The first sword ashore was to cut towards Ping in lieu of payment.

Apple AI is coming, OPPO is the most excited

Wen| Source Sight Keji

Amid the intensifying discussions on the AI business, Apple finally held hands with Ali.

On February 13, at the World Governments Summit2025 Summit held in Dubai, United Arab Emirates, Alibaba co-founder and chairman of the board of directors Cai Chongxin responded to rumors of cooperation between Ali and Apple. He said that Apple needs a localized partner in China to serve their mobile phones. Apple has always been very picky and they talked with many companies in China. In the end, they chose to do business with us. We are very fortunate and honored to do business with a great company like Apple.

The iPhone 16, which complements the AI capabilities of the China market, has in a sense become what CEO Cook calls a epoch-making product. Apple, once considered to be weak in innovation, is expected to return to the center of the stage with AI.

But this also puts pressure on all opponents in the Android camp. The first to bear the brunt are those brands that hold high the banner of Apple’s replacement and try to share the minds of Apple users. Among them, OPPO is the most fruity one.

From industrial design to user interfaces, from marketing strategies to brand tonality, OPPO has Apple’s shadow. Especially in the China market, when iPhone prices were high, the pace of innovation slowed down, and some users began to seek alternatives, OPPO accurately captured this demand.

With people-friendly prices, excellent photos, and some aspects (such as fast charging) that surpass Apple’s experience, OPPO has successfully attracted a group of users.

However, when the iPhone 16 came on the scene as a complete AI, OPPO’s former narrative of Apple’s replacement became increasingly bleak under the light of genuine Apple.

AI remedial classes for iPhone

For a long time, AI was absent from Apple’s narrative system.

Android manufacturers have regarded AI as the core selling point of mobile phones, talking about generative AI, AI photography, AI assistant and other functions, but Apple seems calm. In fact, Apple launched Siri many years ago, which can be regarded as the prototype of AI functions, but Apple’s pace in the AI field is always one step behind.

Behind this, there are not only Apple’s ultimate pursuit of user privacy and data security, but also its relative conservatism in the accumulation of AI technology. In addition, compared with technology giants such as Google and Microsoft, Apple is relatively restrained in its investment in underlying AI technologies and algorithms, as well as its contribution to the open source community.

The iPhone 16 finally broke this restraint.

Disclosure information shows that the iPhone 16 series will be fully equipped with Apple Intelligence. This is not a simple function superposition, but a complete set of AI solutions deeply customized by Apple based on its own ecology and user habits.

It not only includes AI processing capabilities on the device side, but also emphasizes the collaboration of cloud AI, striving to provide a smarter and more personalized experience while ensuring user privacy.

More importantly, in order to solve the problem of implementing AI functions in the China market, Apple has rarely chosen to cooperate with China’s local Internet giant Alibaba. With Alibaba Cloud’s computing power support and localized data processing capabilities, iPhone 16 ‘s AI functions are expected to better adapt to the needs and usage habits of China users.

Data from consulting firm Counterpoint Research shows that in 2023, Apple’s share of the high-end market (more than US$600) of China’s smartphone market will reach 67.1%. This means that Apple occupies an absolute dominant position in China’s high-end mobile phone market. Canalys report also pointed out that despite fierce competition from Android manufacturers, Apple maintained its first position in the high-end market in China in the first quarter of 2024.

The significance of cooperation with Ali goes beyond the technical level. It marks an important shift in Apple’s strategy: a shift from a closed ecosystem in the past to a limited openness.

For Apple, AI is not only a icing on the cake, but also a core strategy related to the future competitive landscape. After all, in the context of slowing growth in the smartphone market, AI has become a new battlefield for major manufacturers to compete for users.

IDC’s forecast report points out that in 2027, AI mobile phone shipments are expected to exceed 500 million units, accounting for more than 40% of total smartphone shipments.

The AI breakthrough of the iPhone 16 is an important step for Apple in this strategic direction. It not only makes up for its own shortcomings in the AI field, but more importantly, it injects new vitality into Apple’s ecosystem and enhances the long-term competitiveness of the iPhone.

“A fully fledged iPhone 16 will undoubtedly pose a direct threat to the entire Android camp, especially those brands that focus on high-end experience. Android manufacturers that once relied on experience differentiation to build advantages now need to face an Apple with a comprehensive upgrade of its AI capabilities, and the competition difficulty coefficient has suddenly increased.

Difficult to conceal marginalization

As the iPhone 16 AI fully arrives, OPPO seems to have a piece of good news.

Canalys latest report shows that in 2024, the Southeast Asian smartphone market rebounded strongly, with manufacturers shipping reaching 96.7 million units, a year-on-year increase of 11%, ending two consecutive years of decline. OPPO led the market for the first time, accounting for 18% of the market with shipments of 16.9 million units, a year-on-year increase of 14%.

The success of the Southeast Asian market is an affirmation of OPPO’s overseas strategy. For a long time, OPPO has regarded the Southeast Asian market as an important strategic position. Through precise market positioning, localized marketing strategies, and continuous product innovation, OPPO has achieved outstanding results in the Southeast Asian market.

However, the success of the Southeast Asian market cannot conceal the challenges OPPO faces in the China market.

Once upon a time, OPPO was the king of offline channels in the China market. With its strong channel capabilities and precise marketing, OPPO seized territory in the offline market and once became the number one brand with market share in China.

But in recent years, with the rise of online channels and changes in user consumption habits, OPPO’s traditional advantages are gradually being eliminated. IDC data shows that in the first quarter of 2024, shipments in the smartphone market in China fell by 6.6% year-on-year. OPPO’s market share is 15.7%, ranking fourth, which is lagging behind the first place in Glory at 17.1% and the second place in vivo at 16.4%. In the third quarter, OPPO fell directly out of the top five.

More importantly, in the high-end market, OPPO has always been difficult to truly break through. Although the Find X series has a good performance in terms of design and technology, OPPO’s brand image in the minds of high-end users still lags behind that of brands such as Apple and Huawei.

Canalys data shows that in the the mainland of China market, Apple ranked first in the high-end market with a market share of 52% in the price range above US$600 (approximately RMB 4355) in the third quarter of 2024. Although it fell by 5% year-on-year, its leading position remains unshaken. Huawei followed closely with a market share of 33%, with a year-on-year increase of 34%, showing strong growth momentum.

OPPO, once regarded as an equivalent to Apple, seems to be in an awkward situation in the high-end market.

On the one hand, it is trying to get rid of the stereotype of low-end manufacturers and strives to break through to the high-end market. For example, the Find X series is an important attempt at high-end.

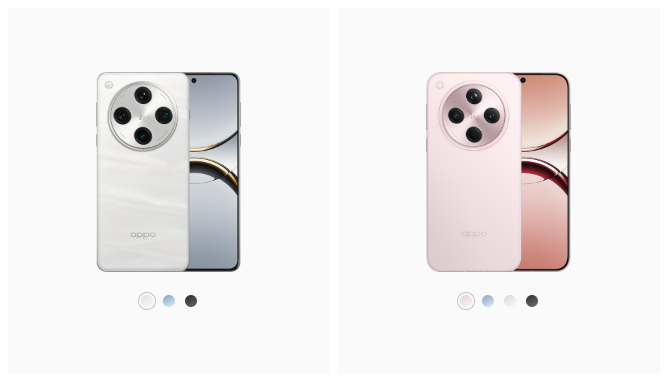

OPPO Find X8 series

On the other hand, its brand genes and user base determine that it is difficult for it to completely get rid of the shadow of parity. In its early years, OPPO relied on imitating Apple’s design and marketing strategies. Although it has continued to make progress in technological innovation, it has never been able to truly compete with Apple in terms of brand tonality.

This fruity brand image may have been an important boost to OPPO’s rapid rise in the early days. But in today’s market environment, it may become a burden. When the real apple becomes stronger and more attractive, the one-time narrative becomes a little pale and powerless.

Especially in the AI era, when the iPhone 16 used Apple Intelligence as its core selling point to redefine the high-end smartphone experience, OPPO’s previous layout in the AI field did not seem to have enough strong voice.

What is even more worrying is that in the minds of high-end users, OPPO’s brand image seems to be gradually blurred. OPPO, which used to label photos and fast charging, seems to be a little confused in product differentiation in recent years. In the highly competitive China market, OPPO’s market share and brand voice are at risk of being marginalized.

breakthrough road

Faced with the AI evolution of iPhone 16, OPPO is not waiting to wait and die. This company is also actively seeking change, trying to find a new breakthrough path in the AI wave.

The most direct action is to increase investment in research and development. OPPO founder Chen Mingyong has publicly stated that in the next three years, OPPO will invest a research and development budget of 50 billion yuan to focus on core technologies. AI is undoubtedly one of the key directions.

At the product level, OPPO is also trying to get rid of fruity and create differentiated competitive advantages. Find X series, which is the main high-end flagship, continues to innovate in imaging, design, fast charging and other aspects. The Reno series places more emphasis on youth and fashion and caters to the needs of young users.

The ColorOS system is also trying to get rid of the shadow of iOS Like and add more self-developed technologies and features.“” Pantone color card and aquatic design are both attempts by OPPO to seek differentiation at the system level.

Overseas markets have also become an important growth engine for OPPO. Counterpoint data shows that in Q2 of 2024, OPPO ranks first in market share in Southeast Asia. In the European market, OPPO is also expanding steadily. The global layout provides OPPO with a broader market space.

However, it is still unknown whether these efforts can help OPPO successfully break through in the AI changes. What is in front of OPPO is a self-revolution related to the future.

On the AI technology route, choosing to focus on self-research or win-win cooperation in order to compete with giants such as Apple, and investing fully in the field of large models or focusing on end-side AI will directly determine OPPO’s future competitiveness.

In terms of brand image building, getting rid of the equal label and creating a more unique and high-end brand image is also the key to OPPO’s competitiveness in the high-end market.

At the product strategy level, OPPO needs to continue to innovate in advantageous areas such as imaging, fast charging, and design to create products with differentiated competitive advantages.

The iPhone 16 complements the AI function. Although the final effect is unknown, it at least sounds the alarm for Android manufacturers such as OPPO. The former equalization model may have come to an end. How to find your own way to survive in the AI era is an era proposition that OPPO must answer.

OPPO’s future is full of variables and suspense. The battle to hunt the iPhone 16 is far from over.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.