Kao’s earnings reversal is more like a “surgical repair” than a recovery driven by endogenous growth.

Kao’s five-year consecutive decline finally reverses: Growth concerns under the game of “slimming” and high-end modernization in China’s market

Photo source: Visual China

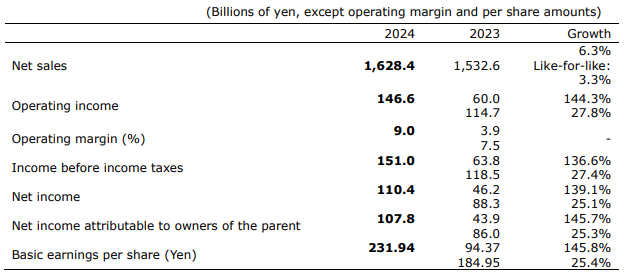

Blue Whale News, February 7 (Reporter Wang Hanyi)On February 7, Kao Group released its 2024 annual financial report, announcing that profit attributable to shareholders surged by 145.7% year-on-year, ending a five-year consecutive decline since 2019.

However, there are hidden worries behind this glamorous financial report: although the American and European markets grew by 9.9% and 17.7% respectively, overall sales in the Asian market (excluding Japan) fell by 4.6%, with the China market continuing to be under pressure due to nuclear sewage incidents and increased competition.

Revenue and profits rose both

The latest financial report shows that from January 1 to December 31, 2024, Kao Group’s net sales were 1,628.448 billion yen (approximately RMB 77.714 billion), an increase of 6.3% year-on-year; operating income was 146.644 billion yen (approximately RMB 7 billion), a year-on-year increase of 144.3% from the previous year; net income was 110.374 billion yen (approximately RMB 5.264 billion), a year-on-year increase of 139.1% from the previous year; net profit was 107.767 billion yen (approximately RMB 5.143 billion), an increase of 145.7% year-on-year.

Photo source: Intercept from financial report

Sales of the entire Consumer Goods Division increased by 4.8% year-on-year to 1.2682 billion yen (approximately RMB 60.522 billion). In terms of business, sales of the health and life care business were 544.3 billion yen (approximately RMB 25.98 billion), a year-on-year increase of 4.2%.

Among them, sales of fabrics and home care products increased by 7.6% year-on-year to 375.7 billion yen (approximately RMB 17.93 billion). Kao accelerates product development through the Scrum model and also benefits from the increase in the frequency of laundry caused by hot weather in Japan, driving market growth.

In the health and beauty care business, sales were 424 billion yen (approximately RMB 20.23 billion), a year-on-year increase of 7.9%. Skin care and hair care products performed strongly, especially Biore makeup remover, new facial masks and Bondi Sands high-end skin care brand driving growth.

Sales of the cosmetics business were 244.1 billion yen (approximately RMB 11.65 billion), a year-on-year increase of 2.3%. In the Japanese market, KANEBO’s high-end skin care products and cosmetics performed outstandingly. However, due to intensified competition in the China market, Kao adopted a strategy of restricting shipments to optimize inventory, resulting in a significant drop in overall sales in Asia.

In terms of regions, sales in Japan increased by 5.3% to 823.2 billion yen (approximately RMB 39.286 billion), while sales in Asia as a whole fell by 4.6% to 212.5 billion yen (approximately RMB 10.141 billion). The American and European markets performed outstandingly, with sales increasing by 9.9% and 17.7% respectively to reach 139.1 billion yen (approximately RMB 6.638 billion) and 93.5 billion yen (approximately RMB 4.462 billion).

Survival is the broken arm behind the soaring profits”

In 2024, Kao’s net profit growth will mainly rely on shutting down inefficient brands such as AUBE and COFFRET D OR, reducing distribution inventory and optimizing the optimise cost structure.

Among them, in the first three quarters, its cosmetics business’s operating profit loss expanded to 7.9 billion yen, and the optimization of distribution inventories in the China market directly dragged down profitability.

The double-edged sword effect of the high-end strategy has also shown that although the group vigorously promotes high-end brands such as SENSAI and EST, cosmetics sales in the Asian market fell by 2% year-on-year in the third quarter of 2024, and high-end lines failed to offset the weakness of mass brands.

In the same period, mid-end products such as Kerun and Freifang maintained their fundamentals through localized production, but it was difficult to hide the shortcoming of insufficient brand premium.

According to Blue Whale News, Kao’s internal documents show that its cosmetics shipments in the China market will proactively shrink by 30% in 2024 to ease the backlog of channels. Although this move will boost profit margins in the short term, it may sacrifice market share and make room for foreign giants such as Peléal, Huaxizi and L’Oréal.

Faced with the slowdown in China’s market growth, Kao’s response strategy also shows the dual characteristics of contraction and focus.

Since 2023, Kao has successively closed Kanebo’s Freshel, Blanchir Superior and other brands, and terminated the production of affordable cosmetics AUBE. Although the high-end brand EST has not withdrawn from China, its strategy of closing its Tmall flagship store and switching to the audio channel reflects the difficulty of high-end implementation.

In 2024, Kao will transfer the production lines of Kerun and Freifon silk to China and launch localized products such as Kerun 5G red trimming essence, trying to respond to competition from domestic products with cost performance + quality. However, its e-commerce transformation lags behind, with new channels such as Douyin accounting for less than 15%, lagging behind L’Oréal, which accounts for more than 30%.

In addition, it is worth mentioning that in January 2025, Kao launched the largest executive adjustment in nearly 20 years. Yosuke Maesawa, the former president of the cosmetics business, retired. He had promoted the high-end market in China and was replaced by Tomoko Uchiyama, who was born in R & D. This move heralds a shift in strategic focus from market expansion to technology-driven high value-added products.

Almost at the same time, a new global consumer care business unit was established and regional decentralization gave the China business unit greater autonomy and led R & D and marketing.

However, there are still doubts about whether the local team can quickly respond to the needs of Generation Z. For example, the Kerun Baby moisturizing series launched in 2024 has been accused of insufficient innovation and failed to break through the traditional positioning of gentle moisturizing.

Balancing localization and globalization

Despite the outstanding financial data, industry insiders pointed out that Kao’s long-term growth in the China market still faces uncertainty.

First of all, high-end lines such as SENSAI and EST lack historical heritage in China, and are priced at 800-2000 yuan, facing mature rivals such as Shiseido and Estee Lauder. On the Double Eleven in 2024, SENSAI’s sales are less than one-tenth of the Shiseido Red Kidney Series.

Secondly, through horizontal comparison, it can be seen that although Kao claims to increase investment in China’s R & D, its Shanghai Innovation Center will only launch 3 new products in 2024, far lower than L’Oréal’s average annual average of 15 models. The core component ceramide technology has not been broken through for many years, or it is difficult to support high-end narrative.

In addition, the long tail effect of the nuclear sewage incident still exists. In the 2023 financial report, Kao admitted for the first time that nuclear sewage discharge caused the growth of the China market to slow down. Although it will not be mentioned again in 2024, third-party research shows that 30% of China consumers still have doubts about the safety of Japanese makeup and prefer domestic products and European brands.

In the K27 plan, Kao plans to increase the proportion of overseas sales of cosmetics to 50% in 2027. However, the contradiction between localized needs in the China market, such as ingredient preferences and marketing methods, and global standards has become increasingly prominent. For example, the no-additive concept promoted by it has been iterated into precise repair by domestic brands Winona and others.

It can be said that Kao’s earnings reversal is more like a surgical repair than a recovery driven by endogenous growth.

In the China market, its high-end + localization strategy has not yet formed a synergy, superimposed on geographical risks and the red sea of competition. Future growth still relies heavily on the effectiveness of organizational change and technological innovation breakthroughs.

Some analysts predict that if the brand value cannot be reshaped during the 2025-2027 window, the century-old daily chemical giant may escape the fate of a moderate recession.