① Three AMC companies controlled by the Ministry of Finance, China Cinda, Great Wall Assets and Orient Assets, issued an announcement together that part of their equity will be transferred to Central Huijin;

② The number of brokerage licenses under Central Huijin will increase to 7, covering Galaxy Securities, China International Capital Corporation, Shenwan Hongyuan, China CITIC Construction Investment, Dongxing Securities, Changcheng Guorui and Cinda Securities.

Cailian News, February 14 (Reporter Gao Yanyun)The equity held by the Ministry of Finance in the three major AMC companies has undergone major adjustments.

On February 14, three AMC companies controlled by the Ministry of Finance, China Cinda, Great Wall Assets and Orient Assets, issued an announcement together that part of their equity will be transferred to Central Huijin. Specifically, approximately 58% of the equity of China Cinda, 73.53% of Great Wall Assets, and 71.55% of Orient Assets will be transferred to Central Huijin free of charge, and Central Huijin will also become the controlling shareholder of the above three companies. In addition, 66.7% equity of China Securities was transferred to Central Huijin.

On the same day, Shenwan Hongyuan, Dongxing Securities and Cinda Securities issued relevant announcements:

Shen Wan Hongyuan said that the company received a notice from Huijin that 66.7% of the equity of China Securities Fund was planned to be transferred to Huijin, and Huijin had submitted a disclosure in Hong Kong on its holding of shares in the company;

Dongxing Securities received a notice from its controlling shareholder, China Oriental, that the Ministry of Finance intends to transfer all its equity in China Oriental to Huijin. After the transfer is completed, the actual controller of the company will be changed from the Ministry of Finance to Huijin Company.

Cinda Securities received a notice from its controlling shareholder, China Cinda, that the Ministry of Finance plans to transfer all its equity in China Cinda to Huijin. After the transfer is completed, the actual controller of the company will be changed from the Ministry of Finance to Huijin Company.

After Central Huijin receives equity, the number of brokerage licenses under its will increase to seven, covering Galaxy Securities, China International Capital Corporation, Shenwan Hongyuan, China CITIC Construction Investment, as well as Dongxing Securities under the former Orient Assets, Changcheng Guorui under Great Wall Assets and Cinda Securities under Cinda Assets.

The integration of securities firms ‘mergers and acquisitions has ushered in the catalysis. The Ministry of Finance transferred the equity of Cinda Assets, Orient Assets and Great Wall Assets to Central Huijin, or paving the way for the integration of brokerage licenses. Can the long-rumored “China Gold + Galaxy” work? In fact, the “CICC + Galaxy” merger method has been rumored many times and denied many times. Another rumored template is that CICC and Galaxy will merge AMC’s securities assets respectively.

The controlling interests of three AMC companies of the Ministry of Finance were transferred to Huijin

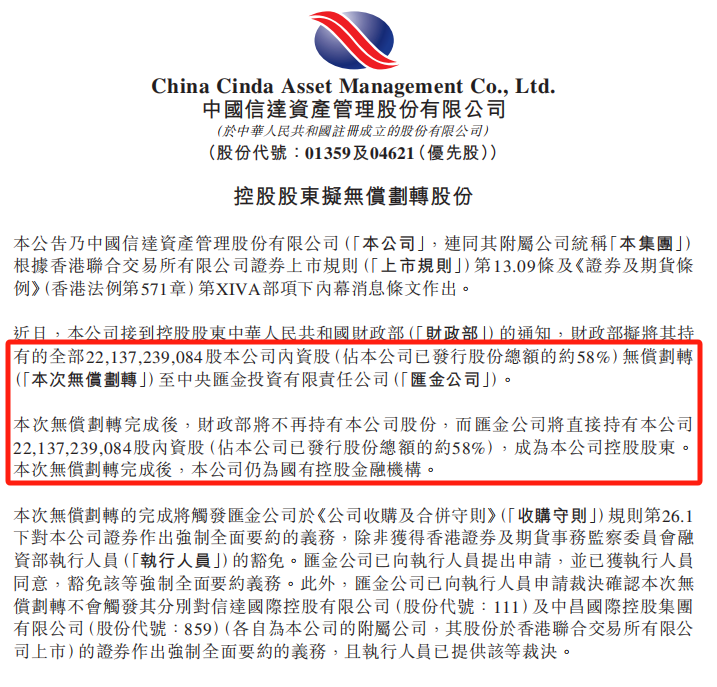

China Cinda announced that it recently received a notice from the controlling shareholder, the Ministry of Finance, that the Ministry of Finance plans to transfer its 22.137 billion domestic shares of the company (accounting for approximately 58% of the company’s total issued shares) to Central Huijin free of charge. After the free transfer is completed, the Ministry of Finance will no longer hold shares in the company, and Huijin will directly hold 22.137 billion domestic shares of the company and become the controlling shareholder of the company. After the completion of this free transfer, the company will still be a state-controlled financial institution.

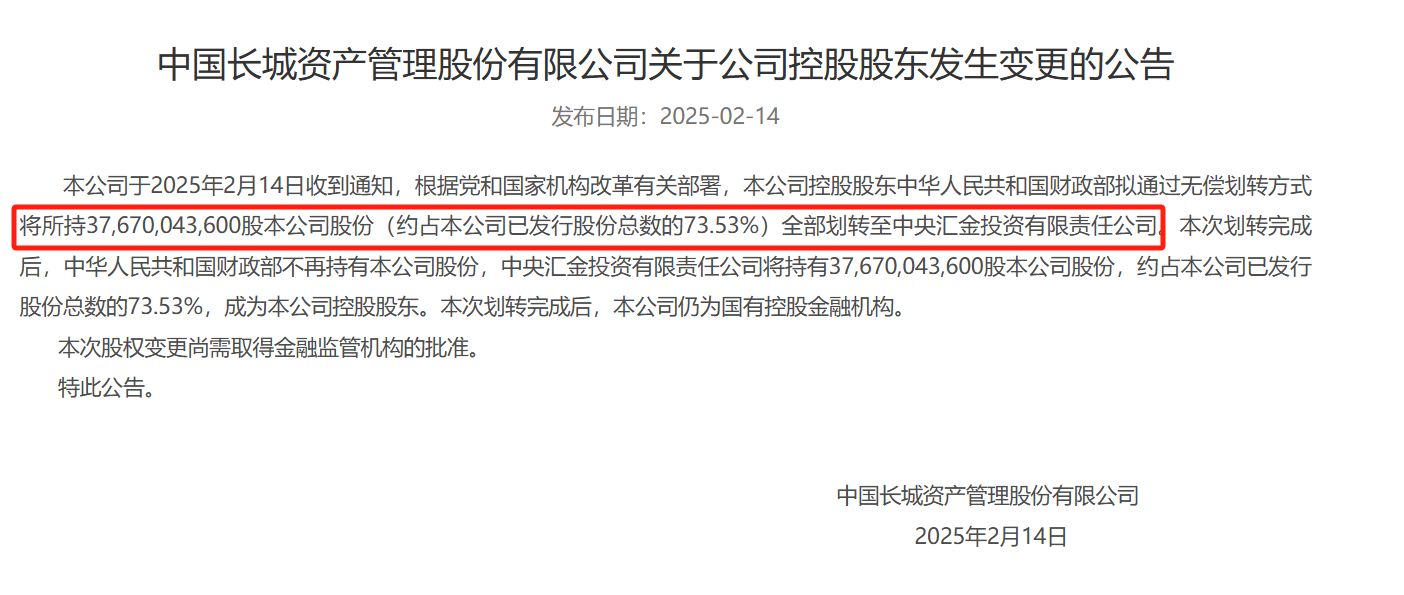

Great Wall Assets issued an announcement stating that the company received notice that according to the relevant arrangements for the reform of party and state institutions, the Ministry of Finance, the company’s controlling shareholder, plans to transfer its 37.67 billion shares of the company (accounting for approximately 73.53% of the company’s total issued shares) through free transfer. Transfer all to Central Huijin.

After the completion of this transfer, the Ministry of Finance will no longer hold shares in Great Wall Assets Co., Ltd., and Central Huijin will hold 37.67 billion shares in Great Wall Assets, accounting for approximately 73.53% of the company’s total issued shares, becoming the controlling shareholder of the company. After the completion of this transfer, the company will still be a state-controlled financial institution.

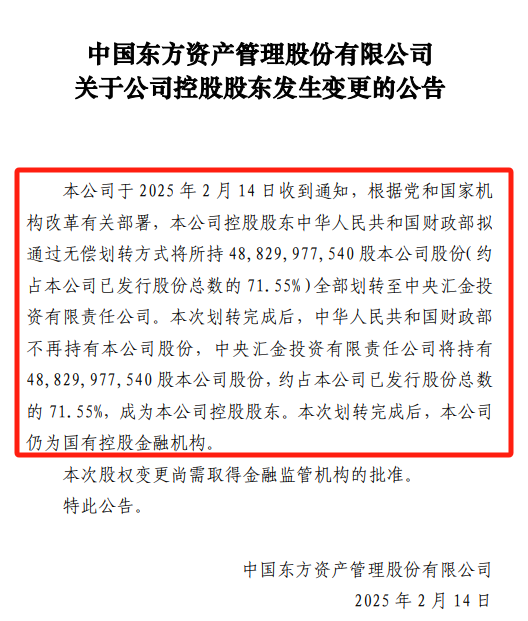

Orient Assets issued an announcement stating that the company received a notice on February 14, 2025. According to the relevant arrangements for party and state institutional reform, the Ministry of Finance, the company’s controlling shareholder, plans to transfer its 48.83 billion shares of the company through free transfer (approximately 71.55% of the company’s total issued shares) were transferred to Central Huijin.

After the completion of this transfer, the Ministry of Finance will no longer hold shares in Orient Assets. Central Huijin will hold 48.83 billion shares of the company, accounting for approximately 71.55% of the company’s total issued shares, and become the controlling shareholder of the company. After the completion of this transfer, the company will still be a state-controlled financial institution.

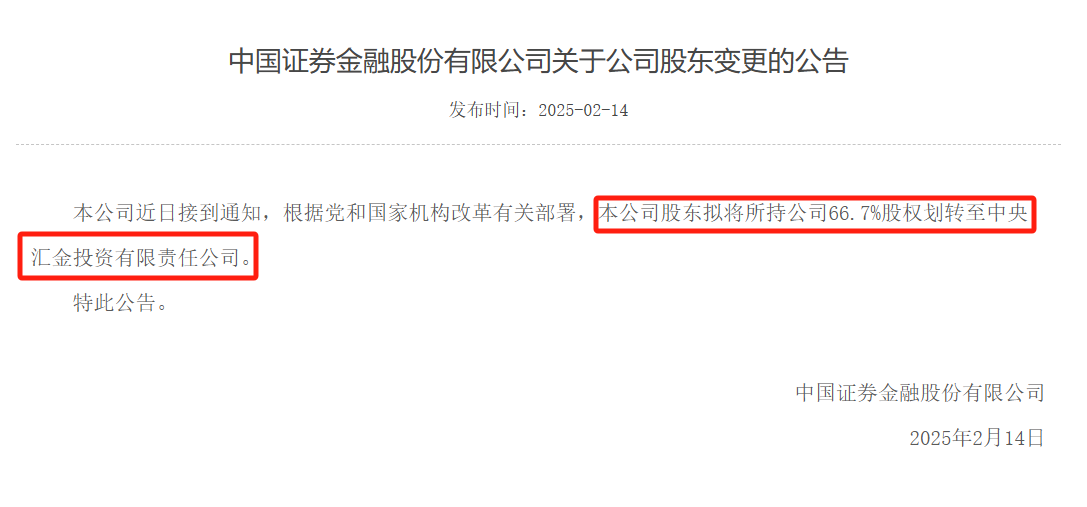

In addition, China Securities issued an announcement that the company recently received a notice that according to relevant arrangements for party and state institutional reform, the company’s shareholders plan to transfer their 66.7% equity in the company to Central Huijin.

The CIC system will have 7 brokerage licenses

Some analysts pointed out that the transfer of shares of the Ministry of Finance in its three major AMCs is a separation of supervision and shareholder roles. After the transfer, the Ministry of Finance’s supervision and shareholder roles have been clarified, which will help improve the market-oriented operation capabilities of state-owned financial enterprises; Optimize the management of state-owned financial capital. Through the professional management of Central Huijin, the allocation efficiency and risk prevention and control capabilities of state-owned financial capital will be further improved.

In addition, market analysis believes that this equity transfer will bring new opportunities for mergers and acquisitions and integration of securities firms. With the increase in brokerage licenses under Central Huijin, market expectations for brokerage integration are also heating up. Previously, rumors about the integration of Galaxy Securities, China International Capital Corporation, Dongxing Securities, and Cinda Securities have been heard endlessly. This equity transfer has undoubtedly added more imagination to these rumors.

A chief strategic analyst at a securities firm said that as early as after the handling of Huarong was completed, preparations had been made for equity adjustments to the three AMCs. Central enterprises require clear investment priorities, focus on main responsibilities and main businesses, and divest non-main businesses. The subsidiaries of the three AMC companies will have corresponding disposals. For example, Cinda Securities and Cinda Australia Asia Fund, which are owned by Cinda, will have corresponding divestitures. This is not only a merger and reorganization of central enterprises, but also a clearing of production capacity.

In addition, some researchers quickly posted a quick comment on the WeChat group saying that the starting point of the equity transfers of the three major AMCs is to improve the state-owned financial capital management system, which has been rumored before. The current business activities of the three major AMCs are supervised by the State Financial Supervision and Administration, and the Ministry of Finance and the Central Bank are responsible for inspection and supervision. After the transfer, the regulatory role of government departments and the role of shareholders can be separated, and state-owned financial enterprises can be better restrained by clarifying these responsibilities.

In March 2023, the “Plan for Deepening the Reform of Party and State Institutions” was issued, proposing to improve the state-owned financial capital management system, promote the separation of management and administration, and the separation of government and enterprises, divest market operating institutions managed by the central financial management department, and relevant state-owned financial assets are assigned to the state-owned financial capital entrusted management institution, which shall uniformly perform the responsibilities of investors in accordance with the authorization of the State Council.

The above-mentioned researchers also pointed out that after being transferred, the CIC system will have seven brokerage licenses and there is a possibility of integration. The three major AMCs have brokerage licenses respectively, namely Cinda Securities (net assets of 17.3 billion, PB 3.32x), Dongxing Securities (net assets of 26.7 billion, PB 0.98x), and Changcheng Guorui Securities (net assets of 4 billion, unlisted); If merged, there will be 7 brokerage licenses under the CIC system (including Galaxy, China International Capital, Shenwan, and China CITIC Construction Investment), or there may be potential integration.

Before the transfer was completed, the securities companies under Central Huijin Company included CICC, Shenwan Hongyuan, China Galaxy, and CITIC Construction Investment. Orient Assets ‘securities company is Dongxing Securities, Great Wall Assets has Great Wall Guorui, and Cinda Assets has Cinda Securities.

Changjiang Securities pointed out in its research report that according to the further breakdown of the ministries and commissions that perform capital contribution responsibilities and their main businesses and the correlation between finance, comprehensive central enterprises with financial attributes and Huijin systems have strong financial attributes. Securities companies are an important component in the financial field. Its securities companies have performed well in terms of capital strength, development model, and profitability; However, the main businesses of industrial central enterprises under the SASAC, the Ministry of Finance and other central enterprises are less correlated with finance, and their securities companies have a certain gap compared with the first two categories in terms of capital strength, shareholder resources, and management model. In the context of becoming bigger and stronger and the guidance of central state-owned enterprises focusing on their main businesses, we can focus on mergers and reorganizations among the same real controller and equity transfers of non-main controlling securities firms.

Some brokerage analysts pointed out that the main significance of the three major AMCs being included in CIC is to improve the management of state-owned capital financial assets. The integration of mergers and acquisitions by securities firms is expected to accelerate. AMC securities firms subsequently classified under the CIC system may have potential integration possibilities, and integration with similar shareholder backgrounds/registered places will be easier to advance.