Wen| The forefront of entrepreneurship, author| Fu Yancui, Editor| Feng Yu

Following drinks such as Jinjiu, Jiang Xiaobai, Weiyi Soymilk, Dayao soda, and Arctic Ocean, coconut milk brands have also begun to re-examine the special value of catering channels.

Recently, Hainan coconut juice brand Nihaoye stated that in 2024, facing the high degree of penetration of traditional terminal retail, the company will deploy catering channels as strategic channels.

For many young people, having a drink while eating has become a habit. Meituan Ecological data and research show that young people have a trend of combined consumption. Among them, meals and drinks are naturally adaptable, and most young users will mix drinks with them at the same time while eating.

Since Ruixing’s raw coconut latte hit the market in 2021 and the trend of healthy sugar reduction, the coconut content in the beverage industry has increased sharply in recent years. In this context, the coconut milk industry, which has many and scattered brands, has also begun to fall into a spiral.

When coconut juice rolls towards a restaurant, what sparks will it collide with?

1. Coconut targets restaurants

Compared with the relatively single beverage brands in the past catering channels, more diverse drinks are now beginning to enter the catering market. Among them, coconut drinks have also begun to appear frequently on tables and catering counters.

“In the past two years, coconut water brands could sometimes be seen in restaurants in Guangdong, and Hello Coconut was also among them.& rdquo; Xu Tao, born in the 1990s in Guangdong, told the “Frontline of Interface News Entrepreneurship” that he saw the coconut water placed in the restaurant as a novelty and shared it with friends. After all, compared to sugar-free tea and carbonated drinks, I feel that coconut water brands are rare in restaurants. rdquo;

(Photo/The coconut water Xu Tao saw in the restaurant)

In fact, since 2021, Luckin Coffee has become popular with raw coconut lattes, driving a large number of brands to start laying out coconut creative drinks. In addition, coconut water is known as a natural sports drink. It is rich in electrolytes, minerals and vitamins, which helps replenish water, promote metabolism and enhance immunity. Compared with sugary drinks and carbonated drinks, coconut drinks are gradually becoming popular among consumers.

“Coconut water is simple in ingredients, has a clear and sweet taste, and has a faint coconut aroma. After every workout, I buy a bottle of coconut water to replenish electrolytes. After the epidemic, I usually not only buy it myself, but also buy it for the elderly. rdquo; Yi Chen, a fitness enthusiast born in the 1990s, said that because in his impression, coconut water is healthier than carbonated drinks.

(Photo/Yichen specially bought coconut milk for the New Year goods he prepared)

Young people’s desire for healthy drinks has made coconut drinks visible and recognized by more consumers. The most intuitive data is that the annual production of coconuts in Hainan, the main producer of coconut in China, is only maintained at about 200 million to 230 million, but China people need to consume 2.6 billion coconuts every year.

Under the popularity of coconut drinks, market competition continues to intensify. Sky Eye inspection shows that as of now, more than 32,000 companies across the country have coconut, coconut milk or coconut milk in their company names or business scope.

In this context, brands such as Hello Coconut want to enter the eyes of more consumers, they must work hard on more channels.

It is understood that Hainan Xunxiang Food Co., Ltd., to which Nihaoye belongs, has coconut products as its core business. It is a source supply chain enterprise of the entire industrial chain integrating import and export trade, processing, production and sales of tropical agricultural and sideline products.

According to its official public account, since 2014, Xunxiang’s brand Hello Coconut has successively developed three classic products: coconut milk, coconut water, and fresh coconut milk, and continues to innovate on this basis. In order to get closer to consumers, in addition to supermarkets, convenience stores, tea shops, and coffee shops, restaurants have also become one of the channels for its brand to develop.

Catering channels do have the capital to become popular. Sky Eye data shows that the number of catering companies currently in operation is 16.31 million, of which 2.55 million are catering companies within one year of establishment.

With such a large market size, if we can open a hole in the catering channel, it will be equivalent to integrating brand notification, product promotion, experience, purchase and even repurchase, making it the best place for situational sales.

It is reported that Hello Coconut’s main products in catering channels are coconut milk and coconut water. Specifically, the retail prices of 1-liter coconut milk and coconut water in AB restaurants (large and medium-sized catering channels) and banquet channels are between 20-25 yuan and 25-30 yuan respectively, while 330ml small bottles are mainly sold to BC restaurants (small and medium-sized catering channels), with retail prices of 8 yuan/bottle and 10 yuan/bottle respectively.

(Photo/Hello coconut cat official flag)

According to public data, in 2024, sales of Hello Coconut in catering channels will increase by more than 50%. Brands such as Haidilao, Shuyi Burning Fairy Grass, Tea Saving Planet, Heqi Peach Peach, and Tea Daye also choose Nihao coconut as their coconut product suppliers.

Obviously, as the audience of coconut drinks begins to increase, if you Haoli can establish stable catering channels, not only will the sales of coconut drinks be guaranteed, but the brand promotion of other new products in the future will also come naturally, with greater business imagination.

2. Dealers enter the market and rush money

For consumer brands, catering channels are thousands of good, but it is not easy for dealers to change even when you want to enter more restaurants.

“To build catering channels, you must first be prepared to lose money.& rdquo; Li Liang, a salesperson of a fast-moving consumer goods dealer, told the “Front Line of Interface News Entrepreneurship” that when doing catering, the dealer must not only prepare funds for product inventory, but also have catering accounting periods, advance market expenses and catering failures. Prepare for bad debts and losses.

Li Liang revealed that although entering the catering channel does not require paying tens or millions of store entry fees, including SKUs, bar codes, display and other fees, like entering a large supermarket, the competition seems to be less. However, many catering owners have many requirements for brands, which makes catering channels more difficult to operate.

“The pressure to do catering channels is extremely high. The territory is only so big, and it’s not easy to do fast-moving products now. I worry about new products every day. I don’t turn around after laying them out. The hairline is so worried that I have moved back two fingers.” rdquo; Li Liang complained that there are no catering channels even in the sky and the sky. When selling new products and looking for catering channels, many places require money before selling them, which means that dealers have to advance the money themselves.” rdquo;

Li Liang bluntly said that a community can sometimes cooperate with 5-8 wholesale brands, but it may not be able to complete the cooperation with 3-5 catering brands.

He explained that once a restaurant sells A’s products, in many cases it will no longer accept competing products. Moreover, catering brand stores generally contain products from well-known brands, unless the brand can provide more special offers and new product display fees, otherwise it will be very stressful. rdquo;

Therefore, the current situation of FMCG products today is that brands are very willing to make catering and are willing to match more cost resources, but dealers think it is difficult to make money from catering and are often very reluctant to make catering channels.

In fact, with the decline in consumption, not only are more and more coconut beverage brands using catering channels as a new driving point, alcohol, beverage, and dairy companies are all seeking to survive and grow in the face of changes, and more FMCG products are looking for the cake of catering channels.

For example, Dongpeng Beverage’s product, Island Coconut, will jointly cooperate with Supreme Pizza in 2024. It has also promoted Island Coconut as the preferred drink at banquets through long-term cooperation with banquet restaurants, wholesale wedding shops, and village chefs in various places.

In addition to the coconut drink brand, Haowangshui, which has the hope of having hawthorn as one of its slogans for dinner parties, once said on official Weibo: We hope to be like milk tea and cola, to become a common beverage that allows you to have a cup of it when you have a meal, but is healthier. Natural and non-added. rdquo; At present, Haowangshui has successively cooperated with chain brands such as Haidilao, Tan Yaxue, and Wangxiangyuan.

Yili is also targeting this big market and launched two products, Changyi 100% oily orange double pomelo flavor and yogurt 1L catering sharing pack, both of which are new products specially developed for the catering market.

Obviously, the Luozi catering channel has become a tacit understanding among FMCG brands.

The location of a restaurant’s beverage area is limited, and the beverage categories selected by catering brands need to be small and refined. If Hello Coconut wants to seize more catering channels in a limited location and appear in front of front-line consumers, it will inevitably face a tough battle.

3. A commercial war triggered by a coconut

Once upon a time, coconut water has always been regarded as a niche product in the domestic market.

Huang Xunlin, founder of Hello Coconut, once recalled to the media that when the Hello Coconut brand was first established, a batch of coconut water they produced might not be sold in China for a month or two. At that time, only about 10 tons could be produced a month, which was just enough to produce production equipment. If you turn on, you have to sell half and lose half.” rdquo;

It was not until in recent years that with the promotion and popularization of new tea drink brands, coconut drinks began to rapidly enter the public’s eye.

Huang Xunlin has high hopes for the company’s coconut drinks. Taking coconut water as an example, Huang Xunlin once said that as coconut water is gradually recognized by consumers, such as its natural taste and health, I believe that coconut water will definitely exceed the current coconut milk market in the next 10 years, and it will exceed many times., it will be the most common item on the market.& rdquo;

(Photo/Hello Ye Official Weixin Official Accounts)

However, Hello Coconut’s dream of making coconut water hit is facing a severe test.

On the one hand, industry data shows that in the past five years, although the domestic coconut water market has steadily expanded, rising from 513 million yuan in 2018 to 780 million yuan in 2022, and is expected to exceed 1 billion yuan in 2025. But compared with the US$3.5 billion market for coconut milk, it still accounts for too small.

On the other hand, by mixing and mixing with freshly made drinks, these coconut drinks follow the footsteps of milk tea shops and cafes, completing multiple penetration of the market. However, the taste of coconut water is light and is influenced by many factors such as region and consumption habits. It is not easy to change consumers ‘habits in a short period of time.

“The southern market has come into contact with coconut water early, but in the northern market, many consumers do not like the taste of coconut water, and brands still need time to cultivate consumer habits. rdquo; Wang Wei, a catering industry practitioner, said that coconut water may be replaced at any time before there are a wide range of beverage options.

Wang Wei believes that although ready-made beverage products such as coconut milk and coconut water are relatively mature, they still mainly appear as a golden supporting role. They always serve as a basis for innovation with other elements. There is not much room for innovation to become a category alone.

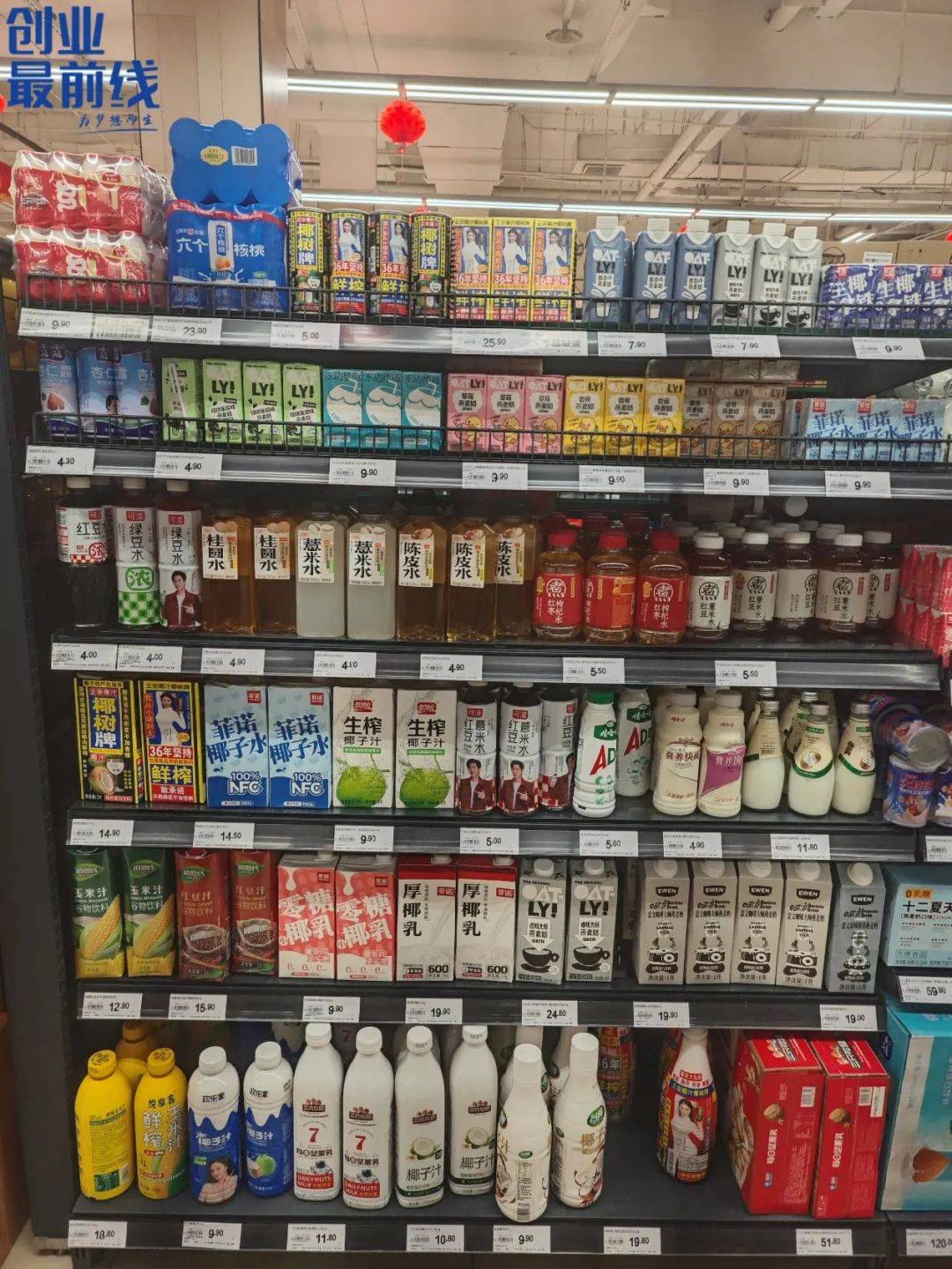

In fact, in the supermarket in Gu’an, Hebei Province, the “Frontline of Interface News Entrepreneurship” found that although the display location of coconut water is not hidden, its number of shelves and display area are significantly lower than other drinks.

(Picture/Coconut drink products on the shelves)

“Our supermarket has more than a dozen brands such as if, Happy Home, and coconut tree, but coconut tree and coconut juice sell the best. More than half of them buy coconut trees and coconut water.& rdquo; The promoter in the beverage area of the supermarket told “Interface News Entrepreneurship Frontline” that he had never heard of the brand you mentioned (Hello coconut). rdquo;

At the same time, even if more and more coconut drink brands appear on the market, imported brands such as Vita Coco, if, INNOCOCO, and UFC, old brands such as Hello Coconut, Coconut Tree, and Happy Home, and new brands such as Cococo Fenfen, Cococo Coconut Zhizhi, even retail platforms such as Hema, Park, Watsons and snack brands such as Zhou Heiya have launched self-owned brands of coconut water, and a fierce battle among brands within the industry has begun.

But even though there are many products, the taste and packaging are gradually becoming homogeneous. Many consumers find that coconut water does not have much special features, and there is not much breakthrough in taste, ingredients, etc.

Even now, the overall market space of the industry is becoming saturated, and the volume seems to have become the brand’s helpless living status. Under the new competitive landscape, many brands have also engaged in price wars.

“On social platforms, I often visit coconut drink brands to do activities. During the Chinese New Year, Hello Coconut’s coconut juice is also doing activities. The main one is buying 10 bottles for 39.9 yuan, and I don’t feel bad no matter how I drink it.&” rdquo; One consumer said.

But low prices have also led to some chaos in the coconut water market. Previously, some industry insiders said that some products that promote 100% coconut water actually have additives, but consumers have no knowledge of it. In addition, due to limited domestic coconut production and rising raw material prices, some companies will choose coconuts of poor quality.

In the eyes of many industry insiders, the health properties of coconut water are the main factor in the popularity of coconut water. When the market to be cultivated encounters surging peers, in 2025, Hello Coconut will face more severe competition.