Trump is once again at the helm, and political trends and economic policies are reshaping the global capital landscape at an alarming rate. Against this background, Strategy Company (formerly known as MicroStrategy, later referred to as Strategy), a listed company known for its massive acquisition of Bitcoin, suddenly announced that it would suspend new Bitcoin purchases.

Written by Hedy Bi, OKG Research

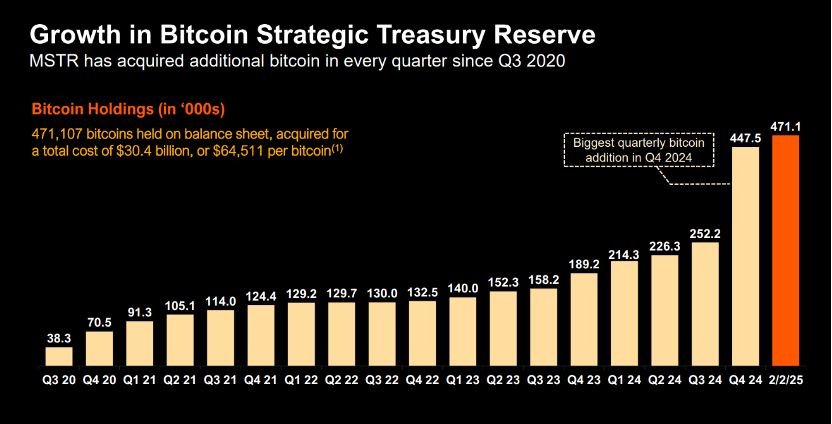

Trump is once again at the helm, and political trends and economic policies are reshaping the global capital landscape at an alarming rate. Against this background, Strategy Company (formerly known as MicroStrategy, later referred to as Strategy), a listed company known for its massive acquisition of Bitcoin, suddenly announced that it would suspend new Bitcoin purchases. At the earnings conference in the early hours of last night, Strategy set a target of US$10 billion for its annual “Bitcoin dollar revenue” in 2025. Assuming that Strategy’s funds for purchasing Bitcoin come entirely from financing, to achieve this goal, either the price of Bitcoin will double, or Strategy will at least double its existing position cost under the theoretical conditions of maintaining the current price of Bitcoin.

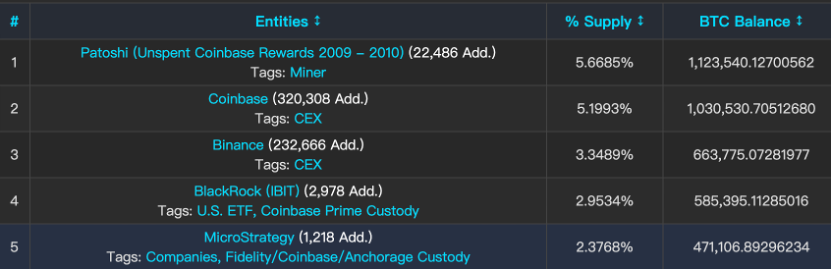

As the world’s largest enterprise-level Bitcoin holder, as of February 7, 2024, Strategy holds 450,000 bitcoins, with an average cost of approximately US$62,000, ranking among the top five global Bitcoin holders, accounting for approximately 2.38% of the total Bitcoin supply. This ratio is comparable to the official gold reserve of the United States (World Gold Council), which ranks first among the central bank’s gold reserves. It also shows Strategy’s leading edge and strategic determination in the field of crypto assets.Because of this, Strategy’s transparency and clear investment strategy make its position changes an important perspective for global investors to pay attention to cryptocurrencies.

For those investors who are accustomed to viewing Strategy as a “digital gold treasury”, Strategy’s recent actions have undoubtedly sparked heated discussions.How to interpret such a “duplicitous” strategy?The author will analyze why Strategy changed its investment strategy for purchasing Bitcoin and the impact this move will have on the Bitcoin market.

Why did Strategy choose to suspend purchases after Trump took office?The answer is far more complex than it seems.One of the key factors is the company’s recent pressure on performance and accounting treatment.

First, although Strategy doubled its Bitcoin holdings in the fourth quarter of 2024, it recorded a net loss per share of US$3.03, far exceeding analysts ‘expectations for a loss per share of-0.12 US dollars. This was mainly due to the large impairment treatment of digital assets held. Under old accounting standards, when the price of Bitcoin fell below its purchase cost, companies needed to reflect this loss in financial statements. If the fair value of an asset is less than its book value, an impairment loss must be recognized.

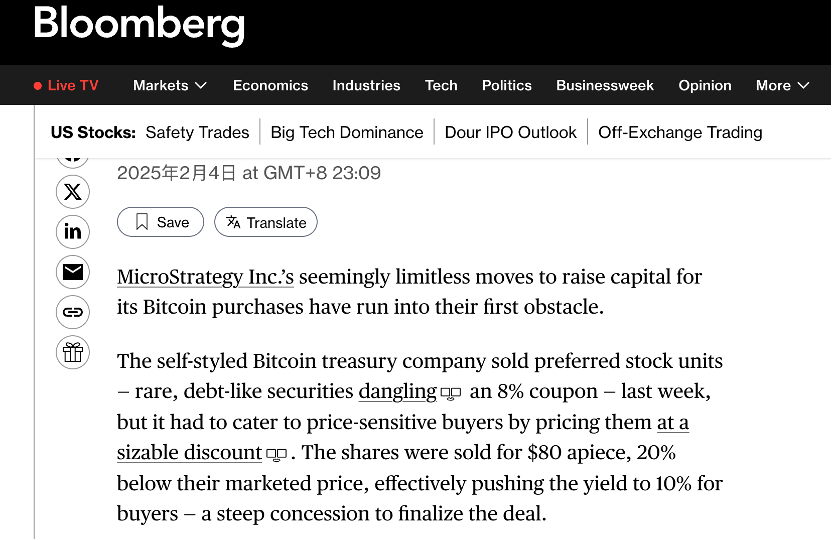

Such unexpected losses will reduce investors ‘confidence in the company, cause them to demand higher returns to bear investment risks, and make it more difficult to attract investors to buy its preferred shares. Therefore, we have seen Strategy selling newly issued preferred shares at a discount of 20%. However, for investors who are optimistic about Strategy’s prospects, discount issuance effectively increases buyers ‘yields.

At the same time, with the implementation of new FASB (Financial Accounting Standards Board) standards, Strategy will recognize unrealized gains on its Bitcoin positions for the first time, but this will make the tax issues it faces more complex: Under the new accounting standards, Strategy needs to measure its Bitcoin holdings at fair value and reflect unrealized gains on its financial statements. While this makes the balance sheet more transparent, it also means companies may need to pay a corporate alternative minimum tax (CAMT, a tax rate of about 15%) on these unrealized gains. Faced with potentially huge tax bills, Strategy must make financial planning to deal with tax obligations.A purchase suspension may be a financial risk control tool to better assess and manage future tax burdens.

In addition, since companies were included in the Nasdaq 100 Index, they have to comply with stricter information disclosure and corporate governance requirements, including stricter insider trading policies to prevent insider trading.One of the reasons for suspending the increase in Bitcoin holdings may be related to restrictions on the lock-up period.Although the U.S. Securities and Exchange Commission (SEC) does not mandate companies to establish lock-up periods, many companies will proactively set lock-up periods for compliance reasons, especially before and after earnings reports are released. For example, Strategy’s fourth-quarter 2024 earnings report was announced on February 5, and a lock-up period may begin in January, limiting its Bitcoin holdings during this period.

Simply put, Strategy is not losing confidence in Bitcoin’s prospects,The performance of “inconsistent words” is not influenced by external market factors, but more due to reasons such as internal financial compliance.

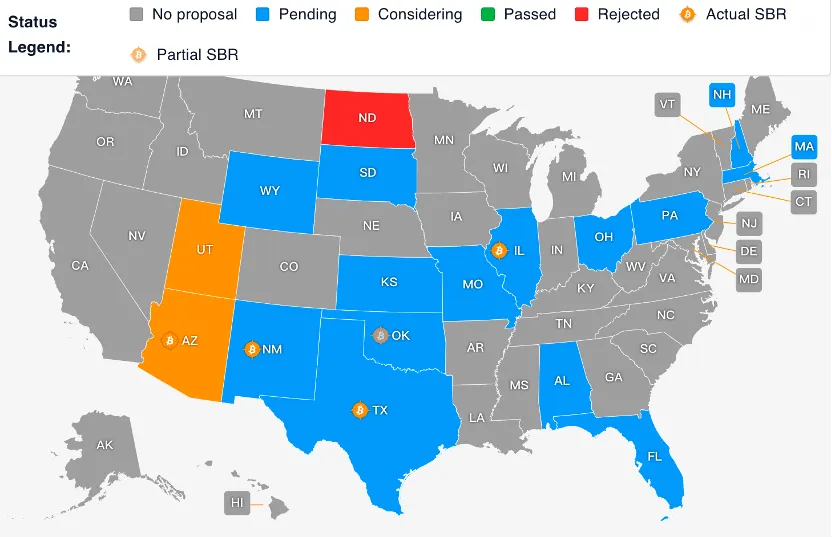

Other institutions in the market will not choose to follow Strategy because of its own reasons. On the contrary, the United States is implementing bitcoin from the bottom up, represented by states. Bitcoin can become a strategic asset at the states. Currently, 16 states have submitted relevant bills, and two of them are making rapid progress. According to the figure below, there is a high probability that the 28,312 bitcoins can be purchased for investment. A state in a “Pending” status does not mean that it is not a supporter of digital currencies such as Bitcoin. Just today (February 7), Kentucky Rep. TJ Roberts launched Bill HB376, proposing to invest 10% of state funds in digital assets with a market value of more than $750 billion.

Based on Kentucky’s 2023 General Fund revenue, 10% of the funds are invested in Bitcoin, which is approximately $1.51 billion. If all 16 states use this data as a reference, approximately more than $24 billion in funds will flow into the Bitcoin market. The funds are equivalent to almost 1.25% of Bitcoin’s current market value (as of February 7) and 3.24% of U.S. gold reserves. According to statistics from the World Gold Council, the value of U.S. gold reserves is approximately US$740 billion. The inflow of funds of this scale has not yet been promoted by any background in the construction of national reserves, but is purely driven by state government policies. This means that in addition to companies like Strategy, other institutions or governments are also making Bitcoin purchases. In less than a month since Trump officially moved into the White House again, Bitcoin’s status in the global financial system has continued to increase at an unprecedented rate that combines unconventional characteristics.

This is just a microcosm of the new policies of the Trump era, full of uncertainty but also full of imagination.