“This year’s Spring Festival will be celebrated in United Arab Emirates. Taking advantage of the friendly winter temperatures, we should hurry up and adapt to the environment. rdquo; An employee of a state-owned energy infrastructure enterprise announced on social platforms that he would miss New Year’s Eve dinners and gatherings in China and celebrate the New Year online with relatives and friends in a foreign country.

In the middle of last year, his company successfully won the bid for a photovoltaic power station project near Abu Dhabi, the capital of the United Arab Emirates. The preparatory stage began, requiring more manpower at key nodes such as equipment mobilization and calibration. Some domestic employees have already set off to rush to the Middle East.

In recent years, the new energy industry in the Middle East has continued to heat up and has become an important target market for upstream and downstream photovoltaic and energy storage companies in China. Just on January 15, the 2.6GW photovoltaic power station in Al Shubach, the world’s largest single photovoltaic power station project under construction, jointly undertaken by several subsidiaries of China Energy Construction, was officially connected to the grid and put into operation. The next day, Power Construction of China announced that it had won the bid for the world’s largest optical storage project, the United Arab Emirates RTC optical storage project.

Along with the builders of the optical storage power station project, there are also equipment manufacturers. It is reported that in the Arschubach project, domestic leading companies in photovoltaic modules, brackets and invertersjingke energy、CITIC Boandsunshine powerThey are all important suppliers. and justOn January 20,Ningde timesOn the same day, Jinko Energy announced that it has become the preferred battery energy storage system supplier and preferred component supplier for the RTC optical storage project in United Arab Emirates, triggering heated discussions in the industry。

In fact, since Saudi Arabia proposed the National Renewable Energy Plan (NREP) in 2016, the potential of optical storage in the Middle East has attracted attention. After 2020, new energy projects in the region will be intensively tendered and started, further stimulating the enthusiasm of sailing to the Middle East to pioneer emerging markets. By 2023 and 2024, as the international trade situation continues to be tense, barriers in traditional markets such as Europe and the United States have been built, and overseas production capacity bases in Southeast Asia have also been attacked. Domestic photovoltaic energy storage is mired in price wars, and demand growth has also turned from boom to decline. A large number of companies have suffered losses and urgently need to expand new overseas markets. The popularity of the Middle East market has also been completely ignited. In addition to the sales force accelerating to seize the local market, building a factory in the Middle East, an option that was previously considered to be risky and low-yield, has also become a fashionable move. GuShiio.com Stock Market Smart APP learned from the International Cooperation Department of China Photovoltaic Industry Association that throughout 2024, member companies have high intentions to participate in the Middle East inspection tour. By the beginning of this year, the Middle East has become one of the must-talk topics when going to sea., related activities have also been stepped up on the agenda.

From product exports to production capacity going to sea

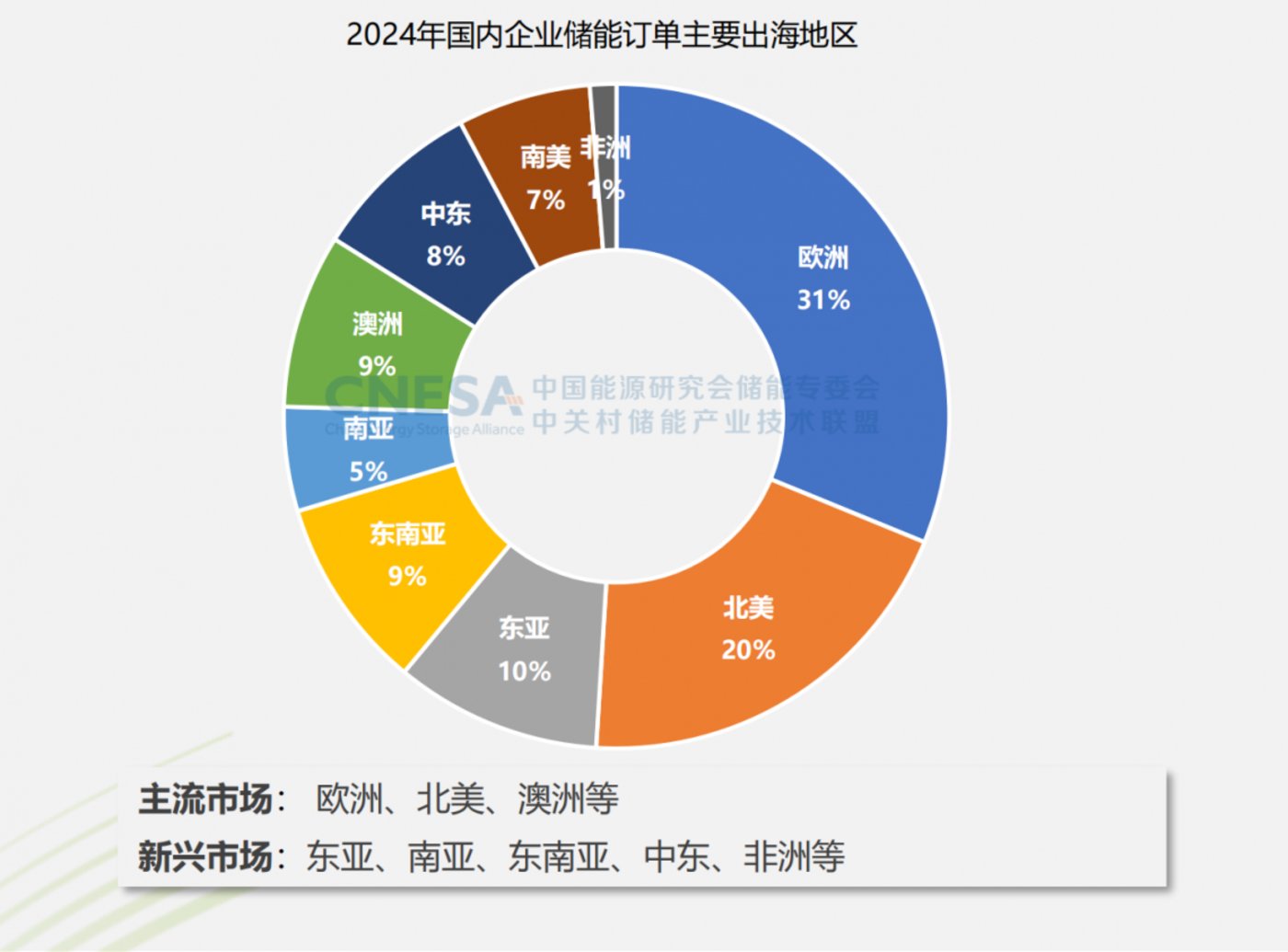

At the recently held press conference of the Energy Storage International Summit and Exhibition 2025, the Zhongguancun Energy Storage Industry Technology Alliance (CNESA) released a series of annual data. Among them, data related to overseas markets showed that in 2024, the scale of overseas energy storage contracts signed by China energy storage companies will once again exceed 150GWh. In addition to the two major markets in Europe and North America, which account for half of the country, traditional markets or entrepot destinations such as Australia, East Asia and Southeast Asia are still stable.The rise of the Middle East market is also particularly noteworthy. The market’s share of overseas orders from Chinese companies has increased to 8%, is also higher than its global proportion of new installed capacity, which shows the eagerness of Chinese companies.

Photo from CNESA

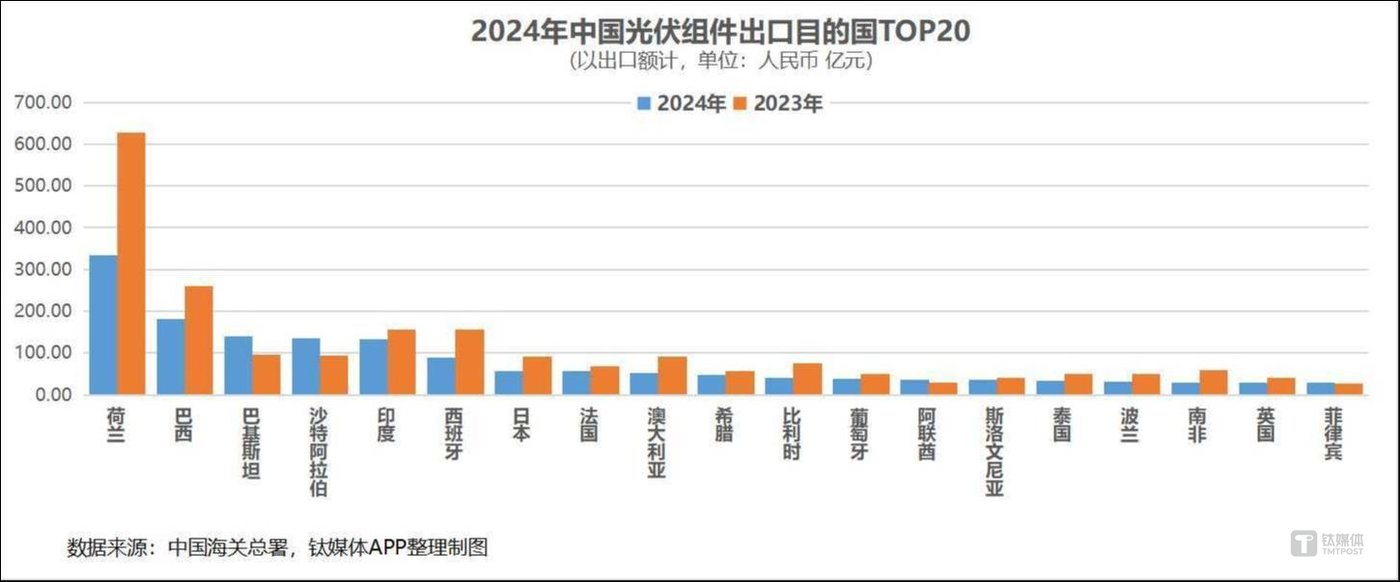

In the field of photovoltaics, this enthusiasm is more evident. GuShiio.com stock market smart APP combed customs import and export data and found thatIn 2024, the total amount of China’s photovoltaic module exports to more than 20 countries in the Middle East will reach 26.285 billion yuan, a year-on-year increase of 23.4%The results are particularly outstanding as photovoltaic exports continue to increase in volume and decrease in price (total exports in 2024 will drop by 25.6% year-on-year). Among them,Last year, module exports to Saudi Arabia increased by 43.1% year-on-year to reach 13.474 billion yuan, and for the first time, exports to a single country in the Middle East exceeded 10 billion yuan; United Arab Emirates remains the second choice in the Middle East, with exports increasing by 28.3% year-on-year to a level of about 3.6 billion yuan; while my country’s components have also experienced a major explosion in the Oman market, with exports surging 2.3 times. This country has also jumped from ninth to third in the Middle East export list. Looking around the world,The Middle East’s share of total photovoltaic module exports in China has increased from 8% in 2023 to 13.1% last year, making it the regional market with the most significant growth in the world。Saudi Arabia further rose from sixth place in terms of export flows to countries to fourth place, United Arab Emirates rose 10 places to the top 20, and Oman jumped directly from 50th to 22nd place. Moreover, judging from the two-year comparison of TOP 20 countries, only Saudi Arabia, United Arab Emirates in the Middle East, Pakistan in South Asia, and the Philippines in Southeast Asia have increased their exports. In other countries, whether in Europe, South America, East Asia or India, Australia, and Thailand, their exports have dropped significantly.

In the field of optical storage, the Middle East has undoubtedly become a hot spot, and has also become a hot keyword for many institutions ‘annual inventory and foresight. From the end of 2024 to the beginning of 2025, in addition to the above-mentioned Jingke Energy and Ningde Era, Sunshine Power,BYD、jingao technologyOther leaders have also announced that they have received orders in the Middle East, and the largest projects of super large orders continue to screen the industry community. A long-term practitioner lamented that everyone has been really working hard on the Middle East market recently.

With the reconstruction of the international trade pattern and the profound adjustment of the supply chain, new energy going to sea has advanced from the 1.0 era when it was made in China and sold globally to the 2.0 era when it was made globally and sold globally. The hopes of optical storage companies for the Middle East obviously do not extend to project construction and maintenance, product export or assembly and sale.Since 2024, more and more companies are considering building factories in the Middle East。

The photovoltaic industry, which has 10 years of experience in sea production capacity, is still a pioneer. According to GuShiio.com’s stock market smart APP,So far, at least 10 photovoltaic manufacturing companies have announced plans to build factories in the Middle East, covering the four main materials (silicon materials, silicon wafers, batteries and modules) and one of the three major terminals,Some projects will be put into production in 2025。These more than 10 projects are all very impressive and even amazing in size, including Jinke Energy,TCL CentralandTrina SolarThe planned production capacity in the Middle East has reached or exceeded 10GW, and the scale of single production capacity is five times or more higher than that of the same company’s U.S. factories since 2023.

For lithium battery manufacturers, the Middle East has also entered the vision of production capacity going out to sea. Previously,ganfeng lithium industry、Yiwei lithium energyBoth have said they will build a battery factory in Turkey, including energy storage batteries. With Haichen Energy Storage announcing in October last year that it would jointly build a battery energy storage system factory with an annual production capacity of 5GWh in Saudi Arabia, the curtain for energy storage companies to accelerate their efforts to build production capacity in the Middle East has also begun.

Judging from the intensive announcement of factory building plans and good news of construction construction in the past two months, China Optics Storage is likely to usher in a new year of production capacity in the Middle East from 2025 to 2026, which will stimulate a new round of overseas craze.

Trump effect

The “Evolution of Photovoltaic Going to Sea” report produced by GuShiio.com Stock Market Intelligence once mentioned that with the introduction of strategic plans and policy measures by major countries such as Saudi Arabia and United Arab Emirates,Promote economic diversification, reduce dependence on the oil and gas industry, and promote energy transformation. The development potential of new energy in the Middle East has been valued and has become one of the most eye-catching emerging markets.。In addition, the local region’s unique endowment of wind and light resources, coupled with the strong strength of sovereign funds in the Middle East, relatively friendly relations with China and strong willingness to invest, have further promoted Chinese companies to move towards the Middle East.

The growth of the Dongguang Storage Market in the past two years and optimistic expectations for the future have undoubtedly supported this decision. Bloomberg New Energy Finance BNEF, InfoLink and other institutions are unanimously optimistic about the growth prospects of photovoltaic installed capacity in the Middle East in 2025. The Middle East Photovoltaic Industries Association (MESIA) predicts that the region will reach a compound annual growth rate of 30% by 2030. Even Wood Mackenzie, who is downcast on global photovoltaic installed capacity growth, also believes that the Middle East market is one of the few regions worth looking forward to and able to maintain growth. In terms of energy storage, Soochow Securities predicts that tenders for major energy storage projects in the Middle East will be intensively implemented in 2025, ushering in a historical explosion period. Among them, the installed capacity of energy storage in 2025 is expected to increase fivefold to 20GWh, and in 2026, it will be based on this. Double to 40GWh (the installed capacity of energy storage in the Middle East in 2023 is 2 GWh, and it is estimated to double to 4 GWh in 2024). In addition, photovoltaic electricity prices in major Middle Eastern countries are among the lowest in the world, and photovoltaic + energy storage costs in some regions have achieved parity with fossil fuels, which has also laid the foundation for long-term growth of market demand.

At this node in late 2024 and early 2025,The reason for bringing the attention of the Middle East market to a higher level is also Trump’s influence。

Since Trump won the U.S. election in early November last year, the development prospects of new energy in the United States have seemed less optimistic. On January 20, local time, on the first day of his inauguration, Trump revoked more than 10 policies of the Biden administration to address climate change, develop clean energy, and restrict fossil energy, including vigorously promoting U.S. optical storage manufacturing. Energy and infrastructure related provisions of the Infrastructure Investment and Jobs Act and the Inflation Reduction Act (IRA) for downstream installation development. At the same time, Trump also officially announced his withdrawal from the Paris Climate Agreement, completely stopped the lease sales of offshore wind power, and promoted oil and gas production through a series of new executive orders. The Biden administration’s four-year green new policy has come to an end, and its legacy has gradually been liquidated. While fossil fuels are accelerating their return to the center of the U.S. energy stage, the door to the development of photovoltaics and energy storage is also narrowing. Although the agency is still very optimistic about the installed capacity of energy storage in the United States in 2025, this is more due to the surge in installation before the implementation of tariffs in 2026. Overall, risks and uncertainties in the U.S. optical storage market have risen sharply. This makes optical storage companies around the world need to find new potential incremental markets. CNESA analyzed in the “Energy Storage Industry Research White Paper 2024” that trade protection policies in the United States and other places have increased, and demand growth in large markets such as Europe has shown signs of declining. Looking around the world, the Middle East has become the emerging market with the most prominent development potential for photovoltaic and energy storage.

For China optical storage companies, the door to the United States seems to be tightening faster, and the urgency to find new markets is greater. On January 22, Trump once said that a 25% tariff could be imposed on China’s exports to the United States as early as February 1. Although this is no longer relevant to photovoltaic products that have already suffered high tariffs, this trend of tax increases and the increasingly high trade threshold will make it very difficult for relevant companies to export to the United States in at least the next four years. Even Chinese companies ‘U.S. factories face more complex prospects. Currently, the five photovoltaic module giants (Jinko Energy,LONGi lvneng, Trina Solar, Jing’ao Technology andArtes) All of them have built factories in the United States, and at least four of them have been put into operation in 2024. There are also many cases of energy storage companies going to the United States to build factories. However, only part of the production capacity of Artes and Jinko have received IRA subsidies. Once these subsidies cannot be put into the pocket, local production capacity may fall into a dilemma of being unable to make ends meet due to excessive labor, investment, and production costs. And the new Secretary of State in the Trump administrationMarco Rubio, who has always paid close attention to the identity of photovoltaic and lithium battery factories during his tenure as a senator, has obvious hostility to the China background of related projects, and has also proposed several times to raise the threshold to prevent Chinese companies from receiving IRA subsidies for their U.S. production capacity.。

From 2021 to 2024, Rubio, a senator, posted nearly 20 related content on his personal social account, calling on the United States to decouple from China’s photovoltaic and lithium batteries

For China optical storage companies, the prospects of the U.S. market are worrying. Southeast Asia, once the most important overseas production capacity base, has also been crippled by a series of tariff measures and double-reverse policies by the United States in 2024. In this context, looking for new incremental markets and production capacity layout has become necessary. Looking at options such as the Middle East, Latin America, and India, the Middle East, where relatively smooth channels have been established under the Belt and Road Initiative framework, and related industries are less affected by changes in the U.S. political situation, has become the most suitable answer.

Known issues and unknown risks

For the Middle East market, China’s optical storage companies have obvious advantages. At a recent overseas photovoltaic market analysis and investment opportunities seminar, Si Junyan, director of the New Energy Business Model and Risk Research Center of Shanghai Electric Power University, said that the advantages of China companies in technological innovation, production capacity and global layout can greatly help their development in the Middle East. The “Evolution of Going to Sea” report also mentioned that Middle Eastern countries generally lack local production capacity and experience in the construction and operation of photovoltaic power plants. The model of joint going to sea through infrastructure + advantageous production capacity is conducive to quickly opening up the situation.

However, for large-scale export of products, especially production capacity to sea, the road to exploration in the Middle East has not been smooth sailing. Including Trina Solar and GCL Technology, some projects that have long announced their intentions have also experienced many twists and turns in the implementation process.

Whether in terms of geographical environment, cultural environment or business environment, the Middle East market is very different from the domestic market, European and American markets, and Southeast Asian markets. However, it is precisely because of this difference that the characteristics of this market have been quickly refined. Almost all companies sailing to the Middle East will pay attention to issues such as geography, climate, low electricity prices, localized labor requirements for local capital to build factories, and religious customs. However, behind these seemingly visible differences or risks, There are often a large number of unknown problems, because it is impossible to understand the real operating model and psychological mechanism of the local area, which leads to the failure of prediction and experience. Targeted preparations are clearly made, but they cannot hit the point.

The GuShiio.com stock market smart APP learned that as early as 2023, GCL Technology chose the destination for its first overseas investment in the Middle East. The primary election was Saudi Arabia, but it was never possible to negotiate cooperation financing and supporting support. Saudi Arabia The fund refused to take on more investment proportions, and the communication with the local government on support such as factory sites, water and electricity was not smooth. In the end, GCL had to move to the United Arab Emirates, but the current negotiations between the two parties are still full of twists and turns. Moreover, GCL has previously made it clear to investors that whether the output of factories in the Middle East can enter the U.S. market is a key factor affecting the return on investment. If they cannot successfully enter the U.S. market and get high prices, the return may be lower than expected.

Even Jinko Energy, which has the most experience in sailing, has suffered losses in the Middle East market. Li Xiande, chairman of the company, once participated in CCTV’s “Let’s Go! During the “Go to the Middle East” dialogue program, he emphasized that when signing contracts in the Middle East, special attention should be paid to details, especially compensation details, and try not to breach the contract, because their penalty clauses are very strict and local companies will really claim a lot of money. On the contrary, Li Xiande also said that negotiations with local funds and companies were long and difficult.

Si Junyan once summarized the challenges of sailing to the Middle East into three points: (1) a series of legal risks such as intellectual property rights and technology export, and environmental protection compliance;(2) market risks such as geopolitics and foreign trade barriers where the project is located;(3) Environmental risks such as special natural environments and differences in cultural environment. GuShiio.com Stock Market Smart APP believes that the economic benefits of local production capacity also need to be focused on. Although low electricity prices in the Middle East can stimulate market demand and reduce production costs, they also lead to lower bidding prices for optical storage products. Compared with European and American markets, profits are not in the same breath, and the return cycle of local projects is often long. If we cannot reduce costs through supply chains, scale effects, or export products to high-profit areas, That could have catastrophic consequences for return on investment. In addition, how to adapt to the local business environment is also a problem. Wang Cheng, a researcher at the Institute of International Trade and Economic Cooperation, once revealed that the Middle East market may seem to be in line with international standards, but there are still many jungle laws hidden. Although there are many cases on the market dealing with Middle Eastern companies. Introduction and experience, various hidden rules are still no small challenge in implementation practice.

Based on relevant reports such as KPMG, Xiaguang, and GuShiio.com Stock Market Intelligence, it is generally recommended that new energy companies sailing to the Middle East do market feasibility studies; formulate scientific strategic plans and implement effective market strategies from the perspectives of market entry and market positioning; Pay attention to adapting measures to local conditions, following the customs, understanding local laws and regulations, religious customs, cultural differences, etc., and strengthen localization levels and create localized teams; create cost advantages and improve the supply chain system; Strengthen all-round management and streamline processes from dimensions such as fiscal and taxation compliance and operational transparency; monitor and judge geographical and trade changes in real time to avoid“ black swan” incidents.

However, the most useful preparation seems to be to cultivate“ internal skills”. At the beginning of this year, Roland Berger’s global partner Zhou Mengxi said at an event that the biggest challenge for China companies to go abroad is not internal or external, mainly the lack of localization of capabilities and governance modernization. She believes that only by establishing a standardized sales management system, giving local sales companies more autonomy, establishing stable cooperative relationships with local suppliers, sharing R & D resources and technology with global teams, and adopting strategic decision-making, collaborative efforts, Only by carrying out comprehensive governance structure modernization reforms in international organizations and regional management and evaluation systems can Chinese companies truly take the right path to sea. In activities and programs such as the 2024 T-EDGE Innovation Conference and GuShiio.com Stock Market Intelligent Finance Annual Conference, GuShiio.com Stock Market Intelligent Finance Dialogue, experts such as Tao Jingzhou, member of the China International Commercial Experts Committee of the Supreme People’s Court of China and international independent arbitrator, Lu Junxiu, senior partner of the Go Global Think Tank, have also mentioned that the more overseas companies face external pressure, the more they need to improve their globalization capabilities, internal refined management, and data management capabilities. Only by truly building itself into an international multinational enterprise can we overcome external obstacles and avoid external risks as much as possible.

Although going to the Middle East has become increasingly urgent, it is difficult to complete the construction of such basic capabilities in a day. Perhaps, there are still many problems, embarrassments and nails waiting for those entering the game, but as long as you see the problems, find the direction, and take steps, you will be one step closer to a correct solution. As Lawrence M. Krause lamented in “The Unknown Problems Known to Humanity,” by pushing the known unknowns, we often gain unexpected gains.(This article is launchedtoGuShiio.com Stock Market Smart APP, author|Hu Jiameng, editor|Liu Yangxue)