Original author: Murphy, online data analyst

–No matter how I don’t know, I’m scared when I compare

Realized Price (RPC) is a concept often used in on-chain data. Before understanding RPC, you need to understand the Realized cap (RC). RC is the sum of valuations based on the prices of all last moves of Timecoins.

RC eliminates interfering factors such as loss or long-term non-circulation, and better reflects the true value stored in the entire blockchain network;

Divide RC by all current circulating supplies to get RPC. The higher the price at which the (mobile) token is sold, the more sufficient the funds for subsequent acquisition, and vice versa. In other words, only the continuous purchase of real money at a high level can make RPC higher, so it is also the most direct basis for observing capital flows.

At the same time, RPC is also regarded as the average turnover cost. Whenever a correction occurs, RPC can play an important supporting role. Once the price is lower than RPC, it means that the average loss is on average. At this time, asset prices are “undervalued”. When cost performance appears, more bargain-hunting funds will be attracted, and a bottom range will be gradually formed.

· BTC

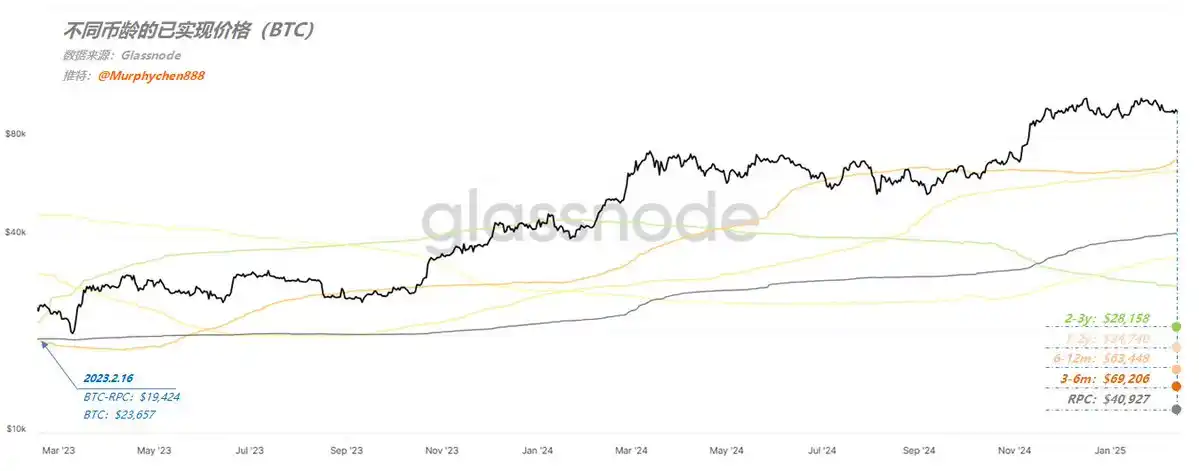

Figure 1 shows RPC data for BTC at different coin ages (holding times). It can be seen that among the four long-term holders (LTH) groups, the longer the time, the lower the average cost. 3-6 The cost for one month (3- 6m) is $69,200; the cost for two to three years (2- 3y) is $28,158; that is, even if the bear market BTC falls back to $3w one day, these LTH groups will still make money.

(Figure 1)

As of February 13, BTC’s RPC is $40,927, based on the current price of $96,600,Investors still have an average floating profit of 136%, and the holding experience is excellent!Therefore, whenever the price of BTC fluctuates, panic selling pressure is not large and will not trigger a chain reaction. This is also one reason why BTC “does not fall deep” in this cycle. Such a low RPC obviously cannot be used as a reference price for the correction of the bull market cycle, but it can be used as a criterion for judging the bottom stage of the bear market cycle.

BTC’s RPC in 2023.2.16 is $19,424, a 2-year growth 210%; BTC prices increased from $23,600 to $96,600 over the same period 409%。The increase in prices is much higher than the increase in capital absorbed,This shows that in addition to capital, BTC has also attracted more mainstream emotional value (high market attention).

· SOL

Figure 2 shows the RPC data of SOL for different coin ages. In the past two years, SOL investors have had a very good position holding experience. It can be seen that the average cost of all long-term currency holders is lower than the current SOL price. The cost of 3- 6m is $167, and the cost of 2- 3y is $71;

(Figure 2)

As of February 13, SOL’s RPC is 1; at the current price of 4,On average, investors still have a floating profit of 37%.From this point of view, the stability of SOL chip structure is far less than that of BTC. But conversely,$141 is also a very strong support level. As long as the bull market consensus still exists, the closer you get to this line, the smaller the selling pressure and the stronger the bottom-hunting sentiment.

In 2023.2.16 SOL, RPC was $39, making it the only mainstream coin with a spot price lower than RPC at that time.In other words, SOL at this time is the most undervalued among the several mainstream currencies and the best cost effective. After 2 years, RPC grows 361%; SOL prices increased from $22 to $195 over the same period 886%。Similarly, the increase in prices is much higher than the increase in capital absorbed (better than BTC), indicating that SOL has also received extremely high market attention in this cycle.

· BNB

Figure 3 shows the RPC data of BNB for different coin ages. As the only token empowered by Binance and BNB Chain, it is also worthy of the word “mainstream”. So let’s also take a look at its data performance.

(Figure 3)

The cost for 3- 6m is $575, and the cost for 2- 3y is $301; similarly, the average cost for all long-term currency holders is lower than the current BNB price. One detail is that during the few days from February 5 to February 8,BNB prices fell to around $570, creating support at the 6-m RPC line,Then it began to rebound.

As of February 13, BNB’s RPC was $495; based on the current price of $665, investors on average still have a floating profit of 34%. But we can find that during the period from 2024.10.4 to 2024.10.7, BNB’s RPC suddenly soared from $206 to $463.

This data is very strange and is very rare in other mainstream currencies with scattered chips. It also reflects the particularity of BNB chip distribution. Only when a huge amount of chips reaching a certain proportion of circulation suddenly move at a high level will the RPC be abnormal. Therefore, it is not easy to assess whether the current RPC $495 can have a supporting effect (the data may be interfered with).

In 2023.2.16, BNB’s RPC was $81, which was much lower than the spot price of $304 of BNB at that time; therefore, the price/performance ratio at that time was not as good as SOL and BTC. But if you include the benefits of Launchpool, Megadrop, HODLer, etc. from holding BNB, it is a different story.

· ETH

Figure 4 shows the RPC data of ETH for different coin ages. Why do I put ETH data last? Because compared with the above three, the data performance is the most unsatisfactory.

(Figure 4)

The cost of 3-6m is $2,923, and the cost of 6-12m is $3,088; that is,ETH is currently the only mainstream currency that still causes investors who have held the currency for 12 months to lose money on average.

As of February 13, ETH’s RPC was $2,104, which was also the lowest point of the February 3 plunge (generated strong support). At the current price of $2,700, investors on average have only a floating profit of 24%. This ratio is lower than both SOL and BNB, and far lower than BTC.

In 2023.2.16, the RPC for ETH was $1,482; it increased by 142% in 2 years; the price of ETH increased by 164% from $1,639 to $2,700 during the same period. The increase in prices is almost the same as the increase in capital absorbed, indicating that ETH has the least emotional value in this cycle. Or compared to BTC and SOL, the market has the lowest expectations.

—————————————–

·Summary

1. From the perspective of the stability of the chip structure, BTC is far better than other mainstream currencies. Long-term currency holders currently have an average floating profit of 136%. SOL and BNB are similar, with 37% and 34% respectively;ETH has the lowest, only 24%. That is to say, the current spot price of ETH is closest to the average turnover cost, and ETH holders have the worst holding experience. Once the price falls below this support, it will easily trigger a chain reaction.

2. Judging from the comparison of price growth and capital absorption in the past two years, BTC and SOL are more enthusiastic about emotions, or higher expectations are placed on them.

3. Since the RPC data of BNB was abnormal in 2024.10, the current RPC cannot determine whether it was interfered. If not, then the current BNB holder’s position holding experience is also very good. At the same time, holding BNB can earn additional mining or airdrop revenue every month, which is also a bonus.

4. Finally, ETH… How should I evaluate ETH? As the only second crypto asset to pass through ETFs, it is high-quality. But I can’t praise the various performances of the Ethereum Foundation. As the founder of Vitalik, there is no doubt that he is a talented developer, but he may not be a qualified leader at present.

PS: If you need to know the RPC support data of other currencies, you can leave a message to me in the comment area. If I can find out, I will reply one by one.

—————————————–

My sharing is only for learning exchanges, not as investment advice

original link