Although ETH has performed poorly recently, as a loyal Holder who still holds ETH, it is a topic worthy of careful study to steadily increase the currency standard of ETH.

Although ETH has performed poorly recently, as a loyal Holder who still holds ETH, it is a topic worthy of careful study to steadily increase the currency standard of ETH.

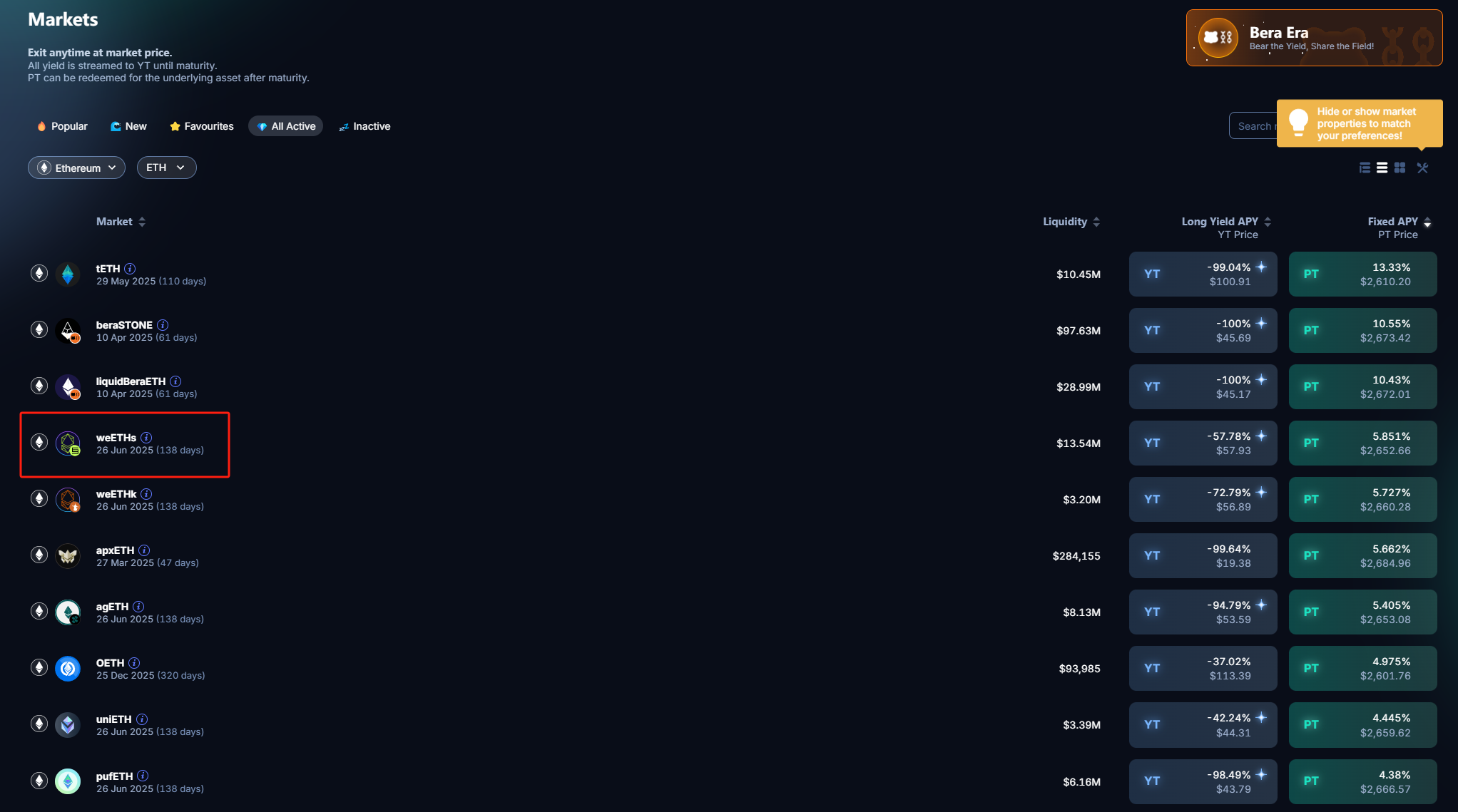

First of all, considering comprehensive security and liquidity considerations, the best opportunity for the current increase in the ETH ultra-low-risk currency standard should be Ether.fi. The current actual yield of Ether.fi is 5.8%, which is significantly higher than other similar protocols.

According to Pendle’s calculations, tETH is a new agreement and has not been tested by the market, and the bear chain requires a certain amount of lockup time. Therefore, Ether.fi’s Symbiotic pool is the protocol with the highest yield except the above two protocols.

Let’s dive in:

Let’s dive in:

About Ether.fi

Ether.fi is a decentralized pledge protocol based on the Ethereum blockchain. Ether.fi provides native re-pledge, where pledge rewards are automatically compounded to generate higher returns. This feature helps users maximize revenue without human intervention. Ether.fi aims to make pledges in the Ethereum ecosystem more accessible, efficient and decentralized.

Main functions and characteristics

One of the main functions of Ether.fi is the liquidity pledge function. Users do not need to lock ETH for a long time, but gain liquidity tokens by pledging ETH, such as eETH (pledged ETH on ether.fi). These tokens represent pledged ETH, and users can trade or use them in various DeFi applications, providing greater flexibility and liquidity.

working principle

Seamless pledge for revenue: Users can pledge their ETH through the Ether.fi protocol. When users pledge their ETH in the Ether.fi protocol, they receive the same amount of liquidity token (eETH). eETH is a native re-pledge mobile pledge token that entitles the holder to receive pledge rewards generated by the underlying pledge ETH while maintaining liquidity and participating in various DeFi.

These rewards are automatically compounded within the Ether.fi protocol to maximize the revenue potential of eETH holders.

Ether.fi uses a liquidity pledge mechanism that allows users to pledge their ETH without having to lock it for a long time. Compared with traditional pledge methods, this feature provides users with higher flexibility and liquidity.

Governance token: ETHFI is the governance token that drives the ether.fi network. By holding an ETHFI token, users can vote on proposals, upgrades, or parameter changes, ensuring a decentralized and community-driven governance model and a more inclusive and democratic protocol management approach.

Why choose Ether.fi?

Ether.fi offers several key advantages to users who want to participate in the decentralized pledge of the Ethereum blockchain, including:

(1) Strong liquidity

It allows users to pledge less than 32 ETH of funds to Ether.fi and automatically receive the same amount of eETH or weETH minted under the agreement. These tokens can be freely traded and quickly exchanged back for ETH or other crypto assets when liquidity is needed.

(2) Multi-scenario application

eETH and weETH have the attributes of ERC-20 tokens. In addition to holding to obtain liquidity pool benefits, they can also be used in various DeFi platforms, such as lending, liquidity provision or as a transaction medium, expanding users ‘access to the Ethereum ecosystem. The scope of operations and potential benefits.

(3) Pledge reward + re-pledge income

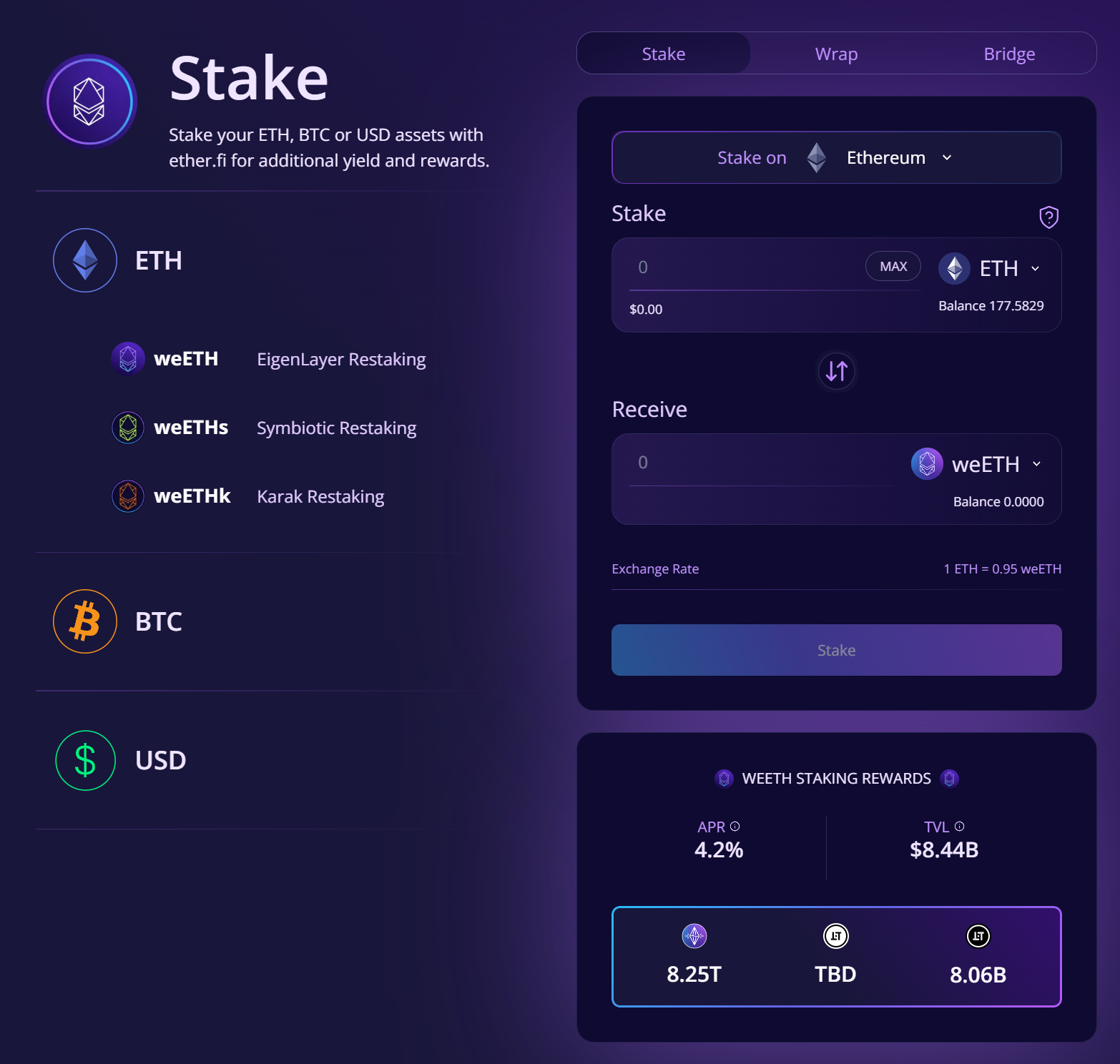

Users can re-pledge to Re-staking protocols such as EigenLayer, Symbiotic and Karak through Ether.fi. These ETH can receive corresponding pledge rewards, which will automatically accumulate and compound growth, bringing more benefits to users over time.

Through the above advantages, Ether.fi aims to make pledges more convenient, efficient and decentralized for users in the Ethereum ecosystem, and maximize pledge benefits.

Through the above advantages, Ether.fi aims to make pledges more convenient, efficient and decentralized for users in the Ethereum ecosystem, and maximize pledge benefits.

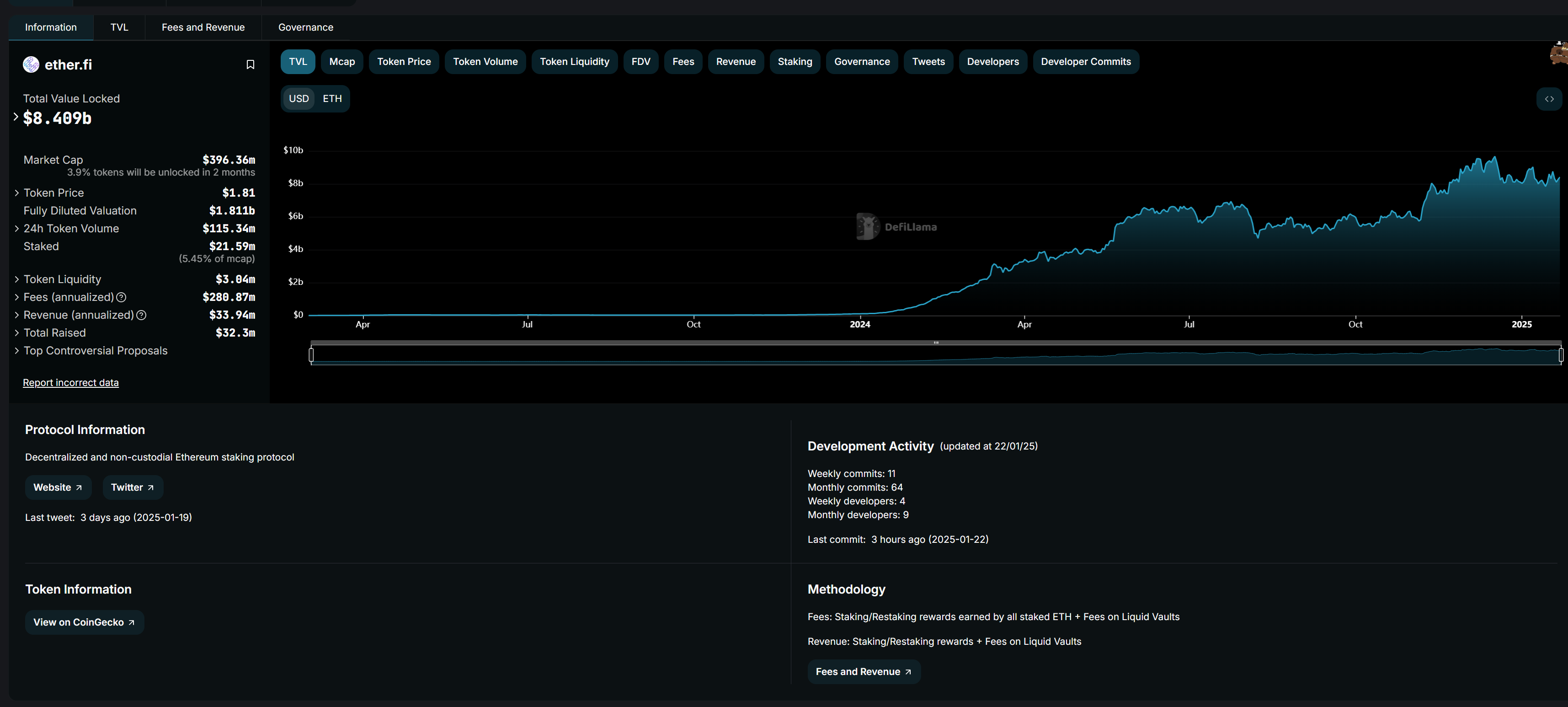

Solid growth trajectory

Explosive growth of TVL: As of January 14, 2025, EtherFi’s TVL (total locked value) has reached ~ US$8.5 billion. It is the fourth largest project in the entire ETH network, including L2, and has excellent security. Among all liquidity pledge projects, it has the highest adoption rate and the fastest growth rate.

Explosive growth of TVL: As of January 14, 2025, EtherFi’s TVL (total locked value) has reached ~ US$8.5 billion. It is the fourth largest project in the entire ETH network, including L2, and has excellent security. Among all liquidity pledge projects, it has the highest adoption rate and the fastest growth rate.

Reliable team background

Ether.fi completed a US$5.3 million financing on February 2, 2023, led by North Island Ventures, Chapter One and Node Capital, with BitMex founder Arthur Hayes participating. On February 27, 2024, Ether.fi completed a US$27 million Series A financing, led by Bullish and CoinFund, demonstrating the rapid expansion trend of the agreement and investor confidence.

Currently, Ether.fi has announced the information of five team members in official documents. Among them, founder Mike Silagadze is currently the CEO of DeFi fund company Gadze Finance and the founder of Top Hat, a Canadian higher education platform (2021 Series E financing of US$130 million). Judging from the successful entrepreneurial experience of the founder of Ether.fi, he has both knowledge and experience in the fields of corporate operations and encryption, and has the ability to efficiently implement and expand the scale of EtherFi, ensuring that EtherFi operations and innovation can meet the needs of the encryption ecosystem.

In addition, the Ether.fi team adheres to 3 guiding principles:

First, make decentralization the main goal and never compromise on the unmanaged and decentralized nature of the agreement.

Second, the Ether.Fi protocol has a sustainable revenue model and has been involved in it for a long time. The team thinks and plans with a long-term perspective.

Third, adhere to professional ethics and will always do the right thing for the Ethereum community.

Composition of pledge income

The income from Ether.fi pledge mainly consists of the following components:

(1) Ethereum network pledge reward: The current annualized rate of return on Ethereum pledge is about 2.7%.

(2) Re-pledge revenue: Ether.fi re-pledges the ETH pledged by users to other protocols or verification nodes such as EigenLayer and Symbiotic, thereby obtaining additional rewards. These rewards may be issued in the form of the project’s own tokens, such as Eigen, ETHFI, etc., or they may be governance tokens or revenue certificate points in other agreements.

(3) MEV benefits: In the Ethereum network, nodes can earn fees during the process of packaging and sorting transactions, including priority fees given by users and MEV benefits. As a node operator, Ether.fi will return part of the transaction sequencing proceeds to pledged users, but this part of the proceeds has certain uncertainties and depends on the activity level of the Ethereum network and transaction congestion.

(4) Liquidity mining rewards: In the liquidity pool of Ether.fi, users will receive corresponding liquidity tokens after pledging ETH, such as eETH or weETH. These tokens can participate in liquidity mining and provide liquidity in other DeFi protocols, thereby earning additional mining rewards. Reward usually takes the form of governance tokens or transaction fee sharing for relevant DeFi protocols.

(5) Airdrops and other incentives: Ether.f will launch airdrops or other incentives from time to time to attract users to participate in pledges. For example, during a certain period of time, every certain amount of ETH pledged will increase the airdrop prize pool by a certain proportion of the total number of tokens, and users will have the opportunity to obtain additional ETHFI tokens or airdrop rewards for other cooperation projects.

Conclusion: According to the mainstream and safe ETH LRT solution currently on the market, Ether.fi provides one of the highest yields.

Estimation of regular pledge income

Among the current mainstream ETH pledge protocols, Ether.fi’s Symbiotic pool has the highest yield in the entire network, with estimates reaching an APR of 6 – 10%.

Symbiotic is EigenLayer’s biggest competitor, and Ether.fi x Symbiotic can be dug into four things:

-ETH comes with a 2.7% yield;

– Ether.fi points;

-Symbiotic points;

-Veda points.

Note: The above APR converts the potential value of the above points, and can be accessed flexibly. Funds can be withdrawn at any time.

It can be stored directly on the Ether.fi front end, Transport Gate: https://app.ether.fi/weeths.

summary

Ether.fi ‘s DeFi application scenario design for eETH allows it to have more DeFi application directions and upper-level revenue superposition mechanisms to achieve better expansion and allow more users to participate in Ether.fi. Overall, Ether.fi, as a derivative product in the LSD track, has innovative design in key management. Its yield advantages and ease of use have helped it obtain considerable TVL, making it the best in current ETH. Rate of return place.