The essence is to compete for Distribution. Who can acquire users more efficiently and achieve retention?

Author: YetaS

The last post received a lot of controversy because it wrote @berachain; yesterday,@cz_binance was also working very hard to use meme to revitalize @BNBCHAIN; on the AMA with @DoveyWanCN,@forgivenever asked why we support the Movement.

That day, when I saw @jinfizzbuzz and wrote @megaeth_labs, some people said that they talked about ecology without going to the test website; these days,@solayer_labs and @StoryProtocol TGE have not met everyone’s expectations. Let me take this opportunity to talk about the logic of our investment in the public chain. Every public chain has its own starting point. What I say does not mean that it is correct. Welcome to discuss it.

How did public chains work in the past?

The essence of blockchain is chain. Since its birth, the first construction of infrastructure has become an industry practice, which has directly spawned a large number of Generic Public Chains with technological differentiation as the selling point. Infra was built and then attracted dapp developers. Become a default choice. But we all know that infrastructure itself cannot attract users. What attracts users? It is investment promotion, and it is applications such as ICO, NFT, Defi, and Meme that can be played. However, these applications will not emerge spontaneously. How can the early public chain be broken?

TGE relies on the Founder’s charisma, the vast amount of financing news, the ultra-large-scale marketing and promotion, and the huge wealth effect. Nowadays, the marketing of these public chains is just a child’s play in the face of EoS. The genius BM and ICO have been playing for a year and raised US$4 billion, and then there is nothing more. Why is this seemingly air path established? Because the public’s attention is limited, no applications or users will take the initiative to come to your ecosystem when Chain is unknown. This is why VCs need to continue to invest in new public chains.

What’s wrong with the current public chain?

At present, the market’s valuation logic for the public chain is in an extremely distorted state.

On the one hand, the market is increasingly not paying for the infrastructure-first model, because there are only a handful of Generic Public Chains that have truly escaped the ecology. This is one of the reasons why investors have lost trust in VCs. A large amount of capital has bet on so many public chains, but most of them have failed to fulfill their growth commitments. The chart below @defi_monk points out this problem very directly.

But on the other hand, the public chain is still the direction with the highest valuation ceiling in the entire industry. So far, no Dapp has proved that it can live longer than the public chain.

After 10 years of evolution, Solana has gone through two full cycles, and the Dapp on them is still active.

In other words, although the market questions the high valuation of the public chain, it is still the high-ceiling track closest to long-term doctrine.

So everyone loves and hates this model. They hate that there is nothing that can be valued at such a high value. They love that if it is done well, it has such a high ceiling benchmark.

This is actually a historical legacy of our industry and needs transformation.

How to turn?

Now there is another path, App Specific Chain, which starts with the phenomenal @AxieInfinity. They make @Ronin_Network and want to try to guide users at the application layer to the chain ecosystem, but the problem is that they haven’t been guided yet, and their own applications are no longer popular.

This cycle this pattern was further ignited by @HyperliquidX, and then we can see:

– @Uniswap — Unichain

– @JupiterExchange — Jupnet

– @OndoFinance — Ondo Chain

– @ethena_labs — Ethena Chain

Take Ethena, which I am most familiar with, as an example. Their next application is Ethereal, which is based on USDe’s perp and starts to build an ecosystem around its core assets and applications. Maybe this is a bit like Hangzhou? After the birth of Alibaba, the entire e-commerce industry has risen in Hangzhou.

This paradigm shift can be said to be because application is the foothold that can truly push the industry to the public. It can also be said to be market segmentation under mature business. Everyone is using different methods to impact the traditional valuation system of the industry.

What are these two models fighting for?

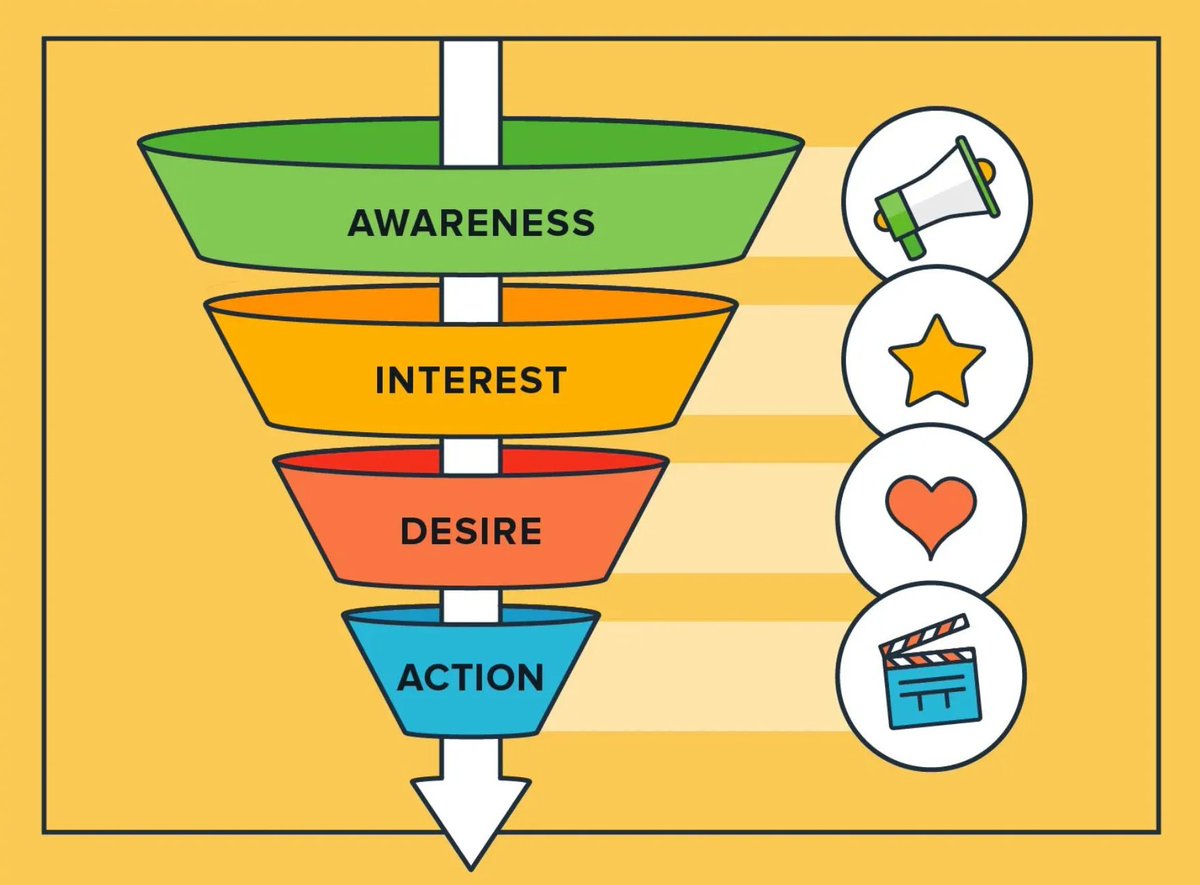

In the public chain ecosystem, Chain relies on large-scale infrastructure promotion and financing narratives to attract Dapp developers to settle in, and ultimately achieves user retention through the application ecosystem. Dapp directly acquires users through real application scenarios, and gradually builds its own ecosystem under user migration and synergy, and eventually evolves into a chain.

From virtual to real, from real to virtual, different paths reach the same goal. What is the essence behind this? The essence is to compete for Distribution. Who can acquire users more efficiently and achieve retention?

In Web2, the barriers to Distribution are much higher than products, because the marginal costs of most products are close to zero, and the barriers to competition in distribution channels are extremely high.

Distribution means traffic portal monopoly + platform network effect + data monopoly. They together shape Web2 ‘s core competitiveness.

Take TikTok as an example:

– Monopoly of traffic entrances: TikTok seizes the outlet of Short Video and becomes a new generation of traffic entrances

– Platform network effect: Establish a bilateral market for creators, viewers and advertisers. As content supply increases, user stickiness continues to increase

– Data monopoly: Massive user data trains recommendation algorithms, continuously improving distribution accuracy and forming a strong data barrier

Why did we vote for Hooked? We have always said that this is a web 2.5 product, because Tap to earn is actually a long-proven effective customer acquisition model that can obtain huge external traffic. However, one of the things it was ultimately falsified is that the user traffic brought by airdrops is of low quality and insufficient conversion rate. Even if traffic is obtained efficiently, it cannot be retained. This is also the reason why we chose to pass all Telegram tap-to-earn projects in the future. If we changed the channel, the model would remain unchanged and the user quality would still be low.

Returning to this business essence, Distribution logic also exists in web3, but the way users obtain it is different.

In the past, Generic Public Chain did not have mature product support and could not rely on products to obtain traffic, let alone monopoly effects. Therefore, the way it occupies Awareness relies mainly on:

– Technology pioneer: Attracting early developers and geeks

– Founder’s charisma and cultural uniqueness: Shaping identity and forming community

– Financing and Token incentives: driving user growth in the short term

However, the success or failure of this model depends entirely on the fact that when the consensus strength is strong, it can build an ecological moat; when it is weak, when the market wind direction changes, the flow will disperse.

Nowadays, there are more and more App Specific Chains, which indicates that Web3 is gradually returning to Web2 ‘s business model, driven by practical applications, and completing efficient transformation and long-term retention through market segmentation and refined operations of private domain traffic.

I tend to think that the growth logic of this model is healthier and more in line with the evolution of the real business world.

What will the future hold?

The coexistence of these two paths reflects to some extent that the industry is still in its early stages and has not yet formed an absolute monopoly in a certain model, and that paradigmatic shift has not yet occurred.

All investment is essentially a judgment of the situation. At what point in time are we at now? Generic Public Chain has not yet been falsified, but with the sharp rise in demand for breaking circles, it has been difficult to gather enough consensus solely by relying on technical narratives or financing narratives; at the same time, the paradigm transition from build super dapp to build chain has not yet been confirmed. This is not only a switch between products and infrastructure, but also the ability to leap from PMF-driven product thinking to cultural shaping and ecological construction. There are few founders with this leapfrog evolution.

Both have opportunities and challenges. The real difference is that they require very different capabilities from founders. The core of venture capital is to price the Bet market based on these judgments on trends, events, and people, place bets in extremely high uncertainty, and bear the risk of failure in exchange for the ultimate risk return.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern