Money from car companies is easy to make, but money from overseas is hard to make.

Listing in Hong Kong in the Ningde era: Even if you earn 140 million yuan a day, you need to “replenish blood”

Wen| Dingjiao One Jin Yu Fan

Seven years after the A-share listing, Ningde Times, which has a market value of one trillion yuan, is rushing to IPO Hong Kong stocks.

On the evening of February 11, Ningde Times submitted a prospectus in Hong Kong stocks, and seven banks, including China International Capital, JPMorgan Chase, Goldman Sachs, and UBS, formed an investment group to escort it.

According to Bloomberg, the scale of Ningde Times ‘IPO in Hong Kong may exceed US$5 billion (approximately RMB 36.5 billion).

The reason why people call the Ningde era the King of Ningde is not only because of its strong market position (the power battery field has ranked first in the global market share for eight consecutive years, and the energy storage battery has ranked first in the global market share for three consecutive years), but also because the investment institutions and retail investors (small and medium shareholders) in the Ningde era have gained A lot from the wealth-making wave they set off in the capital market.

Recently, Ningde Times announced a special dividend plan for 2024, which plans to distribute a cash dividend of 12.3 yuan (including tax) for every 10 shares to all shareholders, with a total cash dividend of 5.397 billion yuan.

As of September 2024, Ningde Times has a cash reserve of 259.8 billion yuan on its accounts. This amount of capital reserves is very abundant in the entire A-share market. Many people wonder that there was no shortage of money in Ningde era, why did they have to go public for a second time?

In fact, the Ningde era has long targeted overseas markets, especially the European and American markets that are still in the early stages of electrification.

In the first three quarters of last year, nearly 30% of Ningde’s revenue came from overseas. The sprint for Hong Kong stocks is to seek funds for overseas factories and prepare for the global production layout.

In the past three months, Ningde Times’s share price has increased by more than 45%, and is currently hovering around 255 yuan/share, with a total market value of approximately 1.12 trillion yuan. Nowadays, in the impact of A+H listing, there are voices in the market shouting the Ningde era valuation of 2 trillion yuan, and some investors are worried that its share price in A shares will fluctuate.

The question of how to value the Ningde era has once again been raised. How many bubbles are there in the current market value of trillions? How much room for growth is there? This depends on whether it is a high-end manufacturing company that strives for technological innovation, or a manufacturing company that strives for scale and price. The two sets of valuation logics are completely different.

Money-making machine: Car companies fight among themselves, King Ning is sure to make money

The key reason why the capital market is willing to give Ningde a trillion-dollar valuation is that it has a market share of more than 50% in the domestic power battery market and earns 45% of the industry’s profits.

“The cost of power batteries has accounted for 40%-60% of our cars. Aren’t I working for the Ningde era?& rdquo;

A complaint by Zeng Qinghong, former chairman of GAC Group, in 2022 revealed the biggest winner in China’s new energy industry chain. It was not the booming new car building, but the Ningde era, a battery manufacturer who regarded itself as a stage.

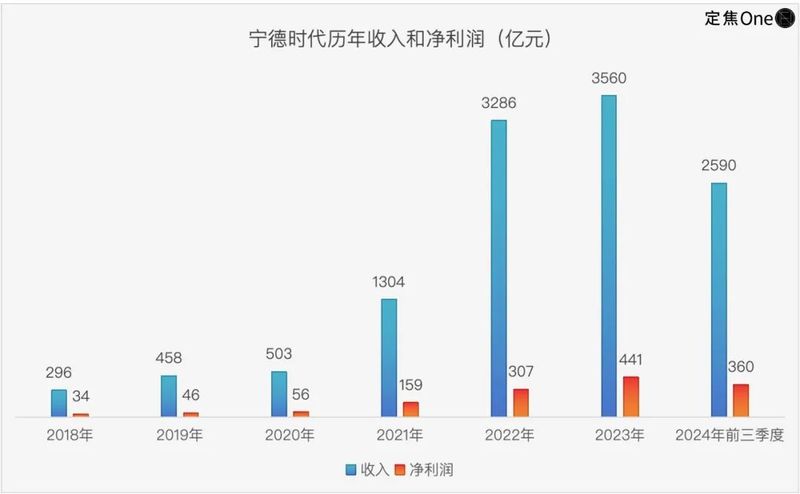

With its strong say in the industrial chain, Ningde’s profit record has been maintained since 2015. Last year, due to the decline in the prices of raw materials such as lithium carbonate, Ningde Times had to adjust product prices, which led to a year-on-year decline in revenue, but it did not prevent it from making more money.

In the first three quarters of 2024, Ningde Times’s revenue was 259 billion yuan, a decrease of 12% compared with the same period of the previous year, but its parent net profit reached 36 billion yuan, a year-on-year increase of 16%.

In January this year, the 2024 annual results forecast released by Ningde Times showed that revenue in 2024 is expected to be 356 billion yuan-366 billion yuan, a decrease of 8.7%-11.2% from 400.9 billion yuan in 2023; the net profit attributable to shareholders of listed companies is between 49 billion yuan and 53 billion yuan, an increase of 11%-20% compared with 44.1 billion yuan in 2023.

For comparison, BYD, which produces its own batteries and integrates the entire industry chain, will have an annual net profit of 30 billion yuan in 2023.

We calculate that Ningde’s average quarterly revenue is close to 90 billion yuan, and its net profit is at least 12 billion yuan; its average daily revenue is 1 billion yuan, and its net profit per day is 140 million yuan, making it the leader in the A-share manufacturing industry.

Looking at all major industries, it is probably difficult to find such a company with revenue of hundreds of billions and becoming increasingly profitable.

The Ningde era is a connecting link in the entire industrial chain. The upstream are various equipment and material suppliers, and the downstream are complete vehicle factories.

Its automotive customers include BMW, Mercedes-Benz, Stellantis, Volkswagen, Ford, Toyota, Hyundai, Honda, Volvo, SAIC, Ideal, Xiaomi, etc. The power batteries in Ningde era were mainly passenger cars, which means that its largest customer groups were Tesla, NIO, Xiaopeng, Geely and other car companies that took the electric EV route. Among them, Tesla’s shipments are huge.

When it comes to selling batteries, Ningde Times has a cooperative relationship with car companies. I use the latest power battery products on your products. As your sales increase, my market share increases, and the scale effect becomes stronger and stronger.

In the past two years, China’s auto industry has fought a price war. No matter how low auto companies have set prices in the market, they still have unswervingly taken batteries from the Ningde era. Because the Ningde era had high battery life and low spontaneous combustion rate.

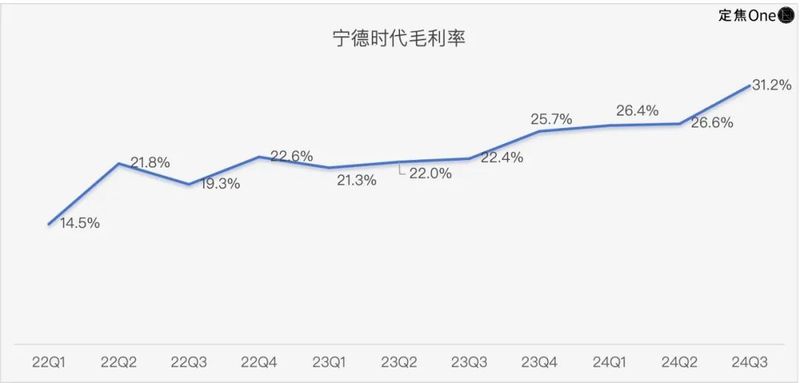

Even if a car company loses every car it sells, Ningde never makes a loss of money. The gross profit margin of its power system is 24.3%, which was as high as 35% at its peak. In other words, for a battery system that sells for 100,000 yuan, Ningde Times can take away 25,000 yuan in profits.

Its money-making ability is significantly higher than that of its peers. In Q3 of 2024, the gross profit margin of Ningde Era will reach 31%, while Yiwei Lithium Energy, Guoxuan High-Tech, and Xinwangda will be 19%, 18%, and 15%, respectively.

Fundamentals: Power batteries struggle to maintain market share

The core of Ningde’s trillion-dollar valuation is the power battery business.

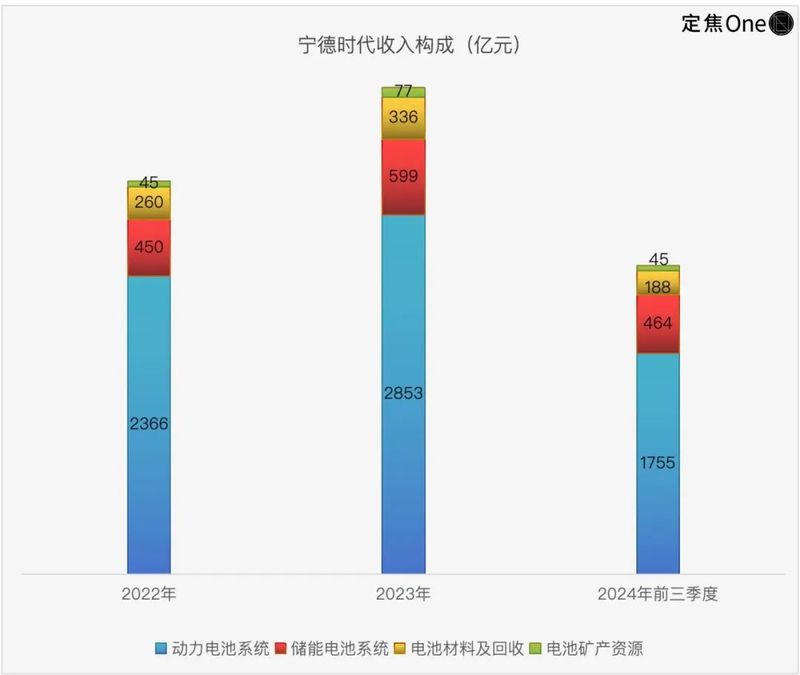

This was also the revenue pillar of Ningde’s era. It once contributed more than 80% of its revenue. In the past two years, due to the growth of energy storage and battery recycling businesses, the proportion has dropped to nearly 70%.

The market gave it a high valuation based on one judgment: as global new energy vehicle sales continue to rise and the replacement process of fuel vehicles accelerates, new energy vehicle companies will have an increasing demand for batteries, and the power battery business in the Ningde era will follow suit. The water rises.

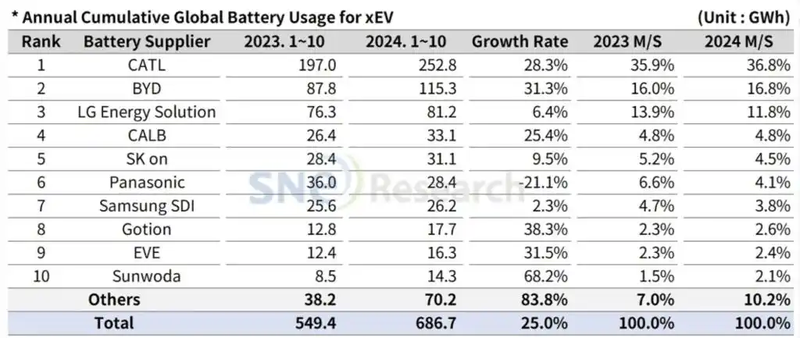

Ningde Times power batteries have outperformed the global and China’s growth rate of new energy vehicles, and their market share still leads. Data released by South Korean institution SNE Research shows that in the first 10 months of 2024, Ningde Times ‘share in the global power battery market was 36.8%, ranking first and 20 percentage points ahead of second place BYD.

Global power battery statistics from January to October this year

However, many investors are still worried that Ning Wang’s market share may lose.

In the first half of last year, due to the decrease in power battery shipments in Ningde Era, Q1 and Q2 revenue fell by 10% and 13% year-on-year respectively. Especially in Q2, the domestic and foreign market share dropped slightly.

Among them, in the domestic market, due to the increase in the market share of the battery business of BYD and other vehicle manufacturers, the market share of Ningde Times dropped from 48% in Q1 to 44%;

In overseas markets, Ningde Times’s market share of power battery loading fell to 26%, which may be related to the switch of Model 3 battery suppliers from Ningde Times to Panasonic. In 2023, Ningde Times ‘market share in overseas markets will be 29%.

In Q3 last year, the situation improved, and the market share was maintained in the Ningde era. The domestic market has increased its market share to 45% due to the increase in shipments of mid-to-high-end ternary lithium batteries. However, the market share of overseas markets is still declining, which may be related to the increase in tariffs imposed by the United States on power batteries and the increase in tariffs imposed by Europe on China’s new energy vehicles.

The fundamentals of Ningde’s valuation are the steady increase in the market share of power batteries in the domestic market. However, what makes Ningwang more uncomfortable is that at the demand level, the growth rate of demand for downstream power batteries is slowing down, and the domestic pure electric vehicle market is not growing as fast as that of hybrid vehicles; at the competitive level, second and third-line battery manufacturers are catching up, and car companies are looking for BYD, which is looking for two supplies and three supplies, and provides and sells power batteries by itself, is on the rise.

At the same time, under the continuous price war in car circles, the Ningde era inevitably fell into the dilemma of protecting profits or protecting shares. If profits are protected, downstream customers are not reduced in prices, and downstream customers are allowed to lose profits and sales in the price war, which may lead to a decrease in orders. If shares are protected, profits may decline.

From this perspective, it is not difficult to understand why the Ningde era is so keen on investing in new energy vehicle companies. Investment is also a kind of binding.

New business: Reaching upstream and downstream, but growth space is overseas

After the growth of its main business, power batteries, slowed down, Ningde Times had to accelerate its counterattack and expansion to find the next new story to support valuation.

BYD briefly surpassed the Ningde era in 2023 and became the first in the domestic lithium iron phosphate battery market. Ningde Times launched ultra-fast charging lithium iron phosphate batteries in August 2023, new energy storage products in April 2024, commercial vehicle-specific batteries in July 2024, and extended range and plug-in batteries in October 2024. Special battery for hybrid vehicles.

After all, batteries are only one of the components of electric vehicles. Ningde era is investing heavily in promoting the power replacement model, which is evident in its ambition. In December 2024, it announced the construction of a large-scale power exchange station network. The medium-term goal is to build 10,000 power exchange stations and the long-term goal is to build 30,000 power exchange stations, with a total of 33.6 GWh batteries.

However, the profitability of the power-changing model is the number one problem. As a battery company, battery assets in Ningde era may be relatively easy to make profits, but the operation of power exchange stations is relatively difficult, and the number and scale of power exchange stations need to be maintained at a relatively high level.

Almost at the same time, skateboard chassis, another new business in the Ningde era, also came into operation. In December 2024, Avita, a brand owned by Changan Automobile, announced that the new model will use the new generation skateboard chassis of the Ningde era.

The Ningde era also targeted robots. According to a late LatePost report, Ningde Times has established a team of dozens of people in Shanghai to independently develop robot bodies, control and human-computer interaction algorithms, and plans to manufacture complete industrial robots such as robotic arms and AGVs.

Compared with a variety of new businesses such as power stations and robots, more than one investor said that the current growth space in the Ningde era lies overseas.

In the first three quarters of last year, Ningde Times ‘overseas market generated revenue of 80.1 billion yuan, accounting for 31%. If a global company is defined as contributing 50% of overseas revenue, Ning Wang has not yet reached the standard.

Looking specifically at the top two major businesses, among them, the overseas development of power batteries is facing resistance.

As the United States and the European Union have set up many obstacles on power batteries, Ningde era has to build factories overseas and locally. In addition to a battery factory built in Germany and a Hungarian factory and a Spanish factory under construction, Ningde Times is planning to build a battery factory in a joint venture with car companies in Europe and looking for factory opportunities in the United States.

Unlike the domestic market, where stars dominate the moon, overseas competitors will inevitably compete with the Ningde era for shares. South Korea’s LG New Energy and Japanese companies have turned their attention to lithium iron phosphate batteries.

Energy storage + overseas development also faces uncertainty.

Energy storage is the second largest business in Ningde era. In the first three quarters of last year, its volume reached 46.4 billion yuan, and its revenue share rose to 18%. The application scenarios of energy storage batteries are mainly in the fields of construction machinery, ships, aircraft and robots.

The gross profit margin of the energy storage business is higher than that of power batteries. Last year, Q3 directly increased to 28%. This is mainly because Ningde’s overseas energy storage business accounted for a higher proportion.

However, the barrier to energy storage is lower than that of power batteries, and the future of chemical energy storage is highly uncertain. In addition, energy storage is mostly promoted by a project system, with long signing and landing times, and the stability and growth of overseas markets. It remains to be seen.

It is difficult to become the next TSMC in the Ningde era

The Ningde era, which hit the secondary listing of Hong Kong stocks, stood at the crossroads of revaluation. Whether it is a high-end manufacturing enterprise that strives for technological innovation, or a manufacturing enterprise that strives for scale and price, the valuation logic is completely different.

The peak market value of Ningde Times in A-shares is 1.6 trillion yuan at the end of 2021. Some people believe that in the Ningde era, like TSMC, it earned the most profits in the industry. Using these profits to continuously improve R & D and manufacturing, and then making more money, it became increasingly difficult for other companies to catch up.

As a leader in the chip manufacturing industry, TSMC currently has a market value of US$1.08 trillion, equivalent to RMB 7.9 trillion.

However, at the beginning of 2024, the market value of Ningde reached a low of 640 billion yuan, and has now rebounded to 1.1 trillion yuan. Ningde’s rolling P/E ratio has dropped from a peak of 150 times to the current 23 times.

The main reason for the decline in stock prices is that battery technology iteration speed is not fast enough and competition barriers are not high enough. At the end of 2021, the capacity utilization rate in the Ningde era reached a peak of 95%, and then continued to fall, reaching only 70.5% in 2023, which is relatively low.

The Ningde era is not the next TSMC.

Although the malleability of lithium battery tracks can rival chip OEMs, from new energy vehicles to energy storage, construction machinery, electric ships and even humanoid robots and AI, the speed and scale effect of technology iteration are not as good as chip OEMs.

Tianfeng Securities said in a research report that, first of all, the chip industry has Moore’s Law. The iteration speed of chip technology is significantly faster than that of lithium batteries, and it has economic benefits. The cost of chips with more advanced processes is lower and can be quickly applied downstream. Moreover, smartphones and high-performance computing are in urgent need of chips with advanced processes.

However, the technology iteration in the lithium battery industry is slower, and higher-performance batteries have higher initial costs. The lithium battery industry is currently the main downstream of electric vehicles and energy storage, which are highly price sensitive, so the promotion speed is slow.

Secondly, the manufacturing costs of the chip foundry industry account for nearly 90%, so it is easy to reduce costs through scale. At the same time, TSMC adopts an equipment depreciation policy that is shorter than that of its peers (accelerated to 2-5 years) to strengthen its first-mover advantage, enjoy product and technology premiums, and maintain high profits.

80%-90% of lithium batteries are direct materials, which tests the management and control of the material supply chain. Compared with Japanese and Korean rivals such as LGES, Ningde Times has stronger material cost control capabilities, and compared with domestic competitors, its depreciation life is shorter (except BYD).

Therefore, TSMC’s profits are attributed to its own technological leadership and high technical barriers; downstream application companies such as Apple and Nvidia have high competitive barriers and have sufficient profit space to feed back upstream.

Ningde Times is able to open a profit margin difference of 10-20 points with its rivals, mainly due to its ability in all aspects of materials, manufacturing expenses, and product (focusing on research and development and taking the lead in building iron-lithium fast charging).

This leads to the current situation: even if Ningde’s technology is leading in the era, there is relatively sufficient catch-up time for other battery manufacturers, and it is difficult to have dimension reduction attacks during the technology cycle. There is no essential gap in battery performance among various manufacturers, and car companies cannot increase their market share by using batteries from the Ningde era.

At the same time, the competitive barriers for lithium batteries are not high, leading to rapid overcapacity in the industry.

Due to the oversupply that began to appear in early 2022 and intensified from 2023 to 2024, the new energy vehicle market has turned to a demand-driven logic. It is difficult for car companies to achieve high gross profit margins by pursuing high-end and branding. On the contrary, they will not be able to give more profits to the upstream industrial chain and even compress the profits of the upstream industrial chain. For example, BYD requires upstream suppliers to reduce annual incidents by 10%.

This is also why at the turning point of the battery cycle in 2021, when supply exceeded demand, the Ningde era later showed a downward trend when the domestic market share reached its peak.

Part of the share lost by Ning Wang was seized by second-tier battery manufacturers at low prices, and another part was seized by car companies who developed their own batteries. In addition to BYD, GAC, Chang ‘an, Krypton and NIO have all disclosed plans to develop their own batteries.

Behind the trillion-dollar market value in the Ningde era, there is certainly the vast market space for power batteries and the ten-fold high growth in ten years, as well as the leading edge achieved by China in the power battery industry chain. Regarding its investment logic, in the short term, if the downgrade of demand for power batteries by terminal new energy vehicle companies is the mainstream, then the cost advantage is more important than the product premium; in the long run, it depends more on the breakthrough of next-generation battery technology and whether it can maintain its leading edge if the technological route changes.

References:

Dolphin Investment Research,”The Third Quarterly Report of the Ningde Era seems to indicate that downstream demand is starting to improve”

brocade,”2024 in the Ningde Era: When will the turning point come?”

Caixin,”Ningde Era will have a forecast profit of 49 billion to 53 billion yuan in 2024, and its leading position in the market is firmly established”

Dolphin Investment Research,”Looking at King Ning through TSMC: An Inescapable Cycle Destiny”

Tiger Sniff. com,”In the Ningde Era, Becoming BYD or Foxconn”

Later, LatePost,”Going deep into the Ningde Era and Discovering the Manufacturing Secrets of Trillions of Giants”

Tianfeng Securities,”Thousand Sails Crossing, Another Comparison between Ningde and TSMC

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.