Continue to accumulate wealth through the compound interest effect of time.

Author:Miles Deutscher

Compiled by: Shenchao TechFlow

The four-year cycle has ended. We are entering a new paradigm for cryptocurrency——The fittest survive, and the unfittest are eliminated.

Here are my strategies for how to respond to market changes in 2025 to continue to accumulate wealth in unknown areas.

Before sharing my strategy, let’s discuss why the four-year cycle is a thing of the past.

I think there are two reasons why the four-year cycle no longer applies.

-

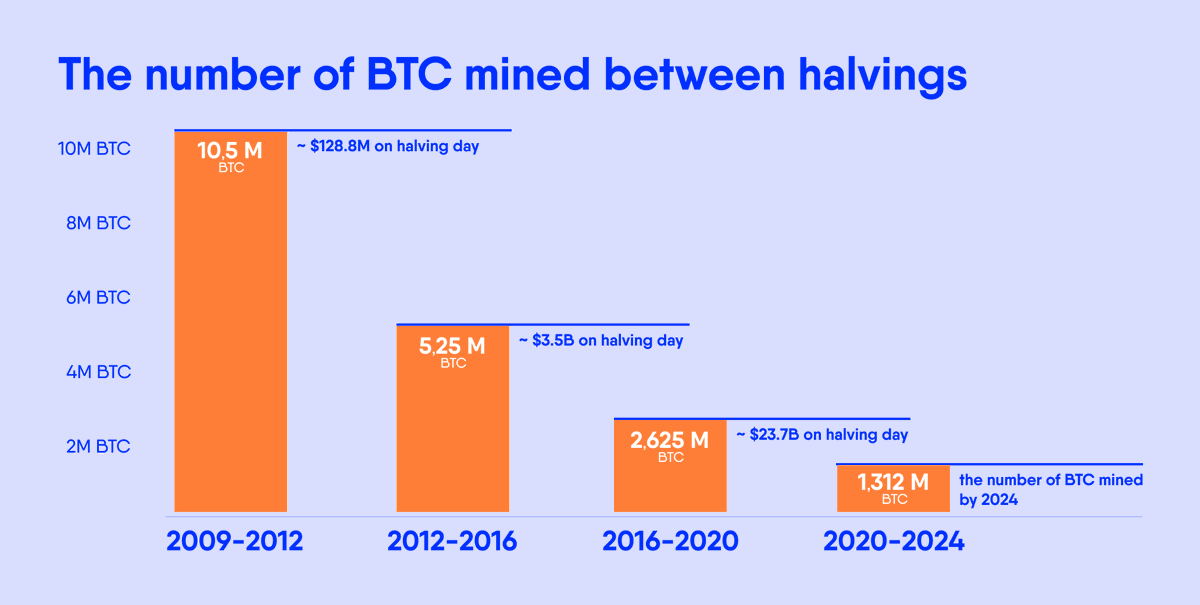

Reduced halving effect

First of all, from a supply-side perspective, the halving effect of Bitcoin ($BTC) is gradually weakening.

With each halving, the decline in the issuance of new bitcoins is shrinking.

For example, the halving in 2012 and 2016 reduced circulation by 50% and 25% respectively, so the impact on market prices was very significant.

But by 2024, the halved circulation reduction will be only 6.25%. This means that the halving has not promoted prices as much as before.

-

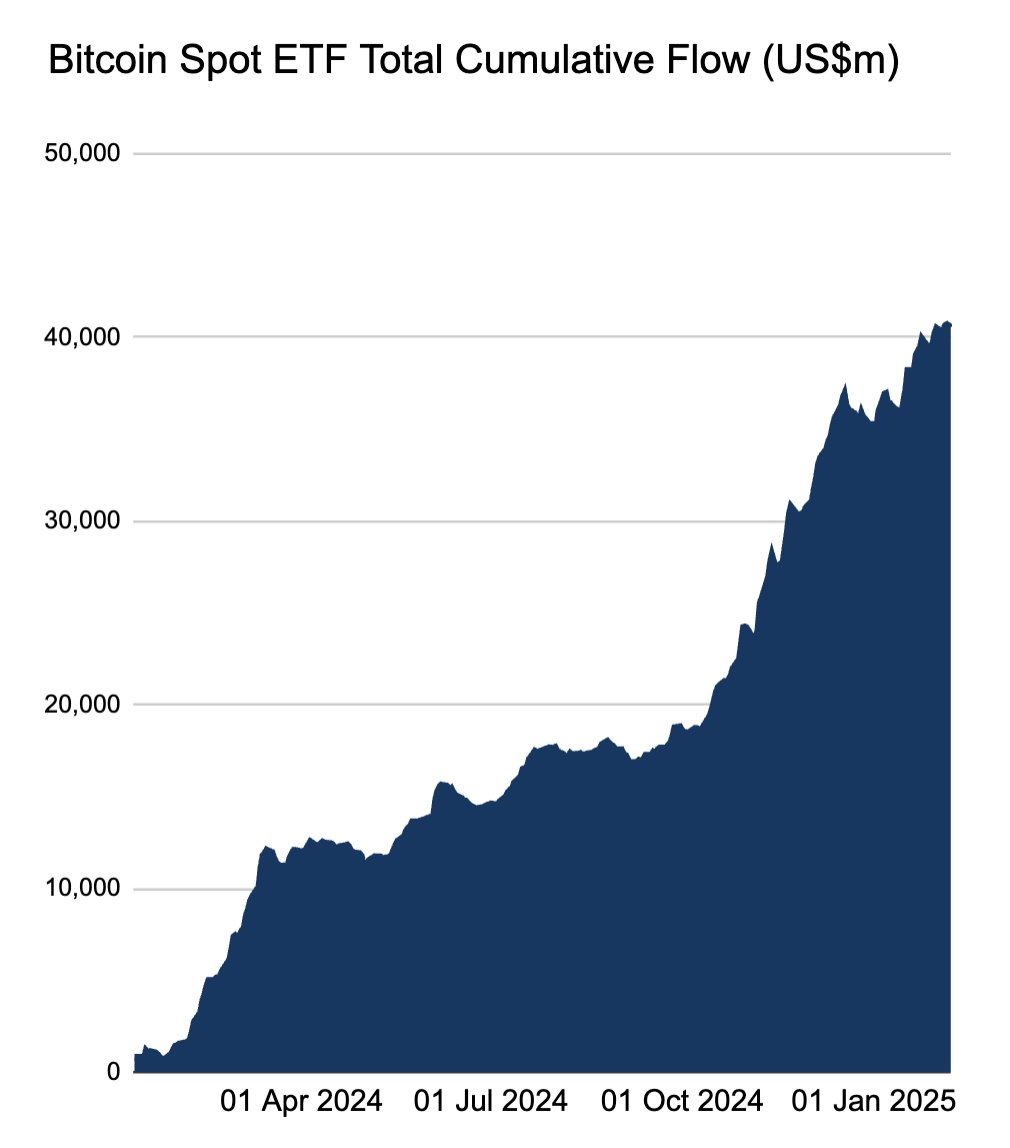

ETF Changed market rules

Second, from the demand side, the launch of Bitcoin ETF is a major variable, permanently changing market rules.

The Bitcoin ETF is a financial instrument that allows investors in traditional financial markets to indirectly invest in Bitcoin.

Since their launch, they have become the most successful ETF products in history, with demand far exceeding expectations.

This influx of demand has not only changed the overall landscape of the crypto market, but also broke many old market rules (such as the four-year cycle).

The biggest impact of ETFs is actually reflected in the altcoin market. Let me elaborate.

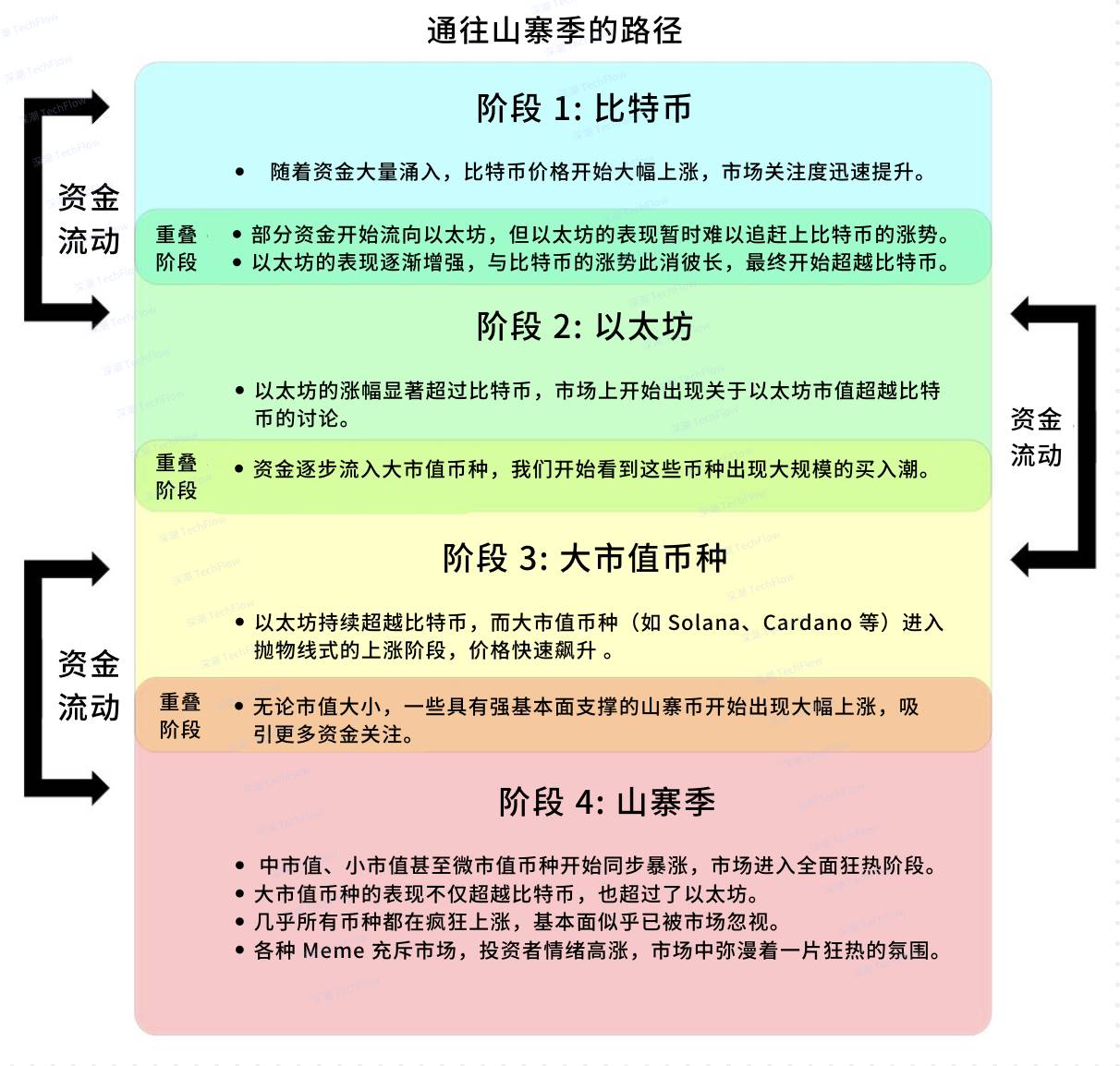

In the past, you might often see a chart showing the price rotation between Bitcoin and altcoins. This will indeed be established in 2021.

But now, this relationship has failed.

(The original picture is from Miles Deutscher and compiled by Shenzhen TechFlow)

Bitcoin’s wealth effect disappears

In 2017 and 2021, when bitcoin prices rose, many wealthy bitcoin whales would shift profits to altcoins on centralized exchanges (CEX), thereby fueling the prosperity of the altcoin market.

However, most new capital flows now enter the market through Bitcoin ETFs, and these funds do not flow into the altcoin market.

In other words, the way money flows has changed fundamentally, and altcoins no longer benefit from the wealth effects of Bitcoin.

Retail investors skipped stages 2 (ETH) and 3 (mainstream coins)

Retail investors flock directly to high-risk speculative projects on the chain, known as Pump Fun.

Compared with 2021, the number of retail investors in this cycle has decreased significantly. This is mainly due to the pressure of the macroeconomic environment and the fact that many people were hit hard during the previous cycle due to events such as LUNA, FTX, BlockFi and Voyager.

However, those retail players who remain in the market have directly skipped mainstream currencies and opted to look for opportunities on the chain.

You can read my detailed analysis of how this phenomenon affects the market here.

If my judgment is correct, which means that cycle theory no longer applies, what changes will this bring to the market in the future?

I have bad news and good news to share.

bad news is: It ‘s getting harder to make money lying flat. This is a natural signal that the industry is gradually maturing.

In fact, there are more trading opportunities in the market right now, but if you still follow the 2021 strategy such as holding a bunch of altcoins and quietly waiting for the altcoin season to come, you may be disappointed or even perform poorly.

The good news is:Since there is no so-called four-year cycle, this also means that the multi-year bear market triggered by specific factors in cryptocurrencies will no longer occur. Of course, from a macroeconomic perspective, a long-term bear market is still possible because cryptocurrencies do not operate in isolation and are now more relevant to the macro economy than ever before.

Markets ‘risk-appetite and risk-aversion periods are more likely to be driven by changes in macroeconomic conditions. These changes usually trigger short-term mini echo-bubbles rather than unilateral gains that last for months. The so-called echo bubble refers to the short-term market rebound caused by changes in the macro environment. Although it is small in scale, it is similar to large bubbles in the past.

In these bubbles, there are plenty of opportunities to make money.

For example, in 2024, we have witnessed the rotation of different hot spots: November is the craze for meme, December is the concept of AI, and January is the agent. There is no doubt that new trends will emerge next.

If you are sharp enough, these are great opportunities to make money, but require a slightly different strategy than in past cycles.

Which brings me to what I want to discuss next: my strategy.

I had dinner with @gametheorizing the other day, and he made a very insightful point.

Many people are pursuing one ultimate goal: whether it’s doubling their portfolio five times, ten times, or twenty times.

But in fact, a better strategy is to focus on multiple small bets rather than putting all their eggs in one basket. By continuing to accumulate a series of small victories, this approach may bring greater rewards in the long run.

Therefore, instead of betting all the money and hoping that the shanzhai season will quickly double your assets, try to passtimecompound interest effectContinue to accumulate wealth.

Specifically, you can use this strategy:

Small bets take profits, bet again and take profits again, and the cycle goes back and forth.

This is why many of the top traders and thinkers in the crypto space, such as Jordi, have been professional poker players. They learned from poker how to view every trade with probability thinking and evaluate possible outcomes rather than blindly betting.

My portfolio is currently allocated like this:

50% is invested in long-term high-belief assets, and 50% is used in stablecoins and active transactions. I will use this part of the funds to look for short-term opportunities in the market and move in and out flexibly.

In addition, I use stablecoins as a yardstick to measure the success or failure of transactions. Every time I exit a trade, I transfer profits back to stablecoins so that I can clearly see my earnings.

If your cryptocurrency portfolio is too fragmented and you don’t know how to respond to current market changes, last week I shared a guide that details how to optimize your portfolio based on market changes.

In this article, I highlighted a key point: the importance of setting invalidity standards for each transaction.It’s like when you decide to buy a cryptocurrency, you need a clear reason to verify (VALIDATION) Your choice is the same. The so-called invalidity refers to the standard for promptly withdrawing from a transaction when market conditions no longer meet your expectations.

I noticed that many people lacked basic risk management awareness and did not set clear exit standards when entering transactions. This practice often leads to unnecessary losses.

If you want to take one advice now that will significantly improve future profitability, it is:Establish clear technical or fundamental invalidation criteria for each transaction. This will not only help you better manage risk, but also improve the overall efficiency of your transaction.

Of course, the level of confidence you have in a trade and the expected duration of holding it may affect how you set criteria or triggers for invalidity. But in any case, that doesn’t change the fact that you need to plan ahead. Having a clear exit plan is one of the keys to a successful transaction.

Although the current market may not fully follow the rules of past cycles, I am still full of confidence in the future. As long as the correct mentality and strategy are maintained, there is still huge room for growth in 2025.

Currently, we are in a bear market stage, but market trends will eventually change and bring many new opportunities.Until then, your primary goal is to survive.

The rewards in the cryptocurrency market often belong to those who can persevere in the face of sharp fluctuations. No matter how ups and downs the market, patience and perseverance are the key to ultimate victory.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern