On the one hand, the investment banking business integration of Guolian Minsheng Securities needs to absorb the potential risk issues of Minsheng Securities ‘existing projects, and on the other hand, it needs to reduce the impact of the latter’s business contraction on the merger synergy effect.

Minsheng Securities ‘investment banking business compliance “stubborn disease” is difficult to eliminate, its rating is even C, and the IPO withdrawal rate at the beginning of the year is 75%, and project reserves are beginning to run short.

(Photo source: Visual China)

Blue Whale News, February 14 (Reporter Wang Wanying)“After the merger of Guolian + Minsheng was quickly finalized and completed, the subsequent integration of various businesses of Guolian Minsheng Securities was the focus of market attention, especially investment banking.” Investment banking business is Minsheng Securities ‘advantageous business and ranks relatively high in the market. Guolian Securities has also continued to develop investment banking business in recent years. Directly picking fruits is the most efficient way in theory. However, if you look closely at Minsheng Securities’ investment banking business in the past two years, the situation may not be so beautiful.“”“”

Let’s first look at the quality of investment banking business. Minsheng Securities’s investment banking practice quality has been rated as Class C by the China Securities Association for two consecutive years. In 2024, its bond business and financial advisory business ratings are also the worst Class C, and it has frequently received regulatory fines. It is difficult to eliminate stubborn diseases, indicating that there is a lot of room for improvement in the company’s practice quality and compliance and internal control.

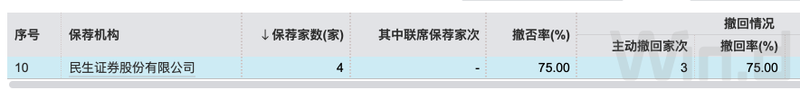

In terms of business, in 2024, Minsheng Securities voluntarily withdrew 29 IPO projects, with a withdrawal rate of more than 60%, and the underwriting recommendation amount dropped by 80% year-on-year. The reporter noticed that two months after the beginning of the new year, Minsheng Securities withdrew three more IPO sponsorship projects, with a withdrawal rate of 75%. A closer look at the withdrawal cases in the past two years shows that there are many flaws such as clearing-type dividends, passing through illness, and changing performance, which question the scale and quality of follow-up business.

At present, there are only 9 IPO projects left in Minsheng Securities Reserve, and the number of projects under review on the Science and Technology Innovation Board is 0. Regarding the compliance and subsequent development of investment banking business, Blue Whale News sent an interview outline to Minsheng Securities, but no reply was received as of press time.

Withdrawn projects with flaws, multiple fines exposed stubborn problems”

In the two months of the first year, Minsheng Securities has withdrawn three IPO projects, namely Zhongda Xincai, Huaxing, and Senfeng Technology, with a withdrawal rate of 75%.

(Photo source: Wind)

In 2024, Minsheng Securities voluntarily withdrew 29 IPO projects, with a withdrawal rate of 61.70%. In sharp contrast, in 2022 and 2023, Minsheng Securities ‘IPO withdrawal rates will remain relatively low, at 19% and 25.84% respectively. The large number of cancellation projects and the rapid increase in cancellation rates are not only due to the impact of the market environment, but also indicating that there are many companies in the sponsored projects that do not meet the listing requirements or pass the test due to illness, and they have chosen to leave.

Judging from the three projects withdrawn by Minsheng Securities this year, they all have flaws.

For example, Zhongda New Materials has problems such as the mismatch between its cash flow and actual net profit, and doubts about the authenticity of its export revenue. In its inquiry, the Beijing Stock Exchange also clearly asked it to explain the authenticity of its performance growth and whether there was a false increase in sales revenue due to customer cooperation.

Huaxing shares have clearance dividends during the issuance period. From 2020 to 2023, the issuer issued a total of four cash dividends, totaling as high as 105 million yuan, almost exhausting the accumulated net profit in three years. After the dividends, the company still carries more than 36 million yuan in short-term debt and plans to raise 248 million yuan, of which 90 million yuan will be used to supplement working capital. This left-handed dividend operation and right-handed fundraising operation has also aroused market doubts.

Senfeng Technology withdrew its IPO application 17 months after the meeting. The company had insufficient investment in R & D, weak technological innovation, and the R & D expense rate had long been lower than the level of the same industry. Shareholders also had disputes over gambling. The Shanghai Municipal Party Committee had asked the company to explain this on the spot.

If the withdrawal of the project only reflects the flaws in Minsheng Securities ‘compliance risk control, then the more than 10 investment banking fines received by the company in 2024 will undoubtedly reveal the stubborn problems in investment banking compliance management.

Take the three fines in December last year as an example. In the IPO of Huali Biotech, after investigation, Minsheng Securities had three major problems: one was insufficient verification of the issuer’s income confirmation basis; the other was insufficient verification of the issuer’s R & D internal control defects and the accuracy of R & D expenses; and the third was insufficient verification in terms of capital flow, production management internal control and other aspects. The Shanghai Stock Exchange requires Minsheng Securities to reflect deeply and take specific rectification measures, while also carrying out internal accountability.

In the same month, the Shenzhen Stock Exchange issued a warning to Minsheng Securities due to violations in the Hengye Microcrystal IPO project. After investigation, there were six major problems in the project, including insufficient and incomplete information disclosure. Minsheng Securities had five violations in the process of serving as the project sponsor, including failure to fully verify the rationality of the purchase price, lack of internal control verification, and verification conclusions and facts. Baodai was criticized in a notice for this.

In addition, the Fortek IPO project sponsored by Minsheng Securities also suffers from insufficient performance of its duties. The Shanghai Stock Exchange pointed out that on the one hand, Minsheng Securities did not completely and fully verify the issuer’s involvement in fund occupation; on the other hand, it did not fully verify the disclosure of information related to the issuer’s R & D personnel and R & D investment. ldquo; Minsheng Securities failed to perform its duties diligently, and carried out verification work in-place, insufficient and inprudent, resulting in untrue, inaccurate and incomplete information disclosure.” rdquo; The Shanghai Stock Exchange pointed out at that time.

The repeated collection of fines also shows the lack of compliance in the practice of Minsheng Securities’s investment banking business and the lack of control over relevant information in the verification and supervision processes.

Another concern is that some industry insiders pointed out to reporters that the merged Guolian Minsheng Securities may face potential risks and negative impacts caused by the legacy projects of Minsheng Securities. Supervision has repeatedly emphasized the principle of responsibility when reporting. Even if the sponsor project is finally terminated, the sponsor’s violations will be punished accordingly after verification. Therefore, the situation in Minsheng Securities ‘previous projects such as passing through difficulties and changing performance may lead to legal disputes and financial risks in related projects, causing unnecessary impact and financial losses to the merged company entities. In addition, these remaining issues may also affect the reputation and credibility of Guolian Minsheng Securities in the market and reduce the trust of investors and customers.

Minsheng Securities has been rated as a Class C investment bank for two consecutive years

As important gatekeepers, brokerage investment banks are duty-bound. The quantity of IPO projects is very important, and the quality is equally important.

At the industry level, the China Securities Association conducted a comprehensive evaluation of the participating securities companies from three aspects: the quality of investment banking business, the quality of bond business practice, and the quality of financial advisory business practice. Judging from the published evaluation results, Minsheng Securities was rated as the worst Category C in the three aspects of investment banking business quality, bond business practice quality, and financial advisory business practice quality. At present, Minsheng Securities has been rated as a Class C investment bank for two consecutive years.

In terms of performance, Minsheng Securities ‘underwriting and recommendation income has also continued to decline. In 2023, the number of IPO companies successfully sponsored by Minsheng Securities will be 20, with a total underwriting of over 20 billion yuan, and underwriting and sponsorship income of 1.599 billion yuan. In 2024, Minsheng Securities only sponsored 6 IPO companies to list, raising a total of 3.896 billion yuan, a year-on-year decrease of 80%, and underwriting and sponsorship revenue totaled 274 million yuan, a year-on-year decrease of more than 80%.

Wind data shows that at present, there are only 9 IPO projects left in the reserve of Minsheng Securities, and the number of projects under review on the Science and Technology Innovation Board is 0. After successive withdrawals, the number of reserve projects has begun to be in short supply compared with previous years.

After being continuously rated as a Class C investment bank, Minsheng Securities’s investment bank reputation has been greatly affected, which will also affect the company’s subsequent contracting work and increase the company’s compliance costs and operational pressure. Affect the company’s market reputation and brand image, reduce the trust of investors and customers, and affect business expansion and market share. For the new entity Guolian Minsheng Securities, Minsheng Securities ‘low rating may also drag down the overall combined business performance and market competitiveness.

Industry insiders pointed out that the current investment banking business integration of the new institution Guolian Minsheng Securities faces dual challenges: on the one hand, it needs to absorb the potential risks of Minsheng Securities’s existing projects, and on the other hand, it needs to avoid the impact of business contraction on the merger synergy effect.

Today, market news said that Guolian Minsheng Securities has set up a leading group and five special working groups to carry out integration-related work. The five special working groups include: investment banking business, research business, asset management business, wealth management and IT group. Huaying Securities, the investment banking subsidiary of Guolian Securities, will integrate with the investment banking business of Minsheng Securities to become an investment banking subsidiary of Guolian Minsheng Securities. It is reported that the chairman of the investment bank subsidiary will be Xu Chun, vice president of Guolian Securities.

Yuan Shuai, founding founder of the New Intelligence School’s New Quality Productivity Living Room, told reporters that in the current wave of securities mergers and acquisitions, the key success factor in investment banking business integration is to balance scale effects and quality control. First of all, clarifying integration goals and strategic positioning is the prerequisite, which helps ensure the smooth progress of the integration process and achieve the expected results. Secondly, strengthening compliance management and risk control is an important foundation for ensuring the stable operation of the business. At the same time, optimizing business structure and improving operational efficiency are also key elements in improving the competitiveness of investment banking business. In the integration process, we also need to pay attention to talent training and team building to ensure that there are high-quality professional talents to support business development. (Blue Whale News Wang Wanying wangwanying@lanjinger.com)