Replace MiuMiu, young people buy Coach out

Wen | Source Sight Anran

The luxury goods industry is accelerating reshuffle. This is the worst era and the best era.

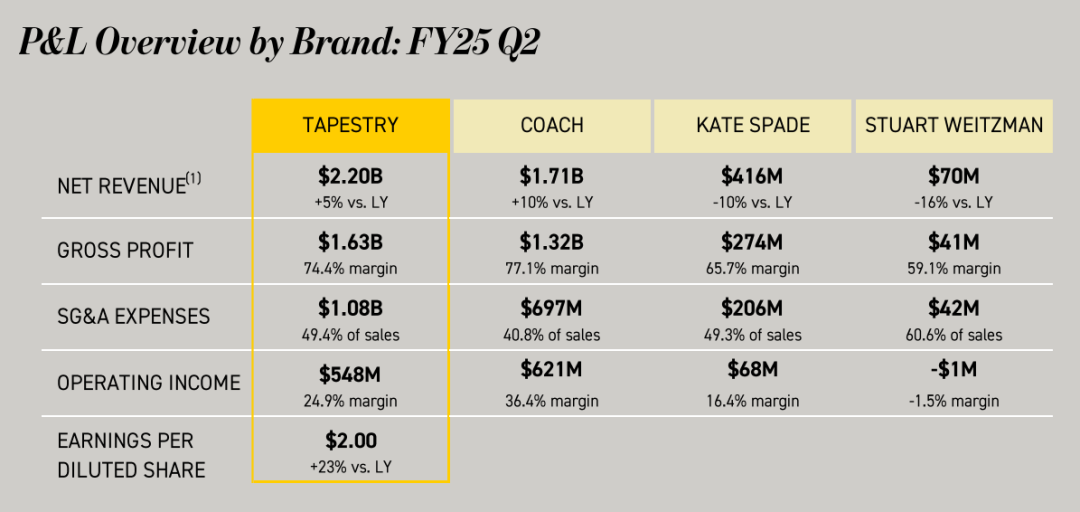

Recently, Coach’s parent company, American light luxury group Tapestry, announced its second fiscal quarter report for 2025.

In the three months ended December 28, 2024, Tapestry Group’s revenue reached a record US$2.2 billion, a year-on-year increase of 5%; gross profit achieved US$1.63 billion, a year-on-year surge of 74.4%; gross profit margin increased by 280 basis points from the previous year.

Although it also has brands such as Kate Spade and Stuart Weitzman, Tapestry still relies mainly on Coach for this round of growth.

During the reporting period, Coach’s operating income reached US$1.71 billion, accounting for approximately 78% of the group’s revenue; gross profit was US$1.32 billion, accounting for approximately 81% of the group’s gross profit; operating profit was US$621 million, exceeding the group’s US$548 million.

In addition, Coach’s year-on-year growth rates of operating income, gross profit, and operating profit in the second fiscal quarter were higher than the group’s overall level.

Screenshot comes from the company’s financial report

As a result, Tapestry raised its 2025 fiscal year results outlook, raising its original forecast of annual revenue of over US$6.75 billion to over US$6.85 billion, and increasing its free cash flow from approximately US$1.1 billion to US$1.2 billion.

Joanne Crevoiserat, CEO of Tapestry Group, once said that the key to Coach’s growth lies in creating an emotional connection between the brand and consumers, forming a positive growth flywheel.

Judging from the financial report, the two ends of this link are mainly tied to young consumers such as Coach and Gen Z.

Under a series of measures such as launching hot new products in line with the trend of quiet luxury, expanding accessory layout aimed at the unique needs of the new generation, and adjusting prices and controlling quantities to enhance brand value and image, Coach has gradually transformed from a rotten street luxury to a personalized brand.

This is similar to Miu Miu, a subsidiary of Prada Group, which is closely connected with young consumers and maintains sustained high growth. Amid macroeconomic fluctuations, the demand preferences of young and newly rich people have become a breakthrough for the luxury goods industry to seek performance growth.

If you take the pulse accurately, you can leap up, such as Coach and Miu Miu against the trend and become a dark horse; if you hesitate, you can even drop a thousand miles away, such as LVMH and Kaiyun, you can reach a deadlock.

From buying vegetable buns to the new favorite of Generation Z

In 2024, Coach fought a beautiful turnaround.

The first is the resurgence of loud voices in the public opinion field. According to the list of the world’s hottest fashion brands in the fourth quarter of 2024 released by fashion search platform Lyst, Coach’s ranking rose by ten places during the period, entering the top five on the list for the first time, becoming the most improved brand.

Ranked before Coach are Miu Miu, SAINT Laurent, Prada, LOEWE and other high-priced luxury and upstarts. Lyst monitoring data showed that Coach’s quarterly demand increased by 65% month-on-month and 332% year-on-year.

In Lyst’s fourth quarter hot item list, Coach Brooklyn handbags topped the list, with a year-on-year increase of 46% in search volume;Coach cherry handbag pendant also ranked fourth on the list.

The second is a new breakthrough in expanding new customer groups. This stems from Coach’s control of current fashion trends and the shopping mentality of new consumer groups.

In terms of product innovation, while the trend of simplicity and luxury is in the ascendant, Coach caters to new trends and creates popular models such as Brooklyn and Empire. These new coaches with a minimalist and high-end style are in sharp contrast to the presbyopic Coach, which has a full screen and a stacked C image of many consumers.

On social platforms such as Xiaohongshu, many consumers regard Coach Brooklyn and Empire as equivalents to The Row, Miu Miu, LV’s Low Key bag, Hermès’s Birkin bag, etc.

Compared with tens of thousands of expensive bags that require careful maintenance, a simple new Coach costs only less than 7500 yuan, and the discount can be even lower. While not losing the sense of design, it also easily creates a feeling of commuting relaxation, which is very attractive to mass consumers under consumption downgraded.

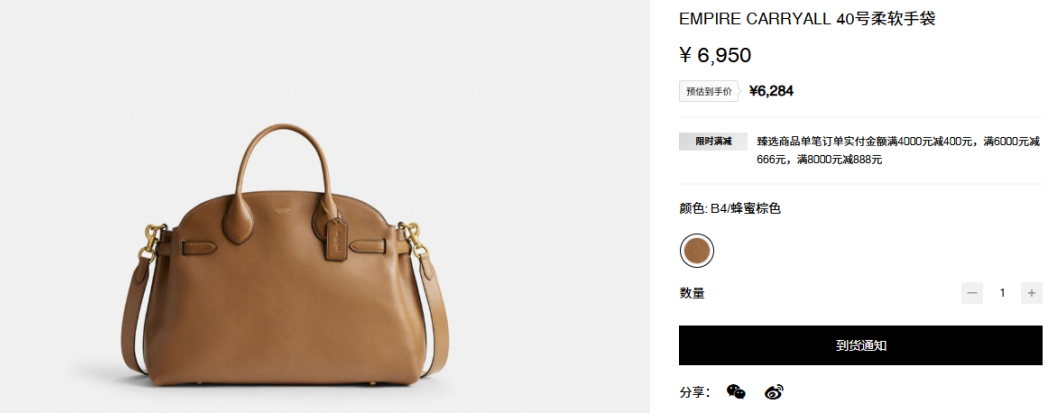

The screenshot comes from Coach’s official website mall

According to source Sight, the Coach Brooklyn and Empire Carryall series with official prices ranging from 2,600 to 5,600 yuan and 4,950 to 7,250 yuan respectively have had to wait for nearly a month for popular color matching models in physical stores; currently, on the official website, there are also shortages of related color matching styles.

In terms of product innovation, Coach bag accessories are expanding the brand and improving its business layout.

Some insiders believe that accessories are becoming a trend. Data showed that Lyst’s search volume for handbag ornaments increased by 77% in the fourth quarter.

The more conservative and low-key simple style and the aesthetic pursuit of a more niche personality may seem to be opposed, but they intersect and coexist in the present. Consumers, especially young consumers, while pursuing overall simplicity, also hope to show their individuality through unique embellishments.

For example, the above-mentioned Coach cherry handbag pendant caters to the personalized customization needs of Gen Z consumers. The popularity of social platforms continues to rise, which also feeds back on brand bags. Casey Lewis, an expert on shopping behavior, said Coach has become the most mentioned handbag brand among teenagers.

In fiscal year 2024, Coach gained more than 6.5 million new customers in North America, more than half of whom were Generation Z and Millennials; in the second quarter of fiscal year 2025, Coach gained approximately 1.7 million new consumers in North America alone, of which Millennials and Generation Z accounted for approximately 60%. It can be said that with its shaping and control of new trends, Coach has become the new favorite of the new generation of young people.

In the final analysis, this mainly benefits from the timely shift and long-term cultivation of the Coach brand line.

Around 2014, the operating costs and high product inventories brought about by large-scale expansion in China brought a double blow to Coach’s operations and brand value.

The proliferation of large and double C logo coaches has flowed into Ole in large quantities, which not only lowers operating profits, but also damages the brand image; the positive-price line bags with weakened logos have also been affected. High discounts have turned light luxury brands that want to show a little bit of style into dilapidated streets. Shopping bags, many customers once felt ashamed to buy them, and the core consumer base gradually lost.

In 2021, Coach will target Generation Z as the main consumer group; in 2022, it will announce the upgrade from Accessible Luxury to Expressive Luxury, which will emphasize the individuality and freedom of serving young people and shift the focus to fashion matching needs.

At the same time, the price of Coach products is gradually rising. Originally regarded as an affordable luxury item, the price of most Coach bags remained at around 2000 yuan.

In 2019, the price of products in Coach stores increased by 10%. After the price increase, there were almost no bags below 3000 yuan in the store; in July 2022, Coach adjusted the price of global products, with an average increase of 7%-8%, and some women’s handbags increased by 10%. As of now, Coach’s official website mall shows that the highest unit price of its bag products is 15000 yuan, and the main price is 3,000 – 5,000 yuan.

Through continuous efforts to restructure routes and increase prices with quality and quality, the brand value of Coach has gradually picked up, and finally ushered in the dawn of victory in 2024.

A backward giant

Liliana lucioni, president of Coach China, once said that if you can win the younger generation (or more accurately, the newly rich group of Gen Z young people), you can win all generations of consumers.

In the second fiscal quarter of 2025, Tapestry Group’s revenue grew the most in Europe, reaching 42%. The group pointed out that this was mainly driven by increased local consumer spending and strong acquisitions of new customers, especially Gen Z.

Coach said that through overall brand building and establishing meaningful and emotional connections with consumers, the brand has gained approximately 1.7 million new consumers in North America, nearly 60% of whom are millennials and Gen Z. During the period, the brand achieved 10% revenue growth with excellent profit margins, including double-digit revenue growth in North America.

The value of Generation Z is being seen by more and more brands. The first brands are laid out to meet the consumer needs and preferences of the new generation, the sooner they will gain benefits.

For example, Miu Miu, an upstart brand that has become popular in recent years, has continued to be popular around the world and has long dominated the Lyst popular brand rankings. In the fourth quarter of 2024, Miu Miu once again topped the list, ranking the hottest brand in three quarters during the year. Last year, Miu Miu also topped the list of Lyst’s global hottest brands.

Screenshot from The Lyst Index Q4 24

Relying on its bold and outstanding design, Miu Miu is popular among young consumers. In the first three quarters of 2024, Miu Miu’s revenue surged 97% to 854 million euros. In the third quarter, its revenue surged 105%, and it has recorded 15 consecutive quarters of high growth.

“Miu Miu, the deputy brand of Qianjin, has actually become an indispensable backbone of the parent company Prada Group.

But there are also giants that are limited by brand positioning and are difficult to turn around in size, such as luxury giants LVMH and Kaiyun Group, which encountered Waterloo in 2024.

In 2024, LVMH Group’s revenue was 84.68 billion euros, down 1.7% year-on-year; net profit was 12.55 billion euros, down 17% year-on-year; recurring operating profit was 19.6 billion euros, down 14% year-on-year.

During the reporting period, revenue from core fashion and leather goods businesses including LV, Dior, Celine, Fendi, etc. was 41.06 billion euros, a year-on-year decrease of 3%; recurring operating profit decreased by 10% year-on-year.

The high-end and high-end old luxury brands seem hesitant to face the issue of rejuvenation, and the group does not seem to have any plans to open up new sub-brands for rejuvenation, letting newcomers rise or become popular.

Similarly, Kering’s performance in 2024 fell sharply, with full-year revenue of 17.194 billion euros, down 12% year-on-year; net profit of 1.133 billion euros, down 62% year-on-year.

Among them, Gucci, which accounts for nearly half of the group’s sales, saw revenue fall 23% year-on-year to 7.7 billion euros;Yves Saint Lauren’s revenue fell 9% year-on-year to 2.881 billion euros.

Faced with frequent high-level changes, uncertain style jumps, and insufficient attraction of new product innovation, Gucci and even Kaiyun Group are in a deeper crisis than LVMH.

Young risks

In fact, luxury brands such as LV and Gucci have long targeted the new generation of newly rich people. Michael Burke, a senior executive at LVMH, once said that LV should cater to the new rich class rather than the old rich class if it is to be younger.

However, leading brands obviously have more concerns, the most worrying of which is the level of consumption power and the instability of consumption preferences of young customers.

Bain & Company pointed out that compared with millennials, the net recommendation value of the Gen Z luxury goods industry dropped by 25%-30%. 50% of consumers believe that luxury brands are overpriced, lack personalization and lack of focus.

As a young consumer group, it is an indisputable fact that their spending power is generally not as good as that of older high-net-worth groups. If we want to meet the consumer needs of young people, high-luxury people will likely have to make concessions on price, which will damage the brand image and value to a certain extent.

Many Gaoluxury therefore hopes to focus on serving core high-net-worth groups.

The “2024 Global Luxury Market Research” shows that the luxury goods global market customer base has shrunk from 400 million customers in 2022 to 350 million by the end of 2024. The reason for the decline may be due to the strategy of prioritizing top customers, because 2% of top customers (VIC) purchases account for 45% of global luxury goods purchases.

However, the report pointed out that the experience of these top customers has not become better, but instead believes that the experience is more transactional. As industry consumption shrinks, class superiority cannot be prominent, luxury service experience is increasingly unsatisfactory to customers, and brands are unpopular on both sides.

The trade-off between high luxury groups and top customers is already a seesaw, but another factor that is difficult to ignore has exacerbated the brand’s concerns, that is, the instability of young consumers ‘preferences.

When discussing the occurrence of new consumption hotspots in its “Outdoor Industry In-depth Report”, Huaxi Securities mentioned that a prominent characteristic of young people is that they maintain a strong curiosity about things and have an extraordinary love for new things. It is a young person’s attitude towards life.

Consumers who pursue niche brands will soon abandon the original brand and pursue the next niche brand that better matches their identity when the niche reaches the public and their personalities begin to spread.

In addition, Zhongtai Securities pointed out in an industry report that the core customer base of luxury goods (1% but contributing 21% of demand) is more loyal to the brand during the economic downturn; consumption by non-core customers (accounting for 99% and contributing 79% of demand) is more vulnerable to macroeconomic fluctuations.

Coach CEO Todd Kahn once said that just as Coach coined the term Accessible Luxury in 2000 and entered the golden age, now Coach will enter the next golden age with Expressive Luxury.

For high-luxury people, perhaps they can find a balance between the old and new customers in the chaos and gloom as soon as possible to avoid being left behind by the golden age.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.