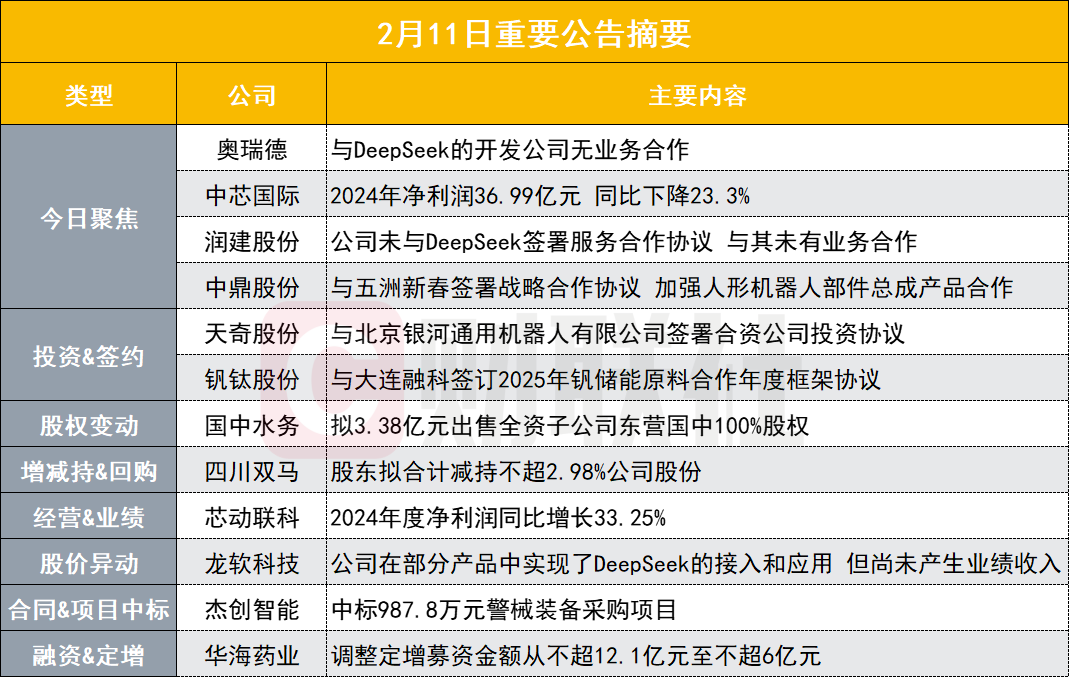

SMIC: Net profit in 2024 will be 3.699 billion yuan, down 23.3% year-on-year

today’s focus

[3 consecutive board Orid: No business cooperation with DeepSeek’s development company]

Orrid announced that the company has noticed that some media have included the company’s shares in the DeepSeek concept stocks. The company explained the relevant matters as follows: The company has no business cooperation with DeepSeek’s development company Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd., and invites investors to make prudent decisions and invest rationally. As of the disclosure date of this announcement, the company does not directly or indirectly hold equity in Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd. In addition to the above matters, the company has not found media reports or information with high market attention that may or have had a significant impact on the trading price of the company’s stock in the near future.

[SMIC: Net profit in 2024 will be 3.699 billion yuan, down 23.3% year-on-year]

SMIC released its performance report. In the fourth quarter of 2024, operating income was 15.917 billion yuan, a year-on-year increase of 31.0%; net profit attributable to shareholders of listed companies was 992 million yuan, a year-on-year decrease of 13.5%. Unaudited operating income in 2024 was 57.796 billion yuan, a year-on-year increase of 27.7%; net profit attributable to shareholders of listed companies was 3.699 billion yuan, a year-on-year decrease of 23.3%. Total operating income, operating profit, and total profit in the fourth quarter of 2024 increased compared with the same period last year, mainly due to the increase in the number of wafers sold, increased capacity utilization and changes in product mix.

[2 Lianban Runjian Co., Ltd.: The company has not signed a service cooperation agreement with DeepSeek and has no business cooperation with it]

Runjian Co., Ltd. announced that the company has independently developed a “Quchi” artificial intelligence open platform to connect and deploy DeepSeek series models, empowering the company’s internal digital intelligence transformation and assisting the development of AI application business. However, the company has not signed a service cooperation agreement with DeepSeek and has no business cooperation with it. There is uncertainty about the impact of this matter on the company’s future performance.

[Zhongding Co., Ltd.: Signed a strategic cooperation agreement with Wuzhou Xinchun to strengthen cooperation in humanoid robot component assembly products]

Zhongding announced that the company has signed a strategic cooperation agreement with Zhejiang Wuzhou Xinchun Group Co., Ltd., and the two parties will strengthen cooperation in the field of humanoid robot component assembly products, including product development, technical specifications and standards, and quality management. The agreement is a framework agreement, and its specific implementation is uncertain. It has no material impact on the operating results of this year. The impact of operating results in future years depends on the implementation of subsequent projects.

[9-board Xinju Network: IT operation and maintenance agent business has not yet generated revenue]

Xinju Network issued an announcement on serious abnormal fluctuations and risk warnings in stock trading. The company’s current share price is obviously irrational speculation, and the trading risk is high and may fall rapidly at any time. The company’s IT operation and maintenance agent business is the application of AI agent technology in the IT operation and maintenance industry. It is significantly different from general AI agents in terms of product form and application scope. Moreover, this business is in the research and development stage and has not yet generated revenue. There is uncertainty about whether the subsequent research and development will be successful and whether it can generate revenue.

[2 Lianban Longsoft Technology: The company has realized DeepSeek access and application in some products but has not yet generated performance revenue]

Longruan Technology announced abnormal fluctuations in stock trading, saying that recently, the DeepSeek concept market has attracted high attention. The company clarified the relevant matters as follows: DeepSeek is an open source large language model. Any user can carry out training based on this model and then conduct personalized development or model optimization to meet the specific needs of different users in diverse scenarios. Although the company has realized DeepSeek access and application in some products, it is still in the research and development stage and has not yet generated performance revenue. Currently, the company’s business development and performance contribution have no substantial impact. Investors are advised to make prudent decisions and invest rationally. After verification, as of the disclosure date of this announcement, the company does not directly or indirectly hold equity in Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd., and the company has no business cooperation with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd.

[Changjiang Power: Controlling shareholder China Three Gorges Group plans to transfer 4% of the company’s total share capital to Changjiang Environmental Protection Group for free]

Changjiang Power announced that recently, the company received the “Notice on Transfer of Certain Shares of Changjiang Power” from the controlling shareholder China Three Gorges Group. China Three Gorges Group, the controlling shareholder of the company, and its wholly-owned subsidiary Changjiang Environmental Protection Group signed the “Agreement on the Free Transfer of State-owned Shares of China Changjiang Electric Power Co., Ltd.”. China Three Gorges Group plans to transfer 979 million shares of the company (accounting for 4% of the company’s total share capital) to Changjiang Environmental Protection Group free of charge. Changjiang Environmental Protection Group promises not to reduce its shares in the company within six months from the date of completion of the transfer of shares of the company, nor does it have any plan to reduce its shares.

[5 days, 3 boards, Light Media: The film “Nezha: The Devil Boy Raises in the Sea” produced and distributed by the company and its subsidiaries is currently in full swing]

Enlight Media released an announcement on abnormal fluctuations and severe abnormal fluctuations in stock trading, saying that the deviation from the closing price increase of the company’s stock trading has exceeded 30% for two consecutive trading days, and the deviation from the closing price increase has exceeded 100% for five consecutive trading days. It belongs to abnormal fluctuations and serious abnormal fluctuations in stock trading. After verification, the film “Nezha: The Devil Boy Raises in the Sea” produced and distributed by the company and its subsidiaries is currently in hot screening. There is no information disclosed by the company in the early stage that needs to be corrected or supplemented. Recently, the public media has not reported undisclosed material information that may or has had a significant impact on the company’s stock trading price. The company’s operating conditions are normal, and there have been no major changes in the internal and external operating environment. The company, controlling shareholders and actual controllers have no major matters that should be disclosed but have not been disclosed, nor are there any major matters in the planning stage. The controlling shareholder and actual controller did not buy or sell the company’s shares during the period of abnormal stock fluctuations.

[6 consecutive board Zhejiang Dongfang: No direct or indirect investment depth has been sought in the relevant private equity funds managed by the company and its fund segments]

Zhejiang Dongfang issued a stock trading risk warning announcement stating that after verification by the company, as of the disclosure date of this announcement, the names and depth searches of companies such as Beijing Deep Search Technology Co., Ltd. and Beijing Jiuzhang Yunji Technology Co., Ltd. invested by the company’s fund segment are relatively similar, but there is no equity investment relationship. Relevant private equity funds managed by the company and its fund segments have not directly or indirectly invested in depth searches.

[7 Connected Board Meg Intelligence: Model adaptation and end-side deployment work have been carried out for DeepSeek related models, and the impact on the company’s operating results is uncertain]

Meige Intelligent issued a change announcement. The company’s main business is wireless communication modules and solutions business. In the early stage, the company has adapted and deployed end-to-side on the company’s high-computing power module products for other open source large models. Recently, model adaptation and end-side deployment work have also been carried out for DeepSeek related models. The above-mentioned matters are currently in the early research and development stage, and no clear orders have been generated. The impact on the company’s operating performance is affected by various factors such as R & D progress, technology iteration, and product demand, and is uncertain.

stock price change

[Sichuang Medical Benefit: The company has no relevant cooperation with DeepSeek]

SiChuang Medical announced an abnormal fluctuation in stock trading, saying that the company is concerned that the market has paid high attention to the DeepSeek concept and AI medical concept recently. After self-examination, the company has no relevant cooperation with DeepSeek.

[5 Lianban Hangzhou Steel Co., Ltd.: The company has nothing to do with core technologies such as the development and application of the DeepSeek system]

Hangzhou Iron and Steel Co., Ltd. issued a stock trading risk warning announcement saying that the company is concerned about recent reports of the deployment and adaptation of its subsidiary DeepSeek. The company’s main business is the production and sales of steel and its rolled products, and the company’s main business will not change in the short term. The business model of the company’s computing power business is mainly the procurement of hardware equipment and related software. After integration, it provides leasing services to customers. It does not involve the research and development of core computing power technologies. It is expected to account for 0.06% of the company’s total operating income in 2024, accounting for a very small proportion. The DeepSeek deployment adaptation involved in relevant media reports means that under the above business model, the company installed DeepSeek software in its partner’s systems. The company has nothing to do with core technologies such as the development and application of the DeepSeek system, and has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd. Investors are advised to pay attention to investment risks.

[5 Lianban Zhejiang Digital Culture: There is no direct or indirect equity relationship with in-depth search]

Zhejiang Digital Culture issued an announcement on abnormal fluctuations in stock trading, saying that recently, the company has noticed that some media platforms regard the company’s stock as a “DeepSeek concept stock.” After internal verification, as of now, the company and its subsidiaries do not have any direct or indirect equity relationship with Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd.(i.e. DeepSeek), nor have they carried out business cooperation.

[Yongxin Zhicheng: The company’s AI model platform has been connected to the DeepSeek series of large-model business revenue accounts for a very small proportion of operating income]

Yongxin Zhicheng issued an announcement on abnormal fluctuations in stock trading, saying that the company’s AI model safety evaluation “digital wind tunnel” platform has been connected to the DeepSeek series of large models and conducted special tests on them. Currently, related business income accounts for a very small proportion of the company’s operating income., has no substantial impact on the company’s business development. As of the disclosure date of this announcement, the company does not directly or indirectly hold an equity interest in Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd.(DeepSeek is a large model owned by Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd.). There is no business cooperation between the company and Hangzhou DeepSeek Artificial Intelligence Basic Technology Research Co., Ltd.

[5 Lianban Dreamnet Technology: The company has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd.]

Dreamnet Technology announced abnormal fluctuations in stock trading. After self-examination, the company released the article “Tianhuizhuitai 2.0 Integration of DeepSeek Large Model Capabilities” through the company’s official Weixin Official Accounts on February 4, 2025. The article mentioned that “Dreamnet Technology has deeply integrated the DeepSeek Large Model into the multi-source AI scheduling engine ‘Tianhuizhuitai 2.0’.” In addition, the company noticed that relevant platforms included the company’s shares in the DeepSeek concept stocks. The company clarified the relevant matters as follows: DeepSeek is an open source large language model. Any user can conduct training based on this model for free, and then conduct personalized development or model optimization to meet the specific needs of different users in diverse scenarios. The company’s Tianhuizhui 2.0 integrates DeepSeek’s capabilities. As of now, the platform is mainly used and served the company’s rich media products, such as 5G letter reading, 5G messaging, etc., and is used to provide customers with rich media content generation and marketing creative generation, etc., providing internal operations with rich media content security review, content data labeling, R & D and operation efficiency improvement and other capabilities. The company has nothing to do with core technologies such as the development and application of the DeepSeek system, and has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd. At present, this matter has no material impact on the company’s main business, has no material impact on the company’s operating income and net profit, and has uncertainty on the company’s future performance.

[5 Connected Board Extension Information: The company does not violate fair information disclosure]

Tuowei Information issued an announcement on abnormal stock price fluctuations stating that the company’s recent production and operation conditions have been normal and there have been no major changes in the internal and external operating environment. After self-examination, the company did not violate fair information disclosure. The company will disclose its 2024 annual report on April 25, 2025, and is still in the preparation period of the report. Please refer to the 2024 annual report disclosed by the company for specific financial data.

Fixed increase financing repurchase

[Yixintang: Plans to repurchase shares from 80 million yuan to 150 million yuan]

Yixintang announced that the company plans to buy back shares for 80 million yuan to 150 million yuan, which is necessary to safeguard the company’s value and shareholders ‘rights and interests. The repurchase price shall not exceed 19.02 yuan/share. The sources of repurchase funds are the company’s own funds and special loan funds for stock repurchase. The company has obtained the “Loan Commitment Letter” issued by Kunming Branch of Shanghai Pudong Development Bank Co., Ltd. Kunming Branch of Shanghai Pudong Development Bank Co., Ltd. has promised to provide the company with a special stock repurchase loan of 135 million yuan, with a loan term of three years.

[Zhiou Technology: Plans to repurchase shares between RMB 50 million and RMB 100 million]

Zhiou Technology announced that the company plans to buy back shares for 50 million yuan to 100 million yuan to implement employee stock ownership plans or equity incentive plans. The repurchase price shall not exceed 28.00 yuan/share. The funds for share repurchase come from self-owned funds and special bank repurchase loans, of which the proportion of special bank repurchase loans shall not exceed 90%. On February 7, the company obtained the “Loan Commitment Letter” issued by Industrial and Commercial Bank of China’s Henan Province Branch and agreed to provide the company with a special loan for stock repurchase, with an amount of no more than 90 million yuan.

[Nengte Technology: It plans to repurchase the company’s shares from RMB 300 million to RMB 500 million for cancellation and reduction of registered capital]

Nengte Technology announced that the company plans to use its own funds and self-raised funds to repurchase some A-shares issued by the company through centralized bidding transactions. The total amount of repurchase funds shall not be less than 300 million yuan and no more than 500 million yuan., the repurchase price shall not exceed 3.90 yuan/share. All shares purchased will be used for cancellation and the registered capital will be reduced accordingly. The repurchase implementation period is 12 months from the date when the repurchase plan is reviewed and approved by the shareholders ‘meeting.

[Huahai Pharmaceutical: Adjust the fixed-increase fundraising amount from no more than 1.21 billion yuan to no more than 600 million yuan]

Huahai Pharmaceutical announced that the 33rd extraordinary meeting of the eighth board of directors of the company reviewed and approved the adjustment of the scale of raised funds for issuing shares to specific objects from no more than 1.21 million yuan (including the amount) to no more than 600 million yuan (including the amount), and adjusted the amount of raised funds to be invested in the project accordingly. Except for this adjustment, other issuance plan matters remain unchanged. The adjustment is within the scope authorized by the shareholders ‘meeting and does not need to be submitted to the shareholders’ meeting for review again. At the same time, the meeting also reviewed and approved a proposal on opening a special account for raised funds.

Winning the bid was approved

[Zhejiang Construction Investment: Subsidiary won the bid for HK$2.1 billion housing reconstruction project]

Zhejiang Construction Investment announced that Huaying Construction, a subsidiary of the company, received a bid letter and successfully won the bid for the 12th phase of the public housing redevelopment project in Pak Tin Village, Shek Kip Mei, Hong Kong, with a bid price of approximately HK$2.1 billion (approximately RMB 2 billion).

[Sunshine Nuohe: Subsidiary BTS0327 clinical trial application accepted]

Sunshine Nuohe announced that the company’s subsidiary Jiangsu Nuohe Billiton New Drug Research and Development Co., Ltd. received the “Notice of Acceptance” approved and issued by the State Food and Drug Administration, and its clinical trial application for the research project BTS0327 was accepted. BTS0327 is intended to prevent acute and delayed nausea and vomiting caused by chemotherapy. This drug is a modified new drug of Class 2. It aims to extend the effective therapeutic concentration time, reduce the frequency of administration, and improve patient compliance by preparing active pharmaceutical ingredients into a sustained-release microsphere preparation. Drug research and development has the characteristics of high-tech, high-risk, and high added value, and there are uncertainties.

[Jiechuang Intelligent: Won the bid for a 9.878 million yuan police equipment procurement project]

Jiechuang Intelligent announced that the company won the bid for the police equipment procurement project of a provincial public security department, with a winning bid amount of 9.878 million yuan. The contract product is a handheld electromagnetic arrest net. The project contract has been signed.

Reduce holdings

[Lege Shares: The controlling shareholder plans to increase its stake in the company by 50 million yuan to 100 million yuan]

Lege announced that based on confidence in the company’s future sustainable development prospects and recognition of the company’s investment value, Ningbo Regent Electronics Group Co., Ltd., the company’s controlling shareholder, plans to increase its shares in the company through centralized bidding within 6 months from the date of disclosure of the announcement, based on its confidence in the company’s future sustainable development prospects and recognition of the company’s investment value. The amount of this increase will not be less than RMB 50 million and will not exceed 100 million yuan.

[Sichuan Shuangma: Shareholders plan to reduce their shares in the company by no more than 2.98%]

Sichuan Shuangma announced that CITIC Financial Assets, a shareholder holding 7.9317% of the shares, and Tianjin Saikehuan, a shareholder holding 10.2698% of the shares, plan to reduce the company’s shares by no more than 11.3583 million shares through centralized bidding and block transactions for 90 consecutive natural days after 15 trading days, accounting for 1.4878% of the company’s total share capital, accounting for 1.5000% of the total share capital after excluding the number of shares in the company’s special securities repurchase account.

[Black Cat Shares: Controlling shareholders increased their shareholding in the company to 35%]

Black Cat announced that Black Cat Group, the company’s controlling shareholder, increased its shareholding by 2.627 million shares through centralized bidding transactions from January 24 to February 10, 2025, and its shareholding ratio increased from 34.64% to 35.00%. This increase in holdings will not involve a tender offer, will not lead to changes in the company’s controlling shareholder and actual controller, and will not affect the company’s governance structure and continuing operations.

Transfer and acquisition of investments

[Ambotong: A wholly-owned subsidiary signed a major contract of approximately 1.492 billion yuan for daily operations]

Abocom announced that recently, Abocom International, a wholly-owned subsidiary of the company in Hong Kong, signed a sales contract with Customer A. The customer purchased information and communication infrastructure module products from the company with a contract amount of US$204 million (equivalent to approximately RMB 1.492 billion). yuan). This contract belongs to the company’s daily operating business and uses the net method to calculate revenue, which is expected to have a positive impact on the company’s future performance.

[Ouke Technology: It plans to invest 585 million yuan to participate in the establishment of Junok Intelligent Manufacturing Fund]

Ouke Technology announced that recently, the company signed the “Gongqing City and Junke Intelligent Intelligent Venture Capital Partnership (Limited Partnership) Partnership Agreement” with Hejun Investment, Jiujiang City Industrial Fund and Dingfa Assets, and plans to jointly invest in the establishment of Gongqing City and Junke Intelligent Venture Capital Partnership (Limited Partnership)(referred to as “Hejun Ouke Intelligent Intelligent and Intelligent Fund”). The total capital contribution subscribed by Junok Intelligent Intelligent Manufacturing Fund is 1.5 billion yuan, of which the company plans to subscribe 585 million yuan with its own funds as a limited partner, accounting for 39%.

[CNNC Titanium Dioxide: Signed a strategic cooperation agreement with Nippon Investment to establish a strategic procurement cooperation relationship for titanium dioxide]

CNNC Titanium White announced that recently, the company signed a strategic cooperation agreement with Nippon Investment Co., Ltd.(referred to as “Nippon Investment”). The two parties agreed to establish a strategic procurement cooperation relationship for titanium dioxide from 2025 to 2027. It is expected that the company will become Nippon Investment One of the largest suppliers of titanium dioxide products.

[Tianqi Shares: Signed a joint venture investment agreement with Beijing Galaxy General Robot Co., Ltd.]

Tianqi shares announced that recently, the company and Beijing Yinhe General Robot Co., Ltd. signed a “Joint Venture Company Investment Agreement”. The two parties plan to invest in the establishment of a joint venture company Tianqi Yinhe Robot Co., Ltd. to integrate the advantages and resources of both parties to develop specific intelligent large models and Specific intelligent robots carry out strategic cooperation in large-scale application in related fields of the automobile manufacturing industry. The registered capital of the joint venture company is 3.6 million yuan, and both parties each subscribed the registered capital of 1.8 million yuan with monetary funds, and each holds 50% equity in the joint venture company.

[Vanadium and Titanium Shares: Signed the 2025 Annual Framework Agreement on Vanadium Energy Storage Materials Cooperation with Dalian Rongke]

Vanadium and Titanium Co., Ltd. announced that Pangang Group Chengdu Vanadium and Titanium Resources Development Co., Ltd., a wholly-owned subsidiary of the company, signed the “2025 Vanadium Energy Storage Raw Materials Cooperation Annual Framework Agreement” with Dalian Rongke Energy Storage Group Co., Ltd., and the total quantity is expected in 2025. 20,000 tons (equivalent to vanadium pentoxide), which does not include raw materials required for the vanadium energy storage joint venture established with Dalian Rongke and other special major energy storage projects. The term of the agreement starts from January 1, 2025 to December 31. The purchase and sales quantities involved in the agreement are the estimated quantities. Both parties will negotiate separately to determine the specific monthly quantity and sign a monthly contract. The final transaction quantity will be subject to the actual settlement. There is uncertainty as to whether this framework agreement can be fully implemented.

[Jimi Technology: Some shareholders plan to make an inquiry to transfer a total of 2.83% of the company’s shares]

Jimi Technology announced that shareholders Chengdu Jimi Enterprise Management Consulting Partnership (Limited Partnership), Chengdu Kaixin Rice Flower Enterprise Management Consulting Partnership (Limited Partnership) and Liao Chuanjun intend to make an inquiry to transfer a total of 1.9785 million shares of the company, accounting for the company’s total share capital. The proportion is 2.83%. The transferee of this inquiry transfer is an institutional investor with corresponding pricing capabilities and risk tolerance. The transferee transfers the transferred shares through inquiry, and may not transfer them within 6 months after the transfer.

[China Water: Plans to sell 100% equity of its wholly-owned subsidiary Dongying China for RMB 338 million]

Guozhong Water announced that on February 7, 2025, the company signed an equity transfer contract with Dongying City Estuary area Finance Investment Group Co., Ltd. to sell 100% equity of its wholly-owned subsidiary Dongying Guozhong to it at a transaction price of 338 million yuan. After the sale, the company will reduce the company’s sewage treatment volume and operating income of its sewage treatment business.

operating results

[Xindonglianke: 2024 net profit increased by 33.25% year-on-year]

Core Dynamic Lianke released a performance report, achieving total operating income of 405 million yuan in 2024, a year-on-year increase of 27.76%; net profit attributable to owners of the parent company was 220 million yuan, a year-on-year increase of 33.25%.

other

[Haitong Securities: The Shanghai Stock Exchange accepts the application for termination of listing of the company’s A-shares]

Haitong Securities announced that the company has submitted an application to the Shanghai Stock Exchange for voluntary termination of listing of A-shares, and received the “Notice on Accepting the Application for Voluntary Termination of Listing of Shares of Haitong Securities Co., Ltd.” issued by the Shanghai Stock Exchange on February 11, 2025. In accordance with the “Shanghai Stock Exchange Listing Rules” and relevant business rules, the Shanghai Stock Exchange decided to accept the company’s application for voluntary termination of the listing of A-shares. The company will publish the relevant termination announcement after approval by the Shanghai Stock Exchange.

[Zhongwei Shares: Authorize management to initiate preparations for overseas issuance of shares (H shares) and listing in Hong Kong]

Zhongwei shares announced that it approved the review and authorization management to initiate preliminary preparations for overseas issuance of shares (H shares) and listing on the Stock Exchange of Hong Kong Limited. The company plans to discuss specific promotion work with relevant intermediaries, but the details of the listing have not yet been determined. This matter needs to be submitted to the board of directors and shareholders ‘meeting for review, and filed, approved or approved by relevant government agencies and regulatory agencies. There is great uncertainty. The company will disclose information in accordance with laws and regulations and remind investors to pay attention to investment risks.

[*ST Jiayu: There is a risk that the stock may be terminated because the stock price is lower than the par value]

*ST Jiayu announced that on February 11, 2025, the closing price of the company’s stock was 0.97 yuan/share, which was lower than 1 yuan for the first time. According to the GEM stock listing rules, if the company’s stock closing price is less than 1 yuan for 20 consecutive trading days, there is a risk that the company’s stock will be terminated. In addition, the company expects the net assets attributable to shareholders of listed companies at the end of 2024 to be-2.106 billion yuan to-1.956 billion yuan. If the audited net assets are negative, the company’s shares will also be terminated from listing. The company also received a notice from the original audit institution, Zhongzheng Certified Public Accountants, that due to administrative penalties, it is expected that it will not be able to complete the company’s 2024 audit business on time. The company plans to hire Pengsheng Certified Public Accountants as the 2024 audit institution.

[Zhongwei Co., Ltd.: The wholly-owned subsidiary and POSCO Holdings terminate investment in the nickel refinery joint venture]

Zhongwei announced that the company had previously disclosed that the company’s wholly-owned secondary subsidiaries Zhongwei Hong Kong Xingchuang and POSCO Holdings planned to invest in the construction of a nickel refinery project in Pohang, South Korea, and all parties (or affiliated companies of each party) will form a joint venture company to implement the project. Due to the continuous changes in the electric vehicle market and related industrial environment, the two parties have carried out multiple rounds of investment analysis and demonstration on project operation and management costs, resulting in the project having not made substantial progress so far. In order to effectively control the risks of foreign investment, the company decided to terminate its investment in the above projects. In the future, the company and POSCO Holdings will continue to maintain a good partnership. This termination of foreign investment will not have a significant impact on the company’s existing business and the company’s overall production and operation activities.

[Hesheng Silicon Industry: Plans to apply for an asset securitization project not exceeding 4 billion yuan]

Hesheng Silicon announced that the company plans to raise funds through the issuance of asset-backed securities, and the issuance scale is expected to not exceed 4 billion yuan.

[Ates: The company believes that Trina Solar lacks factual and legal basis for its claim against the company and Changshu Ates]

Artes announced that the company and its wholly-owned subsidiary Changshu Artes were sued by Trina Solar Co., Ltd. for patent infringement, involving a total amount of 1.058 billion yuan. At present, the case has not yet been heard, and its impact on the company’s current or future profits is uncertain. The company will claim its own rights and interests in accordance with the law and fulfill its information disclosure obligations in a timely manner based on progress. The company has conducted sufficient research and analysis on Trina Solar’s two patents involved in the case, and believes that there is strong evidence to prove that these two patents should be invalid, and that the company’s products and processes do not infringe on the two patents. Trina Solar has claimed a total of more than 1 billion yuan from the company and Changshu Ates based on these two patents, which lacks factual and legal basis.