Original title: BIG IDEAS 2025

Original source: ARK Invest

Compiled by: Nicky, Foresight News

1. Bitcoin: The maturity and institutionalization of the global monetary system

Bitcoin ushers in a milestone development in 2024, with significant improvements in its network fundamentals and institutional adoption rate, demonstrating its long-term value as “digital gold.”

1. Market performance and institutionalization are accelerating

In 2024, the price of Bitcoin hit a record high, exceeding US$100,000, and the market capitalization ratio (as a proportion of the total market value of cryptocurrencies) exceeded 65% for the first time. Behind this growth, the launch of the spot Bitcoin ETF has become a key catalyst. The first batch of spot bitcoin ETFs in the United States attracted more than US$4 billion in capital inflows on their first day of trading, far exceeding the historical record of gold ETFs in September 2004. As of the end of 2024, the total asset management scale (AUM) of Bitcoin ETF has exceeded US$100 billion, and the proportion of institutional investors has increased significantly. At the same time, Bitcoin’s annual volatility fell to an all-time low, while its risk-adjusted return remained better than most major asset classes.

·Halving and scarcity:Bitcoin completed its fourth halving, and the annual inflation rate dropped to 0.9%, which was lower than the long-term supply growth rate of gold (about 1.7%) for the first time, once again highlighting its deflationary nature. The total cap of 21 million pieces set in its code and the mathematical monetary policy further consolidate the narrative of “digital gold.” On-chain data shows that long-term holders (holding for more than 3 years) account for 45%, a record high, indicating that Bitcoin’s recognition as a value store continues to increase.

·Corporate positions and strategic reserves:74 listed companies around the world have included Bitcoin on their balance sheets, with a total holding of more than 550,000 coins, worth approximately US$55 billion. MicroStrategy, as the largest holder, holds 446,000 positions (accounting for 2.1% of Bitcoin in circulation). In addition, Pennsylvania became the first state in the United States to propose establishing a strategic reserve of Bitcoin, marking a government-level exploration of cryptocurrencies.

2. Technological evolution and network health

·New high computing power:Although miners ‘income has been halved after halving, the computing power of the entire network has still reached a historical record, indicating miners’ long-term confidence.

· Runes protocol activation:The Bitcoin-based Fungible Token protocol has driven a surge in transaction volume on the chain, with the number of daily transactions exceeding 800,000, and the ecological application scenarios continue to expand.

·Long-term holding behavior:More than 45% of Bitcoin’s supply has not moved for more than three years, and liquidity on the chain has dropped to a 14-year low, reflecting its positioning as a store of value.

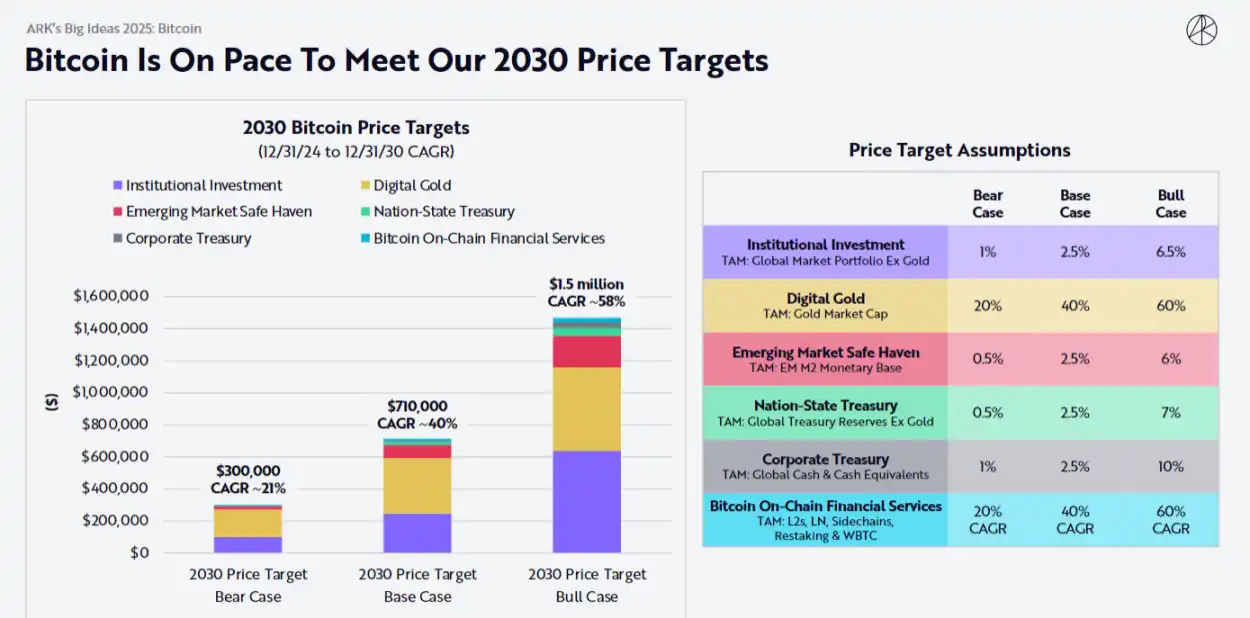

3. 2030 price forecast

ARK predicts that in Bitcoin’s 2030 price outlook:

·Bear market price: $300,000

·Neutral price: US$710,000

·Bull market price: $1.5 million

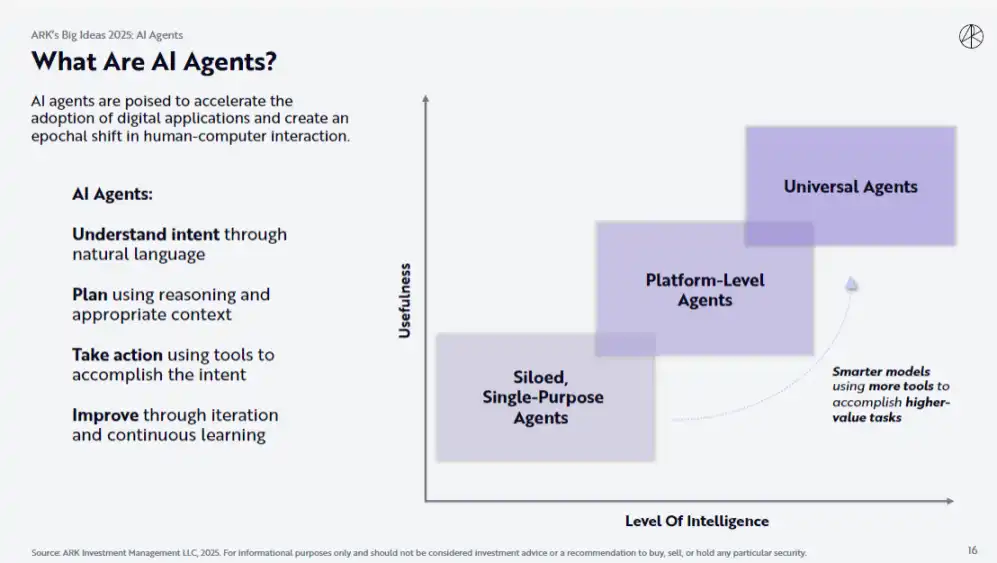

2. AI Agents: Reconstructing human-computer interaction and business efficiency

AI Agents are evolving from single-task tools to universal intelligence platforms. Its core competencies include: natural language understanding, contextual reasoning, tool invocation and continuous learning.

1. Consumer transformation

·Search and advertising refactoring:AI-driven personalized agents will replace traditional search engines, and AI advertising revenue is expected to account for 54% of the digital advertising market in 2030, reaching US$600 billion.

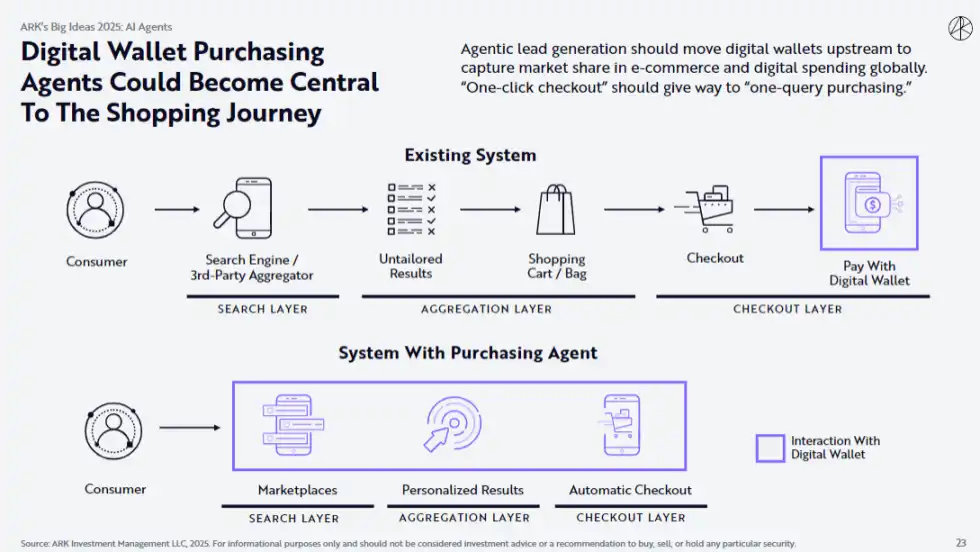

·E-commerce revolution:AI agents are deeply integrated into the operating system, allowing users to complete the entire process of product search, price comparison, and payment through voice or text instructions. For example, shopping agents embedded in digital wallets can automatically screen the best items and complete settlement, driving digital wallets to account for 72% of global e-commerce transactions and creating US$200 billion in additional corporate value per year. Such agents are expected to generate US$9 trillion in online consumption in 2030, accounting for 25% of global e-commerce.

·Hardware popularization:After 2025, most consumer electronics devices will have built-in AI proxy functions, and the penetration curve may surpass that of smartphones.

2. Enterprise efficiency jumps

·Customer service cost optimization:AI customer service can reduce the cost of a single conversation from US$1 to US$0.125, handle 70% of consulting needs, and save more than US$500 billion in labor costs for companies around the world.

·Software development revolution:AI coding tools (such as GPT-4 and Claude 3.5) have been able to solve 70% of real tasks, shorten the software development life cycle by 40%, and promote companies to shift from purchasing software to customized development. If AI agents automate 81% of knowledge work time, a productivity dividend of US$117 trillion will be released by 2030. The size of the software market may surge from the current US$1.5 trillion to US$13 trillion (a compound annual growth rate of 48%), and the demand for underlying cloud infrastructure and AI chips will explode simultaneously.

3. Stable coins: reshaping the digital asset landscape

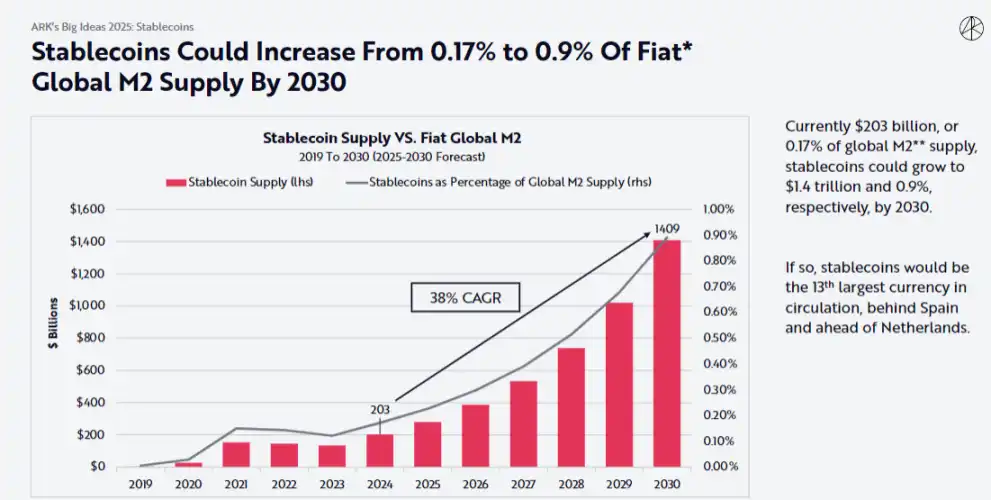

In 2024, the annualized transaction volume of stablecoin will be US$15.6 trillion, surpassing Visa (13.1 trillion) and Mastercard (7.8 trillion), becoming the fastest-growing payment network in the world.

1. Market explosion and innovation

·Scale and efficiency:The annual settlement volume of stablecoins reaches US$15.6 trillion. The value of a single transaction far exceeds that of credit cards. On-chain settlements such as Solana and Tron account for more than 60%. In December, the monthly trading volume of stablecoin on the chain reached US$2.7 trillion, of which small transactions (US$100) accounted for more than 85% of Layer 2. Users in emerging markets (Brazil, Nigeria, etc.) use stablecoins for cross-border remittances and anti-inflation savings, pushing the number of active addresses to exceed 23 million. At the same time, the adoption rate of stablecoins in Layer 2 (Base, Arbitrum) and emerging public chains (TON, Celo) has surged, driving the need for cross-chain interoperability.

·The rise of income-based stablecoins:Ethena Labs ‘USDe provides 20%-30% revenue through its Delta-neutral strategy, locking up assets of US$6 billion in 12 months, pushing the proportion of illegal currencies collateralized stablecoins to 10%.

·Dollar trend:Although many countries have promoted dollarization, the proportion of U.S. dollar stablecoins still exceeds 98%, and Tether and Circle have ranked among the top 20 holders of U.S. debt in the world. Stabiloins have become the core tool for the “digital export” of the US dollar. Especially under the trend of “de-dollarization”, the demand for US dollar staboins in emerging markets has offset the impact of some countries reducing their holdings of US debt. ARK predicts that by 2030, the size of stablecoins will reach US$1.4 trillion, accounting for 0.9% of the global M2 money supply, making it the 13th largest currency in circulation.

2. Regulation and challenges

·Acceleration of compliance:The framework of the U.S.”Payments Stable Coin Act” has begun to emerge, requiring 100% transparency in reserves and audits, and further concentrating the market share of leading issuers.

4. Expanding blockchain: Layer 2 ‘s competition with high-performance public chains

Ethereum Layer 2 and Solana lead the wave of expansion and promote the evolution of the smart contract ecosystem towards high throughput and low cost.

1. Ethereum ecosystem upgrade

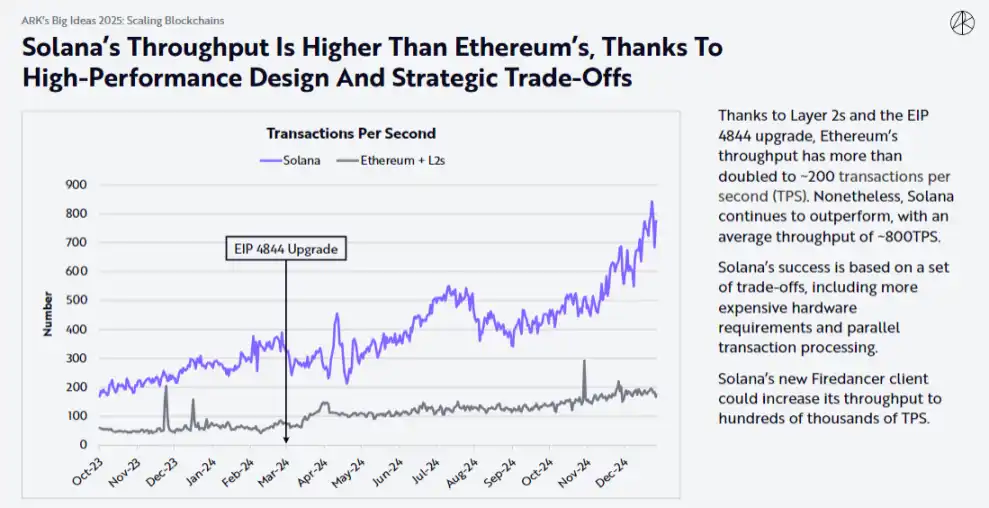

· EIP-4844 Effect: The EIP 4844 upgrade reduced Layer 2 transaction costs from US$0.50 to US$0.05, and the average daily transaction volume jumped from 3 million to 15 million.

·Rapid development of Base: Base chain DAU accounts for 46%, and TVL exceeds US$15 billion. Coinbase ecological synergy has emerged and promoted Ethereum from the settlement level to the application level.

·Developer migration: In 2024, the number of new developers in Solana will surpass the Ethereum main network, and Memecoin and DePIN (decentralized physical network) will become dual engines of ecological growth.

3. Application layer explosion

· DeFi challenges CEX: DEX trading volume increased from 8% to 14%, and the derivatives market grew to 8%. Uniswap’s single employee performance is 200 times that of Binance.

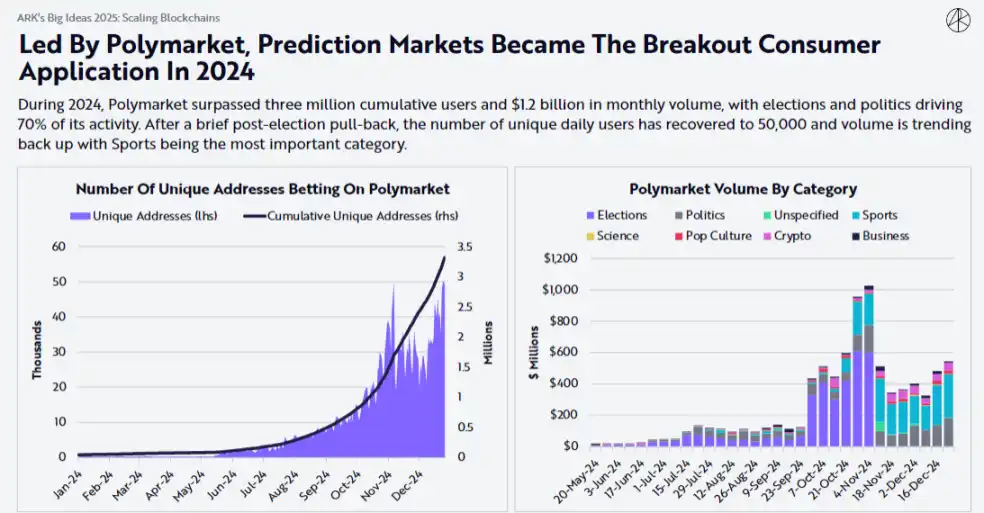

·Forecasting the rise of the market: Polymarket relies on U.S. elections, sports competitions, etc., with monthly transaction volume exceeding US$1.2 billion and more than 3 million users.

The re-pledge economic model is more mature: liquidity pledge agreements (such as Lido and EigenLayer) manage more than 5.5 million ETH (accounting for 17% of the total pledge), promoting the maturity of the re-pledge economic model.

Conclusion: Integration and Breakthroughs of Web3

In 2025, the monetary attributes of Bitcoin, the productivity release of AI Agents, the expansion of the payment network of stablecoins, and the technological breakthrough in expanding the blockchain will together form the core of ARK’s “Big Vision 2025”. The intersection of these technologies will reshape the global economy: AI-driven computing power demand drives the energy revolution, stablecoins enhance U.S. dollar hegemony, and blockchain expansion releases the potential for decentralized applications. Web3 practitioners need to pay attention to the evolution of the underlying protocols, grasp key tracks such as cross-chain interoperability, AI-native DApps, and compliant stablecoins, and capture value in technology integration.

original link