The high-profile takeout cannot hide the frustration of e-commerce.

Jingdong takeout is making a big fuss. Can the e-commerce “fourth brother” turn over?

Wen| slow play

On February 11, JD. com announced its entry into the takeout market and offered a zero-commission move in an attempt to attract high-quality in-house food merchants to settle in. On the 19th, it announced that it would pay five insurances and one gold for full-time riders who take out goods from Jingdong.

However, the seemingly aggressive new business can hardly withstand the scrutiny of the market.

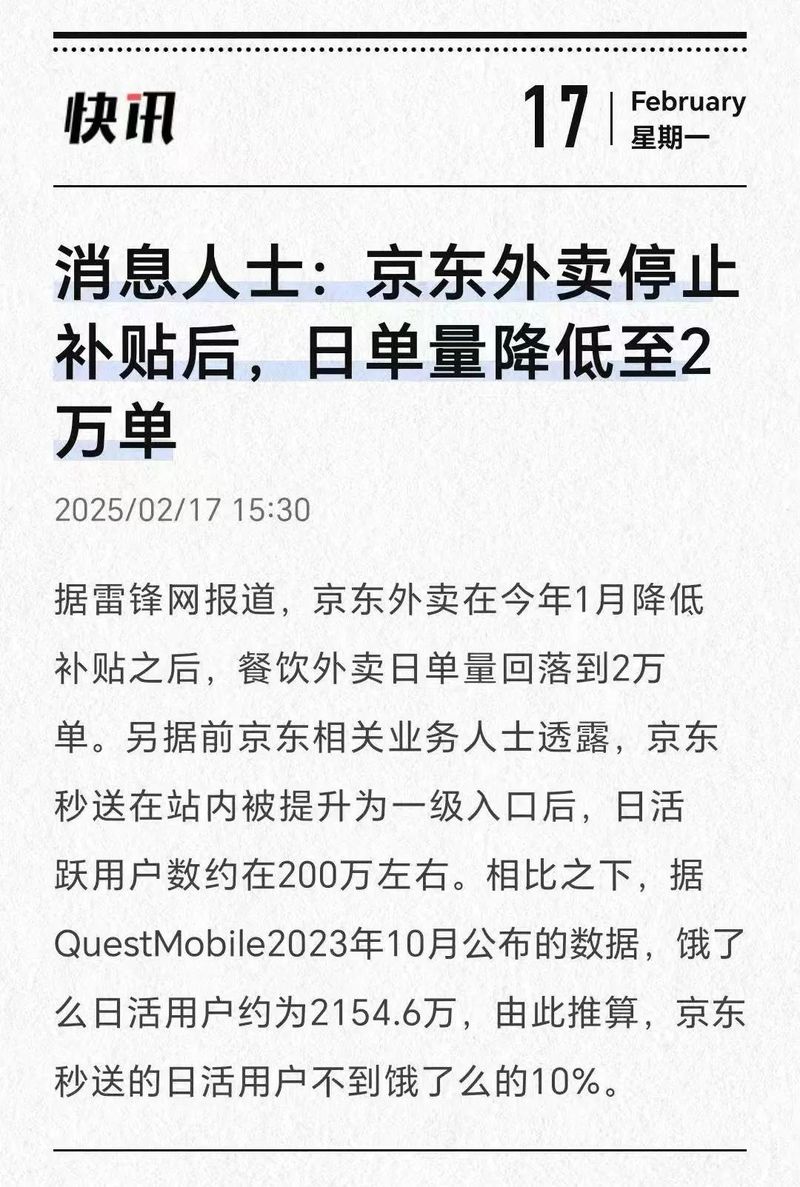

According to media reports, the current number of daily active users of Jingdong Instant Delivery is about 2 million, less than 1/10 of that of Hunmo. At the same time, after Jingdong stopped subsidizing takeout in January this year, the daily order volume quickly dropped to 20,000. This dilemma of declining if subsidies are stopped is exactly the same as Douyin when it first entered the bureau for takeout.

At the same time, according to media surveys, the high-profile announcement of social security for takeout riders does not include the 1.3 million active riders in the core transportation capacity of Dada. Instead, a new team of full-time takeout riders will be built. The first batch of people may have about 10,000 people, and the contract will be renewed. Pay social security for them.

According to media reports, Meituan announced on the 19th that a preliminary pilot plan for social security for riders had been formed last year and is expected to be implemented in the second quarter of 2025 to gradually pay social security for full-time and stable part-time riders.

Social security is expected to cover less riders than Meituan, and this high-profile strategy is not favored by the market. Many international investment banks, including Citigroup, UBS, and Morgan Stanley, are generally cautious, believing that this will have limited short-term impact on the industry structure and JD’s own performance.

More importantly, the rush to launch new takeout services cannot conceal the anxiety of the core e-commerce business. Just four days later, 36krypton related reports stated that Douyin e-commerce will become the third largest in the industry in 2024. This also means that Jingdong’s e-commerce business has been successively expanded by more and Douyin, slipping to fourth place in the industry.

When the fundamentals fell, the new takeout business also faced a tug of war of consumption, competing with Hunmo and Douyin takeout for the top three. This long-distance journey, which requires huge subsidies and resource investment, is not easy for Jingdong.

E-commerce and takeout are difficult to connect to the grid”

Shortly after the beginning of the New Year, the e-commerce business slipped to fourth place, which undoubtedly brought more anxiety to Jingdong’s development.

According to 36Krypton reports, the GMV of Douyin e-commerce in 2024 will be approximately 3.5 trillion yuan, a year-on-year increase of 30%. As a strong competitor of Douyin, Taotian Group’s GMV last year was around 8 trillion yuan, and Pinduo’s GMV last year was about 5.2 trillion yuan.

On February 13, ByteDance held the 2025 All-hands All-Staff Meeting. Kang Zeyu, head of Douyin’s e-commerce business, revealed at the meeting that Douyin’s e-commerce market share has leapt to third place in the industry.

The greater challenge is not limited to this.

On the other hand, the low-price strategy emphasized by Liu Qiangdong after his return did not work. According to Jingdong Group’s latest financial report, in the third quarter of 2024, the company’s operating income achieved a year-on-year growth of 5%. This is also lower than the overall growth rate of the e-commerce industry during the same period.

At the same time, an in-depth analysis of the details of the financial report also found that although JD’s overall financial situation was stable, the growth of its core business was almost stagnant.

Jingdong’s retail business revenue reached 224.986 billion yuan, a year-on-year increase of 6.1%, and profit margin increased by 5.2 percentage points year-on-year. This progress is mainly attributed to the implementation of innovative measures such as integrated delivery, installation, demolition and cleaning services and trade-in of old ones. However, when focusing on the core category of electronics and home appliances, its revenue only achieved a year-on-year growth of 2.7%.

It is against this background that JD is eager to explore the takeout market and seek new drivers for business diversification and growth.

However, what needs to be noted is that Jingdong’s e-commerce traffic, logistics distribution, supply chain and other infrastructure cannot be effectively connected to the grid with takeout.

On the one hand, Jingdong’s e-commerce traffic is already weak in the industry, and the national online traffic is not suitable for the takeout business that relies heavily on intra-city transactions.

On the other hand, JD is good at urban warehouse distribution and supply chain advantages, which are difficult to reuse in same-city supply and instant distribution.

Moreover, judging from the allocation of traffic resources on the main station, although Jingdong Second-Send has been upgraded to a first-level entrance, it does not have much advantage. According to 36Krypton reports, after Jingdong Second-Delivery was upgraded to a first-level entrance in the station, the number of daily active users is about 2 million. In contrast, according to data released by QuestMobile in October 2023, the number of daily live users of Emeima is approximately 21.546 million. It is estimated that the number of daily live users delivered by Jingdong in seconds is less than 10% of those of Emeima.

▲ Picture source: 36 Krypton

Because from the perspective of traffic alone, diverting scarce e-commerce traffic from the main station to takeout is not a reasonable choice; takeout has unique local supply and performance characteristics, which are different from traditional e-commerce traffic * conversion =GMV business. The large-scale traffic advantage in the e-commerce field cannot bring much effect, not to mention Douyin originally brought super traffic, but failed to shake the market structure.

If the take-out business is used as a new level of high-frequency traffic entry, this chain is too long. Take-out needs to build a distribution, supply and other network based on cellular supply in the same city, and the profits are much lower than the main station’s 3C digital and POP platform commissions. It is not a cost-effective business from the perspective of input-output ratio.

The Morgan Stanley report believes that Jingdong’s takeout business has limited impact on the market structure, and the barriers to the takeout market are high, and the business will experience significant losses in the early stage.

Takeout is a long offline war of attrition

Jingdong’s desire for the takeout business will not be overnight.

Back in 2014, Dada’s emergence was an important pawn put by Jingdong in the instant distribution market. This layout has undoubtedly paved the way for Jingdong in the field of takeout.

In 2022, Xin Lijun, then CEO of Jingdong Retail, publicly stated that Jingdong was considering entering the takeout market, which attracted widespread attention in the industry. In 2023, JD will change its name to its instant retail business to Henda.

▲ Photo source: Dada official Weibo

It is worth mentioning that Dada, as a logistics service provider under Jingdong, has grown into the main transportation capacity to undertake Jingdong takeout. According to public information, Dada currently has approximately 1.3 million active riders. Not only that, when Douyin and Kuaidi announced their entry into the takeout market two years ago, Dada was also one of the major logistics service providers.

The takeout catering business can effectively utilize Dada’s existing transportation capacity. At the same time, considering the growing demand for delivery services in the real-time retail market, JD. com’s support is also a key part of its layout of the real-time retail track.

But what needs to be realized is that the takeout track is a resource consumption war with cities, business districts, and even catering businesses as the smallest unit. Judging from Jingdong’s past battles, it is not good at this kind of lengthy war of attrition that is repeatedly pulled.

First, the take-out business is different from the e-commerce business. Its entire transaction model is a typical cellular network. The performance of contracts is highly dependent on the local city, and the suppliers are extremely scattered. It is a long-term war of attrition that requires forming a hard camp and fighting a dead-end battle. Jingdong has established the advantages of the logistics and supply chain in the past in the e-commerce field. It is difficult to reuse. Its advantage is the city-level warehouse allocation capabilities.

In addition, it will not be easy to replenish supply by simply bringing millions of catering businesses across the country back to the Internet. Judging from the progress disclosed successively by the outside world, the early promotion of Jingdong takeout does not adopt a direct sales model, but is promoted through service provider agents, focusing on entering the store in 39 cities, giving agents 120 yuan to 200 yuan/home for new stores. Uncertain commissions. This means that JD. com takeout has fallen into the same ground battle as Hungry and Meituan takeout back then, and it has used manpower and resources to seize supply.

Second, the number of daily users at the instant delivery portal is insufficient, and the e-commerce traffic at the main station is difficult to provide effective support for the takeout business.

Judging from the DAU, Jingdong Second-Delivery only has about 2 million daily jobs as a primary entrance, and the number allocated to the secondary channel takeout entrance is even more limited. Moreover, Guosen Securities ‘research report analysis believes that from the perspective of traffic, JD. com’s main station has 600 million annual purchasing users, JD. com has less than 100 million home-home users, and the penetration rate of instant retail is less than 20%. JD. com App users The mentality of near-field retail/takeout is still weak compared to Meituan, and traffic reuse efficiency is low.

Third, there are major challenges in cutting low frequencies to high frequencies. Jingdong makes instant delivery first and then takeout, which belongs to the reverse low frequency band and high frequency band. Unlike the past Meituan and Hunleomo who switched from meals to non-meals, Jingdong did the opposite. It first made relatively non-high-frequency daily necessities in the same city performance sector, and then tried to cut into high-frequency catering. This process of replenishing supply and filling capacity will be extremely long and requires huge resource investment.

New business cannot solve Jingdong’s anxiety”

Jingdong is not the first company to enter the takeout market, nor is it the last one.

In the past ten years, companies such as Baidu, Didi, Ali, SF Express, Douyin, Kuaishou, and WeChat have all wanted to get a piece of the cake from the takeout market and have invested resources and funds. But without exception, most Internet companies are making small noises. Most of them use takeout as a supplementary business after trying, and more of them shrink their strategies to gradually shut down.

In 2018, in order to consolidate its ride-hailing business, Didi entered the takeout field, and claimed to have won the first place in the local takeout market share on the first day of launch in Wuxi. However, this diversification attempt did not last long. Didi slowed down its expansion in less than a year and officially announced the end of its domestic takeout business in early 2019.

Immediately afterwards, Douyin deployed takeout in 2022. It initially explored through cooperation with Enmaomo, and then launched a group purchase delivery service, relying on a third-party delivery system. Entering 2024, Douyin will further upgrade its takeout business, integrating group purchase and distribution into a ready-to-heart group, achieving a unified entrance for in-store and home-to-home services, and continuing to explore and adjust in the field of takeout. However, recently, Douyin’s takeout strategy has been shrunk, from the local life department to the e-commerce department.

There have been many failed cases in the past. Why does Jingdong continue to join the game?

From the perspective of motivation, Jingdong has been full of longing for high-frequency business in recent years. The take-out business has also entered Jingdong’s vision due to its high-frequency and high-repurchase characteristics. In addition, media reports in recent days that Jingdong has launched an online ride-hailing service on the App. Through the aggregation model and cooperation with third parties, it has entered the same high-frequency track for taxi-hailing.

If we put ourselves into Jingdong’s perspective, we will turn ourselves into a super-entry App by continuously opening up high-frequency services, expand the service boundary as much as possible, and thus complement the main station business. This is a typical scale-oriented approach in the era of e-commerce competition.

But the real problem is that behind the seemingly high-frequency entrance is huge investment. Like takeout, online ride-hailing also needs to start again to grab capacity and replenish supply. Jingdong will do it all over again without exception, all the pits that Didi and Douyin have stepped on.

Moreover, today’s Internet competition has long passed the stage of scale supremacy. This kind of approach in the era of high-growth is obviously not suitable for today’s existing competition pattern. Especially after Jingdong’s core e-commerce business fell to fourth place, how long can this expanding business boundary, investment in traffic and resources last? How tolerant is Jingdong for wars of attrition that require long-term blood transfusions?

These problems all require trial and error and verification by Jingdong.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.