① The price of white feather chicken hit a five-year low, and the industry started to eliminate production capacity;

②5 Lianban Dreamnet Technology announced that the company has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd.;

③ The three major U.S. stock indexes closed mixed, with Tesla falling for five consecutive days to hit a new low since November last year.

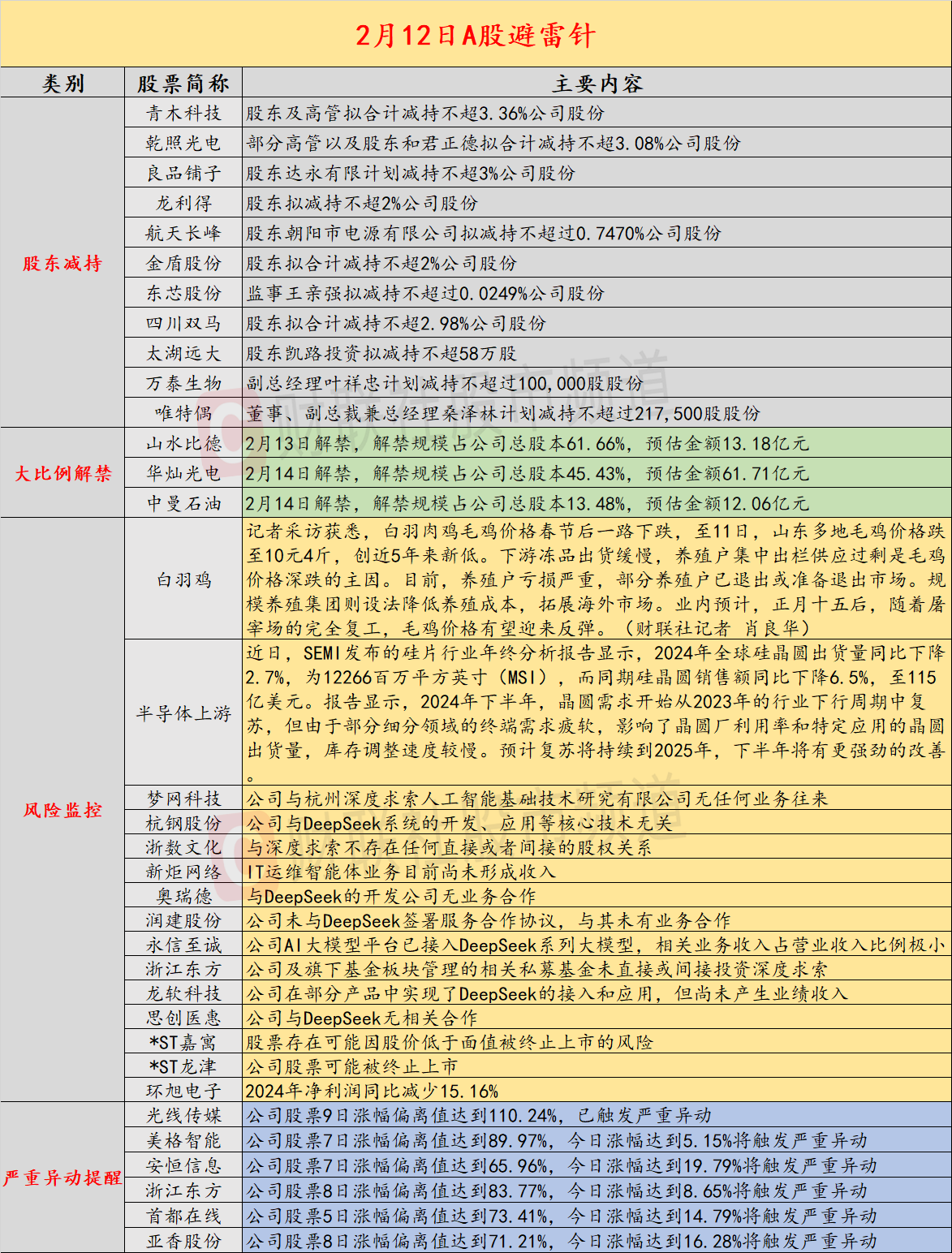

Introduction:Cailian invested in lightning rods on February 12. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) The price of white feather chicken hit a five-year low, and the industry started to remove production capacity;2) The adjustment of MSCI China’s flagship index, and 20 stocks including Anjing Food, Antu Biotech, Huaxi Biotech, and Kelaiying were eliminated; The company’s key concerns include: 1) The announcement of 5 Lianban Dreamcom Technology that the company has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd.; 2) 5 Lianlian Hangzhou Steel Co., Ltd. warned of risks. The company has nothing to do with the development and application of the DeepSeek system and other core technologies; key concerns in overseas markets include: 1) The three major U.S. stock indexes closed mixed, and Tesla fell for five consecutive days to hit a new low since November last year;2) Summers warned that price pressures may break out, saying that this round of interest rate cuts may have ended.

economic information

1. The reporter learned from an interview that the price of white broilers and hairy chickens has been falling all the way since the Spring Festival. By the 11th, the price of hairy chickens in many places in Shandong dropped to 10 yuan and 4 kilograms, a record low in nearly five years. Slow shipments of frozen products downstream and oversupply by farmers are the main reasons for the deep drop in chicken prices. At present, farmers have suffered serious losses, and some farmers have withdrawn or are preparing to withdraw from the market. The large-scale breeding group seeks to reduce breeding costs and expand overseas markets. The industry expects that after the 15th day of the first month, as the slaughterhouse completely resumes work, the price of chicken is expected to rebound. (Financial News Agency reporter Xiao Lianghua)

2. MSCI announced the results of the index review in February. The MSCI Global Equity Index (ACWI) added 23 new stocks and excluded 107 stocks. Among them, the MSCI China Index newly included 8 stocks including Hengxuan Technology, Supply and Marketing Daji, Ates and Jitu Express, and excluded 20 stocks including Anjing Food, Antu Biotech, Huaxi Biotech, Kelaiying and Huayang. The adjustment will take effect after the close of trading on February 28.

3. Tianyan’s legal litigation information shows that Christine Food Co., Ltd., a subsidiary company of Christine, the former “first baking stock”, has added a new bankruptcy review case. The identity of the applicant has not been disclosed yet. The handling court is Shanghai City Third Intermediate People’s Court.

Company warning

1 and 5 Dreamnet Technology: The company has no business dealings with Hangzhou Deep Search Artificial Intelligence Basic Technology Research Co., Ltd.

2. 5 Lianban Hangzhou Steel Co., Ltd.: The company has nothing to do with core technologies such as the development and application of DeepSeek system.

3. 5 Lianban Zhejiang Digital Culture: There is no direct or indirect equity relationship with in-depth pursuit.

4. Aoki Technology: Shareholders and senior executives plan to reduce their shares in the company by no more than 3.36%.

5. Qianzhao Optoelectronics: Some senior executives and shareholders and Jun Zhengde plan to reduce their shares in the company by no more than 3.08%.

6. Good products shop: Shareholder Dayong Limited plans to reduce its shares in the company by no more than 3%.

7. Long Lide: Shareholders plan to reduce their shares in the company by no more than 2%.

8. Hangtian Changfeng: Shareholder Chaoyang Power Supply Co., Ltd. plans to reduce its shareholding by no more than 0.7470%.

9. Jindun Shares: Shareholders plan to reduce their shares in the company by no more than 2% in total.

10. Dongxin Shares: Supervisor Wang Qinqiang plans to reduce the company’s shares by no more than 0.0249%.

11. Sichuan Shuangma: Shareholders plan to reduce their shares in the company by no more than 2.98% in total.

12. Taihu Yuanda: Shareholder Kailu Investment plans to reduce its holdings by no more than 580,000 shares.

13. Wantai Biotech: Deputy General Manager Ye Xiangzhong plans to reduce his shares by no more than 100,000 shares.

14. Viteou: Director, Vice President and General Manager Sang Zelin plans to reduce his shares by no more than 217,500.

15 and 9 connected board new torch network: The IT operation and maintenance agent business has not yet generated revenue.

16.3 Connected Board Orid: There is no business cooperation with DeepSeek’s development company.

17. 2 Lianban Runjian Co., Ltd.: The company has not signed a service cooperation agreement with DeepSeek and has no business cooperation with it.

19 and 6 consecutive board Zhejiang Dongfang: The relevant private equity funds managed by the company and its fund segments have not sought direct or indirect investment depth.

20.2 Lianban Longsoft Technology: The company has realized DeepSeek access and application in some products, but has not yet generated performance revenue.

21. Sichuang Medical Benefit: The company has no relevant cooperation with DeepSeek.

22. *ST Jiayu: There is a risk that the stock may be terminated because the stock price is lower than the par value.

23. *ST Longjin: The company’s shares may be terminated from listing.

24. Huanxu Electronics: Net profit in 2024 will decrease by 15.16% year-on-year.

Overseas warning

1. The three major U.S. stock indexes closed mixed, with the Dow rising 0.28%, the S & P 500 index rising 0.03%, and the Nasdaq falling 0.36%. Tesla fell more than 6%, falling for five consecutive days on the daily line, hitting a new low since November 14 last year and the largest one-day decline since December 18. Netflix fell nearly 2%, while Microsoft, Nvidia, Google, and Amazon fell slightly. Intel rose more than 6%, the largest one-day gain since January 21; Apple rose more than 2%, and Meta rose slightly.

Most popular Chinese stocks fell, with the Nasdaq China Golden Dragon Index closing down 1.66%. NIO and Xiaopeng Motors fell nearly 7%, Ideal Motors and Baidu fell nearly 5%, Beili and Ctrip fell nearly 4%, Jingdong fell more than 3%, and Alibaba rose 1.3%.

2. Four years ago, former U.S. Treasury Secretary Lawrence Summers accused U.S. fiscal and monetary policymakers of excessive stimulus, which could trigger the largest inflation blowout in a generation. Four years later, he warned that price pressures were in danger of erupting again. “This may be the most sensitive moment for inflation escalation since policy mistakes triggered severe inflation in 2021,” Summers said in an interview with David Westin on Bloomberg Television’s “Wall Street Week” program. “This is the moment when we have to be very cautious about inflation, even before you see the policies that the White House has in place.” He urged the Fed to remain vigilant about price pressures and believed that further interest rates may not be cut in the current cycle.

3. European Commission President Von der Leyen said that he would take firm and proportionate countermeasures against U.S. tariffs.

4. Recently, the year-end analysis report of the silicon wafer industry released by SEMI showed that global silicon wafer shipments in 2024 fell by 2.7% year-on-year to 12266 million square inches (MSI), while silicon wafer sales fell by 6.5% year-on-year in the same period., to US$11.5 billion. The report shows that in the second half of 2024, wafer demand began to recover from the industry downturn in 2023. However, due to weak terminal demand in some segments, it has affected fab utilization and wafer shipments for specific applications. Inventory adjustment is slow. The recovery is expected to continue into 2025, with stronger improvements in the second half of the year.