① Today, Light Media has advanced to 20cm5 board connection, becoming the current highest standard for 20cm board connection, with its largest increase of 320% during the year.

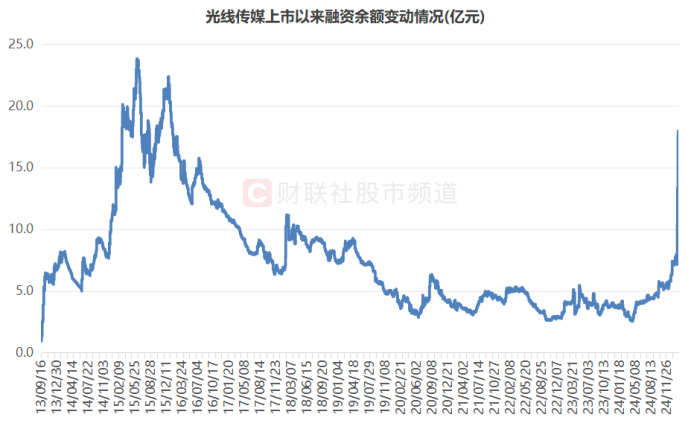

② Enlight Media’s financing balance has seen a sharp increase in recent days. In the past 5 days, it has received a total of 1.08 billion yuan in funds from financing customers to increase positions, an increase of nearly 1.5 times.

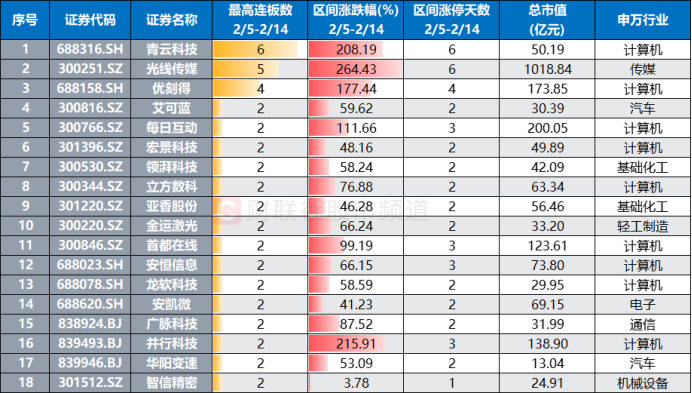

③ From February 5 to the present, 18 shares have recorded 20cm or 30cm connected shares, and Qingyun Technology has recorded the record for the highest large-scale connected shares during the year.

Financial Union, February 14 (Editor Zi Long),Today (February 14), market hot stock Light Media gained another daily limit. As of the close, it advanced to 20cm5 consecutive boards, becoming the current highest 20cm consecutive board. The biggest increase during the year also exceeded three times, reaching a cumulative total of 319.4%. At the same time, Enlight Media’s current annual growth rate has risen to 267.9%. Excluding new shares during the year, it ranks first among all A-shares.

Note: Enlight Media has recently achieved a 20cm daily limit (as of the close on February 14)

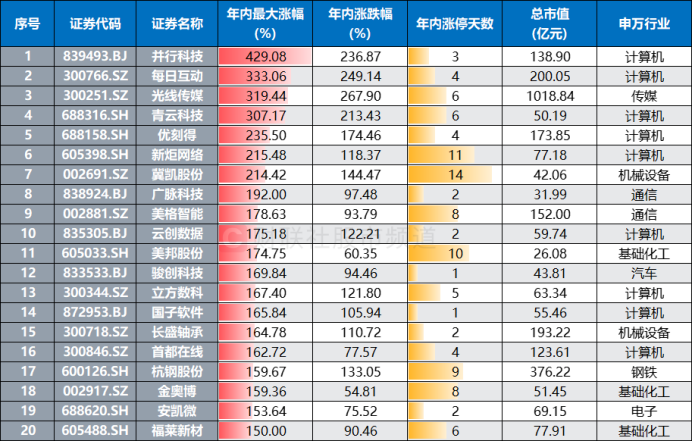

Financing balance reaches a nine-year high, selling one seat and reducing its holdings in days

Boosted by the impressive box office of the movie “Nezha: The Devil Boy in the Sea”, Enlight Media’s share price has also made rapid progress in recent days. It has achieved a total of 6 20cm daily limits in the 8 trading days since February 5, and another 1 The increase exceeded 18%. At present, Enlight Media temporarily ranks as the “annual increase king”, and its largest increase has also increased by more than three times. In addition to Enlight Media, excluding new shares and delisted stocks, as of today’s close, the other three shares of Parallel Technology, Daily Interactive, and Fastcloud Technology have also experienced their biggest increases of more than three times during the year.

Note: Individual stocks with the largest gainers during the year (as of the close of February 14, new shares not listed during the year)

From the perspective of funds, Enlight Media’s financing balance has seen a sharp increase in recent days. As of February 13, it has received nearly 1.08 billion yuan in additional positions from financing customers in the past 5 days, an increase of nearly 150.6%. Among them, financiers increased their holdings on February 12, with a net purchase amount of 494 million yuan in a single day. At the same time, they also “swept goods” significantly on February 7 and 10, with net purchases reaching 370 million yuan respectively., 290 million yuan. At present, the financing balance of Enlight Media has risen to 1.795 billion yuan, a record high in nearly nine years since January 2016.

Note: Changes in financing balance of Enlight Media since its listing (data as of February 13)

In addition, judging from the Dragon and Tiger List,”Lhasa Tiantuan” gathered in the top five seats in Enlight Media’s buy list today, while institutional funds and Shenzhen Stock Exchange General sold significantly net, with net purchases reaching 180 million yuan and 66.33 million yuan respectively. In addition, CITIC Securities’s Beijing Jianwai Street Securities Business Department ranked first, with net sales of nearly 200 million yuan today. It is worth noting that this seat has been continuously listed on the Lhasa Tiantuan Sales List since February 6, and all are “sell one” seats. If only single-day list data is counted, its total net sales have reached nearly 1.9 billion yuan.

Note: Data from Enlight Media’s Dragon and Tiger List on February 14

Large-scale bullish stocks appear frequently, and these hot money frequently appear on the list

Recently, there have been frequent hot spots in the A-share market, and the level of capital activity is relatively high. Affected by this, many popular stocks have advanced to become high-ranking companies, including many “large-scale companies”. As of today’s (February 14) close, based on market statistics from February 5 to the present, a total of 18 stocks have recorded 20cm or 30cm consecutive market prices during this period. Among them, Fastcloud Technology recorded the highest record for large-scale connected stocks in the year with a “record” of 6 consecutive boards. Light Media and Youke also recorded 20 cm5 consecutive boards and 20 cm4 consecutive boards respectively.

Note: Individual stocks that have recorded 20cm or 30cm consecutive boards since February 5 (as of the close of February 14)

Among these 18 large-scale connected stocks, many targets have been frequently listed on the list recently. As of February 13, based on statistics since February 5, stocks such as Fastcloud, UCIDE, Enlight Media, Daily Interactive, and Capital Online have been on the list more frequently, while stocks such as Light Media, Daily Interactive, and UCIDE, Capital Online, and Qingyun Technology rank among the top in the list. In addition, Enlight Media, Capital Online, Cube Digital, and Jinyun Laser institutions have been on the list more times, and Capital Online, Daily Interactive, and Enlight Media’s Shanghai and Shenzhen Stock Connect seats have been frequently on the list.

Note: Relevant data on the Dragon and Tiger List of individual stocks that have recorded 20cm or 30cm consecutive boards since February 5 (Dragon and Tiger List data is from February 5 to 13)

In terms of specific seats, based on statistics from the top five rankings, in addition to institutional, northbound, quantitative and “Lhasa Tiantuan”, CITIC Securities Co., Ltd. Xi’an Zhuque Street, Guoyuan Securities Shanghai Hongqiao Road, Huatai Securities Tianjin Dongli Development Zone Erwei Road, Guotai Junan Securities Co., Ltd. Shanghai Haiyang West Road, Shanghai Securities Shanghai Branch, Tianfeng Securities Shenzhen Branch, Guotai Junan Securities Beijing Guanghua Road, Guosheng Securities Ningbo Sangtian Road, Shenwan Hongyuan Securities, Beijing Jinsong 9th District and other well-known hot money seats are also listed.