Behind the Solana celebrity token is actually a carefully designed wealth harvester system.

Original author: @m7_research

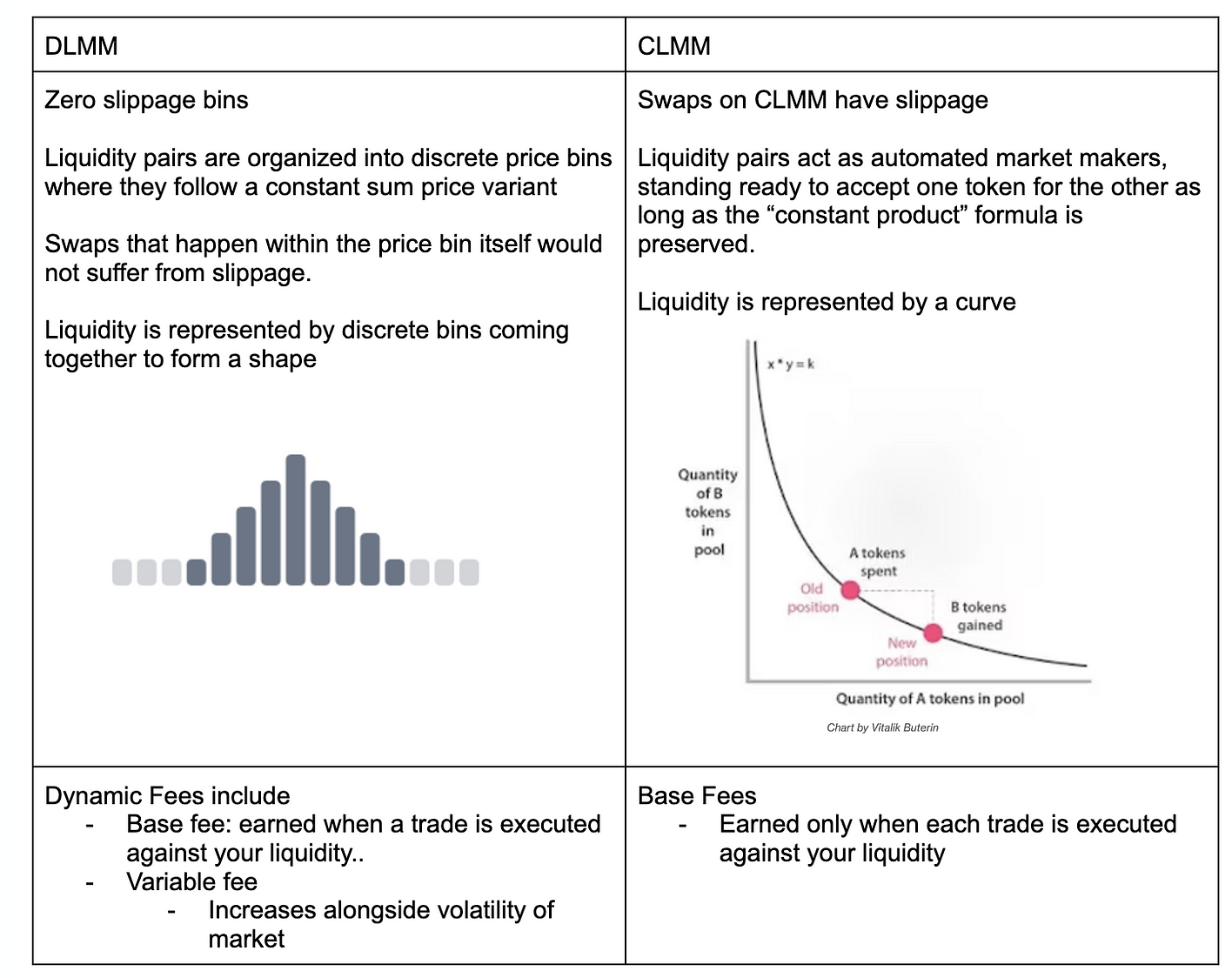

Meteora platform: Innovation mechanisms become manipulation tools

The Meteora platform has gained favor with its DLMM model, which has lower trading slips and flexible liquidity management mechanisms. However, these innovative characteristics, originally intended to improve capital efficiency, have been improperly used and become profit-making tools for project parties and insider traders.

The operating model of systematic manipulation

In a typical celebrity token issuance, project parties typically take the following steps:

-

Create tokens in advance

-

Build a DLMM trading pool on Meteora

-

Inject transaction liquidity

Observations have found that project parties often create DLMM pools of token and USDC trading pairs in advance, injecting only unilateral liquidity. This means that at the opening of the market, a large number of limit sell orders have been preset to wait for the influx of liquidity, and the zero-slip feature of the DLMM trading bin further amplifies the profit margin of the project side.

Insider Trading Analysis: Precise Timing and System Operation

In cases such as $MELANIA,$ENRON, and $LIBRA, insider traders all knew the contract address (CA), trading pool information and opening time in advance. The specific manifestations are as follows:

-

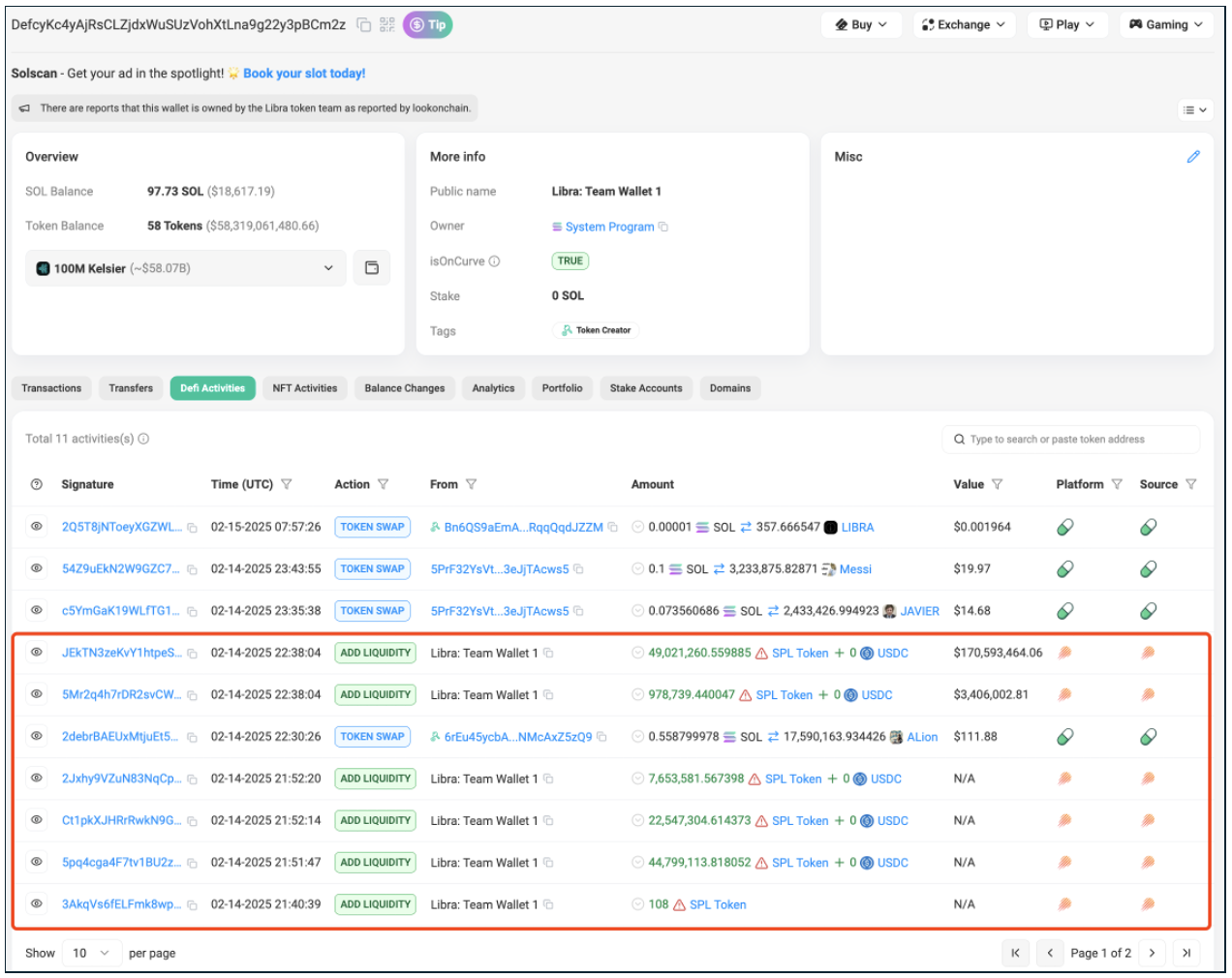

$LIBRA created tokens on the 14th, and created a trading pool 20 minutes before the opening day on the 15th

-

https://solscan.io/tx/3vtogCe5Q52iUYbY6CLRTV3RUf2ggSDoAkPtCYpJrvpvdoqx71mJbS5zgwvze7CDHTBzNohbg4eJiFPw5kUnu5Dh

-

$ENRON created tokens on January 25 and didn’t set up the Meteora pool until an hour before the February 4 transaction

-

https://solscan.io/tx/ydzeZfhtfM4vwU2dH7ALB3acavcNBh5oTSuPgCCBPonoQvm4AbCo5P2Rw4WqyWUvRJj4D3mUN68JzTK1uwqF8Ej

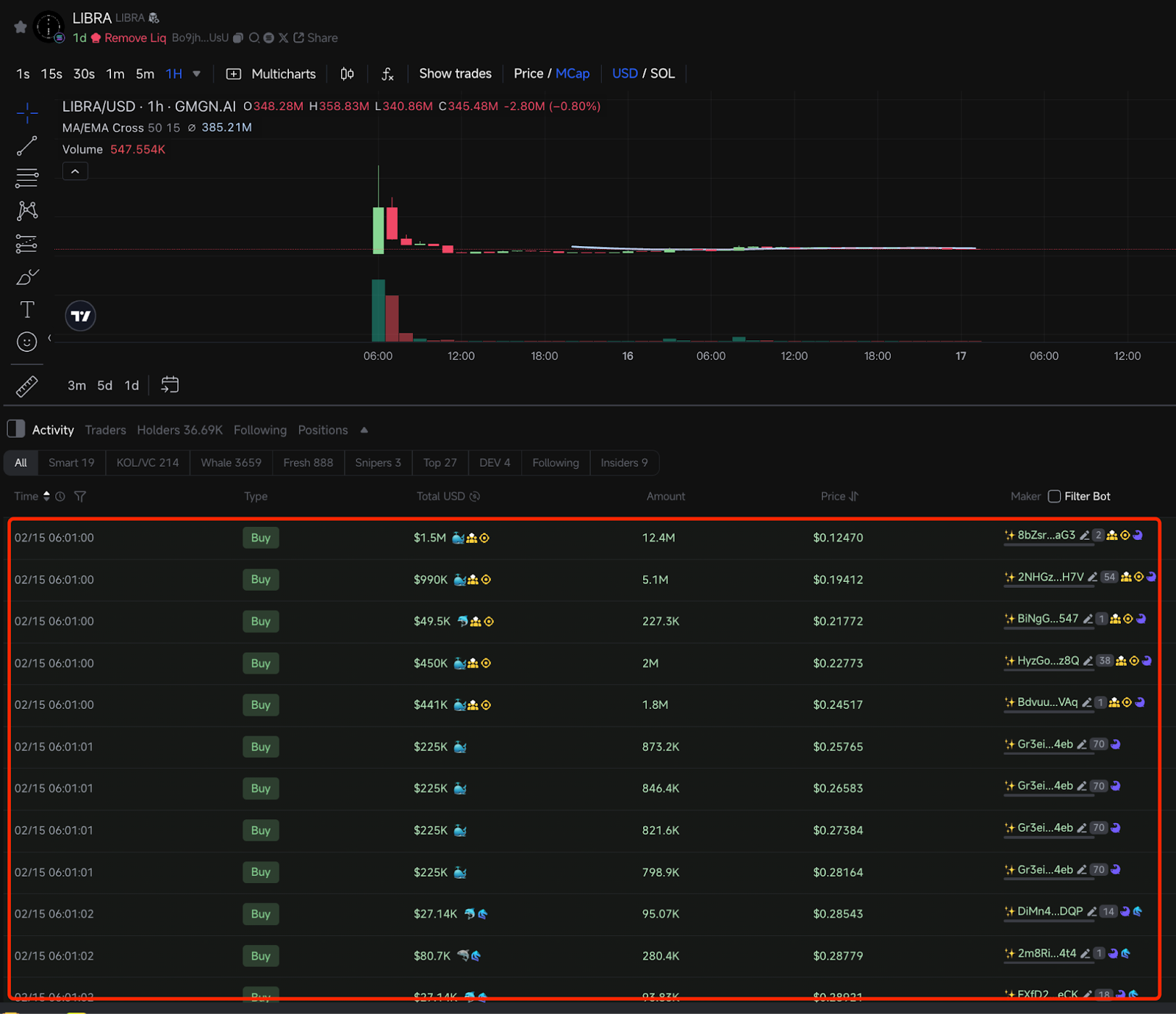

According to GMGN data, nearly US$4.5 million in funds poured into $LIBRA within just two seconds of opening.

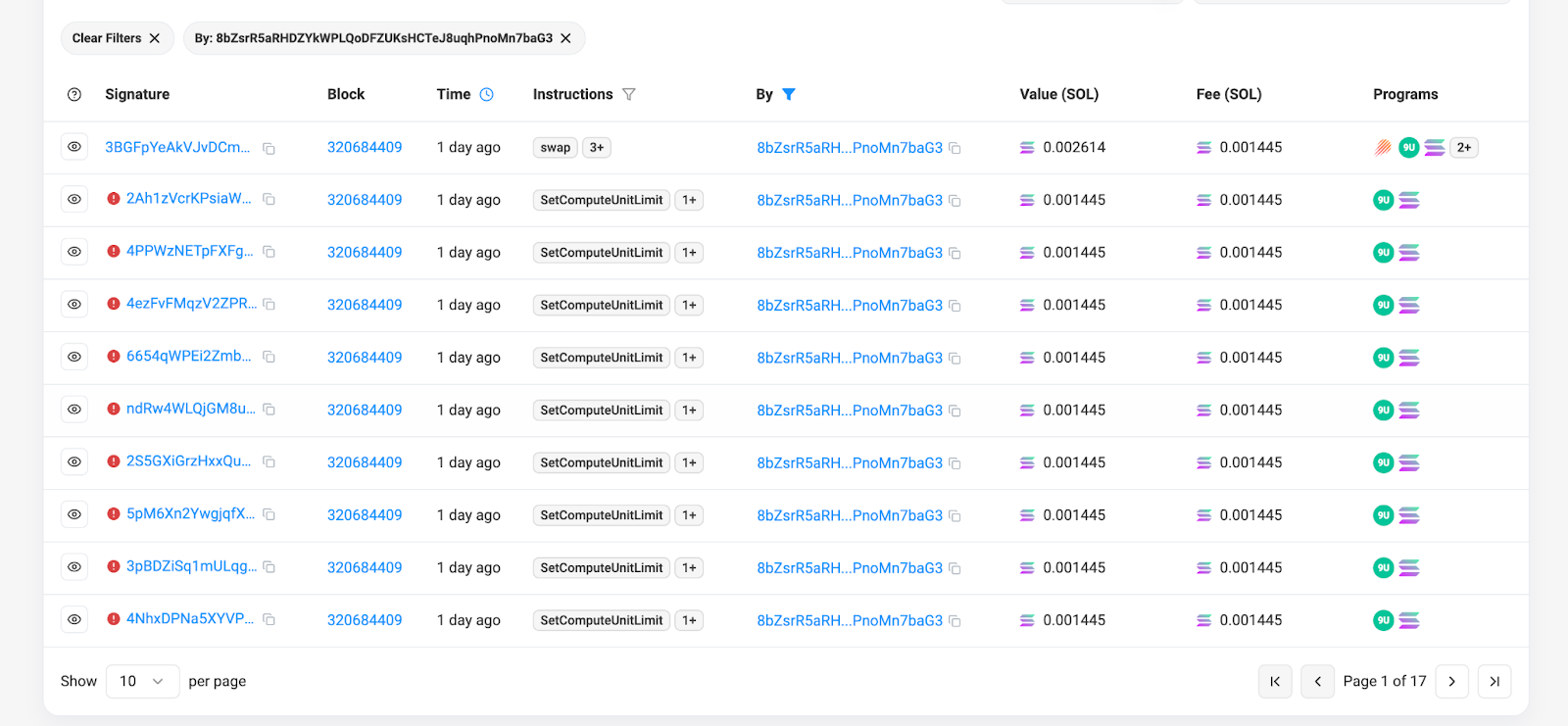

A trader (address: 8bZsrR5aRHDZYkWPLQoDFZUKsHCTeJ 8uqhPnoMn7baG3) won the first spot with a single sniper trade of US$1.4 million. The account initiated 170 transactions in the opening block and did not succeed until the moment the transaction opened. Considering that a pool that only adds unilateral liquidity opens every day on Meteora, such a large amount of precise investment obviously comes from inside information.

Detailed explanation of profit model

The sniper trader adopted a systematic profit-making strategy:

-

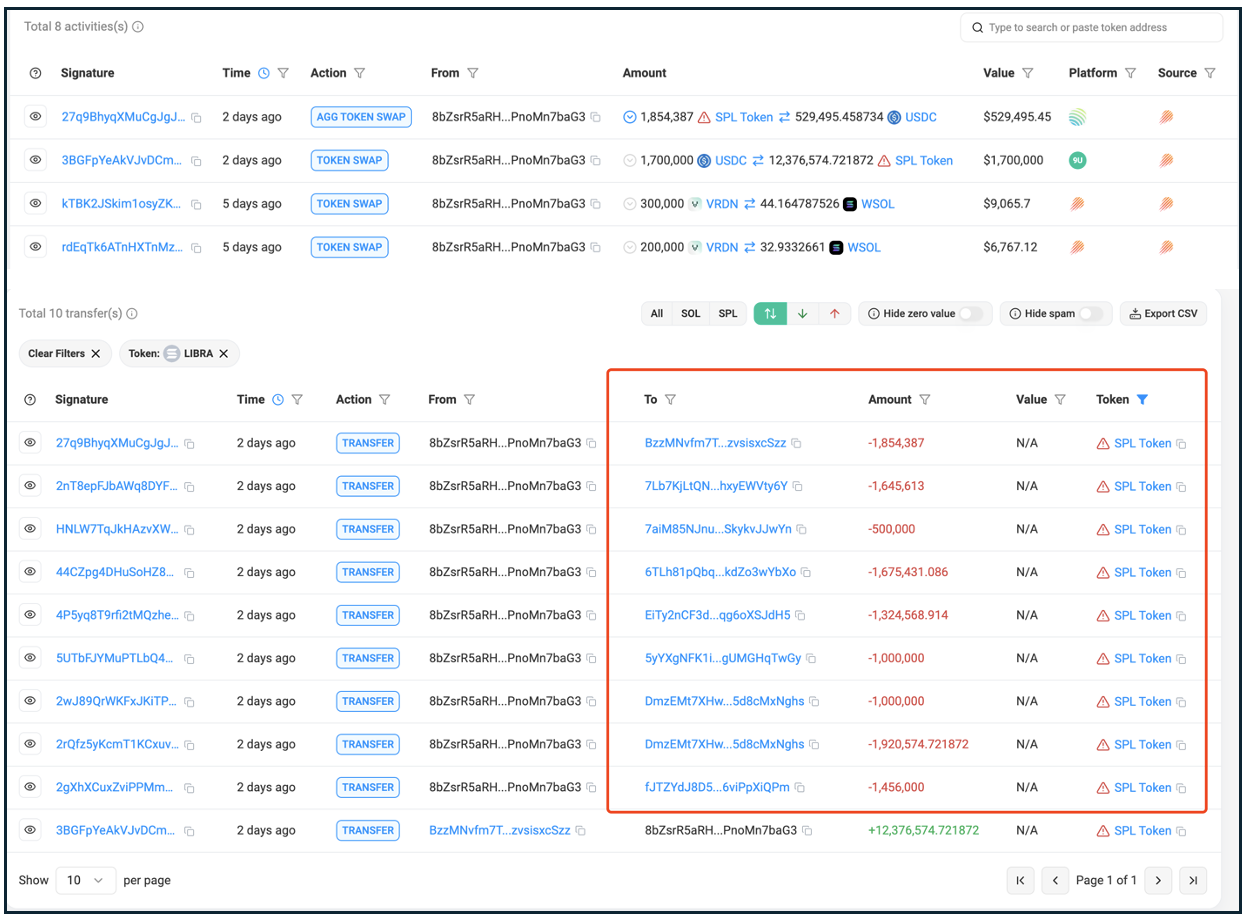

Quickly convert 1.8 million coins into US$530,000

-

Spread the remaining tokens into 8 sub-accounts for distribution

-

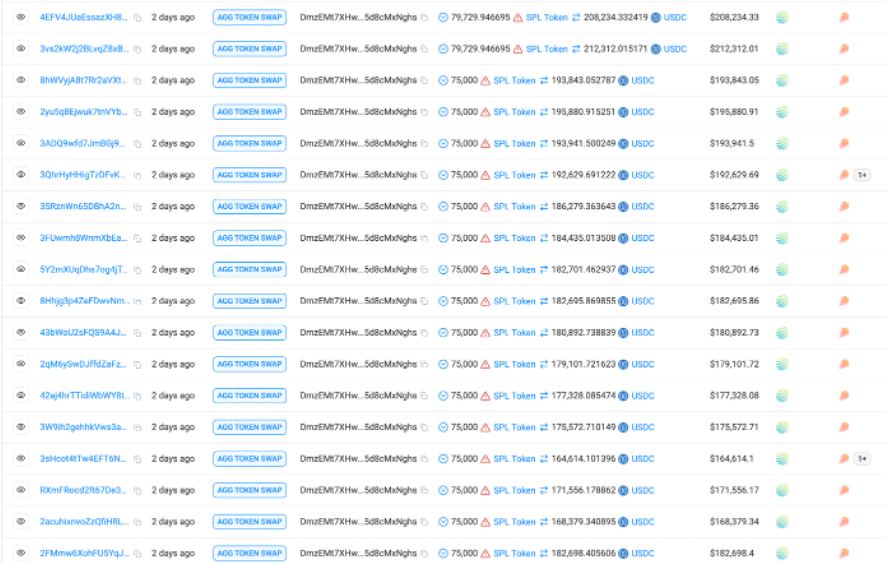

Take the largest sub-account (DmzEMt 7XHwA1tZM5d1XBGvTFWoUpTLutpR5d8cMxNghs) as an example:

-

750,000 coins are sold every 20 seconds, and 14 consecutive operations are carried out

-

The remaining tokens are added to the $LIBRA-$SOL trading pair as unilateral liquidity

-

5500 SOLs were harvested in just 7 minutes

-

Convert all LIBRA and SOL obtained to USDC within 5 hours after the opening, earning a profit of US$5 million

In the end, the sniper account made a total profit of US$17 million through this batch dumping method.

At the same time, the profits of the project party are more substantial. Developer Address (DefcyKc4yAjRsCLZjdxWuSUzVohXtLna 9g22y3pBCm2z) also uses a unilateral liquidity mechanism to add tokens to the Meteora pool, and fee income alone reaches US$10 million.

Market impacts and warnings

Although the $LIBRA case has attracted much attention due to its high attention, it all present similar operating patterns from $ENRON,$MELANIA to $RYAN. Investors have unknowingly fallen into the capital harvesting trap of celebrity +Meteora+ big truck. The high-liquidity mechanism of the Meteora platform has been abused by project parties and insider traders, which has seriously overdrawn the liquidity and investor confidence of the cryptocurrency market.

原文链接