As the regulatory framework becomes gradually clarified, this area is expected to become one of the fastest growing markets in the future.

Author:Cheeezzyyyy

Compiled by: Shenchao TechFlow

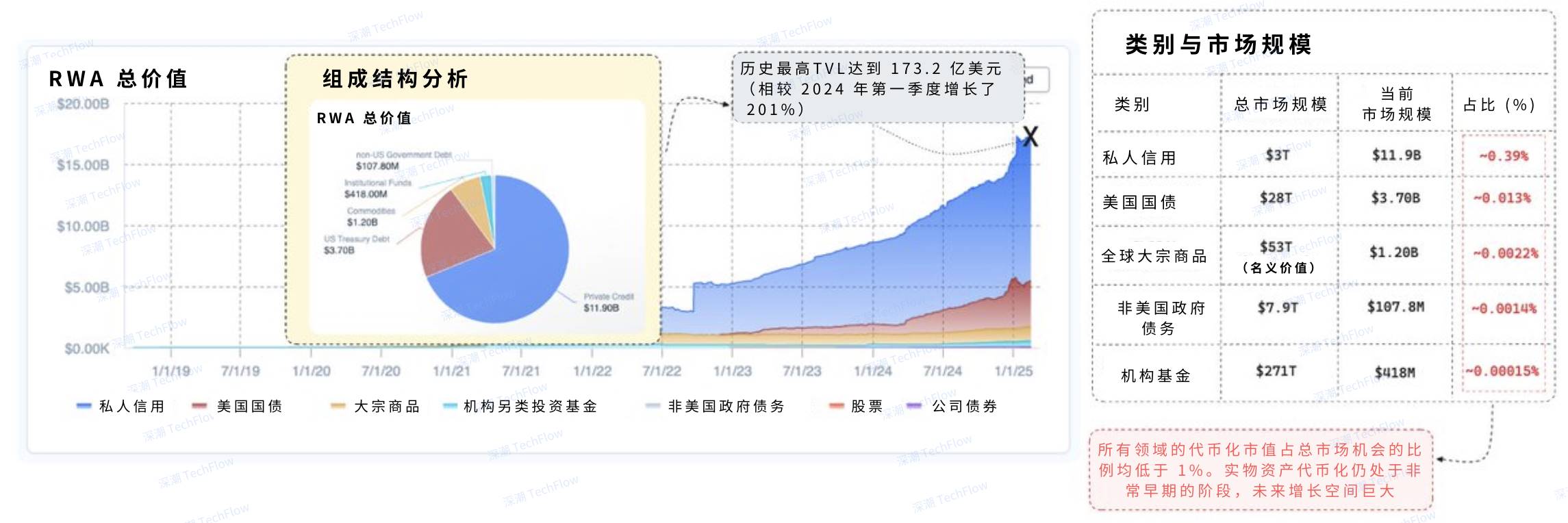

Despite market volatility, RWA continued its strong growth momentum. Its TVL has hit a record high of US$17.32 billion, doubling its growth since 2024.

However, the market potential in this area is still huge. Currently, less than 1% of global physical assets are tokenized, of which private equity accounts for approximately 68% of the market. This shows that RWA tokenization still has broad room for growth in the future.

Here are some key insights worth watching.

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

With the increased interest of institutional investors, the tokenized U.S. Treasury bond market has shown significant growth, with a total size reaching US$3.6 billion. Here are some key projects:

-

$USYC ST-yield launched by @Hashnote_Labs is currently the largest tokenized treasury bond product with a market value of approximately US$1.1 billion.

-

@BlackRock’s $BUIDL fund has reached US$650 million. The fund relies on @OndoFinance’s $OUSG to provide investors with convenient channels to invest in treasury bonds.

-

@FTI_Global’s Money Market Fund (FOBXX) currently has a management scale of US$580 million and continues to attract market attention.

The rapid growth of these tokenized treasury bonds products not only reflects institutional investors ‘recognition of blockchain technology, but also demonstrates the integration potential of traditional financial assets and decentralized finance (DeFi).

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

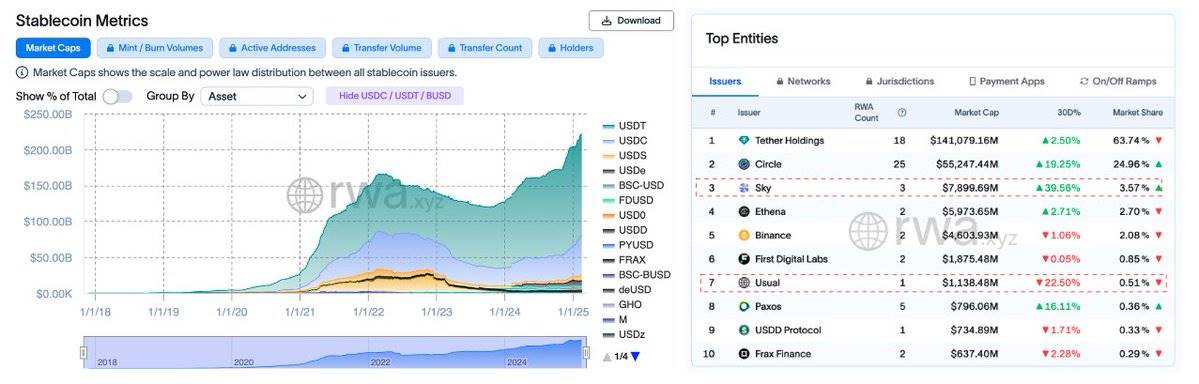

Converting RWA tokens into yield-bearing stablecoins has become one of the most popular application forms currently. Several well-known agreements are actively promoting development in this area, including:

-

@SkyEcosystem launches $USDS

-

$USD0 launched by @usualmoney

It is worth mentioning that many issuers are using their own treasury bond assets to generate stablecoins through tokenization to create passive returns for investors. This model not only introduces a reliable source of revenue for stablecoins, but also further promotes the deep integration of traditional assets and blockchain technology.

Among all markets, commodities have the highest size opportunities, with a total nominal value of US$53 trillion. However, the current value of tokenized commodities is only approximately US$1.18 billion, accounting for only 0.0022% of the total addressable market (TAM). In this field,@Paxos accounts for 50.66% of the market share with approximately US$600 million in tokenized assets, becoming the industry leader.

As technology matures and institutional interest grows, the commodity tokenization market is expected to expand exponentially in the next few years.

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

For institutional investors, the total size of the global market portfolio is as high as US$271 trillion, while the current all-time high of tokenized assets is only US$418 million, led by @Securitize. This shows that there is huge potential for future capital inflows.

As the regulatory framework becomes gradually clarified, this area is expected to become one of the fastest growing markets in the future, bringing more opportunities to investors and the industry.

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

Although various sub-industries of Real World Assets (RWA) are still in the early stages of growth exploration, from the perspective of market potential, this is undoubtedly a trillion-dollar opportunity, and we are only just getting started.

The current market value of tokenization is still very limited, only staying at the level of millions or as low as billions of dollars. This is just the beginning of exponential growth.

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

Therefore, the RWA market is expected to achieve more solid growth, mainly due to strong fundamental support and the increasingly important position of the on-chain asset issuance model in the financial sector.

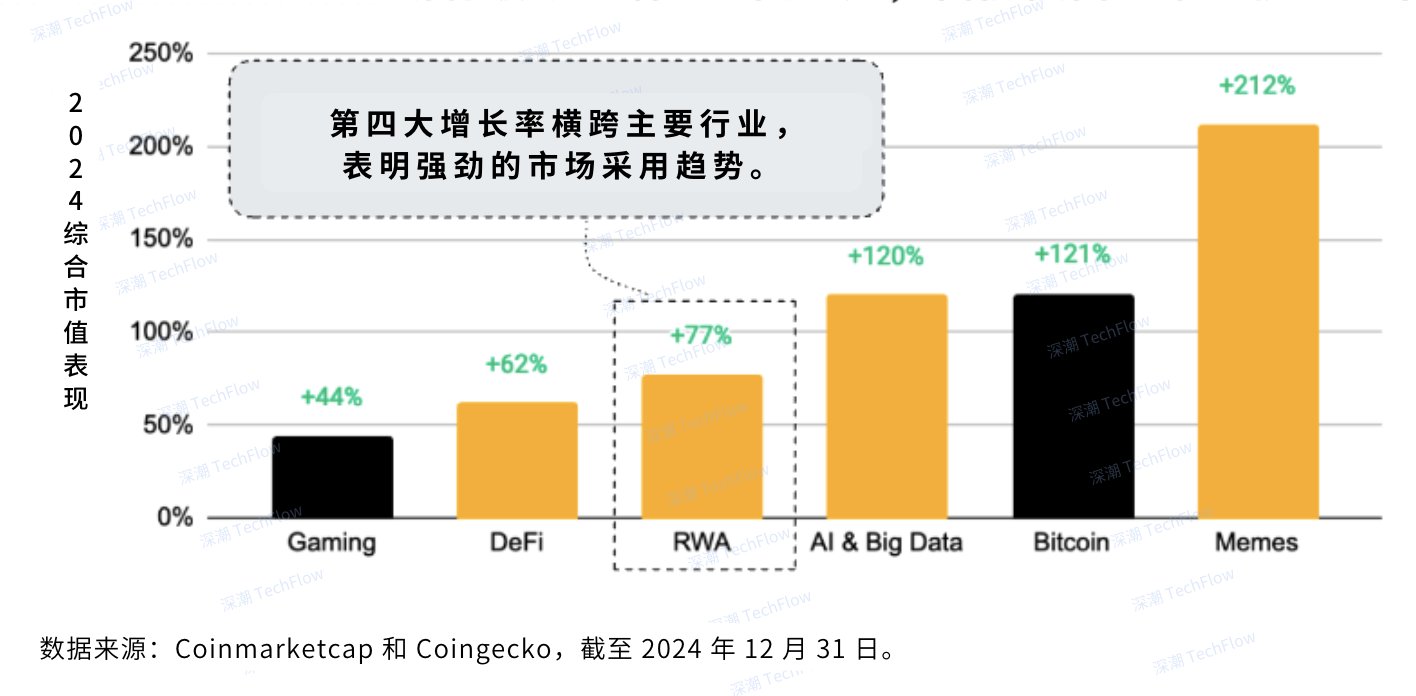

In 2024, the RWA industry ranks fourth among all industries in terms of market value growth, with an increase of 77%.

I think by 2025, RWA is likely to be among the top three performers.

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

Looking to the future, as more and more countries and funds realize the potential of this market, the value structure of tokenized RWA will change significantly.

At the same time, with the gradual improvement of regulatory frameworks, many regions have shown higher acceptance of blockchain-based financial infrastructure.

In the future, this field will be full of exciting opportunities!

(Original picture comes from Cheeezzyyyy, compiled by Shenzhen TechFlow)

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern