① Hong Kong stocks made a major counterattack, and the Hang Seng Technology Index hit a three-year high;

② Multiple positive factors have driven Hong Kong stocks to go bullish, but funds are also quietly flowing out. Why?

③ Can the bull market continue? Institutions are deeply divided.

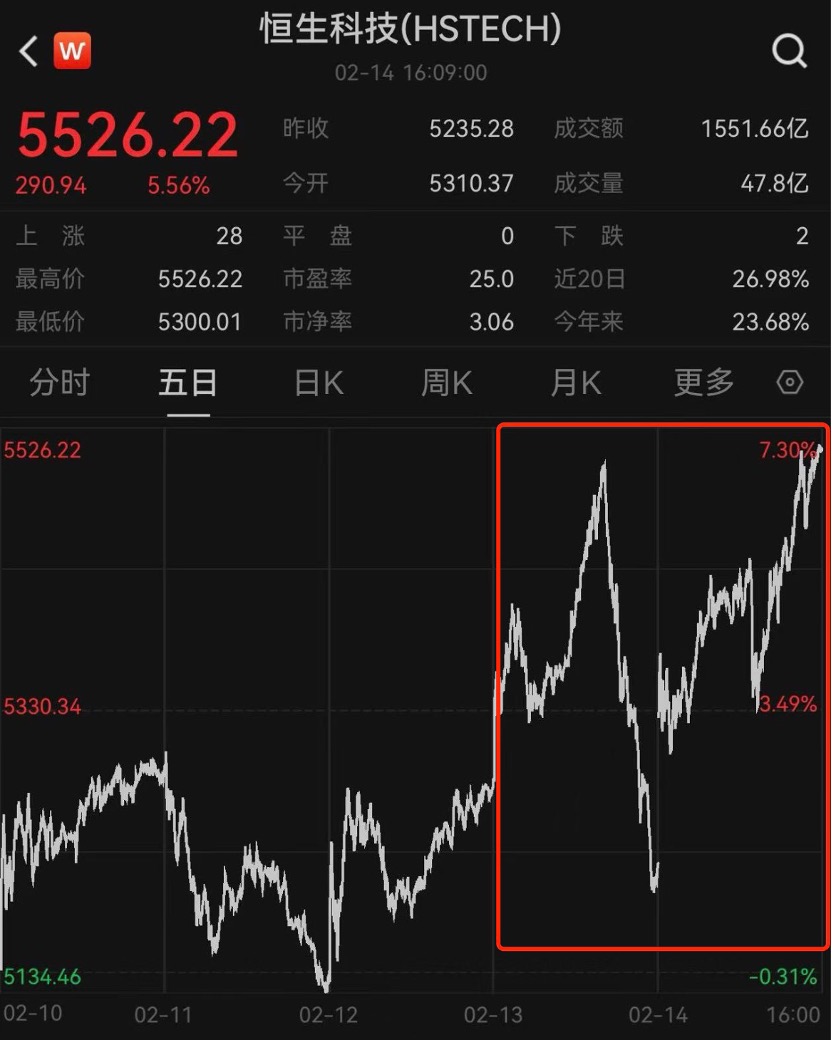

Financial News Agency, February 14 (Reporter Yan Jun)From a big dive to a big counterattack, Hang Seng Technology’s two trading days of roller coaster prices demonstrated “what is a surprise and what is a excitement.”

On February 14, the Hang Seng Technology Index surged 5.29% to close at 5,526.22 points, surging 7% in a single week to a three-year high. In just one month since its January 14 low, the Hang Seng Technology Index has risen by 30.56%.

The rise in the index is quite intuitive in ETFs. On February 14, 24 Hong Kong stock ETFs rose by more than 3%, and 5 rose by more than 4%. Among them, the highest increase was the Bosch China Securities Hong Kong Stock Connect Internet ETF, with an increase of 4.9%. This product has a market size of only 167 million yuan, but its turnover reached a staggering 3.82 billion yuan, and the turnover rate reached 2,140.14%. In addition, ETFs with increases of more than 4% include Hong Kong stock Internet ETFs owned by Warburg, Wells Fargo and E Fund.

How crazy is the market? All 30 constituent stocks included in the CSI Hong Kong Stock Connect Internet Index rose more than 2%, 22 stocks rose more than 5%, and 8 stocks reported double-digit gains, with the overall median increase reaching 7.12%.

Feng Chencheng, manager of the Hong Kong Stock Internet ETF, pointed out that overseas investors ‘attitude towards China’s technology stocks has reversed, which can be seen from the recent trend of e-commerce giant Alibaba. Driven by breakthroughs in artificial intelligence, in the eyes of foreign investors, Deepseek has ignited hope for the revival of China’s technology stocks.

Driven by the AI boom, the overall investment atmosphere in Hong Kong stocks has soared. Most industry institutions believe that this may mean that the prices of underlying assets in China are expected to undergo a revaluation and are expected to be given an AI premium again in the future.

As a wave of surge kicked off, however, in the past two trading days, after the Hang Seng Technology Index reached a high level, it first plunged and then started a strong rebound. From February 13 to 14, the increase was 4.64%, the retracement was-3.7%, and the amplitude reached 6.15%. To a certain extent, it reflected the caution of funds at high levels.

How to view this round of surge, China Asset Management Fund and other institutions believe that the combination of multiple positive factors after the Spring Festival has promoted the original market.

First of all, DeepSeek, the dark horse in the AI circle, has driven the entire artificial intelligence industry to become the main line of A-shares and Hong Kong stocks this year.DeepSeek relies on its low-cost and high-performance advantages to trigger market fluctuations, or push investors to reassess the technological potential of China technology companies on the AI track, and technology stocks may usher in a revaluation of value.

Secondly, the good news of the cooperation between Ali and Apple is spurred.On February 12, according to the information, Apple will cooperate with Alibaba to develop AI functions for domestic iPhone users. The next day, Alibaba co-founder and chairman of the board of directors Cai Chongxin confirmed the rumors of Alibaba’s cooperation with Apple. From the perspective of the industry, the relevant news is of greater significance than the specific benefits. This shows that the two giant companies of China and the United States have the opportunity to work together to cooperate in the field of technology, which has had a positive effect on the release of valuation on A-shares and Hong Kong-listed technology stocks.

In Shen Wanhongyuan’s view, from the preliminary verification of domestic AI needs/applications by bytes/bean bags, to Deepseek’s wake-up reasoning and volume needs, to the cooperation between Apple and Ali, the hidden trends are the trend of localization, diversification and the return of the cloud main line.

Third, global hedging funds are buying China assets, and Hong Kong stocks are the first stop.After foreign institutions such as Deutsche Bank, BlackRock, and UBS shouted that they were bullish on China, foreign real money purchases were further disclosed.

Goldman Sachs said in its latest research report that as of February 7, among Goldman Sachs ‘global prime broker (PB) business, China’s onshore and offshore stocks have collectively become the “market with the largest nominal net purchase volume” this year. That is, in the week of February 3 – 7, there was the strongest wave of hedge funds purchasing China assets in more than four months. Previously, hedge fund magnate Tepper once said to “buy all China assets.” The 13F disclosure document of his Appaloosa LP showed that the hedge fund fully increased its holdings of Chinese stocks and China equity funds in the fourth quarter.

Fourth, the increase of southbound funds.On February 14, real-time purchases of funds from the south reached 8.7 billion yuan. As of the 13th, the total amount of capital transactions to the south reached 154.136 billion yuan.

From the perspective of institutions, the continued injection of southward capital and industrial capital buybacks has enhanced the resilience of Hong Kong stocks. Net purchases for the whole year of 2024 will reach HK$807.869 billion, a 2.5-fold increase from 2023, setting the largest annual net purchase scale. In January 2025, the monthly net inflow of capital from the south reached HK$125.6 billion, the highest in a single month since February 2021, indicating that mainland investors continue to be optimistic about the Hong Kong stock market.

As of February 13, the net capital outflow of equity ETFs (including QDII equity funds) during the year was nearly 24 billion yuan. Among the top five capital outflows, the China Science and Technology Innovation Board ETF had the largest outflow, reaching 8.8 billion yuan. The Jiashi Science and Technology Innovation Board chip ETF outflow was 4.7 billion yuan, and the other three were all QDII funds. The China Hengsheng Internet Technology ETF, E Fund China Securities Overseas Internet ETF and China Hengsheng ETF had net outflows of 5.55 billion yuan, 4.16 billion yuan and 3.54 billion yuan respectively. A total of 20 stock ETF+QDII funds have outflows of more than 1 billion yuan.

Judging from the QDII ETFs with relatively large net capital outflows, overseas Internet and Hang Seng Technology are among the top net outflows.

From the perspective of the industry, it is not surprising that funds are currently flowing out. On the one hand, profit-taking funds have left the market at a profit; on the other hand, taking the Hang Seng Technology Index as an example, the index has exceeded the high of 5,649.27 points in last year’s 924 market. According to usual practice, funds also leave the market during the return stage.

Can the bull market continue? Institutions are deeply divided

What should we do next for Hang Seng Technology? Institutional views differ greatly.

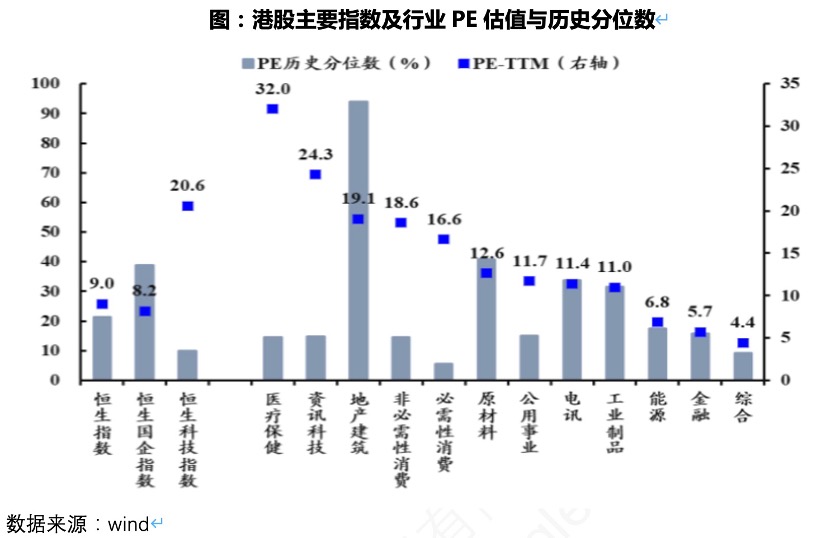

Huaxia Fund pointed out that low valuation is still an advantage of the Hong Kong stock market. Sentiment in the Hong Kong stock market has gradually warmed up. The valuation of the Hang Seng Technology Index is at a historically low level, with a price-to-earnings ratio (PE-TTM) of only 22.69 times, lower than 78.19% since its establishment. This makes the Hong Kong stock market more cost-effective and attracts more investors ‘attention.

Looking forward to the market outlook, Feng Chencheng believes that although in the short term, investors ‘trading focus is still only on China’s Internet sector; in the medium term, the continued growth momentum of China’s technology industry and signs of policy support for the real estate industry are expected to continue to boost investors’ sentiment towards China assets.

However, CICC stated in several thoughts on the new surge in Hong Kong stocks that in this round of surge in Hong Kong stocks, it is still a structural market overall, and it is a more extreme structural market. Only more than 20% of stocks outperform the index (more than 60% of individual stocks outperform the index in the 924 market).

However, these small-scale stocks can be relied on to push the overall index up and outperform A-shares. The main reasons are: 1) the overall market of Hong Kong stocks is small; 2) Hong Kong stocks have more software stocks and major manufacturers, but this A-share does not have; 3) In terms of index construction, the Hang Seng Series Index artificially limits the upper limit of individual stocks to 8%, which will make small and medium-sized companies have a greater pulling effect on the index.

In addition, CICC also said that in this round of surge, long-term foreign capital did not participate, but should be passive funds, trading funds and other short-term foreign capital participation. If technology changes and solves the overall macro deleveraging and contraction problems in the future, and the macro aggregate policy is coordinated and increased, this round of market will further spread to the entire market. If not, the market will continue to be structured.