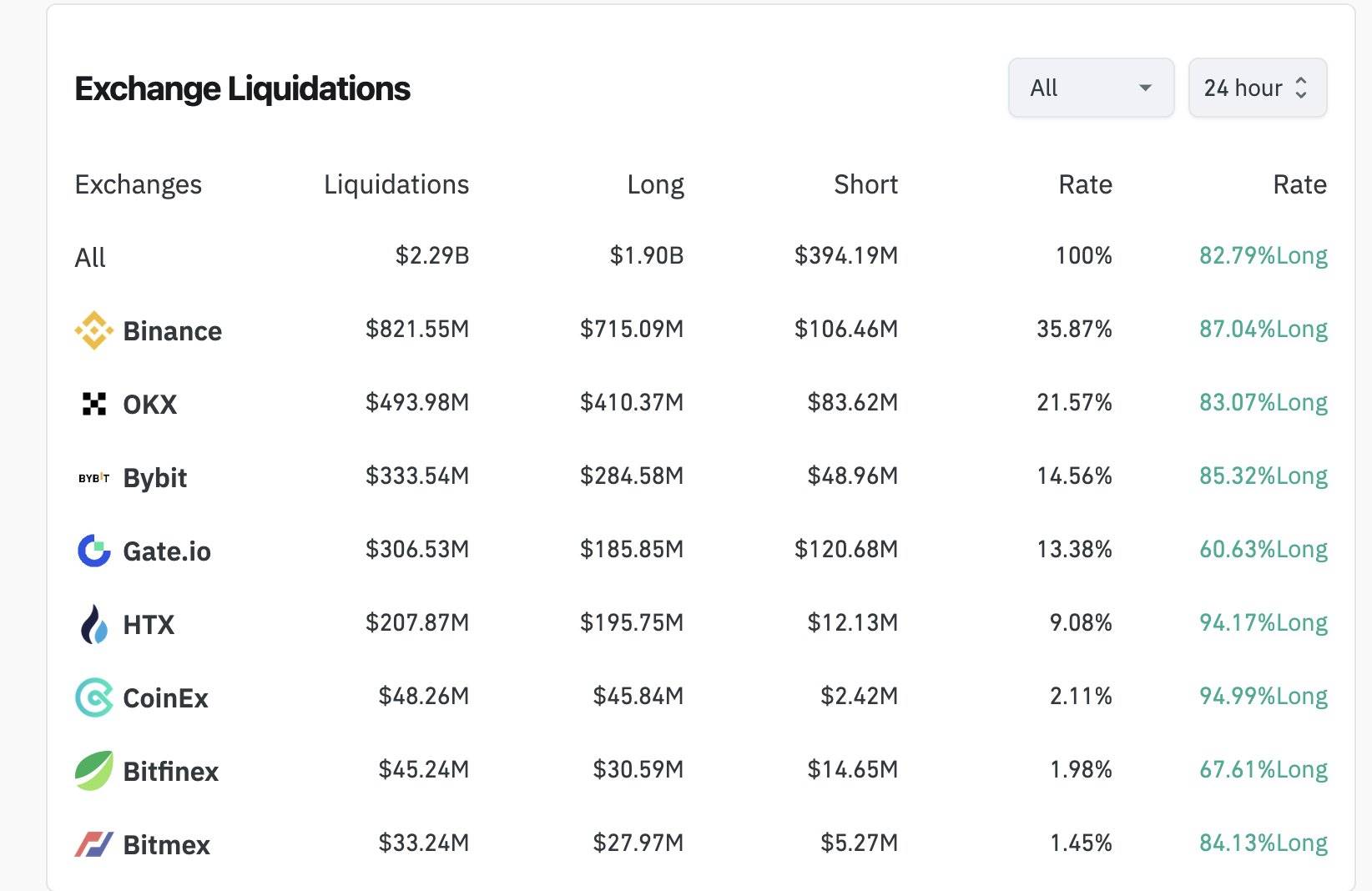

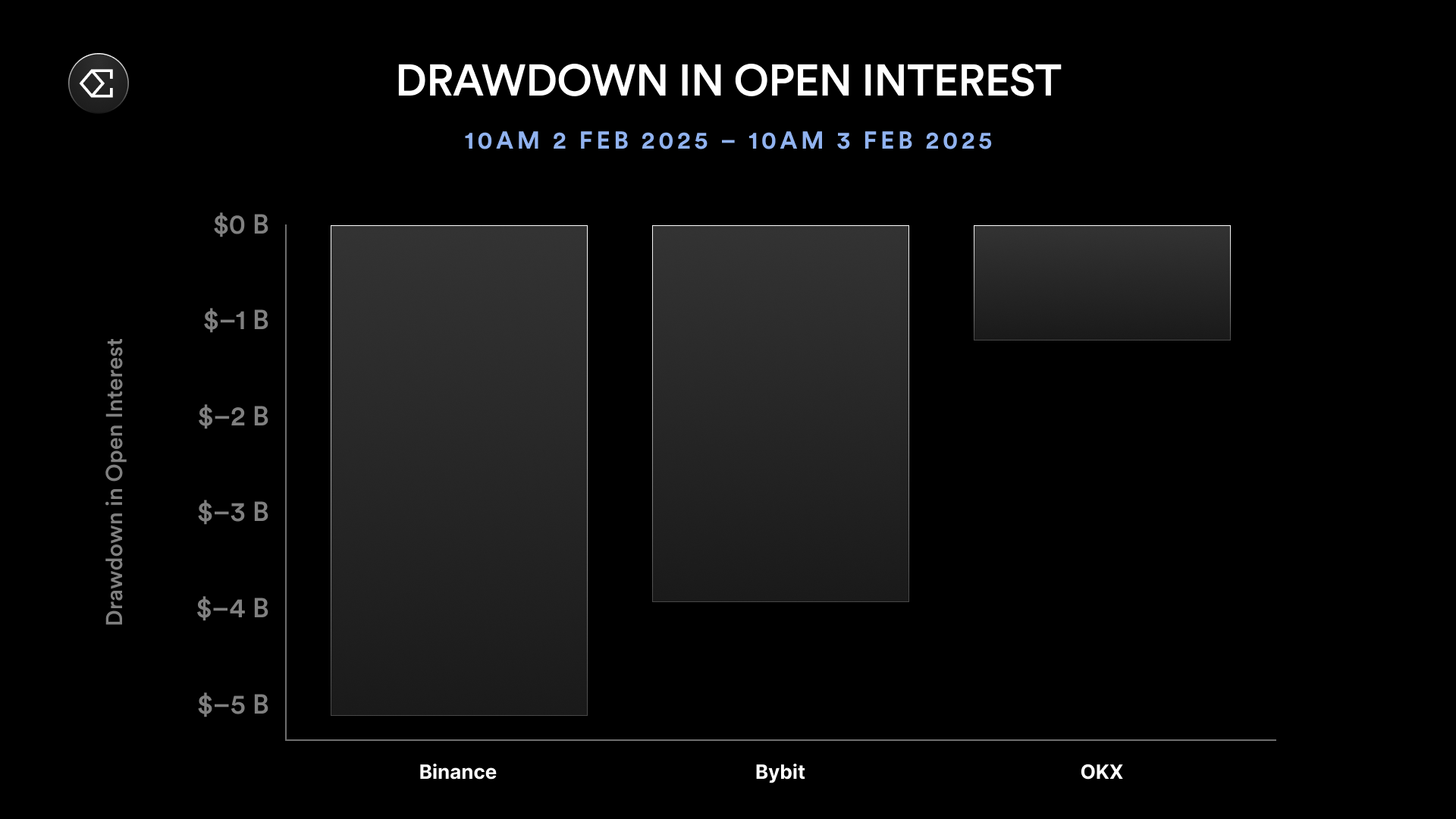

Total open interest on all assets fell by more than $20 billion in the past week. Among them, the nominal loss for BTC contracts is smaller than that for ETH, although the BTC market is almost twice the size of ETH. In the 24 hours from February 2 to February 3, open interest fell by a total of $14 billion.

The sharp sell-off also led to a record high in 24-hour trading volume in the perpetual futures market.

It is difficult to determine exactly how much of this decrease in trading volume and open interest was triggered by liquidations. Due to the limited amount of data pushed by APIs per second, exchanges often underestimate clearing data, which in turn leads to underreporting of statistics from third-party data providers.

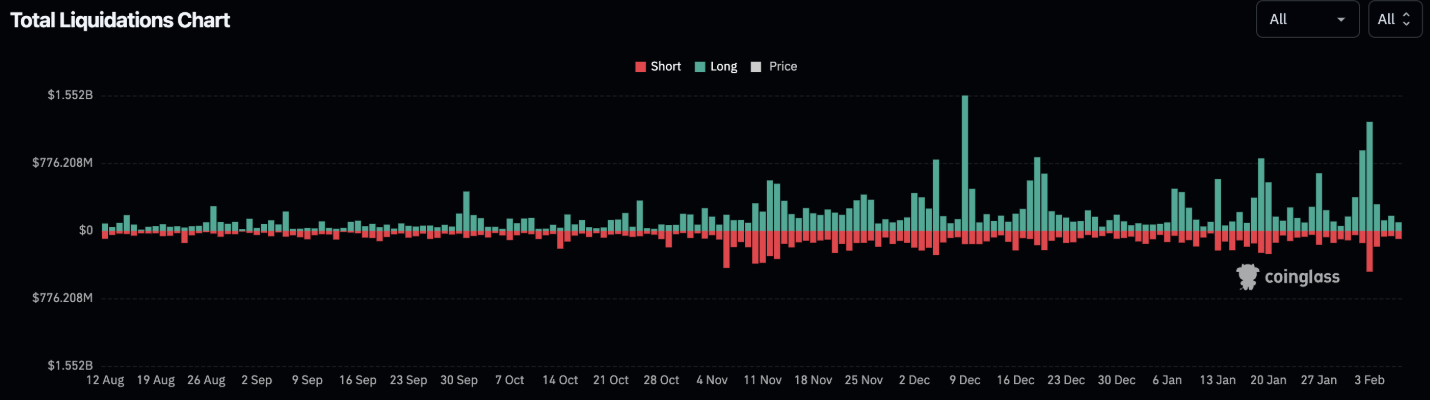

Of the approximately US$14 billion in open interest cleared on February 3, according to statistics, only US$2.3 billion was directly related to liquidation.

Figure: Coinglass data

However, Bybit’s founder and CEO tweeted after the sell-off that a $2.1 billion liquidation occurred on the Bybit platform alone, while Coinglass reported only $333 million.

Figure: Coinglass data

He estimated that the total liquidation amount could be between $8 billion and $10 billion. This figure is closer to the decline in open interest contracts on various exchanges over a 24-hour period. For example, from February 2 to February 3, Bybit’s open interest fell by $4 billion, while Binance’s fell by $5 billion.

If this logic holds, then this could be one of the largest liquidation events in cryptocurrency history. This market stress test also provides Ethena with the opportunity to once again verify the stability of USDe in the face of sharp fluctuations.

USDe’s resilience

Although this is the largest nominal liquidation event in the crypto derivatives market to date, the overall market is still operating normally. USDe’s redemption process was without any interruption, and the cancellation of perpetual futures contracts resulted in few losses. These contracts trade below the spot market during the sell-off period, providing Ethena with a profit opportunity.

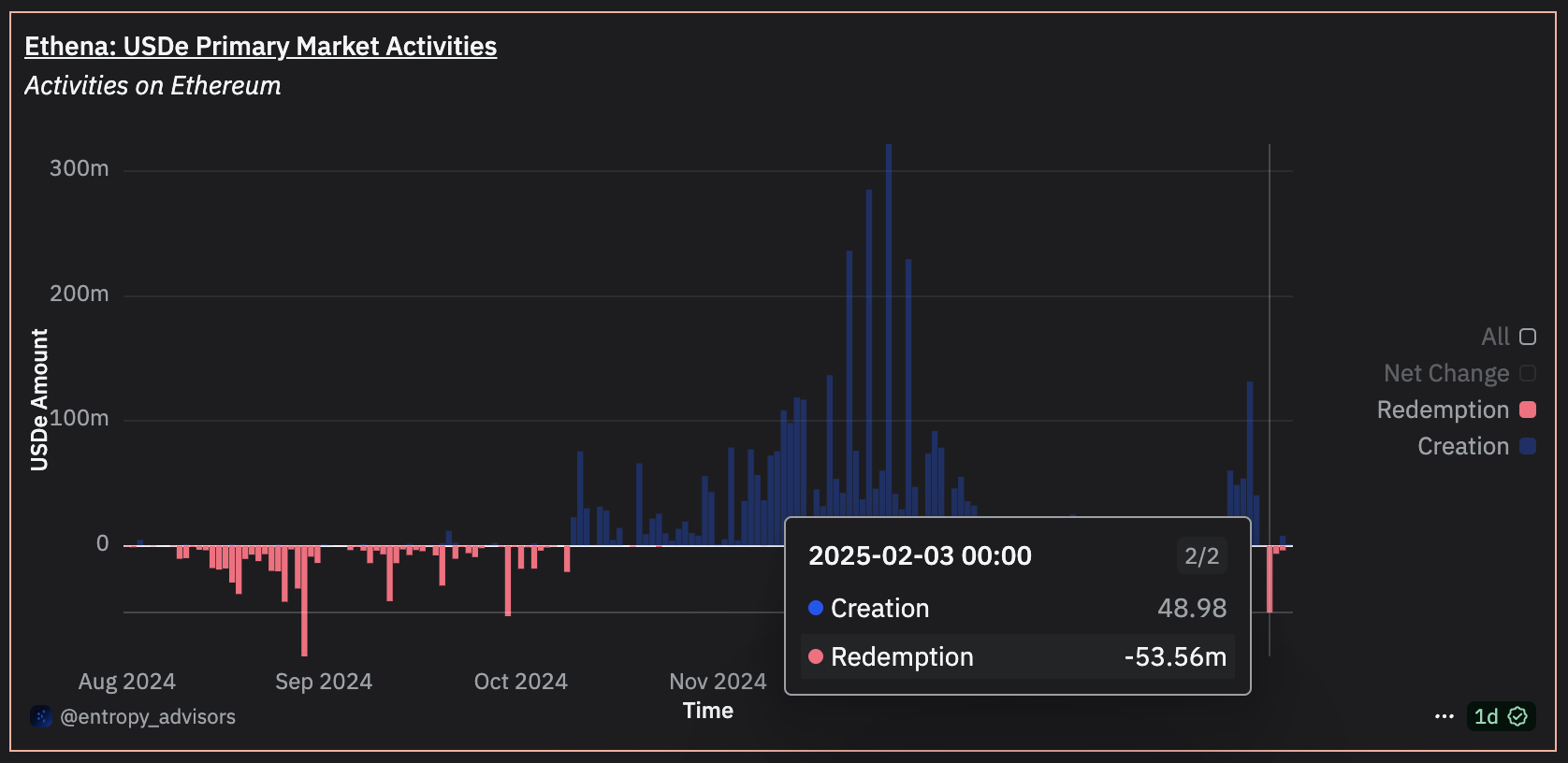

Within 24 hours, the main market completed a total of USDe redemption of US$50 million, and the entire process was smooth and unimpeded. USDe trading volume in the secondary market exceeded US$350 million, and the price difference between USDe and USDT remained within 10 basis points.

During periods of market volatility, USDe prices remain in line with USDC and DAI. This was due to the intervention of market makers, who balanced arbitrage opportunities between the main market and the secondary market in a timely manner.

Figure: USDe price vs USDC (red) and DAI (purple)

In the DeFi ecosystem, sUSDe and USDe collateral (such as Aave, Morpho, Fluid, Curve, and Pendle) are operating normally and have no liquidation, liquidation, or liquidity issues.

As prices fell, many perpetual futures contracts traded below the spot market, providing Ethena with the opportunity to profit by unwinding perpetual futures positions.

Profit opportunities during the selling period

Ethena’s design has one often overlooked advantage:During periods of market downturns, Ethena is usually on the favorable side of trading, namelyshort-sellingsustainablefuturesContract and hold spot.In market sell-off, due to liquidation pressure and panic in the futures market, the price of perpetual futures contracts is often lower than the corresponding spot price. This discount has exceeded 5% in previous market sell-offs, and a similar situation has occurred this time.

Shorting perpetual futures contracts with significant discounts can lead to higher unrealized gains and losses (PnL) while providing a greater margin buffer for Erena’s unleveraged positions. When Ethena’s system automatically cancels these perpetual futures contracts, the agreement can benefit from price imbalances in the market and thus gain a better position in the market.

By closing out perpetual futures contracts that are significantly lower than spot prices, agreements can capture discount gains and convert them into realized gains and losses. This portion of the proceeds will be directly used to enhance the interests of sUSDe holders.

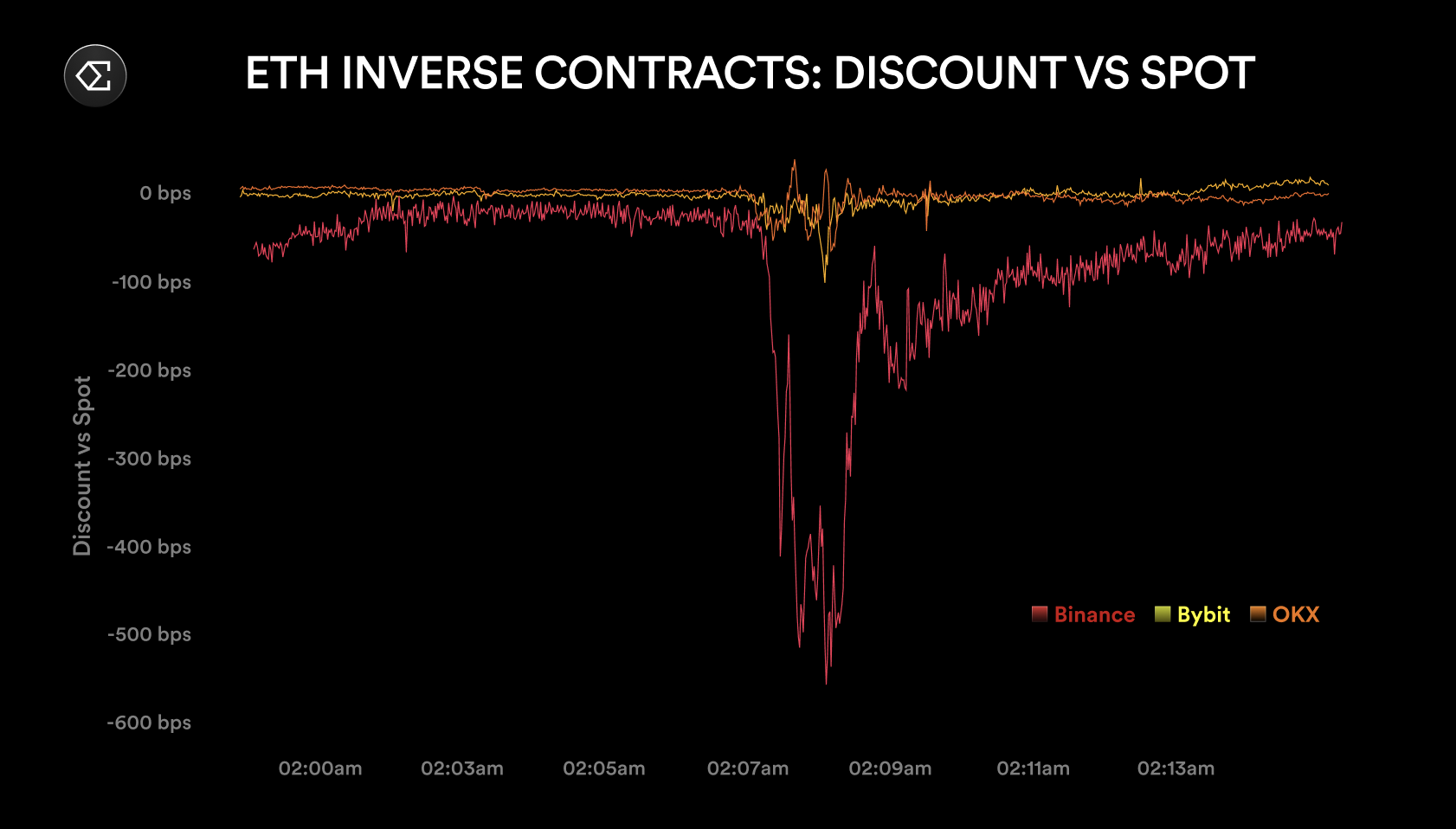

For example, during this sell-off, Binance’s ETH contract (ETH coin-m) showed a discount of-5.8% to the spot price (as shown in the figure below, in basis points). Ethena held short positions of approximately $200 million on the contract, and when the discount peaked, the theoretical unrealized gain and loss exceeded $11 million. If all of those positions were closed, the agreement would have converted those gains into income.

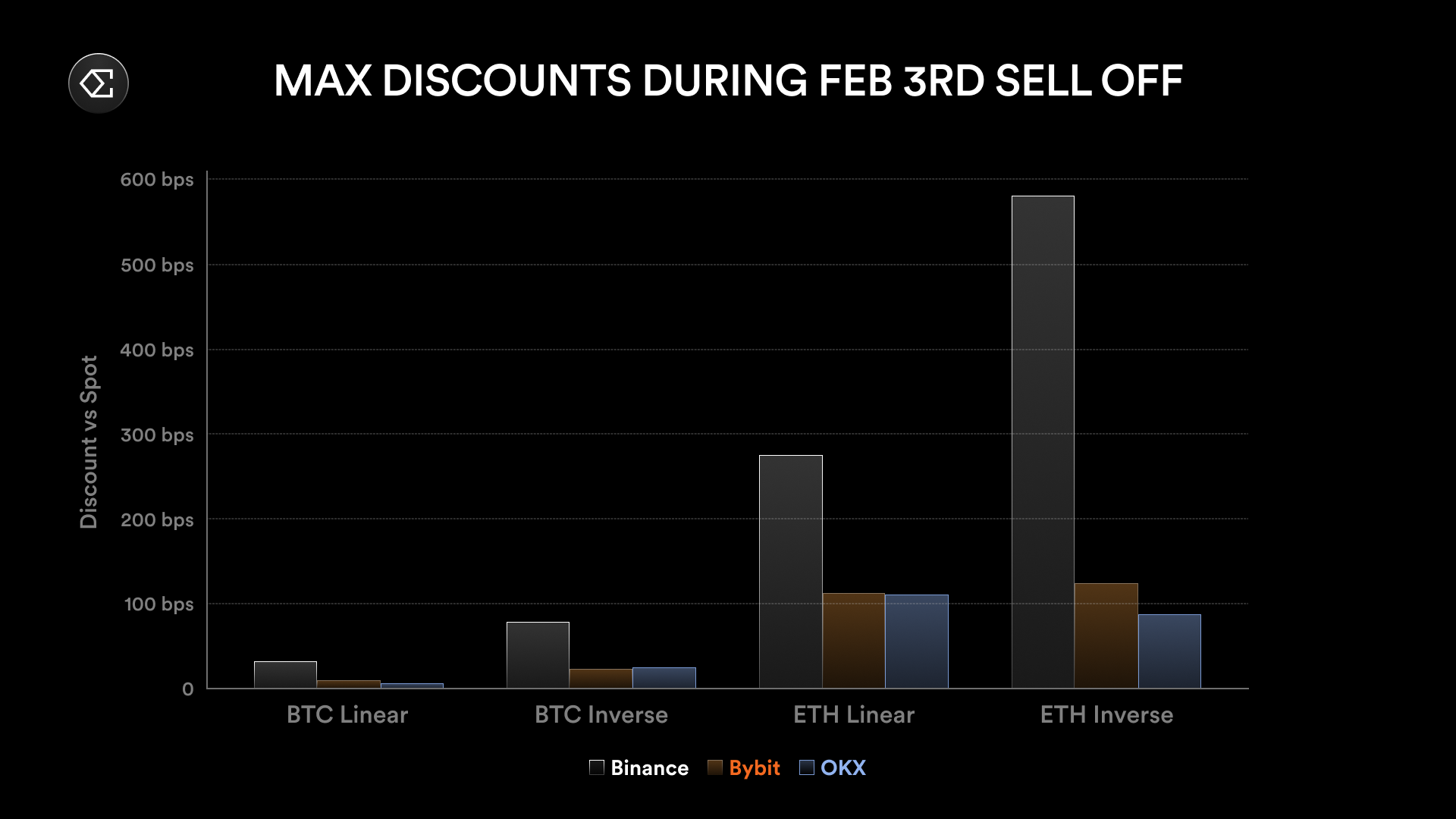

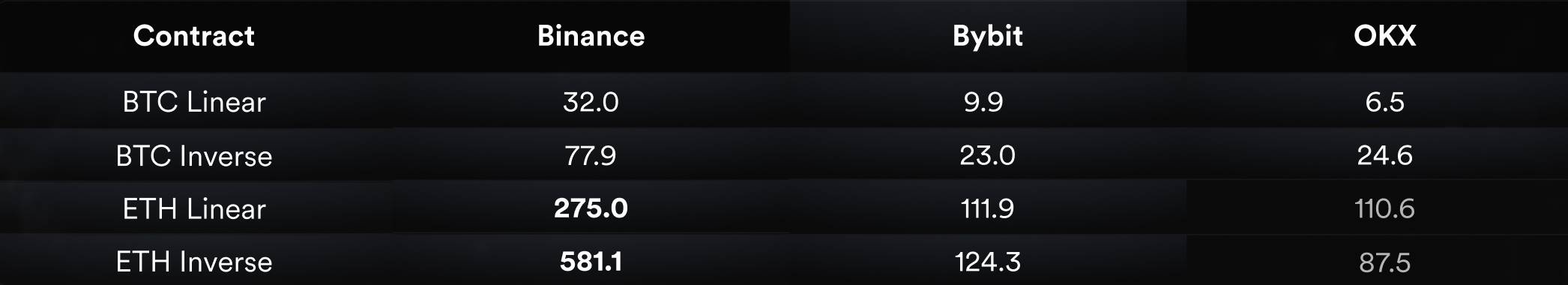

Compared with Binance, Bybit and OKX have smaller ETH contract discounts, only close to 1%. The performance of BTC contracts on the three exchanges generally outperformed ETH contracts, because the sell-off was mainly concentrated on ETH contracts, especially contracts settled on currency standard (reverse).

Figure: Discounts vs. Spot

Overall, Binance’s perpetual futures contract discounts are generally higher than other exchanges.

Chart: Maximum discount between perpetual futures contracts and the spot market (unit: basis points)

Price differences between contracts and assets highlight the importance of execution quality. Ethena’s automated execution mechanism can efficiently capture these market imbalances.

In the past week, the Ethena Agreement has generated a total of US$5.5 million in revenue, of which more than US$500,000 came from two sources: capturing discounts between perpetual futures contracts and the spot market, and canceling contracts with the lowest funding rates. These operations added approximately 50 basis points to sUSDe’s annualized rate of return (APY). At the same time, this part of the realized gains also provides an additional cushion for a possible negative funding cycle over the weekend.

Adapt to lower funding rates

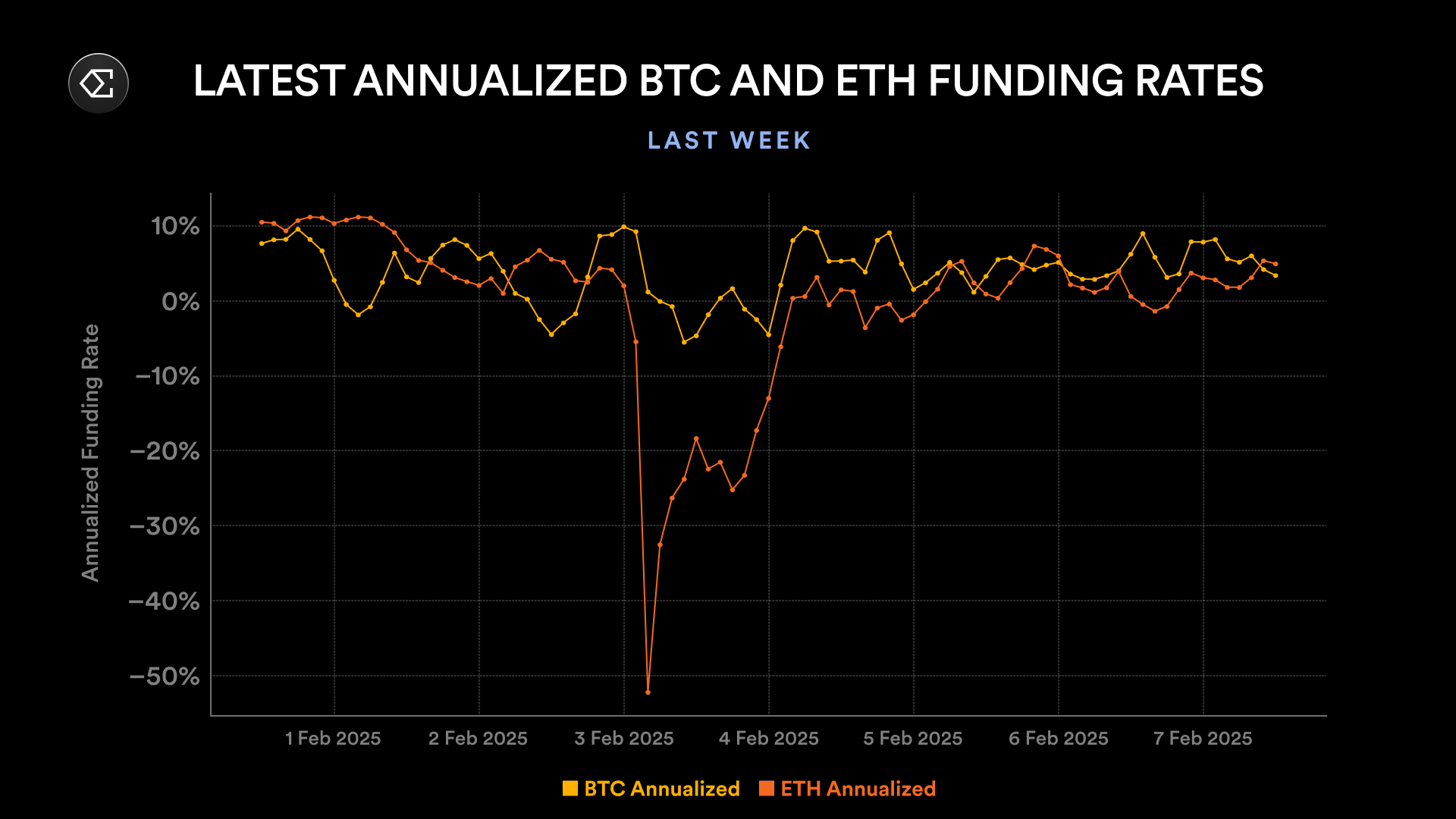

As market volatility intensifies and performance varies significantly between different exchanges and assets, Ethena must respond quickly to structural changes in the perpetual futures market. In the past week, the funding rates for ETH contracts were significantly lower than those for BTC contracts, while the funding rates for both were lower than the levels at the beginning of the year.

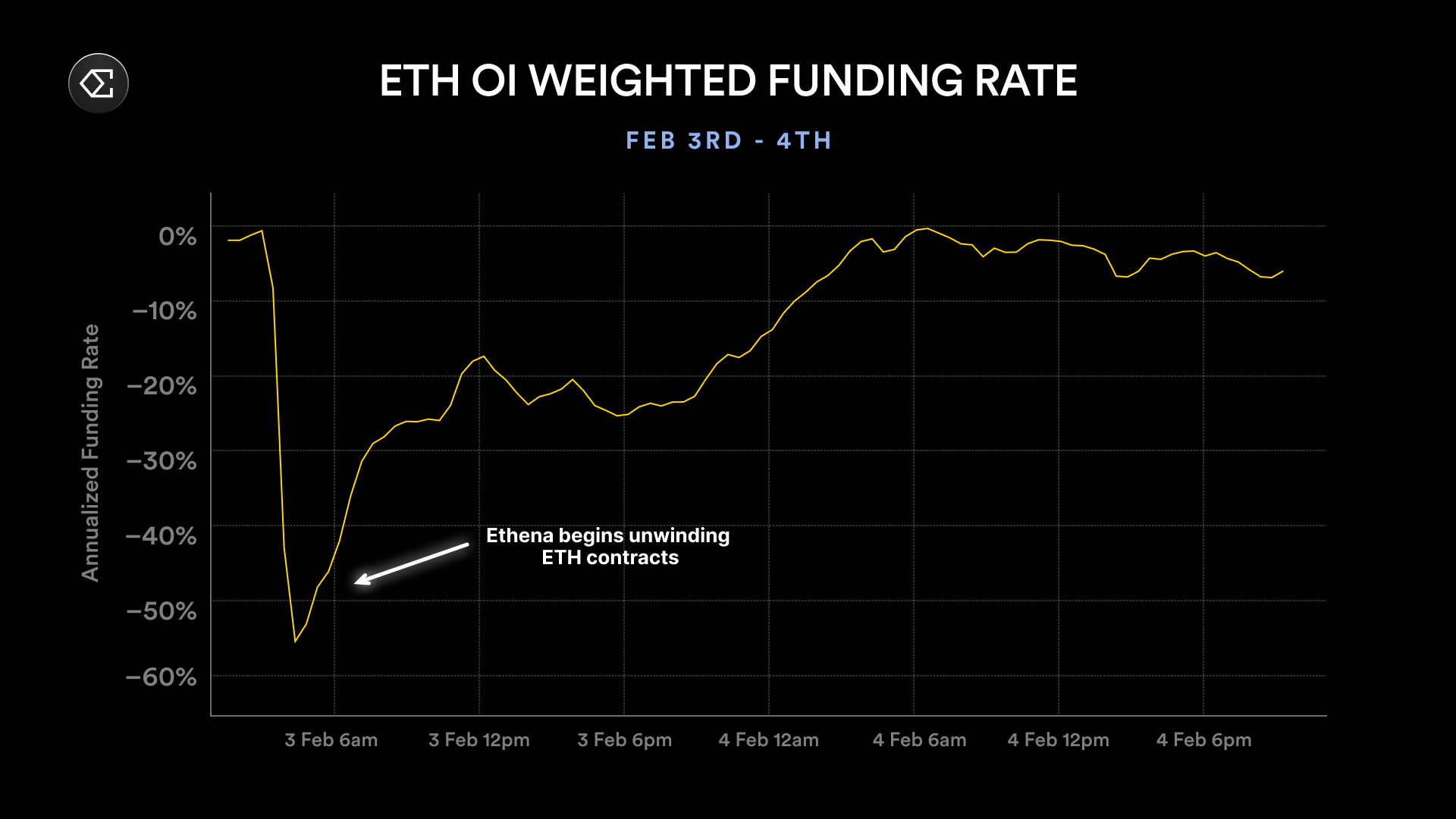

The change in funding rates suggests that Ethena needs to adjust USDe’s asset allocation strategy. By shifting some of the funds to income-based stablecoins such as USDS, the agreement can yield yields of up to 8.75% while reducing reliance on underperforming perpetual futures contracts. Funding rates gradually improved as Ethena began unwinding short positions in ETH.

Chart: Funding rates improve after Ethena closed short positions

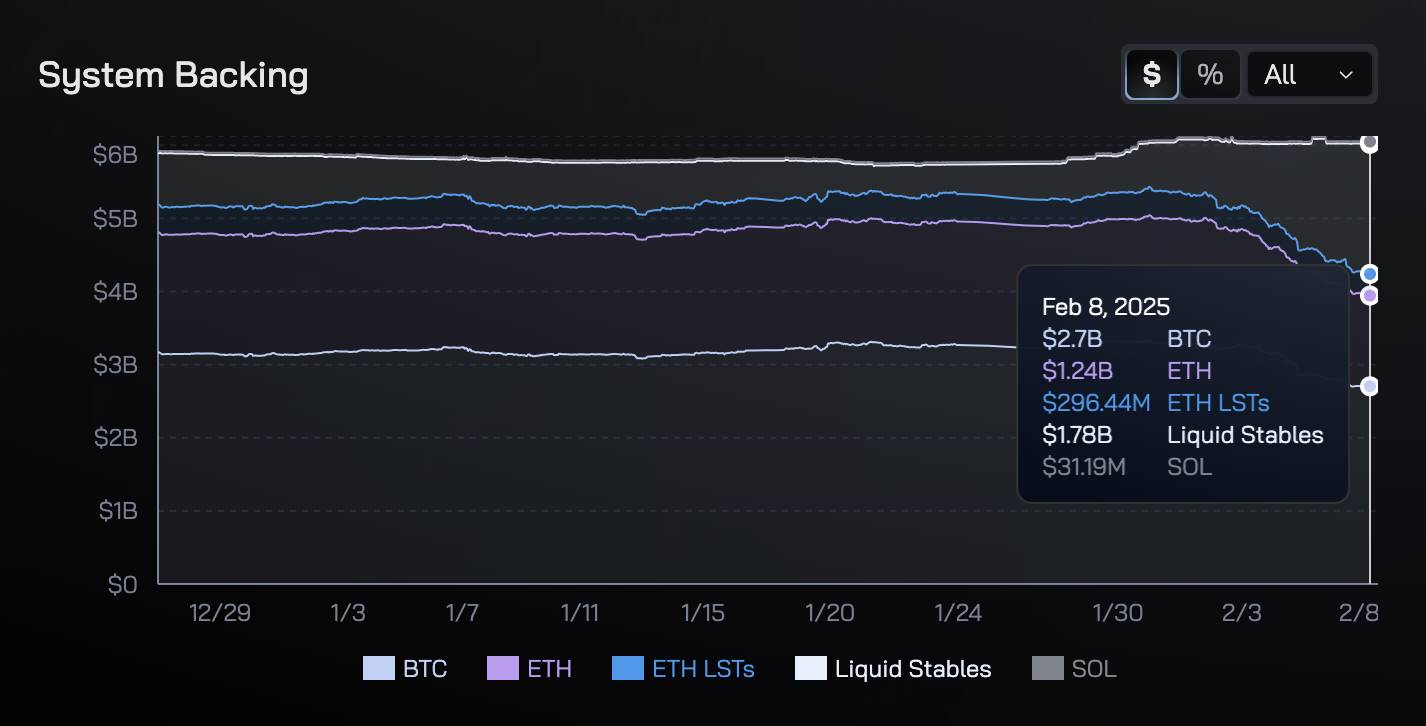

Over the past week, Ethena has demonstrated its ability to respond quickly to market changes. With low funding rates, the agreement will transfer US$1 billion from BTC and ETH contracts to stablecoin assets, providing further guarantees for the stability of sUSDe.

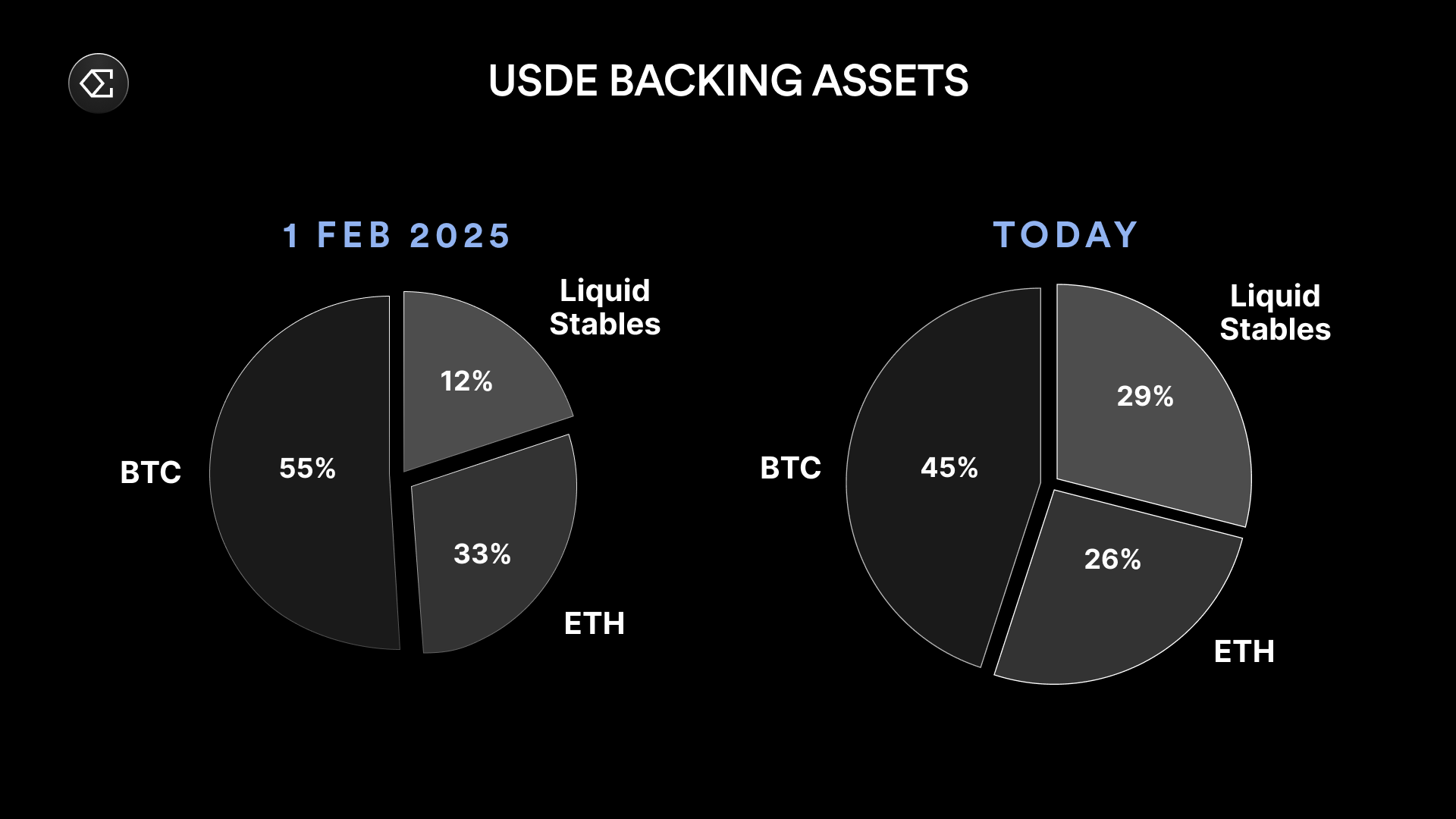

The following comparison chart shows the changes in the composition of USDe supporting assets in early February and the current period. USDe currently has nearly US$1.8 billion in liquid stablecoins as support, accounting for 29% of the total supporting assets. The yields of some of these liquid stablecoins have exceeded the capital rate of perpetual futures. As long as perpetual futures perform less than expected, Ethena will continue to increase the allocation ratio of liquid stablecoins to optimize USDe’s supporting asset structure.

Even in the face of the largest nominal liquidation event in history, USDe still showed strong resilience, not only successfully processing all redemption requests, but also maintaining a stable anchor with the target exchange rate. This performance is due to Ethena’s ability to capture profits during market sell-offs and its structural design advantages in shorting perpetual futures. This design can effectively protect the interests of sUSDe holders when the market goes down.

USDe has demonstrated excellent resilience in every stress test, proving to be one of the most reliable assets on the market today. Ethena hopes to further win the trust of users through continued excellent performance.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern