It has been the second anniversary of the formal implementation of the personal pension system, and now it has ushered in a new development milestone. On December 15, 2024, the personal pension system will be promoted nationwide, and pension products will also be expanded. The first batch of 85 equity-type index funds, including general index funds, index enhancement funds, and ETF-linked funds, will be officially included in the personal pension. Gold investment product catalog.

What are the advantages and disadvantages of personal pensions?What is the positive impact of the comprehensive implementation of the personal pension system? What role does the expansion of product catalog promote the development of business and index funds? What are the current difficulties and pain points in personal pension investment? How should ordinary investors invest in personal pension products in 2025,Get better investment returns?

In this issue of “Titanium Ox, Stock Market!”, He Junni, Director of GuShiio.com Stock Market Intelligence International Think Tank, specially invitedYan Huahai, Director of Ji ‘an Jinxin Pension Research Center、Deng Hequan, Chief Wealth Advisor of Channel Wealth Management Department of China Merchants Fund、WeiboFinance and Economics V @ Wangjing BorgTogether, we will provide investors with an in-depth analysis of personal pension policies and products, and introduce in detail the 2025 personal pension investment strategy.

Important points:

1、Yan Huahai:After the personal pension system was introduced from 36 pilot cities (regions) to the whole country, that is to say, the target group participating in personal pensions has changed from more than 200 million to 1.07 billion. In theory, these 1.07 billion people can participate in personal pensions, which is a huge development imagination space.

2. Wangjing Borg:In the past three years, I have bought FOF funds with relatively large interests such as 2040, 2050 or 2045. Then I made money in the past three years, because when I bought it, I basically bought it at market lows, and I bought it with the 12000 yuan limit at once. In the past three years, many people have lost money when buying personal pension funds, because these sales organizations all promote them at the end of the year. In the past three years, they have reached high points at the end of the year, so they have lost money.

3. Wangjing Borg:I bought index funds this year, and I think I will continue to buy index funds in the future. Because the premium rate of pension FOF funds is too expensive, although the management fee of FOF funds is cheap, the management fee of the active fund you buy is very expensive. The domestic FOF problem is double rates, and the performance is not outstanding; the reason why the performance is not outstanding may also be the reason for charging. After all, the excess income cannot cover the rate.

4. Yan Huahai:At present, our configuration and selection of pension products can be divided into two steps. The first step is to first talk about the allocation ratio of these four types of products, savings, insurance, funds, and financial management. How can we allocate how much capital to these four types of products? The second step is to select specific good products in each category for investment.

Regarding the configuration of these four types of products, I personally understand that we can comprehensively consider it from three dimensions. The first dimension is the holding period. How long do you hold this fund? Whether to consider one year, two years, or 10 or 20 years later, the length of the holding period will affect your choice. The second dimension is the individual’s risk appetite. Is the risk appetite high or low? The third dimension is what range is your expected return? After considering these three issues first and selecting specific products, we can use our comprehensive evaluation system for personal pension products.

5. Deng Hequan:From a rational perspective, the money in the pension account is earmarked for special purposes and can only be withdrawn after retirement. Therefore, it is a lot of money and a lot of spare money. From the perspective of asset management institutions, this money is more suitable for investing in pension funds, because pension funds have the greatest risk among these four types of products, but at the same time their potential returns should also be the highest. For investors who are still in the young group and are far away from retirement, we suggest that if they have the ability to afford it, they should invest more assets and deposit balances in pension funds, because the potential risk-return of funds are more flexible and more conducive to achieving the preservation and appreciation of wealth.

6. Deng Hequan:The inclusion of Y shares of index funds will have a certain impact on FOF products. Index products are relatively transparent and at the same time are Y shares, which have advantages in terms of rates. However, FOF funds still have a tailor-made feature. They will vary from low wave to medium wave and then to high wave based on the allocation ratio of various assets in stocks and bonds and the risk-return characteristics of customers. This kind of multi-faceted product setting model can also provide investors with more choices. I personally prefer the trend of these two types of products coexisting. Of course, the follow-up still depends on which type of product can have better profit-making benefits and bring a better investment experience to customers before there can be further development.

7. Deng Hequan:In 2025, investors may want to try their best to get rid of the investment thinking of the past three years. Don’t choose to take profit just because they have been afraid of falling in the past three years and have a slight rebound. We can’t say that it must be a bull market now, but at least I don’t think it’s a bear market anymore. Therefore, in this volatile market, or even a stronger market, buying every time it goes down, the winning rate and cost performance ratio are relatively high. Therefore, I also suggest that you can be more proactive this year, but also be rational. At the same time, it is best to adopt this kind of bargain-hunting and batch method, including fixed investment, to make some layout, which may be better.

The current personal pension system is the optimal solution, and there is huge room for incremental promotion nationwide.

According to data from the Ministry of Human Resources and Social Security, as of June 2024, more than 60 million people have opened personal pension accounts. However, the analysis pointed out that as of the end of 2023, the estimated amount of personal pension contributions is about 28 billion yuan. The actual contribution rate of personal pension accounts and the per capita storage amount are still at a low level. The problems of hot account opening, cold investment, and low willingness to pay still need to be resolved.

He Junni:What are the highlights of this national promotion of the New Deal? How positive will it have on the promotion of personal pensions? Can we effectively solve the current pain points and difficulties of personal pensions?

Yan Huahai:It is indeed common for personal pensions to have less deposits and less investment. According to data from the Ministry of Human Resources and Social Security at the end of November 2024, the actual number of accounts opened is 72.79 million, which is close to 73 million. The number of accounts opened is still good, exceeding that of enterprise annuity participants. However, the actual deposit scale is only more than 47 billion yuan, and the per capita amount is less than 700 yuan.

Then, after the personal pension system has been extended from 36 pilot cities (regions) to the whole country, that is to say, the target group participating in personal pensions has changed from more than 200 million to 1.07 billion. In theory, these 1.07 billion people can participate in personal pensions, which is a huge development imagination space. Therefore, in 2025 and the next few years, personal pensions have very large room for development.

Of course, the greatest significance and importance of the nationwide promotion of the personal pension system is that it means that my country’s three-pillar pension system has been fully established. The first pillar is basic pension insurance, the second pillar is enterprise annuities and occupational annuities, and the third pillar is personal pensions. This is an important milestone.

I am personally quite optimistic about the future development of personal pensions. Judging from the experience of the United States, the development of personal pensions is a long-term process. From the establishment of IRA (Individual Retirement Account) in the United States in the 1970s to the mid-1980s, the development in ten years was also relatively slow. At the same time, there was also a quantitative change to qualitative change. The past few years were more of a continuous accumulation.general andIn the process of continuous improvement of understanding, there will be a steady development for more than ten years, before there will be a relatively large and rapid development.

On the other hand, in the past two years of pilot projects, personal pensions do have some issues that have been discussed a lot. For example, there will be a 3% tax rate when withdrawing personal pensions; some banks have limited types of personal pension products online, and many individual investors cannot buy products they are optimistic about; in addition, the current annual deposit limit of 12,000 yuan is a bit low for many people; In addition, the overall performance of the domestic stock market has been sluggish in the past two years, and the performance of personal pension fund products has also fallen short of expectations, which has also led to a decrease in people’s enthusiasm for participating in personal pensions.

Overall, people’s awareness and understanding of personal pensions still have considerable deficiencies, and a process of gradual improvement is needed. This is also reflected in the perception of products. There are four major categories of personal pensions products, including savings, wealth management, insurance, and funds. Insurance is also divided into two-inclusive insurance, annuity insurance, etc. In addition to pension FOF funds, funds are now added Index funds. Many people don’t actually understand these products, or only understand some of them, so they will face difficulties in choosing and will not choose.

Therefore, I think that through various methods, like we do today, we can invite experts and big Vs to communicate together, improve everyone’s awareness of personal pensions, do a good job in investor education, so that more people can better understand personal pensions, and better choose the product that suits you. This is very important and something that needs to be done continuously.

He Junni:Mr. Deng, our China Merchants Fund has released the “White Paper on Pension Finance Planning” in the past, collecting a lot of questionnaires and summarizing the confusion and planning of ordinary people about pension finance. There are some conclusions in it, and I am still very impressed.

- Most residents still maintain a wait-and-see attitude towards investing in personal pension accounts

- Insufficient tax incentives are the main reason why residents are reluctant to open personal pension accounts

- Residents prefer relatively regular payment methods, and pension savings rank first among product choices.

- 95% of residents believe that professional caregivers are needed to provide elderly care planning services, but their attitudes towards caregivers are polarized.

In the past 2024, what new changes and developments do you think have occurred in domestic people’s understanding and planning of pension finance, especially personal pensions? What positive impact do you think will have of the new policy of personal pensions promoted nationwide at the end of last year?

Deng Hequan:In 2024, there will still be some changes and improvements in people’s understanding of pension finance, especially the third pillar of pensions, which are reflected in the following aspects.

First, thanks to the boost of policies, it has expanded from the first batch of pilot cities to the whole country. This is a great and clear policy boost. The second is the enhancement of overall financial education, including live broadcasts like ours today, as well as banks, securities firms, and third-party Internet platforms, which are all continuing to provide pension investment-related investment education and live broadcasts, which will also to a certain extent enhance residents ‘attention and understanding of the three pillars of the pension economy.

Third, the diversification of products and the individual needs of customers. With the expansion of personal pension products, investors can have more product choices than in the early stage. Taking public funds as an example, index products such as the China Securities A500ETF have now been included in personal pension products.

He Junni:Hello, Teacher Borg, I noticed that you have been buying a personal pension fund for three years, and you bought several index funds early for the 12,000 yuan in 2025. You also interact with many fans on Weibo about personal pension investment. topic. What do you think of the impact of the new policy on comprehensive promotion of personal pensions at the end of last year? What are the issues your fans are most concerned about personal pension investment?

Wangjing Borg:First of all, the personal pension system is very good, but everything takes time to develop. I think China’s personal pension system has developed rapidly in the past three years. In fact, the 401k plan in the United States (the 401k plan is also called the 401k clause. The 401k plan began in the United States in the early 1980s and is a fully fund-based pension insurance system established by joint contributions from employees and employers.) It only existed in the 1970s. By 2000, after nearly 20 years, the participation rate was less than 50%. Later, in 2006, the United States came up with a default plan, which was that everyone did not have to apply for participation by themselves. Instead, the participation rate increased to more than 50%. The whole process may have taken more than 30 years, but we only used it for three years. Time, I think our process is quite smooth and fast.

China’s policy is tax-free. When you pay your personal pension, you really exempt the tax, and then add a 3% tax when you retire. This is much better than the United States. Personal pensions in the United States are tax-free when you pay them and deferred when you withdraw them. For example, when you pay, the tax rate is 20%, and when you withdraw, the tax rate is also 20%. The tax you raise is also very high. So I think China’s personal pension policy is very good.

On the other hand, ordinary people lack financial knowledge and do not know the benefits of buying this product. So I will show you my actual operation as an investor. In the past three years, I have bought FOF funds with relatively large interests such as 2040, 2050 or 2045, and then I have made money in these three years. Because when I bought it, it was basically at market lows, and I bought it with the 12,000 yuan limit at once. However, in the past three years, many people have lost money when buying personal pension funds, because these sales organizations all promote them at the end of the year, and in the past three years, they have reached high points at the end of the year, so they have lost money.

I bought index funds this year, and I think I will continue to buy index funds in the future. Because the premium rate of pension FOF funds is too expensive, although the management fee of FOF funds is cheap, the management fee of the active fund you buy is very expensive. The domestic FOF problem is double rates, and the performance is not outstanding; the reason why the performance is not outstanding may also be the reason for charging. After all, the excess income cannot cover the rate.

Regarding the issue of the 12,000 quota, if the quota is increased, it will easily create a gap between the rich and the poor. The richer the person is, the more he buys, and then the tax will be reduced. Then, the poor will not pay taxes and will not have the opportunity to participate. So I think this issue is actually very complicated. But at least for now, this model is now a very good compromise. For example, if I include the Y share of the index, what I buy is dividends and science innovation, that is, one side is offense and the other side is dividend defense. Now its rate is almost 1.5 thousandths, and the annual hosting fee is 2 thousandths. I think this is already very good.

In addition, investor education is very difficult. I am also from a financial institution, but it is useless for me to tell others a lot of principles. The final discovery was that as an investor, people would only believe you when they saw you making money by buying funds. So if you ask people to buy personal pension funds and they don’t make money, they will definitely not invest again. I think there is still a long way to go in this regard, but the current model is already an optimal solution in the game between all parties.

How to choose personal pension products is difficult, and pension funds are more suitable for long-term investment

On December 12, five departments including the Ministry of Human Resources and social protection issued a notice to fully implement the personal pension system starting from December 15. It mentioned that to optimize product supply, on the original basis, national debt will be included in the scope of personal pension products, and specific pension savings and index funds will be included in the catalog of personal pension products. Currently, the third pillar of personal pension products sold to individuals include four types of products: savings products, wealth management products, insurance products and fund products.

According to public data from the National Social Insurance Public Service Platform, as of December 31, 2024, 946 personal pension products have been issued, including: 466 savings products, 168 insurance products, 26 wealth management products, and 286 fund products.

For people who have opened personal pension accounts and made personal pensions, the biggest problem they face is the difficulty in selecting products.

He Junni:Our Ji ‘an Jinxin has also launched a unique comprehensive evaluation system for personal pensions, which is now also upgraded to version 2.0. First of all, please ask Mr. Yan to give us a detailed introduction to personal pension products and rating system. In addition, how do individual pension holders apply the evaluation system to select the products that suit them?

Yan Huahai:The host just mentioned that there are more than 900 products, not just ordinary products.ordinary peopleFor professionals, there are also great difficulties in choosing. Because these types of products belong to different categories, savings and insurance are on-balance sheet businesses, and wealth management and funds are off-balance sheet businesses. In addition, many people are familiar with insurance but not funds, and those who are familiar with funds are not familiar with insurance. Insurance products are divided into exclusive pension insurance products, annuity insurance, and two-inclusive insurance. Funds include index funds and FOF funds. FOF funds are divided into target dates and target risks. In addition, there are financial products, etc. The above product categories are very complex. Therefore, I think it is still very difficult for ordinary people to fully understand personal pension products. They still need more professional institutions to help customers understand and choose suitable products.

The Ji ‘an Jinxin Pension Research Center began to evaluate pension products four years ago. It was initially evaluated pension products for the second pillar enterprise annuity. In the past two years, after the pilot of the third pillar personal pension products, more and more people have begun to evaluate personal pension products. From June to July 2024, the Ji ‘an Jinxin Pension Research Center has creatively established a comprehensive evaluation indicator system for the entire third pillar of personal pension products. After the national promotion of the personal pension system on December 15, the national debt and index funds have been included in our evaluation indicator system, and the version of the comprehensive evaluation indicator system for personal pension products has been upgraded to version 2.0.

The following is a brief introduction based on the evaluations of the four types of personal pension products.

1. Evaluation of personal pension savings products

Savings products are usually evaluated based on terms and interest rates. Now Ji ‘an Jinxin has added an indicator of macro-prudential rating. As we all know, banks follow the macro-prudential supervision model. Adding the macro-prudential evaluation dimension can provide an additional dimension to the analysis of savings products. fromTerm, interest rate,Bank macro-prudential ratingComprehensive evaluation of savings products is carried out in three dimensions.

2. Evaluation of personal pension insurance products

Insurance products are divided into two categories. One is exclusive commercial pension insurance products. These products are settled annually and provide the settlement interest rate of the previous year at the beginning of the year. The settlement interest rate is decided by the insurance company itself and released to the public through the company’s official website; The other category is annuity insurance and dual insurance products. These products are very complex. Everyone’s needs are different, and individual differences are large, depending on the person. The specific situation depends on the individual needs and their own circumstances.

Annuity insurance products and dual-insurance products are traditional insurance products, which are actuarially determined according to the law of large numbers. The evaluation of such insurance products is mainly carried out from three aspects:The first is insurance products, such as payment age, collection age, collection method, cash value, etc., according to the specific needs of individuals, there are thousands of people;The second is the insurance companyRegulate the comprehensive risk rating, comprehensive solvency adequacy ratio, core solvency adequacy ratio and other indicators given to insurance companies;The third is value-added servicesWhat value-added services are provided by insurance companies? Such as elderly care communities, green access for serious diseases, etc.

3. Evaluation of personal pension financial products

At the end of 2021, the transition period of the new asset management regulations ended, and bank wealth management products completed the net worth transformation, providing the basis for financial product rating work. Based on a deep understanding and understanding of financial products, Ji ‘an Jinxin has designed a scientific and reasonable evaluation index system for bank financial products and managers.Based on the characteristics of the bank financial management industry, we innovatively introduce macro-prudential ratings into the evaluation index system of bank financial management products, from aspects such as profitability, risk resistance, performance stability, timing ability, macro-prudential ratings, etc., conduct a comprehensive evaluation of bank wealth management products and product managers. Starting from August 2022, Ji ‘an Jinxin officially released the “Evaluation Report on Bank Financial Products and Managers” to publicly disclose the rating results of bank financial products and managers.

4. Evaluation of personal pension fund products

Personal pension fund products include FOF funds and index funds. In 2018, the China Securities Regulatory Commission began issuing pension FOF funds. As a public fund rating agency, Ji ‘an Jinxin Company began rating FOF public funds in 2019.The FOF fund evaluation system consists of four evaluation dimensions: profitability, risk resistance, base selection ability, and timing ability, each evaluation dimension consists of multiple specific evaluation indicators; Ji ‘an Jinxin pairsThe evaluation system of index funds consists of three evaluation dimensions: benchmark tracking ability, excess return ability, and overall expenses。

Ji ‘an Jinxin conducts quarterly research on FOF funds and index fundsConduct an objective and fair public rating, and the entire evaluation process is completely objective, quantifiable, there is no human intervention or subjective evaluation.

From the investment perspective of public funds, the A/C shares and Y shares of FOF funds and index funds are the same. Each fund has the same specific investment strategy, asset allocation, investment manager, etc. The only difference lies in the source of funds and management fee rate. For the selection of personal pension fund products (i.e. Y shares of FOF funds and index funds), you can refer to the public rating results of the A shares of their public fund master shares.

Yan Huahai: At present, our configuration and selection of pension products can be divided into two steps. The first step is to first talk about the allocation ratio of these four types of products, savings, insurance, funds, and financial management. How can we allocate how much capital to these four types of products? The second step is to select specific good products in each category for investment.

Regarding the configuration of these four types of products, I personally understand that we can comprehensively consider it from three dimensions. The first dimension is the holding period. How long do you hold this fund? Whether to consider one year, two years, or 10 or 20 years later, the length of the holding period will affect your choice. The second dimension is the individual’s risk appetite. Is the risk appetite high or low? The third dimension is what range is your expected return? After considering these three issues first and selecting specific products, we can use our comprehensive evaluation system for personal pension products.

He Junni:Mr. Deng, it was mentioned in our China Merchants Fund’s pension finance planning white paper that the ideal pension financial product portrait is that residents prefer products with earnings that can outperform inflation, moderate minimum holding period of about 3-5 years, and low equity centers. Compared with the target date type, most residents choose target risk products. As the chief wealth management consultant, what suggestions do you have on the choice of personal pension products?

Deng Hequan:For ordinary investors, you can make a simple ranking or selection based on their risk-return characteristics. For example, pension savings, pension insurance can be attributed to a low-risk category. Pension financing is actually relatively low-risk, basically similar to some daily financial management that everyone buys. However, among these four types of products, financial management has relatively higher risk-return characteristics than deposits and insurance.

The ones with more complex risk-return characteristics are pension funds, which can be divided into such options as low, medium and high. Specific to each investor, everyone can make a preliminary check-in based on their own requirements and preferences for risks and returns.

From a rational perspective, the money in the pension account is earmarked for special purposes and can only be withdrawn after retirement. Therefore, it is a lot of money and a lot of spare money. From the perspective of asset management institutions, this money is more suitable for investing in pension funds, because pension funds have the greatest risk among these four types of products, but at the same time their potential returns should also be the highest. For investors who are still in the young group and are far away from retirement, we suggest that if they have the ability to afford it, they should invest more assets and deposit balances in pension funds, because the potential risk-return of funds are more flexible and more conducive to achieving the preservation and appreciation of wealth.

He Junni:Teacher Borg mentioned just now that pension funds are actually not a particularly cost-effective business for fund companies at present. As a fund manager, you choose all fund products, including pension FOF purchased the year before and last year, and index funds this year. However, we see that in the pension survey data of China Merchants Fund before, most residents still choose pension savings products.

Besides, like me, I myselfChina Merchants BankI have also made deposits in the personal pension account I have opened, but I have not bought any products yet and have not yet selected them. The account manager of China Merchants Bank called me and recommended an insurance product with a possible yield of 4%. What do you think is the best choice for personal pension products for ordinary investors?

Wangjing Borg:Let me answer your question first, insurance with a yield of 4%. Many people have asked me this question. The yield of this insurance is 4%. Then you bought 1 million yuan. You think the annual income is 4% of 1 million yuan, right? But in fact it is 4% of the insurance value, so the insurance value is not 1 million yuan, but may be 700,000 to 800,000 yuan. This is a big problem. But why do banks recommend insurance? The first is that insurance commissions are high. The second is that insurance will not see the results until many years later, and its risks are lagging behind.

What are the biggest risks to pensions? It is not the risk of losing money, but the possibility that inflation may not be outperformed. This is the biggest risk, which many people do not realize.

Regarding what is appropriate to buy for pensions, this conclusion has been verified for many years, that is, buying products with target dates, 2040 and 2050. But it’s not the target date of China, it’s the target date of the United States. That is, people’s management fees may be 5,000 yuan or 3,000 yuan. The target date of China’s management fees may be 1% a year, which is too high. So I buy index funds now because of their low rates. If the rates for domestic target-date products are the same as index funds in the future, I will buy target-date products.

The Y share of index funds has a great impact on FOF, and reducing rates may be the future solution for pension FOF.

What has attracted much attention is that in the catalog of personal pension products, equity index funds have been added. The first batch of 85 equity index funds were included, including 78 products that track various broad-base indices and those that track dividend indices. 7 products, including general index funds such as the Shanghai and Shenzhen 300 Index, China Securities A500 Index, and GEM Index, index enhancement funds, ETF-linked funds, etc.

He Junni:Teacher Borg has a point on Weibo, saying that the inclusion of index Y shares in personal pension accounts will be a devastating blow to the FOF. Why is there such a judgment? In addition, what do you think is the future solution for elderly care FOF?

Wangjing Borg:First of all, the blow to FOF is because its rates are too expensive, not a blow to this product. Currently, the comprehensive rate for one FOF product is almost 1.5% and the index fund is 1.5%. Rates have a great impact, because it is very uncertain whether a product can outperform the market, but an extra rate per year is still compound interest, and there is a lot of difference every year. Let me tell you a joke. Recently, hasn’t supervision required that fund managers be not linked to scale? Right? Then his active fund also asked for a reduction in the rate, which was absolutely too expensive and dropped to 6.

The domestic FOF problem is double rates, and the performance is not outstanding; the reason why the performance is not outstanding may also be the reason for charging. After all, the excess income cannot cover the rate. The Y share included in the personal pension account is FOF at the beginning of the period, and a discount rate is given-50% off the FOF management fee. The problem is that the FOF rate is 50% off, but the fund management fee purchased by FOF is not discounted at all. For example, before the underlying active fund was a management fee of 1.2%, the FOF was a management fee of 0.8%, and the total rate was 2.0%(This has not taken into account the purchase and redemption fee.) Now, we will give the FOF management fee 50% off, and the underlying active fund will be 1.2%, and the FOF will be 0.4% and the total management fee will be 1.6%. It still looks quite high. If an index fund is purchased at the bottom, the FOF’s 0.4% management fee is higher than the index fund’s 0.15% rate.

The Y share of the index is included in the personal pension account. According to the logic of 50% off the management fee of the Y share, the index fund’s 0.15% management fee will be 0.075%. According to this rate, whether it holds the China Securities A500 Index for a long time, the dividend index is a good choice. You can wait until the semi-annual report to see the scale of the Y share of the index. I think the growth rate of the Y share of the index will be much greater than the growth rate of the FOF. Many large households or people around me are buying personal pension funds this time than before. Be more proactive and buy the Y share of the index.

The development of the FOF in China has been sluggish, and the development of the FOF overseas has also been sluggish. It was not until the launch of multi-asset index products and overseas FOF experts shamelessly included the multi-asset index in the FOF category that the FOF became very large.“”

How to define what FOF? In the sense of the term, it means a fund that is an investment fund, and it requires an extra layer of management fees. However, for many overseas asset indices, some build indexes by putting stock and bond assets in one index fund, and some are achieved by investing in stock index funds and bond index funds. Key people do not charge another layer of management fees, so FOF does not have to charge another layer of management fees.

The launch of Y shares of index funds is a very good model for fund companies. There was no increase in labor costs or increase in personnel costs, and a Y share was increased. It is difficult to make some excess returns in China now, but how to increase returns by reducing rates is still relatively easy. I think this is a trend in the future. I may build my own asset portfolio through index Y shares.

Yan Huahai:Index funds are passive investments and are currently the mainstream of the market at home and abroad. The size of passive funds in the United States has exceeded that of active funds. In September 2024, the size of index funds in China has also exceeded the size of actively managed equity funds. Index funds are very recognized in the global market and have a lot of room for development.

From the perspective of rates, I also agree with Teacher Borg’s point of view. Indeed, the Y share of index funds will have a greater impact on the FOF of pension funds. I mainly want to make more comparisons between these two products from other perspectives.

The first dimension is the dimensions of initiative and passivity, active investment and passive investment. FOF funds are active investments, while index funds are more passive investments;

In the second dimension, 100% FOF funds are allocated to funds, including target date funds and target risk funds. The equity positions of target date funds have a downward curve, from 8%, 90%, to 10%. There are both 20 and 20, which have different target dates (corresponding to the individual’s retirement time); target risk funds include one-year, three-year, five-year, etc. But index funds are different. Currently, 100% of index funds are all stocks and have always maintained high equity positions. Therefore, index funds are a high-risk and highly volatile variety, while FOF funds are relatively more stable.

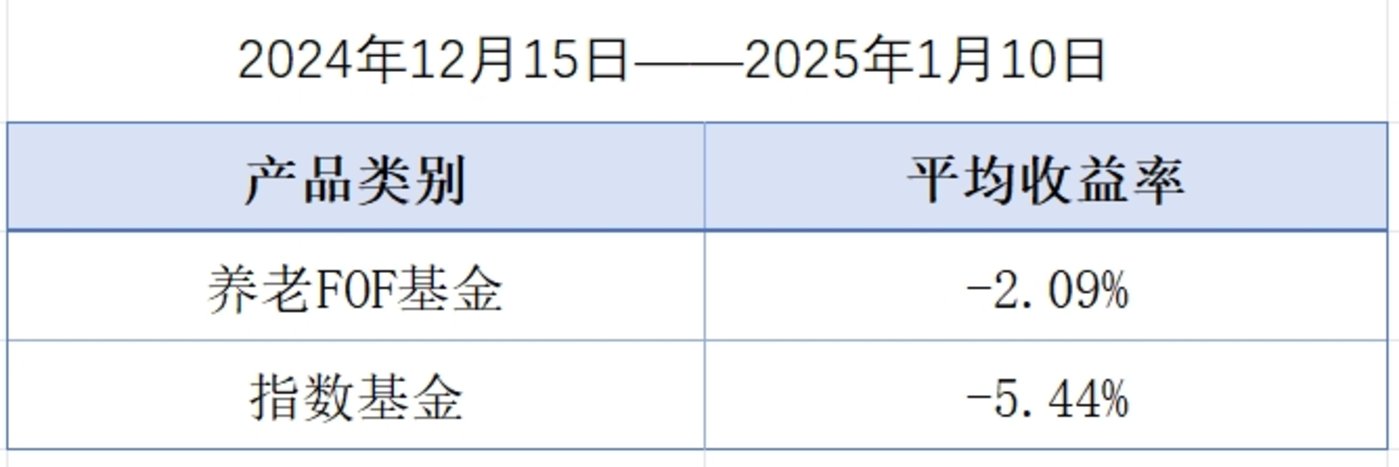

I have compiled statistics here on the average performance and income data of FOF funds and index funds from the national promotion in mid-December to January 10 last Friday. The average return of 201 FOF funds was-2.09%, and the return of index funds in the past 20 days was-5.44%.

In other words, during these more than 20 days, index funds fluctuated more than FOF funds. Index funds rise a lot when they rise, and fall a lot when they fall.

What is the future development direction of FOF funds? I think these two types of funds will coexist for a long time in the future. From a foreign perspective, target-date FOF has long been the most suitable product for elderly care. When the China Securities Regulatory Commission issued pension fund guidelines in 2018, why did it insist on adopting the FOF fund form? Starting from the pension attributes, we must first consider safety and stability, which is very consistent with the low volatility and stability characteristics of FOF funds.

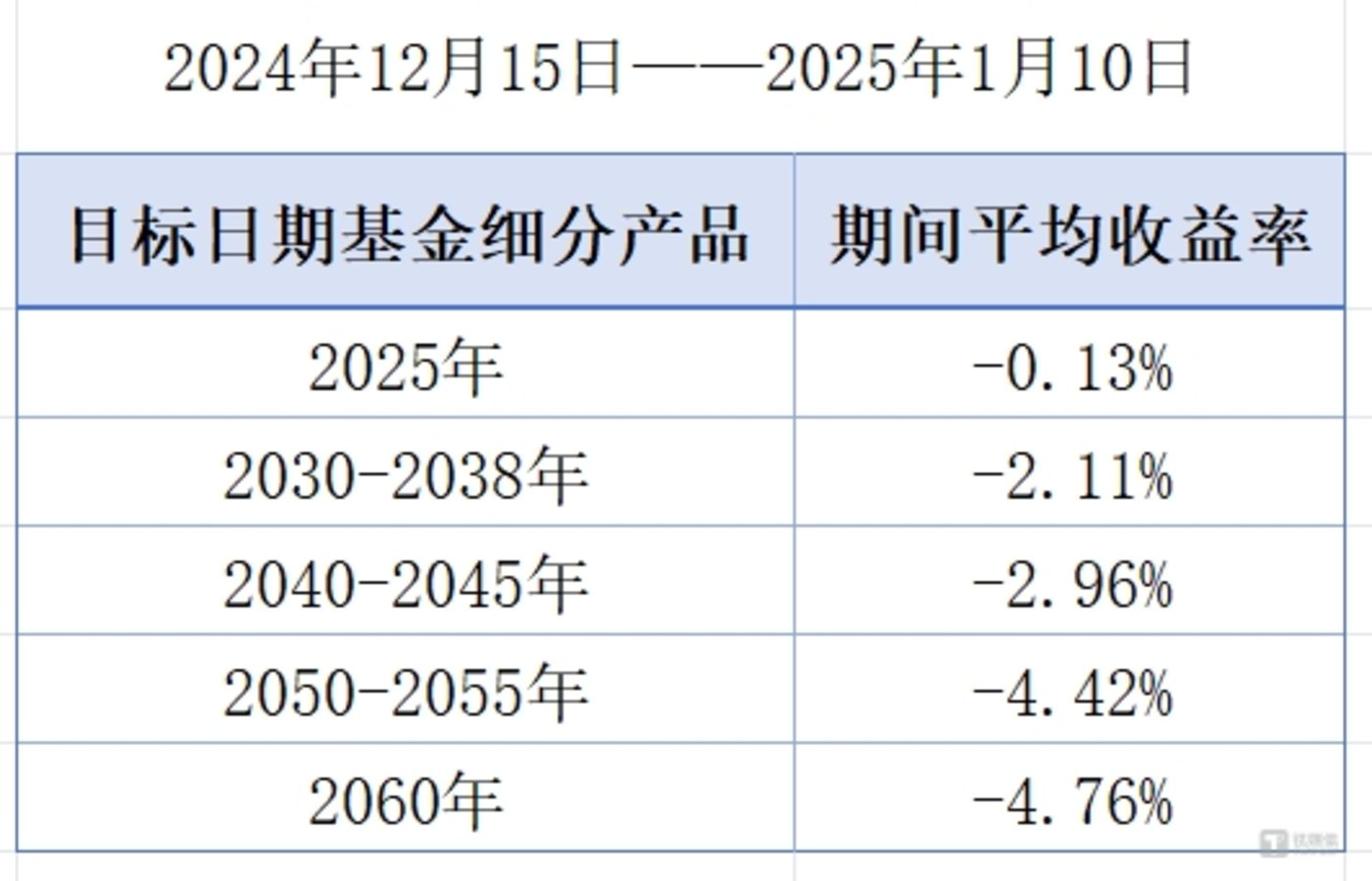

Therefore, whether it is a FOF fund or an index fund, in the long run, it is only suitable for investors with different risk appetites. Professional investors like Mr. Borg who have high risk appetites and have a full understanding of indices may be more suitable for using index funds to build a portfolio. But for the general public, it is more appropriate to use the target dates of 2040, 2045, and 2050 to build a combination from the entire life cycle. 2030, 2040, and 2050 represent the time for retirement. The longer this time goes, its stock equity position will continue to decline from high to low. Our statistical data also presents this objective rule in a particularly interesting way. For example, for the 2025-2060 target-date fund, from mid-December last year to January 10, 2025, the average return of the 2025 target-date fund was-0.13%, the average return of the 2030 – 2038 target-date fund was-2.11%, the average return of the 2040 – 2048 was-2.96%, the average return of the 2050 – 2055 target-date fund was-4.42%, and the average return of the 2060 dropped to-4.76%. That is to say, the longer the term, the higher the equity position, the more it will fall during the stock downturn. Conversely, if it is a bull market, the more it will rise. This is very, very consistent with its product attributes.

So whether it’s a FOF fund or an index fund, it can suit different risk appetites. At present, why increase index funds? In fact, the host also mentioned just now is for more professionals or more people who understand funds to invest. Whether it is the China Securities A500, the Shanghai and Shenzhen 300, Science and Technology Innovation 50, etc., the composition of these indices is different. If you choose an index fund to invest, you must first understand the index, which is a necessary prerequisite.

Deng Hequan:The inclusion of Y shares of index funds will have a certain impact on FOF products. Index products are relatively transparent and at the same time are Y shares, which have advantages in terms of rates. However, FOF funds still have a tailor-made feature. They will vary from low wave to medium wave and then to high wave based on the allocation ratio of various assets in stocks and bonds and the risk-return characteristics of customers. This kind of multi-faceted product setting model can also provide investors with more choices. I personally prefer the trend of these two types of products coexisting. Of course, the follow-up still depends on which type of product can have better profit-making benefits and bring a better investment experience to customers before there can be further development.

Bear market thinking should be abandoned in 2025, and pension funds can be deployed in batches at present

He Junni:Since the beginning of 2025, the A-share market has once again experienced a continuous decline. What do several guests think of the subsequent market performance? Now it’s about laying out pension fundsHersheyMachine? How to configure? Can pension funds turn over and achieve good returns in 2025? Mr. Borg, do pension funds also need to operate at a certain time?

Wangjing Borg:I personally feel that the 12,000 quota is not worth spending too much energy. This year, there was a new quota, which happened to fall sharply on January 3, so I bought it. For pension FOF, you still have to choose to buy at a low point. For example, 2040 and 2050, these are long-term lock-in, so there is no need to consider the issue of taking profits at a high point. Index Y shares are freely bought and sold, and of course they can be operated in bands.

Regarding the future market, I am still relatively optimistic, but my optimism does not mean blindly chasing high prices. I will not buy when it is expensive. I will choose to buy when I think I think it is cheap.

Yan Huahai:Currently, index funds are at a relatively low position. If they are held in a long-term manner, they can buy one after another. In addition, when choosing an index fund product, it may be better to not only look at the product itself, but also consider the company and fund manager.

If an individual buys a pension FOF fund, if the individual retires in 2040 or 2045, if he does not have much time to manage the funds, he can just buy it directly. Of course, we must also consider the fund company, fund size, investment research capabilities, and fund manager strength.

Deng Hequan:The host also mentioned that the customer experience of investing in pension funds in the past few years has not been very good. I personally think this year can be more optimistic, because the market at the end of September last year should be said to have brought some differences to the market, including some policy changes and other aspects. Therefore, in 2025, investors may want to try their best to get rid of the investment thinking of the past three years. Don’t choose to take profit just because they have been afraid of the decline in the past three years.

We can be more proactive in our strategy in 2025. Of course, at the same time, we can learn from Teacher Borg’s operation, which is, buy if it falls. In the past three years, you may have bought it when you fell, and you might have put a quilt when you bought it, but since September last year, you actually bought it when you fell, often at a low point, because the market has gotten rid of the unilateral downturn in the past.

We can’t say that it must be a bull market now, but at least I don’t think it’s a bear market anymore. Therefore, in this volatile market, or even a stronger market, buying every time it goes down, the winning rate and cost performance ratio are relatively high. Therefore, I also suggest that you can be more proactive this year, but also be rational. At the same time, it is best to adopt this kind of bargain-hunting and batch method, including fixed investment, to make some layout, which may be better.

See more program contentTitanium bull, stock market 33

Risk warning: Guests share their views for reference only and do not constitute investment advice or commitment. Market views change with changes in the market environment and do not constitute any investment advice or commitment.